The recent Bitcoin (BTC) price surge has ignited renewed interest and confidence among investors, leading many to believe that the BTC bull run is accelerating.

According to trader and crypto analyst Adrian Zduńczyk, Bitcoin has reached a new 52-week closing high and has maintained a close above the previous high of $32,000 for three consecutive weeks.

This sustained upward momentum indicates a strong bullish trend sentiment and signals the beginning of the third wave of the Bitcoin bull run.

Analyst Highlights Key Trends

Zduńczyk points out several dominant trends that contribute to the positive outlook for Bitcoin. The rising 200-week and 50-week moving averages (MAs) highlight the long-term uptrend strength, with key support levels at $28,800 and $26,600.

Additionally, there is a growing correlation with the S&P 500, as evidenced by the 7-week correlation coefficient of 0.34. This alignment with traditional markets suggests that Bitcoin increasingly trades similarly to the Nasdaq.

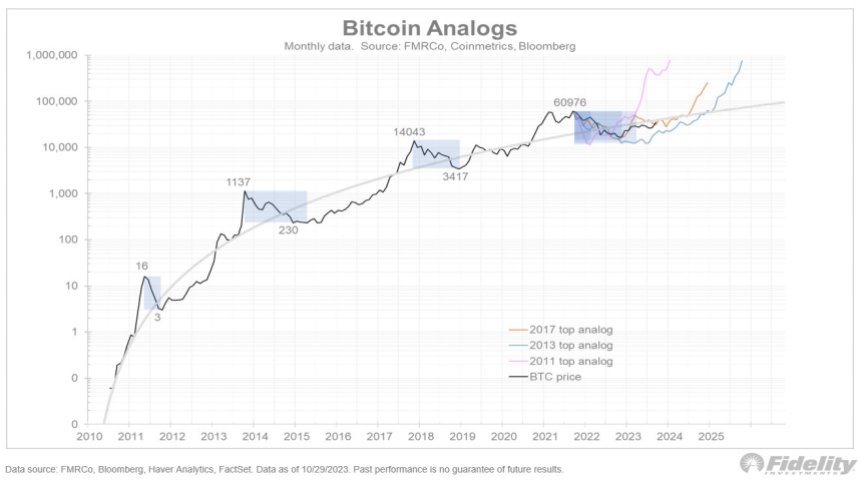

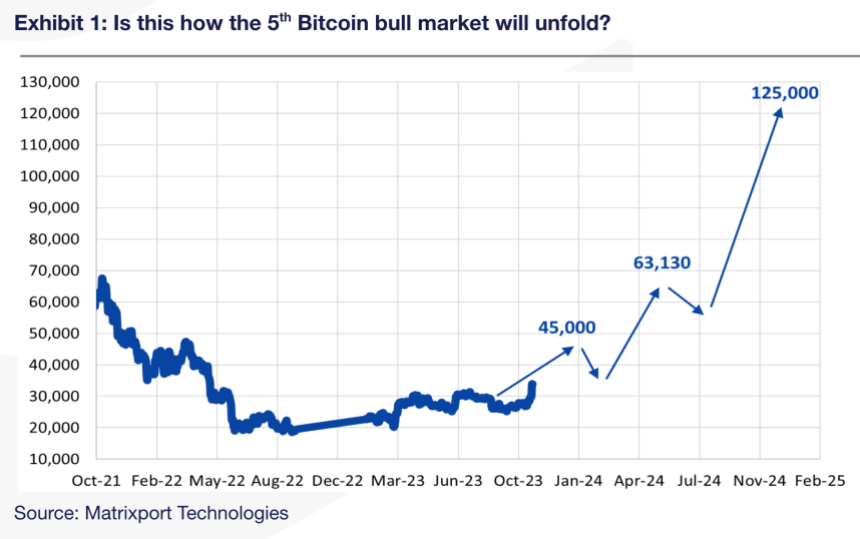

Fundamental drivers also play a significant role in Bitcoin’s upward trajectory. Traders eagerly anticipate the approval of spot Bitcoin exchange-traded funds (ETFs) and the upcoming fourth halving event.

Furthermore, according to Zduńczyk, the historical pattern of previous halvings indicates that Bitcoin has rallied significantly after each halving and has never retraced to pre-halving prices.

Examining the daily trend, Zduńczyk highlights the technical strength demonstrated by Bitcoin’s reliable breakout above $32,000. Breakouts often lead to new trend formations that persist over time.

Despite occasional volatility, the 50-day average true range (ATR) trend and the 50-day relative strength index (RSI) momentum trend are rising, indicating ongoing positive momentum.

Bitcoin’s future appears promising, supported by positive market trends, fundamental drivers, and technical indicators. However, warning signs cast doubt on Bitcoin’s favorable outlook, as renowned crypto analyst Ali Martinez pointed out.

Bitcoin Bullish Momentum At Risk?

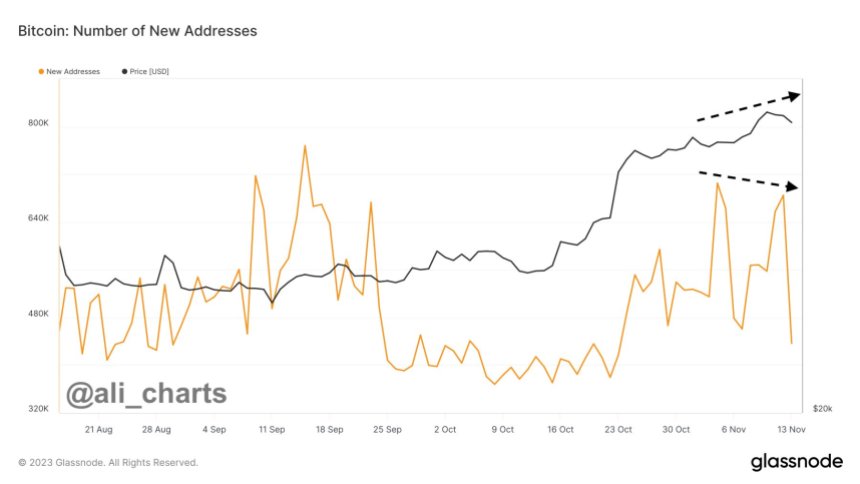

Martinez draws attention to the bearish divergence between Bitcoin’s price and network growth, indicating a potential lack of sustained momentum in the ongoing uptrend.

The chart above shows a notable disparity between the exponential rise in Bitcoin’s price and the dramatic decline in new addresses over recent days.

This bearish divergence raises concerns about the overall strength of the current uptrend. While Bitcoin’s value has experienced significant gains, the number of new addresses created has decreased significantly.

According to Martinez, this bearish divergence between Bitcoin’s price and network growth serves as an on-chain sell signal that traders should be aware of. The slowdown in network growth despite the price surge suggests that the current upward momentum may not have enough strength to sustain.

At the time of writing, BTC is trading at $36,200, down 1.6% over the past 24 hours. However, it is still up a substantial 4.6% over the past 7 days.

It remains to be seen if a surge in new addresses will be able to support BTC’s bullish momentum and break the current consolidation phase. Alternatively, the cryptocurrency could retest support levels in the coming days.

Featured image from Shutterstock, chart from TradingView.com