Manta Pacific is the native layer 2 of the Manta Network.

Forget High Gas Fee Challenges, Ethereum Remains Bullish: Time To Buy More?

Despite concerns over network congestion and high gas fees, Ethereum remains bullish in the long term, according to borovik.eth–a partner at Rollbit, who posted on X on December 26. The key factors driving the positive outlook are pointing to Ethereum’s developer ecosystem, its role in the broader blockchain ecosystem, and the launch of numerous Layer-2 solutions (L2s).

Will Layer-2 Activity Drive ETH To New Highs?

Borovik.eth remained deviant and optimistic about ETH, even with Solana (OSL) and other layer-1 coins like Cardano (ADA) soaring in 2023. In the analyst’s view, Ethereum’s scaling challenges are manageable, believing that developers will find ways of “resolving this concern permanently over the long term.”

Based on this optimism, the Rollbit partner believes that ETH will likely recover strongly in the coming sessions considering the level of development, especially of layer-2 scaling options meant for the pioneer smart contract platform. According to Borovik.eth, the development of layer-2 off-chain options backed by massive companies, for instance, Coinbase, a crypto exchange, and venture capitalists (VCs), positions Ethereum (ETH) favorably for a bull run.

As of December 26, ETH remains in an uptrend but is cooling off after solid gains in Q4 2023. At spot rates, ETH is underperforming most layer-1 platforms like Injective Protocol (INJ) and Solana (SOL), whose prices rallied, reaching new 2023 highs. ETH prices are still trending below $2,400, a critical resistance level. If bulls overcome this line, ETH may fly towards $3,500 or better in the months ahead.

The spike in SOL’s valuation, especially in H2 2023, has led to a comparison with ETH. Even so, most traders are optimistic. Arthur Hayes recently stated that users should begin rotating funds from SOL to ETH, an endorsement of the second most valuable coin by market cap.

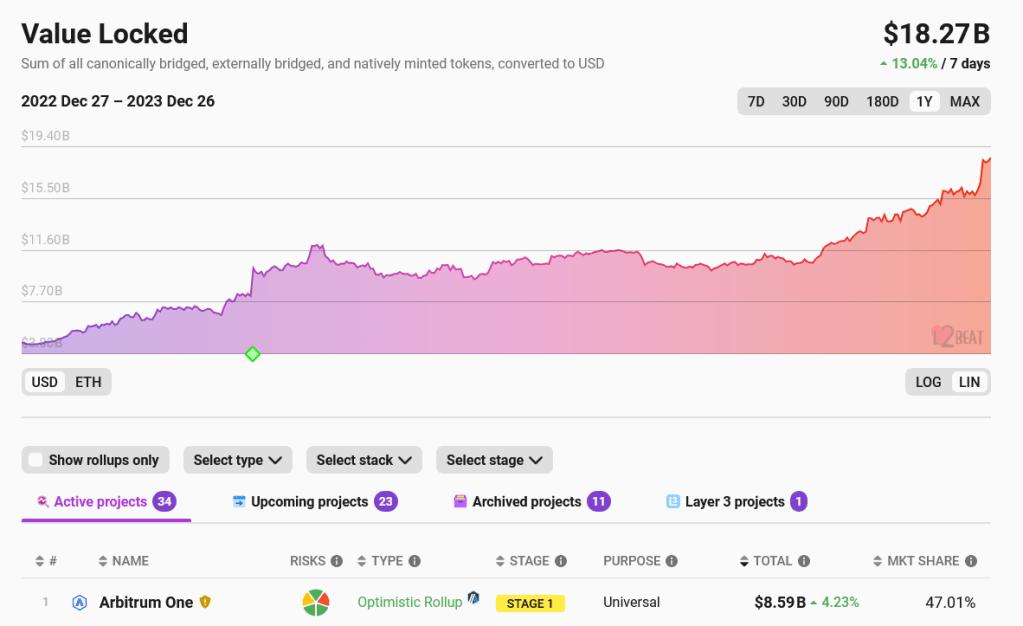

Ethereum Layer-2s Manage Over $18.8 Billion

While Ethereum faces challenges around on-chain scaling, developers have been working hard to resolve this issue. The release of layer-2 off-chain options using rollups has been key in this drive. Most of these solutions, including Arbitrum and Optimism, have been critical in alleviating pressure from the mainnet, thus reducing gas fees. According to L2Beat, layer-2 protocols manage over $18 billion as total value locked (TVL). There are also 34 active projects, with 23 more being developed.

Among the big companies hitching the layer-2 ride is Coinbase, where through Base, users can transact cheaply while relying on the Ethereum mainnet for security. According to Borovik.eth, over 60% of Base’s revenue is from rollup fees charged, highlighting the importance of their scaling solution and the role Ethereum plays in all this.

Related Reading: Shiba Inu Whale Moves $45 Million In SHIB, Bullish?

The upcoming Dencun Upgrade set for integration next year will further slash layer-2 fees. Developers plan to release this update in the Goerli test network as early as mid-January 2024.

Seamless Protocol Issues SEAM, Bags First Base-Blockchain Token Listing on Coinbase

Seamless previously operated the “OG Points” program, allowing thousands of users to earn points in their on-chain wallets.

Rebecca Rose: ‘What Goes on Inside That Brain’ of Jesse Pollak’s?

The artist made an NFT of the Base leader for our Most Influential package.

Karl Floersch’s ‘Optimism’ Tech Paved the Way for Coinbase’s ‘Base’ Blockchain

The CEO of OP Labs helped create a set of tools that let developers build their own layer-2 chains.

Jesse Pollak Is Putting the Base in Coinbase

Coinbase’s layer-2 blockchain, which launched this year, helps the exchange to scale and reduce transaction fees. Rivals, like Kraken, are now said to be launching their own layer 2s.

Blast Surpasses Cardano And Base – Here’s How Much DeFi Investors Have Locked

Blast is the latest Layer 2 network to burst into the scene in the last week and has taken the decentralized finance (DeFi) world by storm already. This network which seemingly came out of nowhere has backing from Paradigm, and as its popularity has risen, it has surpassed Base and Cardano’s Total Value Locked (TVL) in less than a week after launch.

Blast TVL Crosses $565 Million

The Blast network was officially announced on November 21 and it quickly garnered support from crypto investors. In the first day, the network saw over $81 million in crypto locked. And in two days, the figure had quickly grown above $123 million.

Despite some of the FUD (Fear, Uncertainty, and Doubt) that has followed the launch of the network, investors have continued to bridge their assorted into it. By Sunday, November 26, the total value locked on the Blast network had officially crossed $544 million, according to data from DeFi tracker DeFiLlama.

This figure puts the network’s TVL ahead of older competitors such as Coinbase’s Base. While Blast’s TVL sits at $544 million, the Base TVL is at $338.26 million. This means that Blast’s TVL is currently 60% higher than that of Base.

In the same vein, the Blast TVL is also way ahead of that of Cardano. Presently, the Cardano TVL sits at around $330.07 million, just a little lower than Base, and around 61% lower than that of Blast.

New L2 Draws Criticism From DeFi Investors

Amid the rapid growth that Blast has enjoyed, it has also drawn criticism from DeFi investors. The concerns have ranged from security to how the network is being run. One of the most pertinent criticisms has stemmed from the fact that all of the crypto being bridged to the network will be locked until next year.

The network revealed that investors will not be able to access their locked funds until February 2024. In addition, Blast promises users yield on their Ethereum (ETH) and stablecoins being bridged to the network, but with no readily discernible way of how this yield will be earned.

Some members of the crypto community have, however, figured out that the funds were being deposited into the Lido DAO protocol. Apparently, Blast is currently earning around $1.5 million a month by depositing the bridged funds into Lido. This has further raised concerns about the growing dominance of Lido, which is headed toward 33.3% and could pose a risk for the Ethereum network.

Nevertheless, Blast continues to dominate conversations around DeFi on social media. There is now a total of 266,130 ETH locked on the network, with the expectations of an airdrop happening in 2024.

Circle to Enable Cross-Chain USDC Transfers With Cosmos’s Noble Later This Month

Decentralized exchange dYdX will be the a user of CCTP, as the project expands beyond Arbitrum, Base, Ethereum and Optimism.

Ethereum Layer-2 Booming: Will Gas Fees Drop Even In A Bull Market?

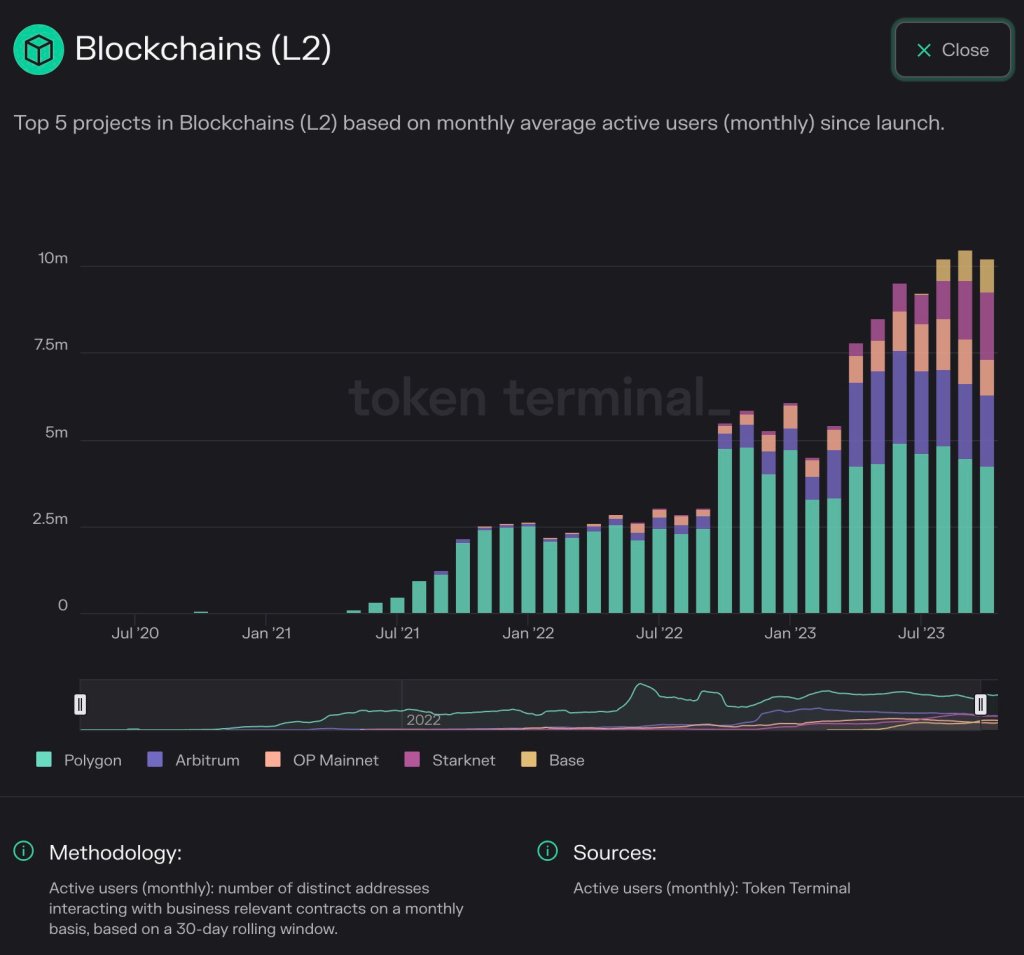

The adoption of Ethereum layer-2s is on the rise if Token Terminal data shared on November 6 is anything to go by. According to statistics from the blockchain analytics platform shared by Erik Smith, the Chief Investment Officer (CIO) of 401 Financial, the average active addresses over the past three months has exceeded 10 million, a nearly 2X expansion from early 2023.

Related Reading: Can The ADA Price Climb Above $20 In The Bull Market? Analyst Provides Answers

Ethereum Layer-2s Finding More Adoption

Looking at the chart, Polygon, an Ethereum sidechain, remains the most popular. At the same time, Arbitrum and OP Mainnet, which are common layer-2s adopting the roll-up technology, are actively being used.

Even so, OP Mainnet’s share is gradually dropping. Base, a layer-2 backed by Coinbase, and StarkNet are also finding adoption, expanding their share over the past three months.

In crypto, active addresses refer to the number of unique wallet addresses (sending and receiving) that have interacted with the blockchain, in this case, Ethereum, over a given period.

An uptick or contraction in the number of active addresses can be used to measure sentiment and the level of uptake. In bear markets, active addresses tend to drop, only rising when bulls flow in, pointing to a possible scramble for arising opportunities.

The recent uptrend coincides with the rapid expansion of leading crypto prices. Ethereum (ETH) prices are inching closer to the $1,870 resistance level, with a breakout above this line a potential trigger for a leg up that might see the coin retest $2,100 and even register new 2023 highs.

Usually, rising crypto prices tend to revive demand as the number of active addresses and, in some instances, the total value locked (TVL) in decentralized finance (DeFi), and more.

What Will Happen To Gas Fees?

Ethereum is the world’s most active smart contract platform, stretching its dominance mainly because of its first-mover advantage. The blockchain anchors more DeFi, non-fungible tokens (NFTs), and gaming activity. Deploying protocols, depending on their objectives, can either directly launch on the mainnet or layer-2s.

The mainnet is directly secured by validators, while layer-2 solutions depend on the mainnet for security but often re-route transactions off-chain. In this arrangement, more transactions can be processed cheaply and efficiently, relieving the mainnet.

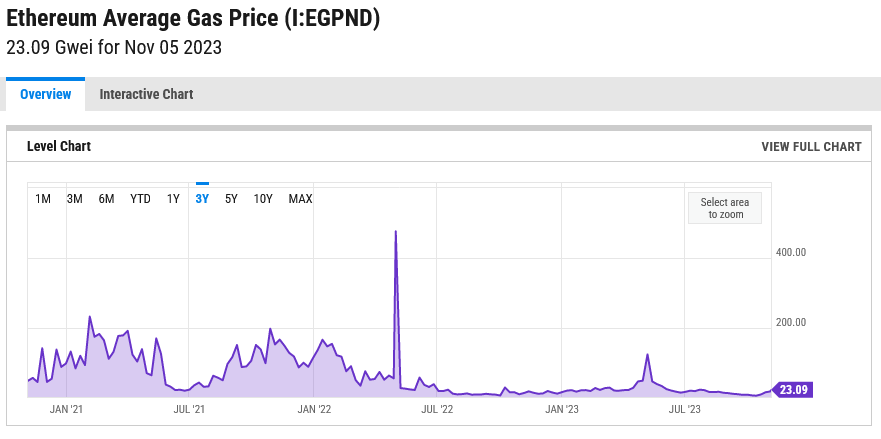

Though the Ethereum base layer is secure, its peak transaction throughput remains relatively lower at around 15 TPS. This means during peak demand, gas fees tend to be higher, impacting user demand.

Still, Ethereum gas fees remain at a multi-year low at around 23 Gwei, according to trackers, as seen on the chart below. This is down from 240 Gwei recorded in February 2021 when crypto assets rapidly rose.

For now, whether gas fees will increase as the market recovers is yet to be seen. What’s evident is that as users opt for layer-2s, the mainnet will likely be relieved, keeping gas fee fluctuation low.

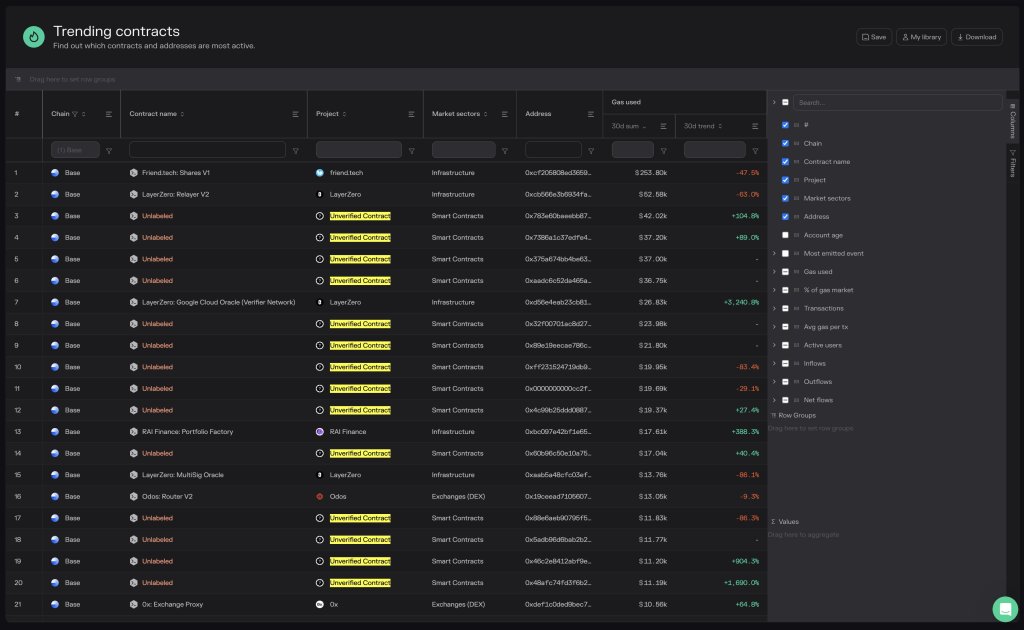

66% Of Top Smart Contracts On Base Have One Big Problem

14/21, or 66%, of the top gas-consuming smart contracts on Base, a layer-2 platform for building and deploying smart contracts, are unverified. According to Token Terminal data on October 24, the same contracts are some of the most actively used, reading from gas fee trends over the last month.

Friend.tech Leads The Gas Race On Base

Base is a layer-2 scaling solution and one of OP Mainnet and Arbitrum’s competitors. The platform relies on the Optimistic Rollup technique, allowing transactions to be batched off-chain before being confirmed on the mainnet. This is the same approach competitors, including Arbitrum and OP Mainnet, adopted.

As of October 24, the most gas-consuming protocol already labeled and known to be deployed from a given developer is Friend.tech. Still, the developer remains anonymous.

The decentralized social media protocol allows users to buy and sell keys to each other’s X accounts. In this way, trading parties can access exclusive in-app chatrooms and content by a given user.

By deploying on Base, Friend.tech users enjoy lower trading fees than they would have launched on the mainnet. Beyond fees, the protocol can also scale since the layer-2 solution can handle higher throughput than the mainnet.

In the last month, Friend.tech generated over $253,000 in gas fees. The execution fee, often known as layer-2 fee, on Base, which uses Optimism, is set by the network and is flat.

The fee prevents users from spamming the network and rewards nodes that prove all transactions submitted on the platform. The other fee is the approximate for confirming the same transaction batch on the mainnet. This fee is generally higher than the execution fee.

The Case Of Popular But Unverified Smart Contracts

While gas fees generated by Friend.tech is over $253,000, it is down over 47% in the last month. This could suggest that trading activity fell since the fee generated by a network is directly proportional to how frequently it is used.

Friend.tech fees, when writing, remain suppressed, underperforming the activity of unverified smart contracts, looking at fees generated over the last month. Over the previous 30 days, one unverified contract has seen a 104% increase in trading fees, reaching $42,000. Another contract has increased by 1,690%, exceeding $11,000 in the same period.

As the name suggests, these unverified codes have yet to be confirmed by a third party. This can mean there is no guarantee that the same developer built and deployed code on Base. At the same time, the code might contain malicious code that could steal from addresses it interacts with.

Base network launches 8-week training course for blockchain developers

Base Bootcamp will offer students weekly meetings with a mentor, a dedicated Discord server, and access to Coinbase and Base engineers, the team stated.

Hedera (HBAR) Q3 Triumph: Transaction Volume Soars, Network Revenue Crosses 1M Milestone

According to a recent report by the online database platform Messari, the Hedera (HBAR) Network, an open-source, public blockchain governed by the Hedera Governing Council, has showcased significant growth in the face of a challenging crypto market during Q3 2023.

Hedera Network Hits New Record With 99 Million Daily Transactions

Per the report, Hedera Network’s transaction volume continued its upward trajectory, achieving a new record of 99 million daily average transactions in Q3 2023.

This milestone marks the fifth consecutive quarterly increase in transaction activity, with the Hedera Consensus Service responsible for 99% of all transactions on the network.

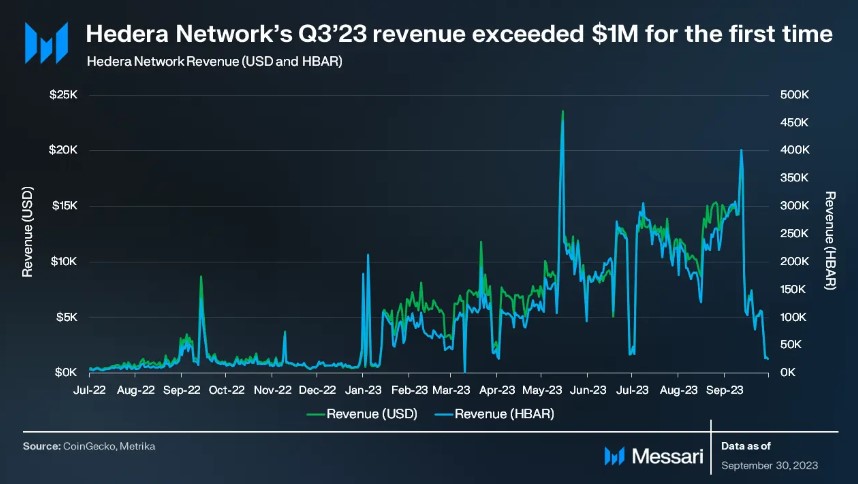

Notably, the network’s revenue derived from transaction fees surpassed $1 million for the first time, experiencing a remarkable 30% quarter-on-quarter growth.

According to Messari, the Hedera Consensus Service largely drove the revenue growth and remained independent of HBAR’s price fluctuations, as transaction fees are fixed in USD terms.

While the overall crypto market experienced a moderate downturn during Q3 2023, HBAR’s circulating market capitalization grew by 7.6% quarter-on-quarter, reaching $1.7 billion by the end of September.

HBAR’s fully diluted market capitalization also increased by 2.5%, settling at $2.5 billion. As a result, the Hedera Network emerged as the 31st-largest crypto protocol by market capitalization, demonstrating its growing prominence in the industry.

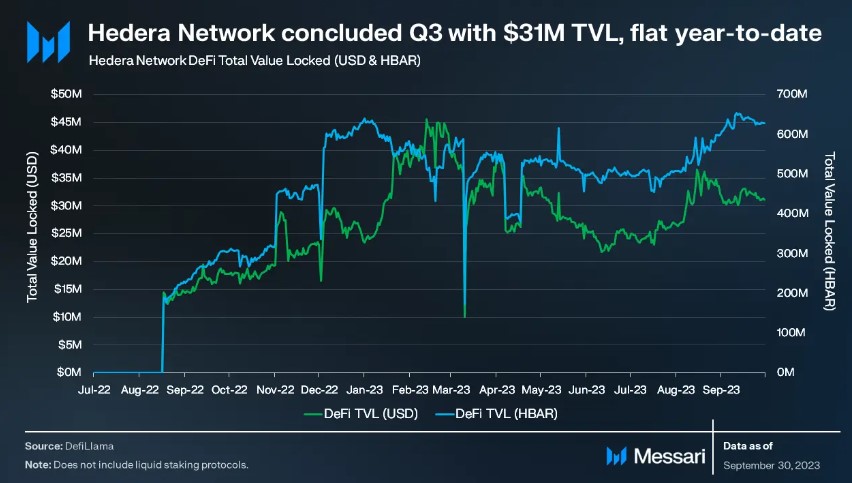

Hedera’s TVL Skyrockets By 29%

The protocol’s Total Value Locked (TVL) reached $31 million in Q3 2023, a 29% increase from the previous quarter. While the broader market witnessed a reduction in TVL, Hedera’s year-over-year (YoY) TVL growth stood at an impressive 75%.

SaucerSwap, the leading protocol within the Hedera ecosystem, accounted for most of the TVL, with $27 million locked, comprising 87% of the Hedera Network’s total TVL. According to Messari, this growth in TVL can be attributed to the launch of new protocols within the ecosystem.

On the flip side, the Hedera community has strongly emphasized enhancing developer tools and collaborations.

In Q3 2023, significant progress was made toward achieving Ethereum Virtual Machine (EVM) equivalence. The community introduced developer-focused features, integrated the JSON-RPC codebase, and refined contract creation transactions through HIP-729.

These efforts have increased compatibility with EVM networks and expanded the capabilities of smart contract development on the Hedera Network.

High Staking Percentage And Strategic Partnerships

The Hedera Network reported a high staking percentage, with 85% of the circulating supply and 56% of the total supply staked.

Core entities such as the HBAR Foundation, Swirlds, and Swirlds Labs have staked their HBAR allocations and the Hedera Treasury to support validators in meeting the minimum staking threshold for network consensus. Notably, these entities have chosen not to collect staking rewards.

Per the report, the Hedera Governing Council modified the staking rewards structure during Q3, adjusting the reward rate to 2.5% and setting a maximum staked quantity to ensure proportional reward rates.

Despite the challenging crypto market conditions in Q3 2023, the Hedera Network has showcased significant growth. The expansion of TVL and the dominance of SaucerSwap further solidified the ecosystem’s position.

Despite the growth of Hedera Network’s ecosystem, the native token, HBAR, is currently trading at $0.0460, reflecting a 4.5% decrease in value over the past 24 hours. This trend has persisted throughout the year, resulting in a year-to-date decline of 24%.

Featured image from Shutterstock, chart from TradingView.com

Tokenized U.S. Treasuries Arrive on Coinbase’s Base with Backed’s RWA Token Issuance

The market for tokenized U.S. Treasuries has grown sixfold this year to $666 million, according to a real-world asset data provider.

Blackbird, Crypto Restaurant App, Raises $24M in Funding Led by A16z

The target audience is restaurant users, but the blockchain-based project comes with its own “Flypaper” and fungible FLY tokens.

At Last, Blockchain Developer OP Labs Delivers ‘Fault Proofs’ Missing From Core Design

The developer’s OP Stack software – the blueprint for Coinbase’s new Base blockchain – had been criticized for the lack of a crucial security feature, likened to driving a fast car without airbags.

Is The Ethereum Winter Over? L2 Exploding, ETH Futures ETF Launches

After sinking roughly 30% from 2023 highs, Ethereum appears to be bouncing off from the pits of the crypto winter. Looking at candlestick arrangements in the daily and weekly charts, the coin has primary support at around $1,500 and is firm, bouncing off with decent trading volume.

At spot rates, ETH is up approximately 3% following positive developments sparked by the increasing adoption of its layer-2 scaling solution and the recent news that VanEck, a player managing billions of assets, is preparing to launch an Ethereum derivatives product.

Ethereum Layer-2 Solutions Exploding

Taking to X on September 28, Alex Masmej, the founder of Showtime, believes that Ethereum’s layer-2 ecosystem has expanded to such an extent that it no “longer makes sense to build on other platforms.”

The development and deployment of Ethereum layer-2 solutions took center stage following network congestion, which forced gas fees to spike to record highs in the last bull run.

Developers have responded to the network co-founder Vitalik Buterin’s urging. The expert believes they are quickly constructing and deploying safe, universal platforms that have gained widespread popularity.

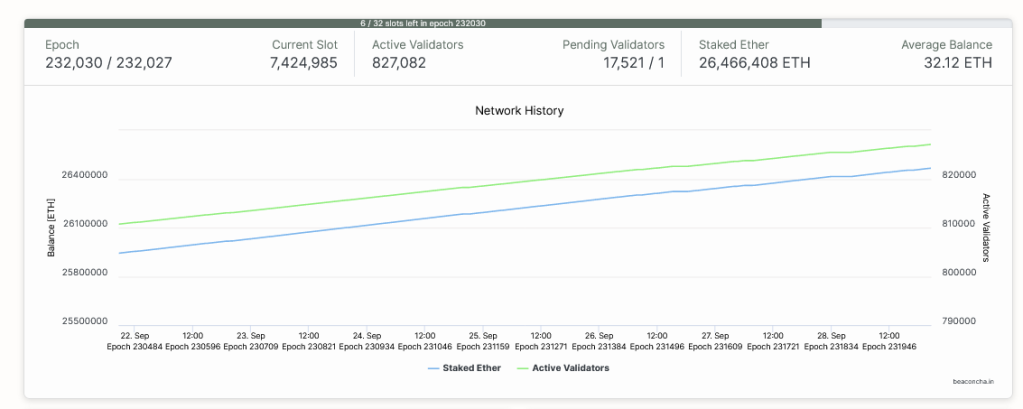

Layer-2 platforms bundle transactions off-chain before confirming them on-chain, allowing for faster and more cost-effective operations while benefiting from the security of Ethereum. As of September 28, there were over 827,000 validators whose job is to confirm transactions and ensure that the network is secure, thanks in part to their geographic distribution.

Most layer-2 solutions use optimistic rollups, including Arbitrum, Base, and OP Mainnet. However, Masmej also said that once ZK rollups, which utilize zero-knowledge proofs to validate transactions without revealing sensitive data, are available, it will end the scalability trilemma, further boosting the capabilities of layer-2 solutions.

In the founder’s assessment, high throughput options, including Solana, will be a hedge. At the same time, Cosmos, which drives blockchain interoperability, will act as a long-term source of inspiration. Meanwhile, Ethereum will continue to flourish as Layer-2 options gain traction.

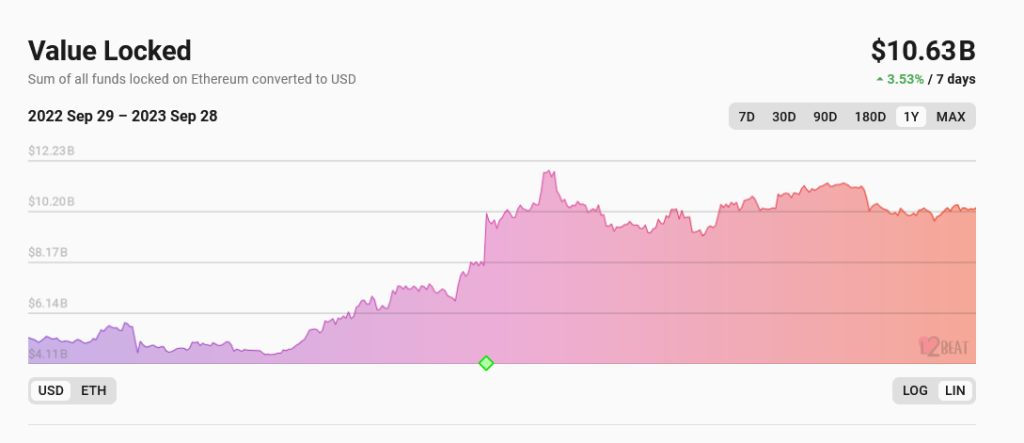

Rising TVL And ETH Complex Products Launching

According to l2Beat data, popular solutions like Arbitrum and Base, which offer faster and cheaper processing environments while remaining coupled with Ethereum and enjoying the pioneer network’s fast-move advantage, have larger total value locked (TVL). As of September 28, layer-2 platforms have a TVL of over $10.6 billion, more than Solana’s market cap, which stood at $8 billion, according to CoinMarketCap.

Beyond layer-2 adoption, ETH is being catalyzed by the news that VanEck, a global asset manager, is preparing to introduce its Ethereum futures exchange-traded fund (ETF). Specifically, the VanEck Ethereum Strategy ETF (EFUT) will invest in ETH futures contracts provided by exchanges approved by the Commodity Futures Trading Commission (CFTC).

Like the Bitcoin Futures ETF product, which is already being offered, the Ethereum derivative product will allow institutions to gain exposure, boosting liquidity.

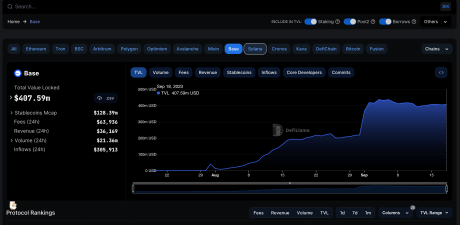

Explosive 6-Week Growth Sees Base Hit New Milestone

Coinbase’s layer 2 scaling solution, called Base, has seem a meteoric rise in popularity recently. In just six short weeks since its launch, Base’s total value locked (TVL) has skyrocketed to nearly $400 million. This rapid rise in use and popularity has even seen it recently overtake the Solana blockchain in TVL.

Coinbase’s Layer 2 Scaling Network TVL Overtakes Solana

Base operates as a layer 2 network on Ethereum launched by Coinbase in collaboration with Optimism to offer a safe, low-cost, developer-friendly way to build on-chain. Since its launch, Base has managed to find a strong market fit, allowing it to quickly penetrate the crypto market. However, this hasn’t been without some hiccups.

Before its public launch, Base had some glitches, which developers were able to rectify quickly. Earlier this month, the network faced another setback as block production unexpectedly stopped for 45 minutes. According to DeFi TVL aggregator DefiLlama, Base’s TVL has risen +111% in the past month to now holding more than $370.29 million.

Last week, Base’s growth saw it blow past the Solana blockchain in terms of transaction volume. This growth has continued, and the Layer-2 network has now moved ahead of Solana whose total value locked (TVL) dropped by 12.22% in the last month to $310 million. Also, this places Base’s TVL ahead of other popular chains like Cronos, Bitcoin, and Cardano.

Base Sees Massive Growth In Just 6 Weeks

Base’s growth kickstarted with Aerodrome, a decentralized exchange, which deposited $190 million on the network after its launch. Base’s growth can also be attributed to the popularity of Friend.tech, a decentralized social app. With a current TVL of $38.6 million, Friend.tech is one of the projects native to Base with a the largest stake. Other projects with a considerable stake in TVL include Stargate, Curve DEX, and Compound V3.

At the moment, Ethereum continues to lead the pack in terms of TVL. However, the coming months will be crucial in determining whether Base can sustain its momentum and continue gaining mainstream traction. At its current trajectory, Base could surpass $500 million in TVL in the coming weeks and solidify itself as a leader in layer-2 scaling networks.

According to BaseScan, the number of daily transactions on Base reached a new high of 1.88 million on September 14, as reported by BaseScan. The layer-2 network has now processed more than 40.31 million transactions at the time of writing.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from iStock

Base surges past Solana as total value locked nears $400M

As per DeFi Llama data, Solana’s TVL has decreased by 9.64% over the past month to sit at $358.96 million, while Base’s TVL has surged to $397.32 million.

Coinbase’s BASE Shows Teeth As TVL Nears Solana

Ethereum-based Layer 2 network “Base” has put on an impressive performance yet again, with its Total Value Locked (TVL) coming close to one of the most notable blockchains.

Coinbase’s BASE Has Outperformed Solana

Coinbase’s layer 2 blockchain network, Base, has seen an upward trajectory movement since it was introduced to the public, outperforming some of the notable blockchains in the crypto market. The network is now drawing close to Solana in terms of TVL, indicating remarkable growth within the network.

Data from DeFiLlama shows that the blockchain network now sits a little above $407 million in TVL, while Solana sits a little above $650 million in TVL. The uptick in Base’s TVL is due to the significant number of users and developers currently settling on Base for their decentralized applications (dApps) and other financial protocols.

The blockchain network also managed to surpass Solana in terms of transaction volume and number of unique addresses. In the past two months, the blockchain network has experienced an immense increase in transaction volume and number of unique addresses more than that of Solana. Data from IntoTheBlock shows an impressive increase of 1.88 million daily transactions on September 16, 2023.

Base’s immense increase in transaction volume and number of unique addresses can be traced back to the growing user base of Base’s Friend.tech, a social platform that allows users to buy and sell shares in public figures.

“In just 2 months, Coinbase’s Base L2 has skyrocketed, topping the charts in transactions and unique addresses. Much of this growth is fueled by the new social app, FriendTech,” IntoTheBlock stated on X.

Base operates as a layer 2 network on Ethereum that came about due to the combined effort from Coinbase and Optimism. Incubated by Coinbase, Base was created to provide its users with a faster transaction process, improved scalability, and lower gas fees.

Currently, Base surpassing Solana in transaction volume, and the number of unique addresses is one of the most impressive achievements of the blockchain network, due to Solana being one of the most notable blockchains in the crypto ecosystem known for its speed and scalability.

During the first week of its mainnet launch, the blockchain network also surpassed Cardano in terms of TVL, transaction speed, and number of successful transactions. The blockchain saw more successful transactions in one week than Cardano’s successful transactions in one month.

Social App Friend.tech Attributed To Base’s Achievements

You can’t rule out Friend.tech when talking about Base’s achievement in the crypto market. The social app is well-known among users and investors and has become an eminent topic of discussion in the community.

During its official launch on August 10, 2023, the invite-only social app recorded over 4,400 ETH ($8.1 million) in trading volume in just 24 hours after its launch. The social app has also reportedly accumulated more than 130,000 daily users since its release. Base also saw a surge in Transactions Per Second (TPS) as more investors engaged in the social app.

Base Posts New All-Time High In Daily Transactions Amidst Friend.tech Resurgence

Base, the Coinbase-incubated Ethereum layer 2 (L2) network, has seen rising adoption since opening its door to the public barely a month ago. While the blockchain platform has gained significant traction, its pool of users and protocols has also witnessed substantial expansion.

In a testament to this rapid growth, Base recently registered its highest number of transactions in a single day.

Base Network Records Massive On-Chain Activity In One Day

According to data from IntoTheBlock, Base has seen its daily transactions soar to a new all-time high. The blockchain platform registered a total of 1.88 million transactions on Thursday, September 14.

Lucas Outumuro, head of research at IntoTheBlock, revealed that Base recorded more transactions than the sum of Arbitrum and Optimism transactions (780,000 and 370,000, respectively) on the same day.

The network fees is another metric that reflects the apparent surge in Base’s on-chain activity in recent days. Data from TokenTerminal showed that the blockchain generated more network fees than Arbitrum and Optimism.

Furthermore, Base notched its peak transaction throughput in the past week. According to L2beat, the network recorded a significant 21.29 transactions per second (TPS) on Thursday, September 14.

This figure placed Base above other L2 chains and Ethereum in terms of transaction throughput. Nevertheless, the network remains in the top spot, with a current TPS of 19.58.

These feats underscore the positive performance of the Coinbase-incubated network in the past few weeks. Base has managed to stake a strong claim for a place amongst the top L2 blockchains, as demonstrated by its surging on-chain activity.

However, it is worth noting that Base still lags behind Arbitrum and Optimism regarding total value locked (TVL). According to DefiLlama, Base has a TVL of nearly $373 million, while Arbitrum and Optimism boast roughly $1.7 billion and $650 million, respectively.

What’s Behind This Latest On-Chain Activity Surge?

The latest surge in on-chain activity on the Base network has been linked primarily to the renewed hype of the decentralized social network, Friend.tech.

IntoTheBlock made this connection in a report, saying, “Interestingly, it is not DeFi applications nor NFT marketplaces driving the surge in Base’s activity. Instead, a significant portion of usage can be attributed to a new social application, FriendTech.”

Friend.tech is a decentralized social media platform built on Base. It allows users to trade “keys” of X (formerly Twitter) accounts and interact with social media personalities in a closed, group chat format.

The Friend.tech platform, once pronounced dead by critics, sprung back to life in the past week. The decentralized application seems to be enjoying renewed user interest, with its TVL surpassing $30 million in the last few days.

Friend.tech has been experiencing an uptick in activity, shattering its trading volume record two days in a row. Meanwhile, the platform has seen an increase in capture fees, which reached an all-time high of about $2 million on September 14.