AERO, the native token of liquidity protocol Aerodrome Finance, jumped by 77% on Tuesday after it was selected by the Base Ecosystem Fund, which is led by CB Ventures.

Uniswap Expands Reach: Deploys v2 Protocol On Six New Chains Including Arbitrum And Polygon

Uniswap (UNI), one of the largest decentralized cryptocurrency exchanges (DEX) by trading volume, has made an important announcement regarding deploying its v2 protocol on six additional chains.

The chains on which the v2 protocol has been deployed include Arbitrum (ARB), Polygon (MATIC), Optimism (OP), Base, Binance Smart Chain (BSC), and Avalanche (AVAX).

Uniswap Widens v2 Protocol Deployment

According to a recent post on X (formerly Twitter) by Uniswap Labs, the software product developer working on the protocol, the decision to deploy the v2 protocol on more chains is primarily driven by the desire to simplify the experience for Liquidity Providers (LPs).

While the protocol’s v3 offers advanced features tailored for active liquidity providers, the development team believes the v2 protocol offers a more “straightforward approach.”

By default, v2 pools cover the entire price range, reducing the need for upfront decisions and minimizing the active involvement of liquidity providers. This simplification streamlines the process and makes it more accessible to a broader range of users, according to the announcement.

Another benefit of using the v2 protocol on multiple chains, according to Uniswap Labs, is its cost efficiency. Creating pools on v2 is more gas efficient than other versions, resulting in lower gas costs to add liquidity.

This cost reduction can be translated into savings for users, making swaps on the platform “incredibly affordable.” In addition, the use of v2 on Layer 2 scaling solutions significantly reduces the risk of frontrunning and manipulative practices known as Miner Extractable Value (MEV).

Ultimately, by offering an official v2 deployment directly accessible through the Uniswap interface, the developers suggest that users can be assured of a safe and secure environment for their swaps.

UNI Price Dip, Platform Metrics Remain Solid

Despite the recent developments that could attract investors’ attention and drive broader adoption of the Uniswap protocol, the exchange’s native token, UNI, is currently undergoing a significant correction in line with the overall market trend.

Currently, UNI is trading at $7.22, representing a 4.4% price drop in the past 24 hours and a 1.1% decline in the last trading hour. However, it’s worth noting that UNI has been one of the better-performing tokens in the market, with price increases of 14.7% and 16.8% in the past fourteen and thirty days, respectively.

Furthermore, according to data from Token Terminal, the Uniswap ecosystem continues to exhibit substantial growth in key metrics.

The fully diluted market capitalization of Uniswap stands at $7.56 billion, reflecting the total value of all tokens if they were fully in circulation. This figure has experienced a notable increase of 18.4% over the past month.

In contrast, the circulating market capitalization, which considers the currently circulating tokens, is valued at $6.94 billion, indicating a 19.9% increase over the same period.

Despite the overall surge in market capitalization, the trading volume of the UNI token has experienced a significant decline of 69.3% over the past 30 days, amounting to $2.79 billion.

The total value locked (TVL), a measure of the value of assets locked within Uniswap’s smart contracts, has also experienced a 14.4% increase, reaching $4.76 billion.

Featured image from Shutterstock, chart from TradingView.com

Developer Explains Why Meme Coins Are Shifting Base From Ethereum

Foobar, a code builder, criticizes Ethereum, accusing its developers of neglecting crucial improvements. Because of this shift, projects, including meme coin issuers, are adopting alternative protocols, including layer-2s and modern blockchains like Solana, which boast more features, mostly higher scalability.

Ethereum Developers Are Blocking Mainnet Updates

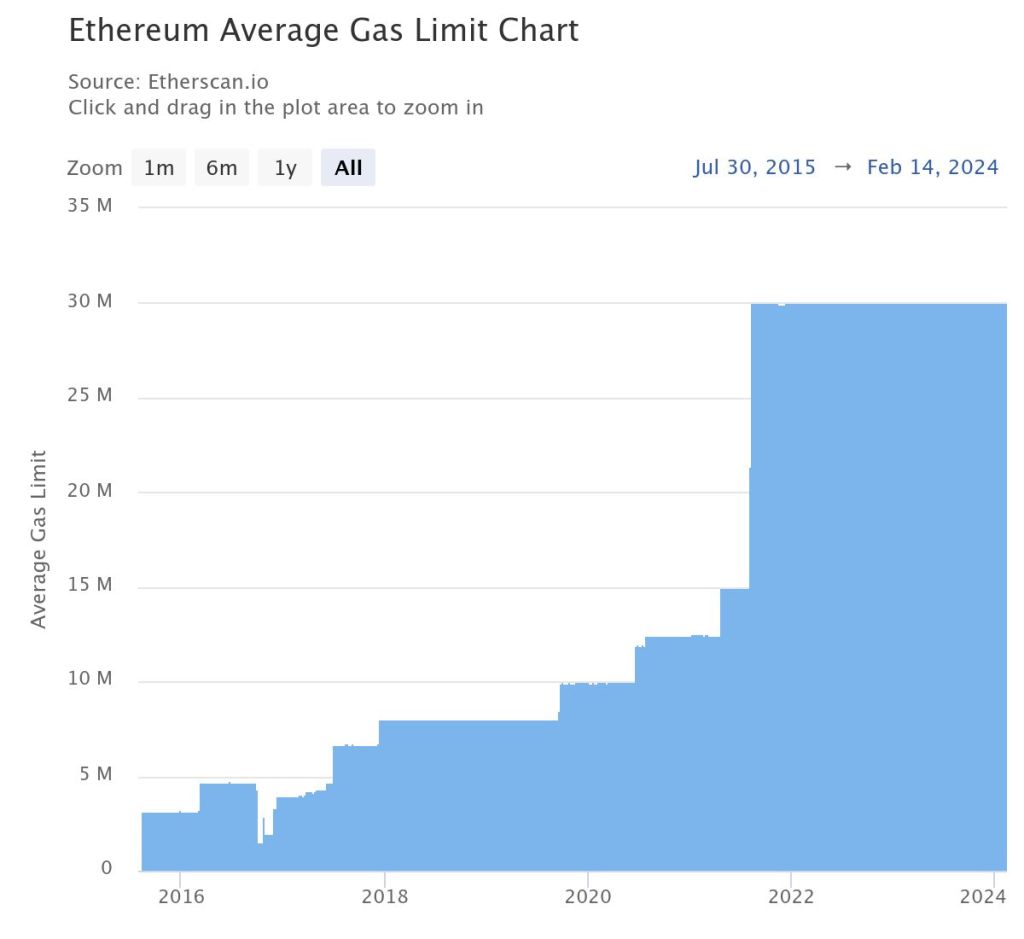

Taking to X, the developer claims that there have been no major mainnet improvements chiefly because such upgrades are being blocked by core and client developers. Specifically, Foobar cites the long-standing delays for features like Trie State Storage Optimizations (TSTORE) and Externally Owned Account (EOA) batch transactions. The developer also noted the lack of block gas limit increase since 2021.

The developer adds that the absence of main net updates and opcode improvements leading to the implementation of these proposals could be why decentralized apps (apps) launching on Ethereum are “bleeding tremendous value” due to high fees and limitations.

TSTORE and EOA batch transactions are proposals that, if they see the light of day, could see Ethereum scale better. Specifically, proposers of TSTORE forwarded a solution to address storage bloat to improve performance. On the other hand, EOA will enable the bundling of transactions from the same sender, reducing gas fees.

Meanwhile, Etherscan data shows that the block gas limit has been capped at around 30 million since August 9, 2021. Subsequently, Ethereum throughput remains low, and gas fees are higher, considering the high on-chain activity.

The failure of clients to integrate these proposals, the developer continues, makes Ethereum unusable for “any interesting app requiring moderate complexity.” Subsequently, many projects are migrating to layer-2s like Base, Arbitrum, Optimism, or entirely different blockchains like Solana and Avalanche due to limitations on the Ethereum mainnet.

Meme Coins Find Home In Solana And Others

As of mid-February 2024, more meme coin developers, reading from the popularity of emerging projects, are deploying from high throughput and low-fee platforms like Solana, Avalanche, and even Base. Meme coins like Bonk, Honk, and even the successful Bald on Base are examples.

Meanwhile, meme coin projects on Ethereum, like Pepe Coin (PEPE), appear to be losing market share as Shiba Inu, for example, launched Shibarium to offer its users lower transaction fees.

Foobar thinks the lack of improvements on the Ethereum mainnet is why Uniswap v4 has yet to launch. The new iteration of Uniswap, a popular decentralized exchange (DEX) powering Ethereum token swapping, is yet to release its latest version.

Based on existing documentation, v4 will include new features and functionalities, including Hooks. Supporters claim this tool will make the DEX more flexible, drawing more users once it goes live.

Crypto Trading Platform Avantis Opens Perpetual Swaps DEX on Base Network

How To Buy, Sell, And Trade Crypto On The Base Network

The foundational infrastructure of the Base Network brings about yet another Ethereum Layer 2 network, distinguished by its scalability and empowerment through the notable association with Coinbase. Coinbase is recognized globally as one of the most trusted cryptocurrency exchanges and companies, Coinbase effectively manages a diverse portfolio of crypto assets, solidifying its status as a cornerstone within the digital currency realm.

Positioned as a pivotal solution to address the persistent challenge of high transaction costs within the Ethereum network, the Base Chain stands quite firmly to revolutionize transaction fees, delivering a cost-effective alternative within the secure Ethereum environment. The assurance of a safe and reliable ecosystem is heightened by the affiliation with Coinbase, an industry titan renowned for its unwavering commitment and 10-year-long track record of great service.

Reasons To Trust The Base Chain

The current centralized phase of the Coinbase company, with its owners and Devs known to the public, establishes a solid foundation for users to place their trust in the Base chain. With over a decade of extensive experience in the cryptocurrency space, Coinbase has consistently demonstrated its expertise by developing and launching numerous successful crypto products.

This wealth of experience instills confidence in the Base Chain as it navigates its initial stages of centralization, with a strategic vision to progressively evolve into a decentralized entity over time.

For those embarking on their journey within the Base Chain ecosystem, it is imperative to keep certain key considerations in mind. Firstly, the association with Coinbase serves as a testament to the network’s reliability and credibility. Additionally, users can anticipate ongoing enhancements and decentralization initiatives as the Base Chain matures, aligning with the broader ethos of blockchain technology.

In summary, the Base Network, fortified by its affiliation with Coinbase, emerges as a promising Ethereum Layer 2 solution, poised to alleviate the burden of high transaction costs while providing a secure and gradually decentralized environment.

Key Features To Note About Base Chain

- Absence of Native Token: Notably, the Base Chain currently operates without a native token. Instead, transaction fees within the ecosystem are conducted using Base ETH. This choice streamlines interactions on the Base Chain and positions it as a unique player within the cryptocurrency landscape on the Ethereum chain. Some chain accepts their native token for gas fees but the Base chain accepts Base ETH.

- Layer 2 Security Powered by Ethereum: The Base Chain distinguishes itself as a layer 2 chain, constructed upon the robust Ethereum technology. This strategic integration ensures a heightened level of security, leveraging the well-established reputation of Ethereum as one of the most secure technologies in the crypto community. Consequently, the Base Chain is anticipated to offer a security profile close to the Ethereum Layer 1 network.

Related Reading: How To Buy, Sell, And Trade Tokens On The Avalanche Network

- Developer Transparency and Coinbase Backing: In contrast to many emerging chains, the Base Chain stands out due to its transparent development process and substantial backing by Coinbase. The association with Coinbase, a leading cryptocurrency exchange, lends credibility and trust. Considering Coinbase’s track record of providing crypto products to over 100 million users and processing $80 billion worth of crypto assets without controversies, users can confidently rely on the expertise of the development team.

- Anticipated Low Gas Fees: One of the attractive features of the Base Chain is the expectation of significantly lower gas fees compared to the native Ethereum chain. This affordability factor provides users with an opportunity to experience Ethereum Layer 1 compatibility at a fraction of the cost, enhancing the cost-effectiveness of transactions on the Base Chain.

- Open Source Technology with Optimism Integration: The Base Chain’s Open Source technology is powered by the Optimism Open Source chain. This integration not only supports the overall functionality of the chain but also simplifies the development process for creators. Developers can anticipate a user-friendly environment for building applications on the Base Chain, thanks to the enhanced capabilities and support provided by the Optimism Open Source chain.

Expanding on the diverse utilities and functionalities within the Base Ecosystem

- Bridging Utility: The Base Ecosystem has a bridging utility, facilitating seamless interoperability with other blockchain networks. This feature enhances the overall connectivity of the Base Chain, allowing for the fluid transfer of assets and data across different blockchain environments.

- DeFi (Decentralized Finance) Utility: Positioned at the forefront of decentralized finance, the Base Ecosystem provides comprehensive support for DeFi applications. Users can engage in a spectrum of financial services, including lending, borrowing, and trading, all within the secure and efficient framework of the Base Chain.

- Gaming Utility: Acknowledging the growing significance of blockchain in the gaming industry, the Base Ecosystem integrates a gaming utility. This functionality opens avenues for the development and deployment of blockchain-based games, ensuring a secure and transparent gaming experience for users.

- Social Utility: Recognizing the social aspect of blockchain technology, the Base Ecosystem incorporates a social utility. This facet enables the creation and deployment of decentralized social applications, fostering interactions, and transactions within a secure and trustless environment.

Related Reading: How To Buy, Sell, And Trade Tokens on The Polygon Network

- NFT (Non-Fungible Token) Utility: The Base Ecosystem extends its utility to support Non-Fungible Tokens (NFTs), a rapidly evolving and popular aspect of the blockchain space. Users can create, trade, and interact with NFTs seamlessly, leveraging the secure infrastructure of the Base Chain.

- Compatibility with EVM-Supported Wallets: The Base Ecosystem ensures widespread accessibility by allowing users to utilize and access its utilities through different Ethereum Virtual Machine (EVM) supported wallets. This compatibility enhances user convenience, as individuals can leverage familiar wallets to engage with the diverse utilities offered by the Base Chain.

How To Buy, Sell, And Trade On The Base Network

Select an EVM-Compatible Wallet

To be able to make any transactions on the Base network, you need to have an EVM-Compatible Wallet. Click here to see a list of wallet options you can select from but I would recommend you use MetaMask, it is one of the most popular Ethereum Virtual Machine (EVM)-compatible wallets and also one of the most used wallets for Base Network transactions.

If you are using a PC, install the Metamask wallet extension by clicking on “Add to Chrome” to add the extension to your Chrome browser, as shown below:

Once installed, open your MetaMask, set up your account, and make sure to keep your secret phrase very safe, I would advise that you write it down on a shit of paper, away from the internet where it can’t be hacked.

Add The BASE Network To Your MetaMask

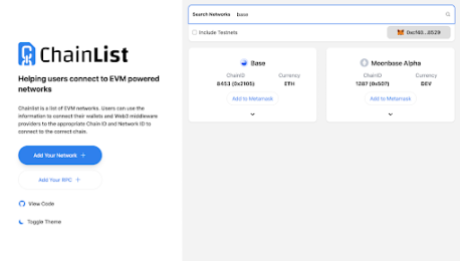

To add the Base Network to your MetaMask, search for Chainlist on your browser, open it, connect your MetaMask wallet, search for Base, and add it to MetaMask by clicking on “Add to Metamask”, click on “Approve” and lastly click on “Switch Network” on your Metamask.

Acquire Base ETH

To make any transaction on the Base Network, you need Base ETH. Get your Base ETH from these cryptocurrency exchanges such as Binance, OKX, or KuCoin. Buy ETH on these platforms, go to the withdraw section, making sure to choose the BASE network as your transfer Network, which automatically converts your ETH to Base ETH as it gets to the ETH wallet destination.

Related Reading: How To Buy, Sell, and Trade Tokens On The Arbitrum Network

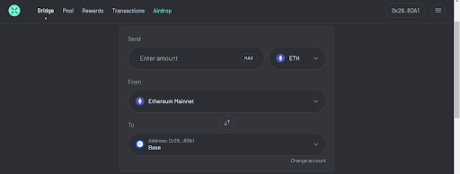

Alternatively, if you already have native ETH in your Metamask wallet, you can use the BASE bridge to bridge from the Ethereum Mainnet to the Base Network.

Bridging to Base Network ETH From Other Ethereum Layer 2s

If you wish to bridge your ETH to Base ETH from other Ethereum Layer 2 solutions, I would recommend secondary bridging platforms featured on the BASE Bridge platform. These platforms facilitate a smooth transition to the Base Network from various Ethereum Layer 2 environments, as shown below.

Example Of Bridging to Base ETH From Other Ethereum Layer 2s

ACROSS PROTOCOL is the first secondary bridging platform featured on the BASE Bridge platform as shown above, all you need to do is connect your Metamask wallet and select the amount of ETH you want to bridge to Base ETH and Bridge.

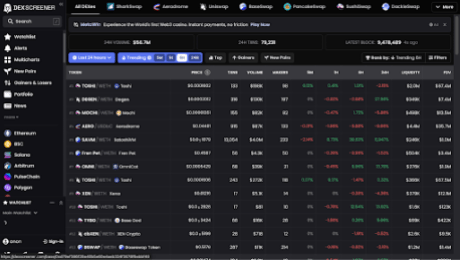

After Acquiring your Base ETH, you need to do your research and know which token you want to buy on the Base Network on Coingecko before heading over to Dexscreener to check for the token, Dexscreener serves as a valuable tool for checking available tokens on the EVM chain, including the Base Network.

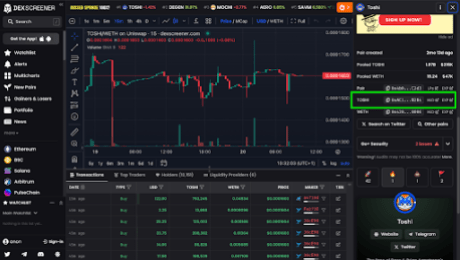

By selecting the Base network on Dexscreener, you can access a comprehensive chart of available Base tokens. Note that not all tokens are supported on every DeFi DEX, search for the token you would like to trade and select it. After selecting, look out for the Green Box section selected in the image to identify which DeFi platforms support the token you wish to trade.

Obtaining Token Contract Address

Scroll down on the Dexscreener to find the token contract address or go back to Coingecko and copy the contract address. This address is crucial when trading on DeFi platforms.

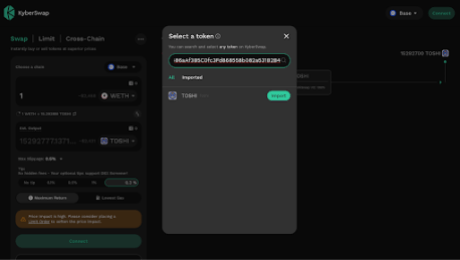

Copy the contract address, and when you enter it in the swap section of a DeFi platform like Uniswap, it will reveal the token. If the token is not available on Uniswap, the Dexscreener will redirect you to another supported DeFi where you can trade the token like KyberSwap.

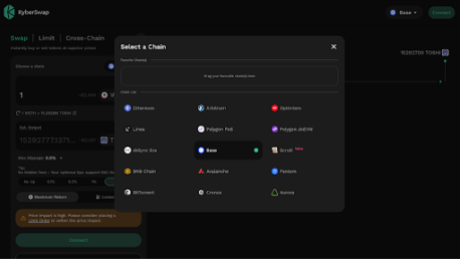

Connect your wallet to KyberSwap, click on the denominator token, and paste the contract address of the Base token in the search box. Before initiating any trade on DeFi, confirm that the network on the DeFi is on, in this case, the Base Network, ensuring the token’s availability on the Base Network. If it’s not initially on the Base Network, go to “Select a chain”, and select the Base network to ensure compatibility.

Choose the desired pair of Base tokens and ETH (or other base pairs), specify the amount you want to swap, and execute the trade.

Related Reading: How To Buy, Sell, And Trade Tokens On The BSC Network

Reverse Trading For Base Network ETH

If you wish to trade from a BASE token to Base ETH, simply reverse the order. Place the Base token at the top and the ETH at the bottom, then proceed with the swap. This allows you to exchange your Base token for ETH within the Base Network.

By following these steps, you can confidently navigate the trading process on the Base Network, leveraging the features of DeFi platforms and Dexscreener to make informed decisions and execute trades seamlessly.

Conclusion

The Base Network is another Ethereum Layer 2 network which is also affiliated with Coinbase, which is one of the most trusted cryptocurrency exchanges and companies in the crypto space with over 100 million users and processing $80 billion worth of crypto assets. Base Network has a lot of features which I have pointed out in the article already, although the Base Network does not have its Native token yet, it is still trusted and reliable due to its affiliation with Coinbase.

Manta Pacific Replaces Base as Fourth Largest Scaling Solution: L2Beat

Manta Pacific is the native layer 2 of the Manta Network.

Forget High Gas Fee Challenges, Ethereum Remains Bullish: Time To Buy More?

Despite concerns over network congestion and high gas fees, Ethereum remains bullish in the long term, according to borovik.eth–a partner at Rollbit, who posted on X on December 26. The key factors driving the positive outlook are pointing to Ethereum’s developer ecosystem, its role in the broader blockchain ecosystem, and the launch of numerous Layer-2 solutions (L2s).

Will Layer-2 Activity Drive ETH To New Highs?

Borovik.eth remained deviant and optimistic about ETH, even with Solana (OSL) and other layer-1 coins like Cardano (ADA) soaring in 2023. In the analyst’s view, Ethereum’s scaling challenges are manageable, believing that developers will find ways of “resolving this concern permanently over the long term.”

Based on this optimism, the Rollbit partner believes that ETH will likely recover strongly in the coming sessions considering the level of development, especially of layer-2 scaling options meant for the pioneer smart contract platform. According to Borovik.eth, the development of layer-2 off-chain options backed by massive companies, for instance, Coinbase, a crypto exchange, and venture capitalists (VCs), positions Ethereum (ETH) favorably for a bull run.

As of December 26, ETH remains in an uptrend but is cooling off after solid gains in Q4 2023. At spot rates, ETH is underperforming most layer-1 platforms like Injective Protocol (INJ) and Solana (SOL), whose prices rallied, reaching new 2023 highs. ETH prices are still trending below $2,400, a critical resistance level. If bulls overcome this line, ETH may fly towards $3,500 or better in the months ahead.

The spike in SOL’s valuation, especially in H2 2023, has led to a comparison with ETH. Even so, most traders are optimistic. Arthur Hayes recently stated that users should begin rotating funds from SOL to ETH, an endorsement of the second most valuable coin by market cap.

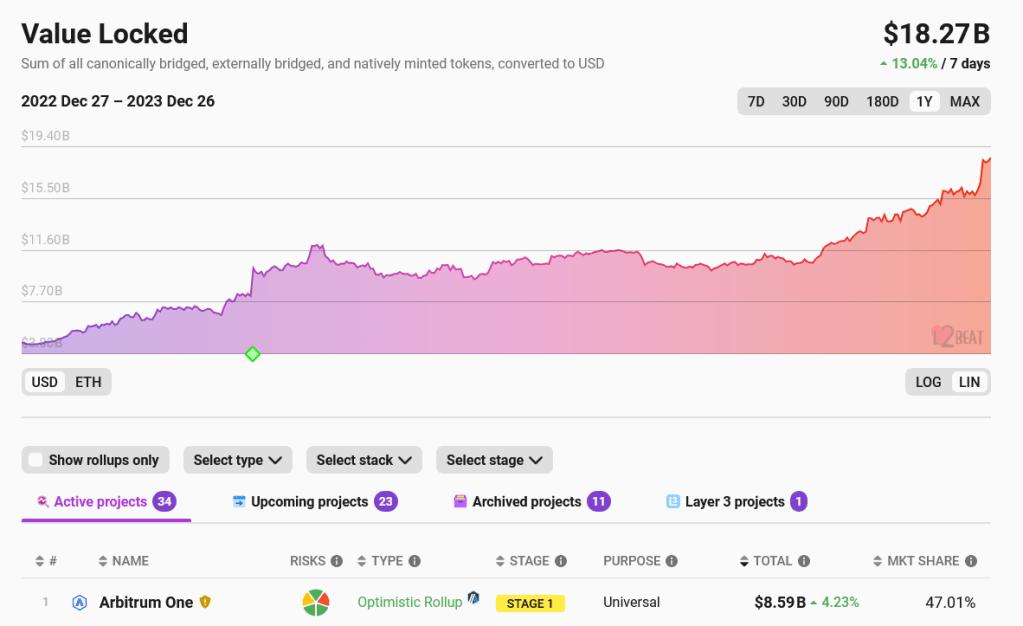

Ethereum Layer-2s Manage Over $18.8 Billion

While Ethereum faces challenges around on-chain scaling, developers have been working hard to resolve this issue. The release of layer-2 off-chain options using rollups has been key in this drive. Most of these solutions, including Arbitrum and Optimism, have been critical in alleviating pressure from the mainnet, thus reducing gas fees. According to L2Beat, layer-2 protocols manage over $18 billion as total value locked (TVL). There are also 34 active projects, with 23 more being developed.

Among the big companies hitching the layer-2 ride is Coinbase, where through Base, users can transact cheaply while relying on the Ethereum mainnet for security. According to Borovik.eth, over 60% of Base’s revenue is from rollup fees charged, highlighting the importance of their scaling solution and the role Ethereum plays in all this.

Related Reading: Shiba Inu Whale Moves $45 Million In SHIB, Bullish?

The upcoming Dencun Upgrade set for integration next year will further slash layer-2 fees. Developers plan to release this update in the Goerli test network as early as mid-January 2024.

Seamless Protocol Issues SEAM, Bags First Base-Blockchain Token Listing on Coinbase

Seamless previously operated the “OG Points” program, allowing thousands of users to earn points in their on-chain wallets.

Rebecca Rose: ‘What Goes on Inside That Brain’ of Jesse Pollak’s?

The artist made an NFT of the Base leader for our Most Influential package.

Karl Floersch’s ‘Optimism’ Tech Paved the Way for Coinbase’s ‘Base’ Blockchain

The CEO of OP Labs helped create a set of tools that let developers build their own layer-2 chains.

Jesse Pollak Is Putting the Base in Coinbase

Coinbase’s layer-2 blockchain, which launched this year, helps the exchange to scale and reduce transaction fees. Rivals, like Kraken, are now said to be launching their own layer 2s.

Blast Surpasses Cardano And Base – Here’s How Much DeFi Investors Have Locked

Blast is the latest Layer 2 network to burst into the scene in the last week and has taken the decentralized finance (DeFi) world by storm already. This network which seemingly came out of nowhere has backing from Paradigm, and as its popularity has risen, it has surpassed Base and Cardano’s Total Value Locked (TVL) in less than a week after launch.

Blast TVL Crosses $565 Million

The Blast network was officially announced on November 21 and it quickly garnered support from crypto investors. In the first day, the network saw over $81 million in crypto locked. And in two days, the figure had quickly grown above $123 million.

Despite some of the FUD (Fear, Uncertainty, and Doubt) that has followed the launch of the network, investors have continued to bridge their assorted into it. By Sunday, November 26, the total value locked on the Blast network had officially crossed $544 million, according to data from DeFi tracker DeFiLlama.

This figure puts the network’s TVL ahead of older competitors such as Coinbase’s Base. While Blast’s TVL sits at $544 million, the Base TVL is at $338.26 million. This means that Blast’s TVL is currently 60% higher than that of Base.

In the same vein, the Blast TVL is also way ahead of that of Cardano. Presently, the Cardano TVL sits at around $330.07 million, just a little lower than Base, and around 61% lower than that of Blast.

New L2 Draws Criticism From DeFi Investors

Amid the rapid growth that Blast has enjoyed, it has also drawn criticism from DeFi investors. The concerns have ranged from security to how the network is being run. One of the most pertinent criticisms has stemmed from the fact that all of the crypto being bridged to the network will be locked until next year.

The network revealed that investors will not be able to access their locked funds until February 2024. In addition, Blast promises users yield on their Ethereum (ETH) and stablecoins being bridged to the network, but with no readily discernible way of how this yield will be earned.

Some members of the crypto community have, however, figured out that the funds were being deposited into the Lido DAO protocol. Apparently, Blast is currently earning around $1.5 million a month by depositing the bridged funds into Lido. This has further raised concerns about the growing dominance of Lido, which is headed toward 33.3% and could pose a risk for the Ethereum network.

Nevertheless, Blast continues to dominate conversations around DeFi on social media. There is now a total of 266,130 ETH locked on the network, with the expectations of an airdrop happening in 2024.

Circle to Enable Cross-Chain USDC Transfers With Cosmos’s Noble Later This Month

Decentralized exchange dYdX will be the a user of CCTP, as the project expands beyond Arbitrum, Base, Ethereum and Optimism.

Ethereum Layer-2 Booming: Will Gas Fees Drop Even In A Bull Market?

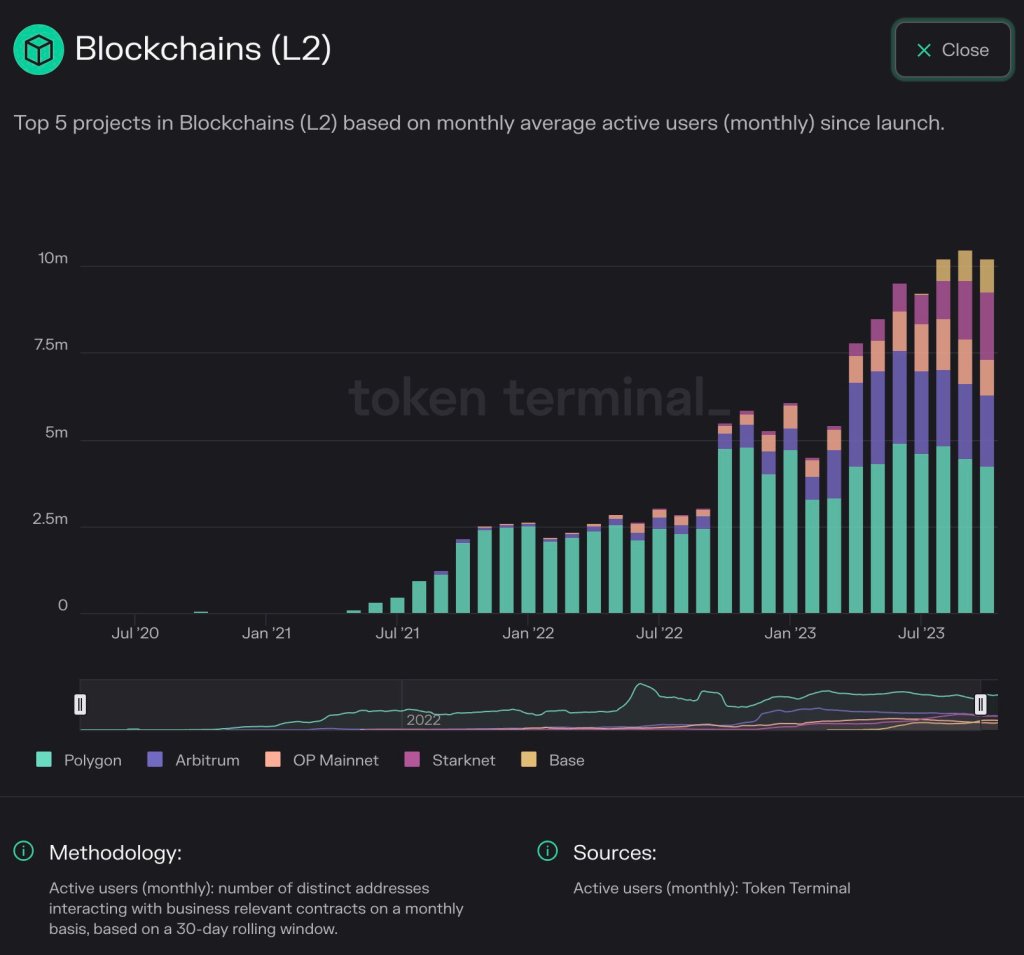

The adoption of Ethereum layer-2s is on the rise if Token Terminal data shared on November 6 is anything to go by. According to statistics from the blockchain analytics platform shared by Erik Smith, the Chief Investment Officer (CIO) of 401 Financial, the average active addresses over the past three months has exceeded 10 million, a nearly 2X expansion from early 2023.

Related Reading: Can The ADA Price Climb Above $20 In The Bull Market? Analyst Provides Answers

Ethereum Layer-2s Finding More Adoption

Looking at the chart, Polygon, an Ethereum sidechain, remains the most popular. At the same time, Arbitrum and OP Mainnet, which are common layer-2s adopting the roll-up technology, are actively being used.

Even so, OP Mainnet’s share is gradually dropping. Base, a layer-2 backed by Coinbase, and StarkNet are also finding adoption, expanding their share over the past three months.

In crypto, active addresses refer to the number of unique wallet addresses (sending and receiving) that have interacted with the blockchain, in this case, Ethereum, over a given period.

An uptick or contraction in the number of active addresses can be used to measure sentiment and the level of uptake. In bear markets, active addresses tend to drop, only rising when bulls flow in, pointing to a possible scramble for arising opportunities.

The recent uptrend coincides with the rapid expansion of leading crypto prices. Ethereum (ETH) prices are inching closer to the $1,870 resistance level, with a breakout above this line a potential trigger for a leg up that might see the coin retest $2,100 and even register new 2023 highs.

Usually, rising crypto prices tend to revive demand as the number of active addresses and, in some instances, the total value locked (TVL) in decentralized finance (DeFi), and more.

What Will Happen To Gas Fees?

Ethereum is the world’s most active smart contract platform, stretching its dominance mainly because of its first-mover advantage. The blockchain anchors more DeFi, non-fungible tokens (NFTs), and gaming activity. Deploying protocols, depending on their objectives, can either directly launch on the mainnet or layer-2s.

The mainnet is directly secured by validators, while layer-2 solutions depend on the mainnet for security but often re-route transactions off-chain. In this arrangement, more transactions can be processed cheaply and efficiently, relieving the mainnet.

Though the Ethereum base layer is secure, its peak transaction throughput remains relatively lower at around 15 TPS. This means during peak demand, gas fees tend to be higher, impacting user demand.

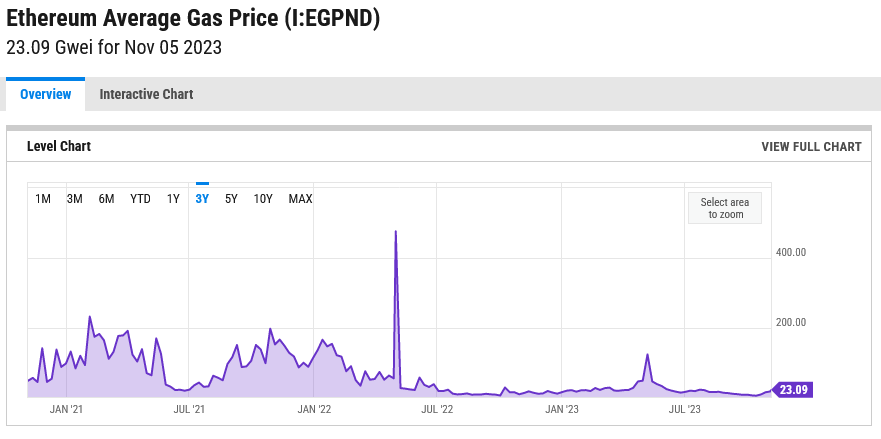

Still, Ethereum gas fees remain at a multi-year low at around 23 Gwei, according to trackers, as seen on the chart below. This is down from 240 Gwei recorded in February 2021 when crypto assets rapidly rose.

For now, whether gas fees will increase as the market recovers is yet to be seen. What’s evident is that as users opt for layer-2s, the mainnet will likely be relieved, keeping gas fee fluctuation low.

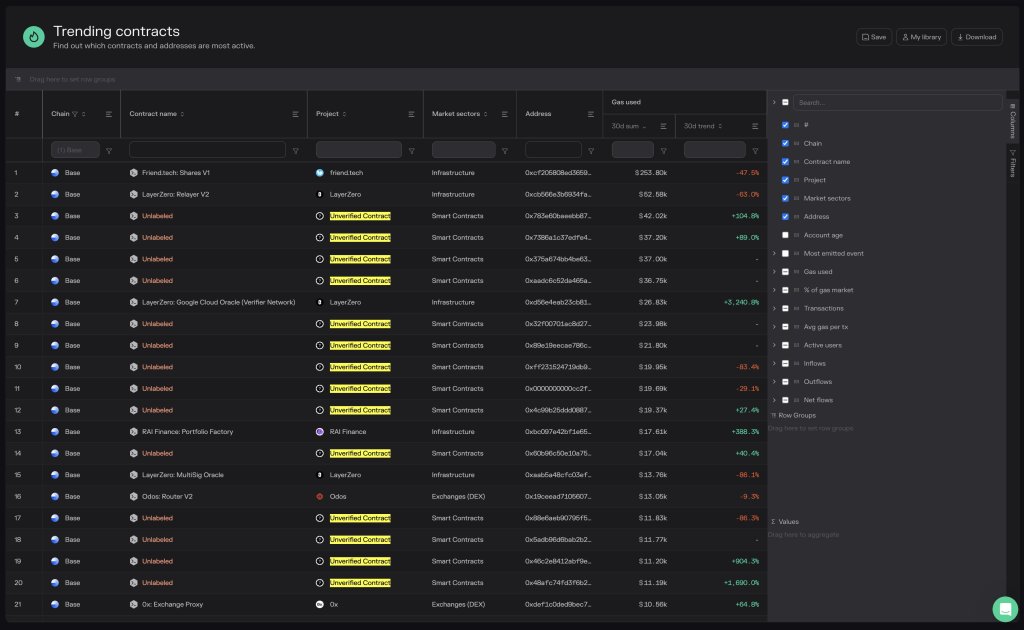

66% Of Top Smart Contracts On Base Have One Big Problem

14/21, or 66%, of the top gas-consuming smart contracts on Base, a layer-2 platform for building and deploying smart contracts, are unverified. According to Token Terminal data on October 24, the same contracts are some of the most actively used, reading from gas fee trends over the last month.

Friend.tech Leads The Gas Race On Base

Base is a layer-2 scaling solution and one of OP Mainnet and Arbitrum’s competitors. The platform relies on the Optimistic Rollup technique, allowing transactions to be batched off-chain before being confirmed on the mainnet. This is the same approach competitors, including Arbitrum and OP Mainnet, adopted.

As of October 24, the most gas-consuming protocol already labeled and known to be deployed from a given developer is Friend.tech. Still, the developer remains anonymous.

The decentralized social media protocol allows users to buy and sell keys to each other’s X accounts. In this way, trading parties can access exclusive in-app chatrooms and content by a given user.

By deploying on Base, Friend.tech users enjoy lower trading fees than they would have launched on the mainnet. Beyond fees, the protocol can also scale since the layer-2 solution can handle higher throughput than the mainnet.

In the last month, Friend.tech generated over $253,000 in gas fees. The execution fee, often known as layer-2 fee, on Base, which uses Optimism, is set by the network and is flat.

The fee prevents users from spamming the network and rewards nodes that prove all transactions submitted on the platform. The other fee is the approximate for confirming the same transaction batch on the mainnet. This fee is generally higher than the execution fee.

The Case Of Popular But Unverified Smart Contracts

While gas fees generated by Friend.tech is over $253,000, it is down over 47% in the last month. This could suggest that trading activity fell since the fee generated by a network is directly proportional to how frequently it is used.

Friend.tech fees, when writing, remain suppressed, underperforming the activity of unverified smart contracts, looking at fees generated over the last month. Over the previous 30 days, one unverified contract has seen a 104% increase in trading fees, reaching $42,000. Another contract has increased by 1,690%, exceeding $11,000 in the same period.

As the name suggests, these unverified codes have yet to be confirmed by a third party. This can mean there is no guarantee that the same developer built and deployed code on Base. At the same time, the code might contain malicious code that could steal from addresses it interacts with.

Base network launches 8-week training course for blockchain developers

Base Bootcamp will offer students weekly meetings with a mentor, a dedicated Discord server, and access to Coinbase and Base engineers, the team stated.

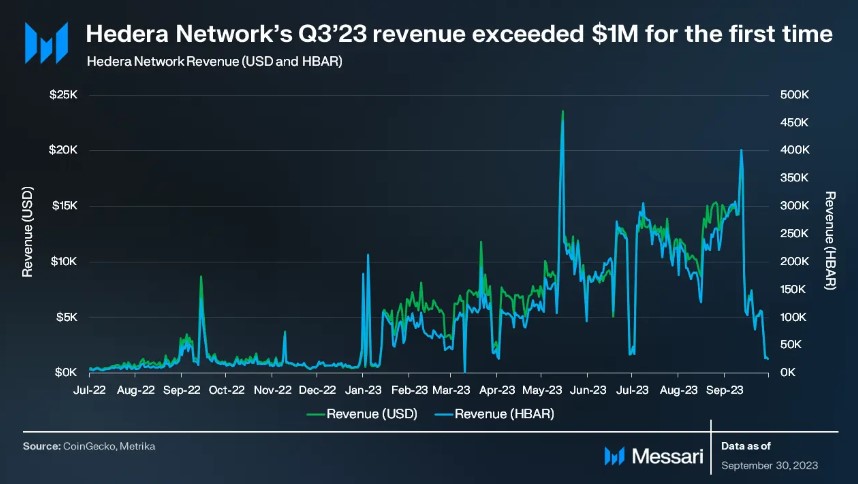

Hedera (HBAR) Q3 Triumph: Transaction Volume Soars, Network Revenue Crosses 1M Milestone

According to a recent report by the online database platform Messari, the Hedera (HBAR) Network, an open-source, public blockchain governed by the Hedera Governing Council, has showcased significant growth in the face of a challenging crypto market during Q3 2023.

Hedera Network Hits New Record With 99 Million Daily Transactions

Per the report, Hedera Network’s transaction volume continued its upward trajectory, achieving a new record of 99 million daily average transactions in Q3 2023.

This milestone marks the fifth consecutive quarterly increase in transaction activity, with the Hedera Consensus Service responsible for 99% of all transactions on the network.

Notably, the network’s revenue derived from transaction fees surpassed $1 million for the first time, experiencing a remarkable 30% quarter-on-quarter growth.

According to Messari, the Hedera Consensus Service largely drove the revenue growth and remained independent of HBAR’s price fluctuations, as transaction fees are fixed in USD terms.

While the overall crypto market experienced a moderate downturn during Q3 2023, HBAR’s circulating market capitalization grew by 7.6% quarter-on-quarter, reaching $1.7 billion by the end of September.

HBAR’s fully diluted market capitalization also increased by 2.5%, settling at $2.5 billion. As a result, the Hedera Network emerged as the 31st-largest crypto protocol by market capitalization, demonstrating its growing prominence in the industry.

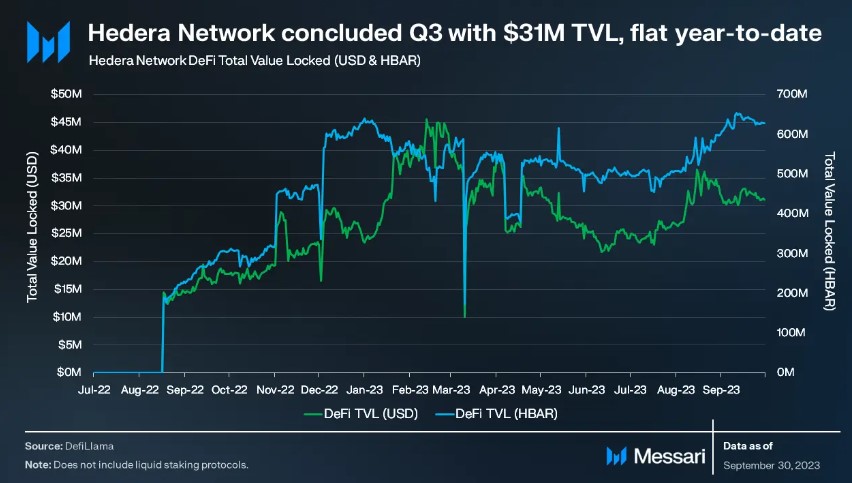

Hedera’s TVL Skyrockets By 29%

The protocol’s Total Value Locked (TVL) reached $31 million in Q3 2023, a 29% increase from the previous quarter. While the broader market witnessed a reduction in TVL, Hedera’s year-over-year (YoY) TVL growth stood at an impressive 75%.

SaucerSwap, the leading protocol within the Hedera ecosystem, accounted for most of the TVL, with $27 million locked, comprising 87% of the Hedera Network’s total TVL. According to Messari, this growth in TVL can be attributed to the launch of new protocols within the ecosystem.

On the flip side, the Hedera community has strongly emphasized enhancing developer tools and collaborations.

In Q3 2023, significant progress was made toward achieving Ethereum Virtual Machine (EVM) equivalence. The community introduced developer-focused features, integrated the JSON-RPC codebase, and refined contract creation transactions through HIP-729.

These efforts have increased compatibility with EVM networks and expanded the capabilities of smart contract development on the Hedera Network.

High Staking Percentage And Strategic Partnerships

The Hedera Network reported a high staking percentage, with 85% of the circulating supply and 56% of the total supply staked.

Core entities such as the HBAR Foundation, Swirlds, and Swirlds Labs have staked their HBAR allocations and the Hedera Treasury to support validators in meeting the minimum staking threshold for network consensus. Notably, these entities have chosen not to collect staking rewards.

Per the report, the Hedera Governing Council modified the staking rewards structure during Q3, adjusting the reward rate to 2.5% and setting a maximum staked quantity to ensure proportional reward rates.

Despite the challenging crypto market conditions in Q3 2023, the Hedera Network has showcased significant growth. The expansion of TVL and the dominance of SaucerSwap further solidified the ecosystem’s position.

Despite the growth of Hedera Network’s ecosystem, the native token, HBAR, is currently trading at $0.0460, reflecting a 4.5% decrease in value over the past 24 hours. This trend has persisted throughout the year, resulting in a year-to-date decline of 24%.

Featured image from Shutterstock, chart from TradingView.com

Tokenized U.S. Treasuries Arrive on Coinbase’s Base with Backed’s RWA Token Issuance

The market for tokenized U.S. Treasuries has grown sixfold this year to $666 million, according to a real-world asset data provider.

Blackbird, Crypto Restaurant App, Raises $24M in Funding Led by A16z

The target audience is restaurant users, but the blockchain-based project comes with its own “Flypaper” and fungible FLY tokens.

At Last, Blockchain Developer OP Labs Delivers ‘Fault Proofs’ Missing From Core Design

The developer’s OP Stack software – the blueprint for Coinbase’s new Base blockchain – had been criticized for the lack of a crucial security feature, likened to driving a fast car without airbags.