As the long-awaited deadline for a positive or negative decision on spot Bitcoin ETF applications approaches, Bloomberg reports that the BTC options market is seeing increased hedging activity as traders prepare for a crucial decision on January 10th.

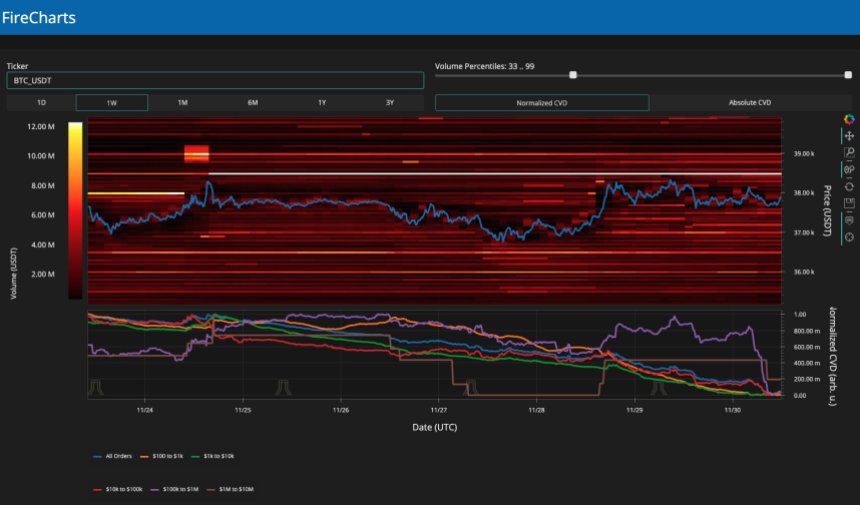

The report indicates a surge in open interest for put options expiring on Jan. 12, suggesting that market participants are taking steps to mitigate potential losses in the event of a negative verdict by the US Securities and Exchange Commission (SEC) regarding these index funds holding the cryptocurrency.

Market Readies For Bitcoin ETF Verdict

The Bloomberg report highlights that the open interest for put options, which allow holders to sell Bitcoin, has seen a significant increase for contracts expiring on January 12.

This surge in open interest has resulted in a higher put-to-call ratio for these specific options compared to contracts with expiration dates further out from the January 10 deadline.

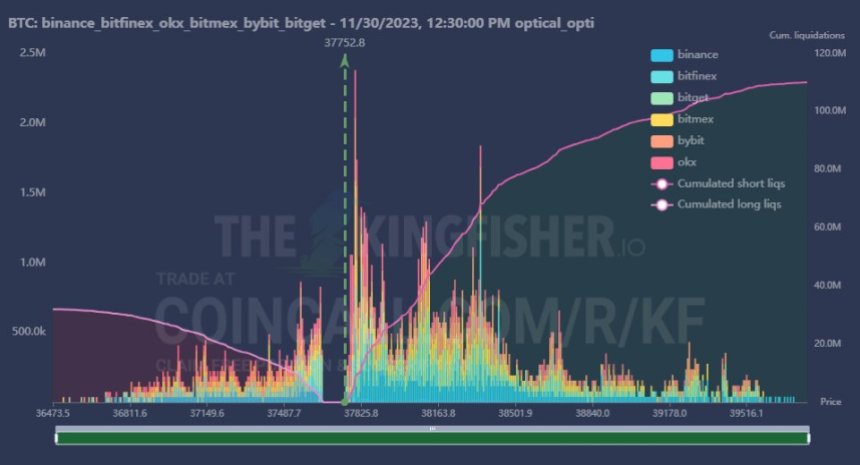

As seen in the chart below, the most prominent strike prices for the put contracts are $44,000, $42,000, and $40,000, respectively, indicating that put holders could exercise their options to minimize losses in case of a negative market reaction to the SEC decision.

The put-to-call ratio, considered a measure of overall market sentiment, stands at 0.67 for the January 12 options contracts, indicating a more cautious approach among traders.

Ryan Kim, head of derivatives at FalconX, suggests that leveraged/speculative traders are employing Bitcoin put options to protect their leveraged longs, anticipating significant price movements in either direction.

The higher put-call ratio for January 12 options further reflects the market’s desire for protection against a potential negative decision.

The surge in open interest for put options expiring on January 12 indicates a growing need for protection in case of an unfavorable ruling. While Bitcoin’s rally has softened the impact of its 2022 decline, market expectations for ETF approval may already be priced in, posing potential risks for the market.

BTC’s Price Resistance And Potential Dip

Bitcoin has experienced a remarkable rally this year, with expectations for ETF approval driving its price up by more than 60% since mid-October.

However, the Bloomberg report suggests that the surge in demand for the anticipated ETFs may already be factored into the token’s price, potentially exposing the market to a “sell the news” scenario in the second week of January.

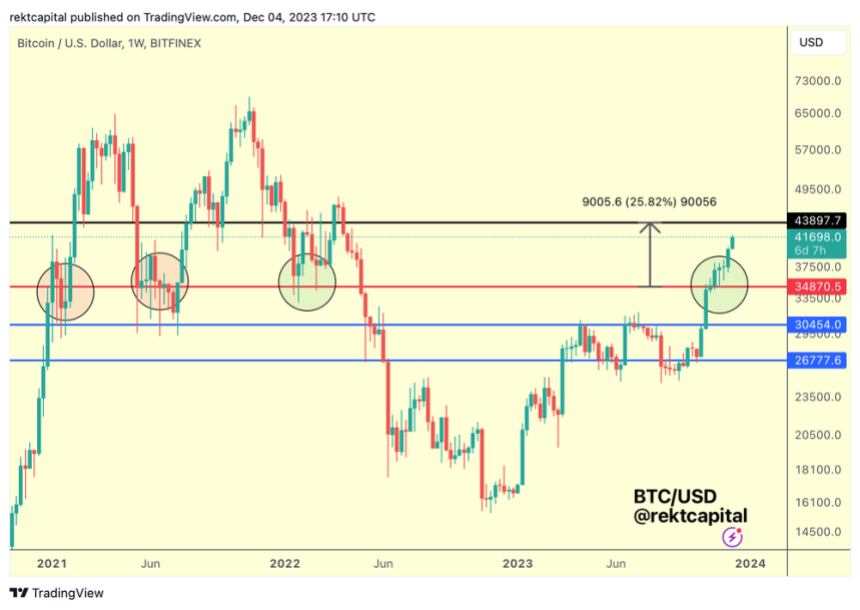

Furthermore, QCP Capital, a Singapore-based crypto asset trading firm, predicts topside resistance for Bitcoin in the range of $45,000 to $48,500 and a possible retracement to $36,000 levels before the uptrend resumes.

Bitcoin is currently trading at $43,400, experiencing a 1% decline over the past 24 hours. Over the past 14 days, the cryptocurrency has shown a sideways price movement with a slight decrease of 0.4%.

Given Bitcoin’s well-known volatility, it remains uncertain how the market will react as the looming decision and potential catalysts draw near, and how these factors will impact its price dynamics.

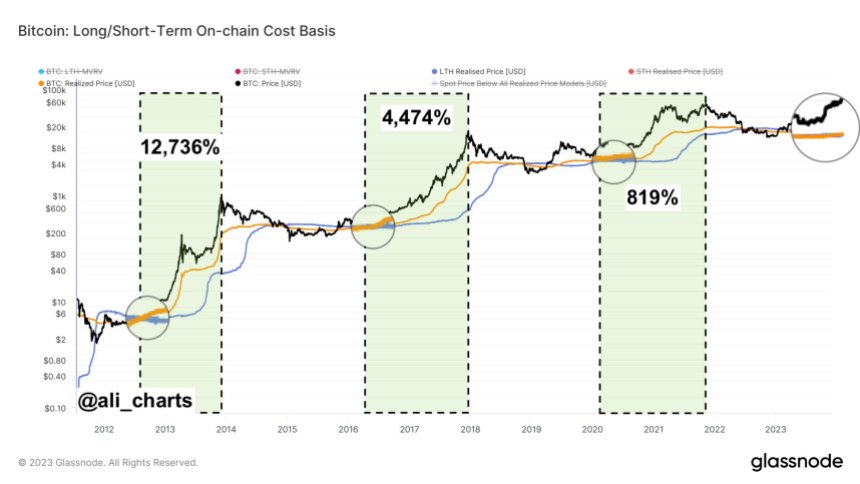

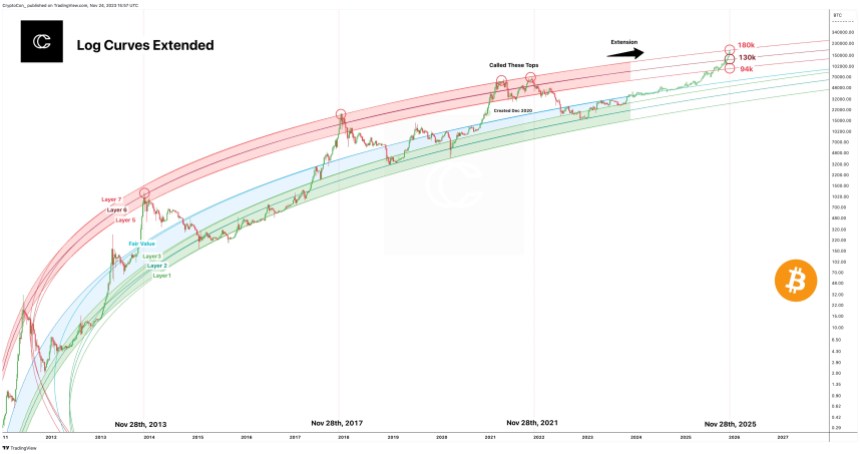

However, the upcoming decision is not the sole catalyst that can potentially drive Bitcoin’s price in 2024. The cryptocurrency is also anticipated to experience a significant catalyst in April 2024, known as the halving event.

This event has historically resulted in an upward surge in Bitcoin’s price, and it is predicted to propel the cryptocurrency beyond its previous all-time high (ATH) of $69,000 throughout the upcoming year.

Featured image from Shutterstock, chart from TradingView.com