The price of Bitcoin fell drastically towards the $60,000 mark in the days leading up to the just concluded halving. On-chain data has shed light on what could very well be the reason for this price dip in the middle of all the excitement around the halving.

Particularly, data has revealed that some miners have been selling their holdings in the days leading up to the halving event, with the entire BTC holdings of miners hitting a 12-year low.

Miners’ Bitcoin Holdings Hit 12-Year Low

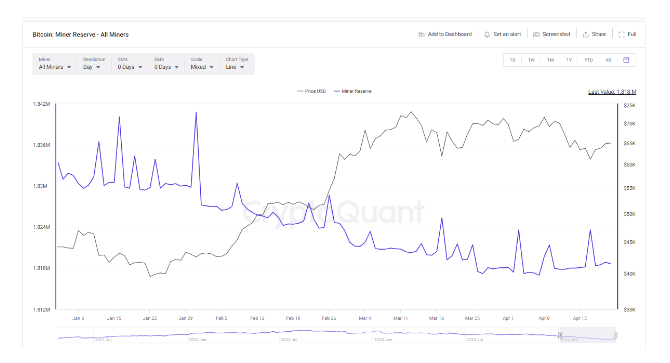

On-chain analytics platform IntoTheBlock noted this interesting trend amongst Bitcoin miners. According to the platform’s “Miners’ Bitcoin Holdings,” the collective BTC reserve across various miners has now dropped below 1.9 million BTC, its lowest in over 12 years.

Interestingly, the metric shows that miner reserves have been on a continued trend of outflows since the beginning of the year, just after the approval of Spot Bitcoin ETFs. This means the outflow from miner wallets can be linked to increased demand from the various Bitcoin ETF wallets, with the latter now controlling over 4.27% of the total circulating wallets.

As Bitcoin goes into the halving, miners’ BTC holdings hit 12 year low. This indicates that miners have been net sellers leading up to the halving. pic.twitter.com/WNi74RkluG

— IntoTheBlock (@intotheblock) April 19, 2024

At the time of writing, CryptoQuant data puts the total number of miner reserves at 1.818 million BTC, a decrease of 22,000 BTC from 1.84 million on January 3. Additionally, this outflow from the miner reserves was exacerbated in the days leading up to the halving, as noted by IntoTheBlock.

“This indicates that miners have been net sellers leading up to the halving,” IntoTheBlock said in a social media post.

The persistent selling pressure exerted by miners may have been a contributing factor in Bitcoin’s stagnant pace between $65,000 and $70,000 over the past weeks. This outflow of BTC from miner wallets into the market seems to have flooded the market with more than enough BTC, which in turn contributed to a crash to $60,000 during the week.

What’s Next For Bitcoin?

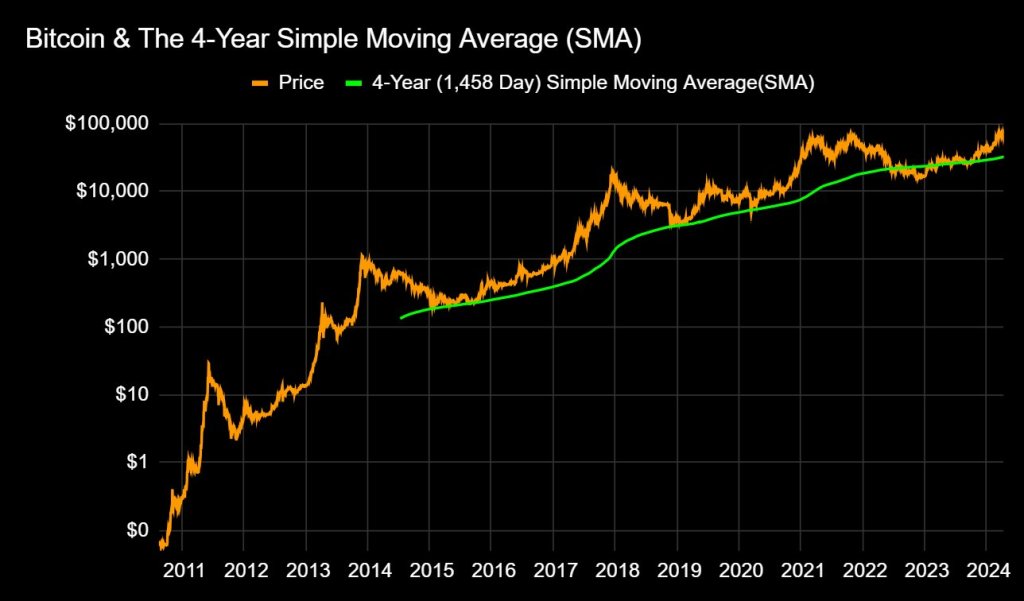

The practice of Bitcoin miners selling their holdings in the days leading up to the halving is not unusual, as demonstrated by their actions in past halving events. At the time of writing, Bitcoin is trading at $64,978, up 8% after rebounding up at $60,000. The much anticipated fourth Bitcoin halving has now been completed and the industry looks forward to its effect over the next few months.

The halving is ultimately a balancing act for miners. Although miners’ revenues are cut in half, the reduced Bitcoin supply and possible price increase can help offset some of the losses over time. According to a report, Bitcoin miners could sell up to $5 billion worth of BTC after the halving, with the price of the cryptocurrency potentially falling to $52,000.

Featured image from Pexels, chart from TradingView