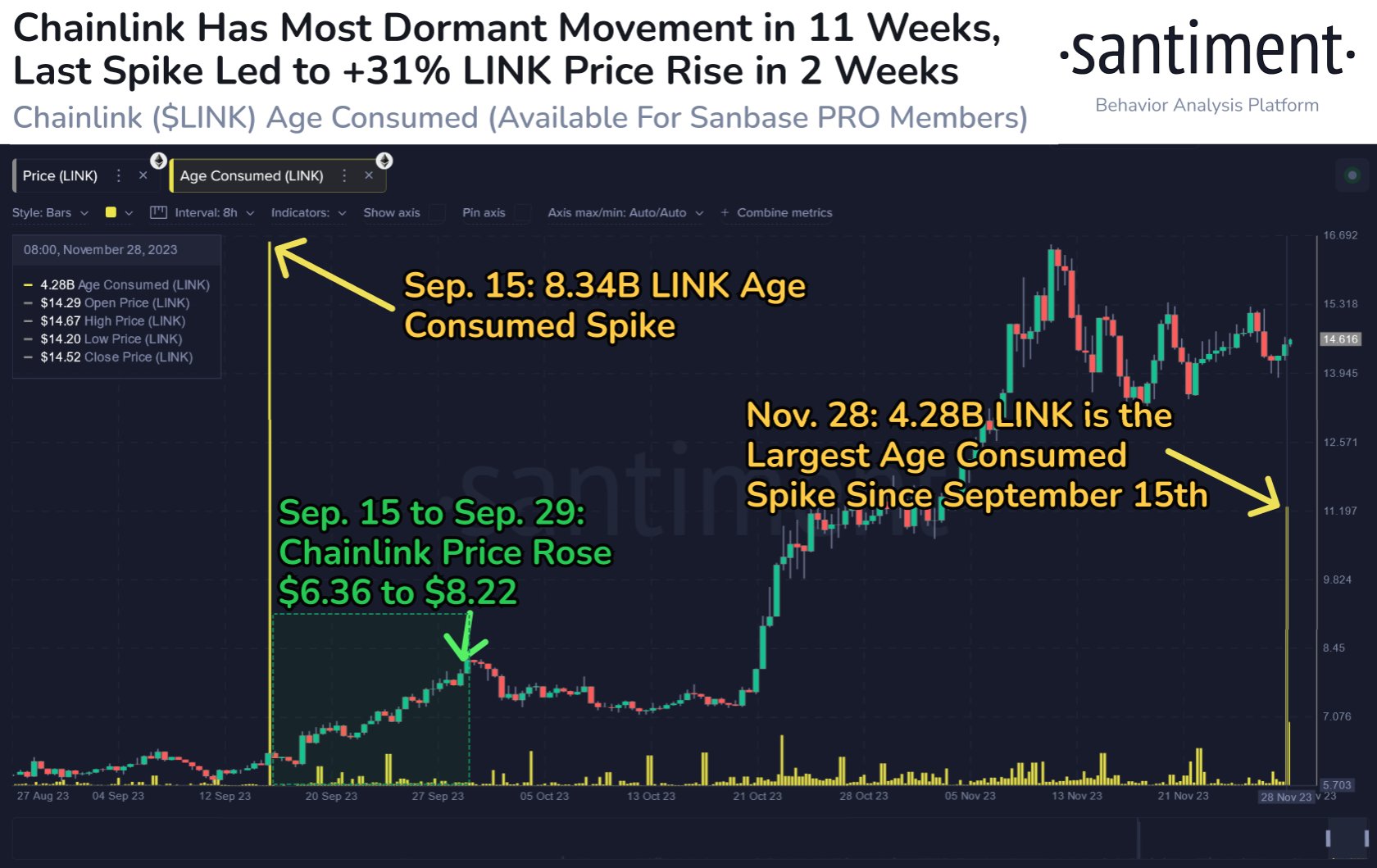

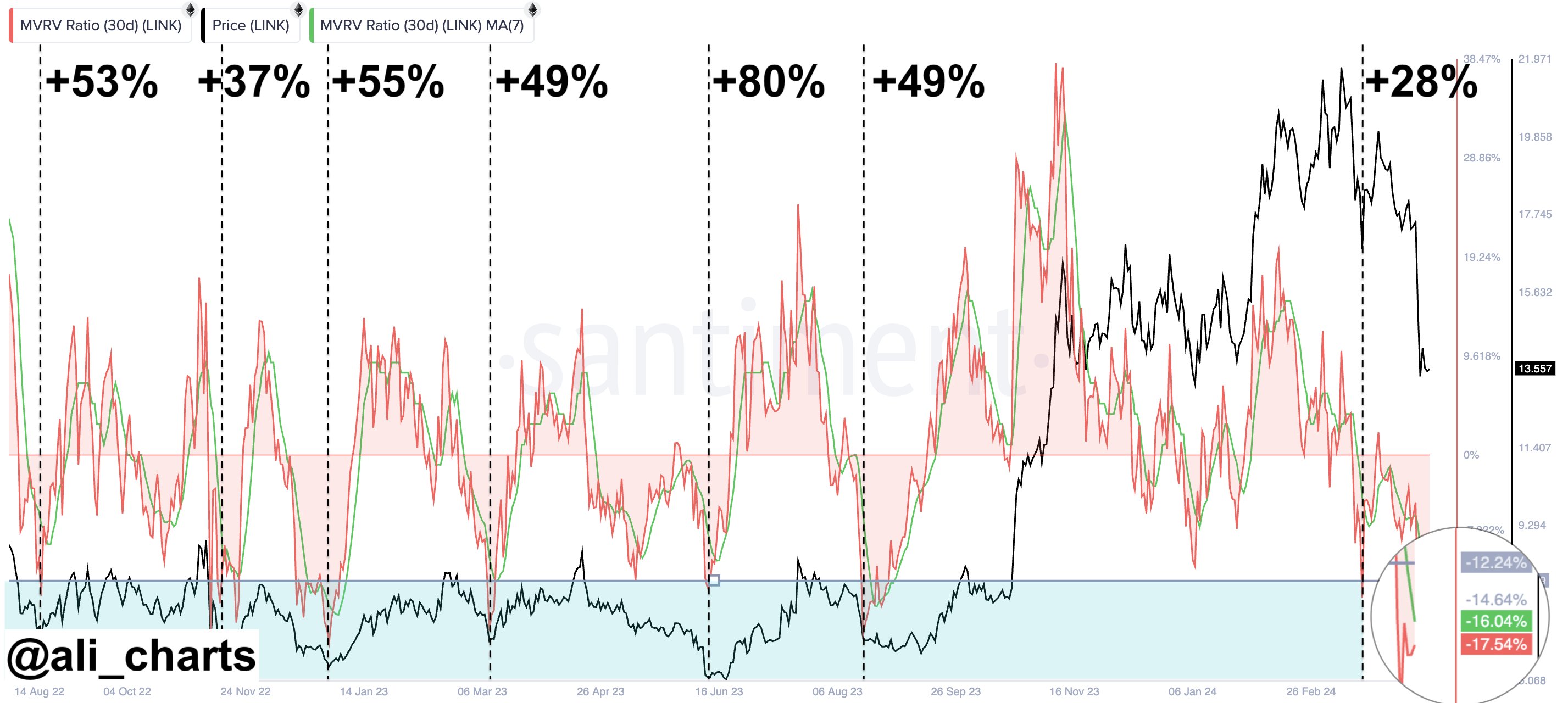

On-chain data shows that a Chainlink indicator is currently forming a pattern that has led to an average 50% increase for LINK in the past.

Chainlink 30-Day MVRV Ratio Has Plunged

In a new post on X, analyst Ali discussed the latest trend in Chainlink’s 30-day MVRV ratio. The “Market Value to Realized Value (MVRV) ratio” is a popular on-chain indicator that tracks the ratio between LINK’s market cap and realized cap.

The market cap naturally refers to the total valuation of the asset’s circulating supply at the current spot price. In contrast, the realized cap is a different type of capitalization model that calculates the total value of the cryptocurrency by instead taking the price at which each coin in circulation last moved on the network as its “true” value.

Since the last transaction of any coin was probably the last time it changed hands, the price at its time would signify its current cost basis. As such, the realized cap sums up the cost basis of every coin in circulation.

In this view, the realized cap would be nothing but a measure of the total capital the investors have used to purchase the asset. In contrast, the market cap represents the value that they are holding right now.

The MVRV ratio compares these two models, and its value can provide hints about whether the overall market holds more or less than it puts into Chainlink.

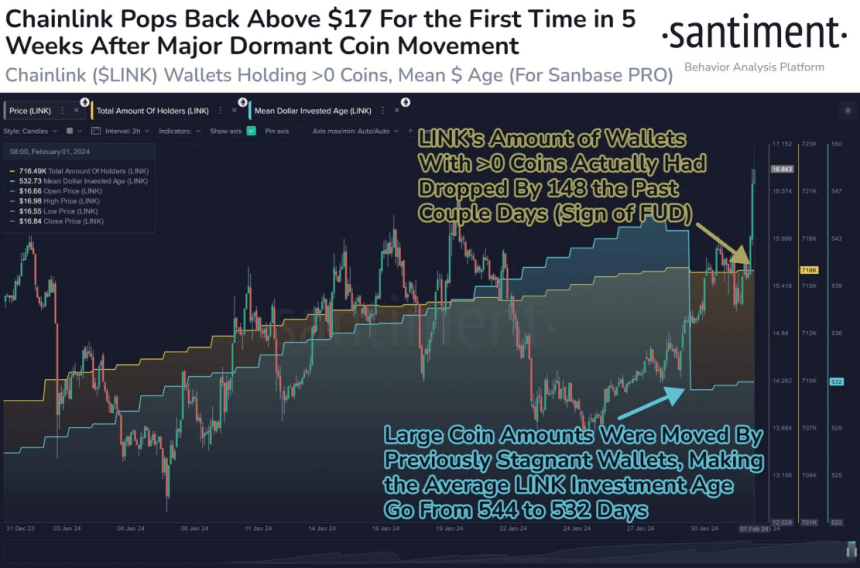

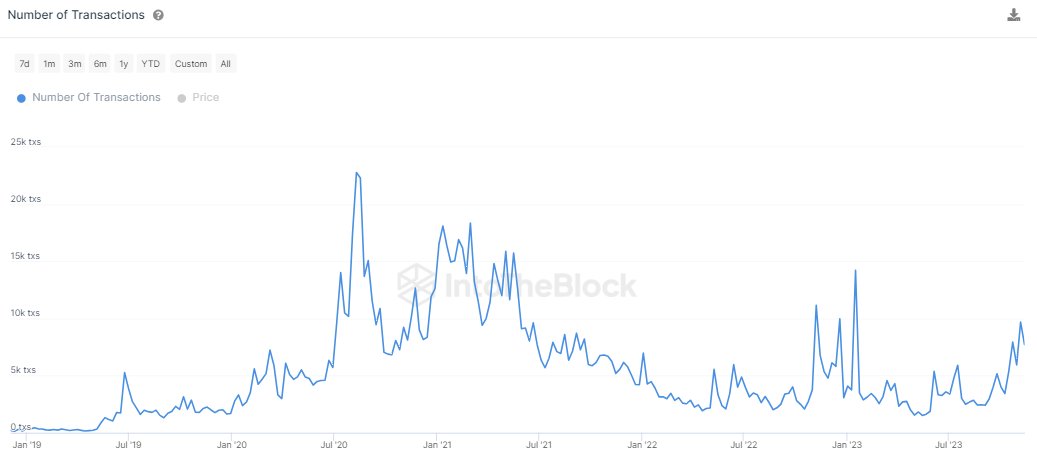

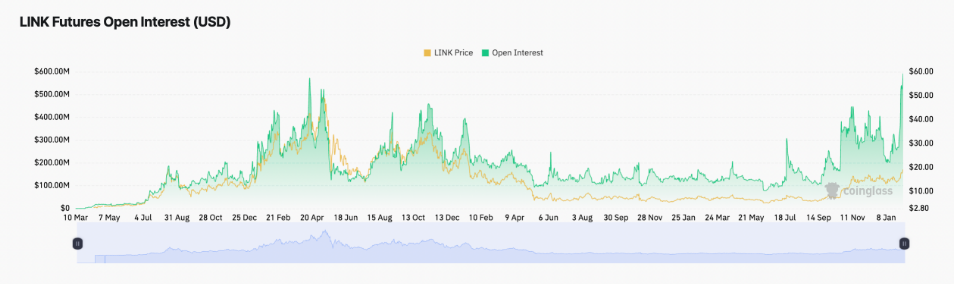

In the context of the current topic, the 30-day version of this indicator is of focus, which restricts itself to only the investors who bought within the past month. Here is the chart shared by the analyst that shows the trend in this LINK indicator over the past couple of years:

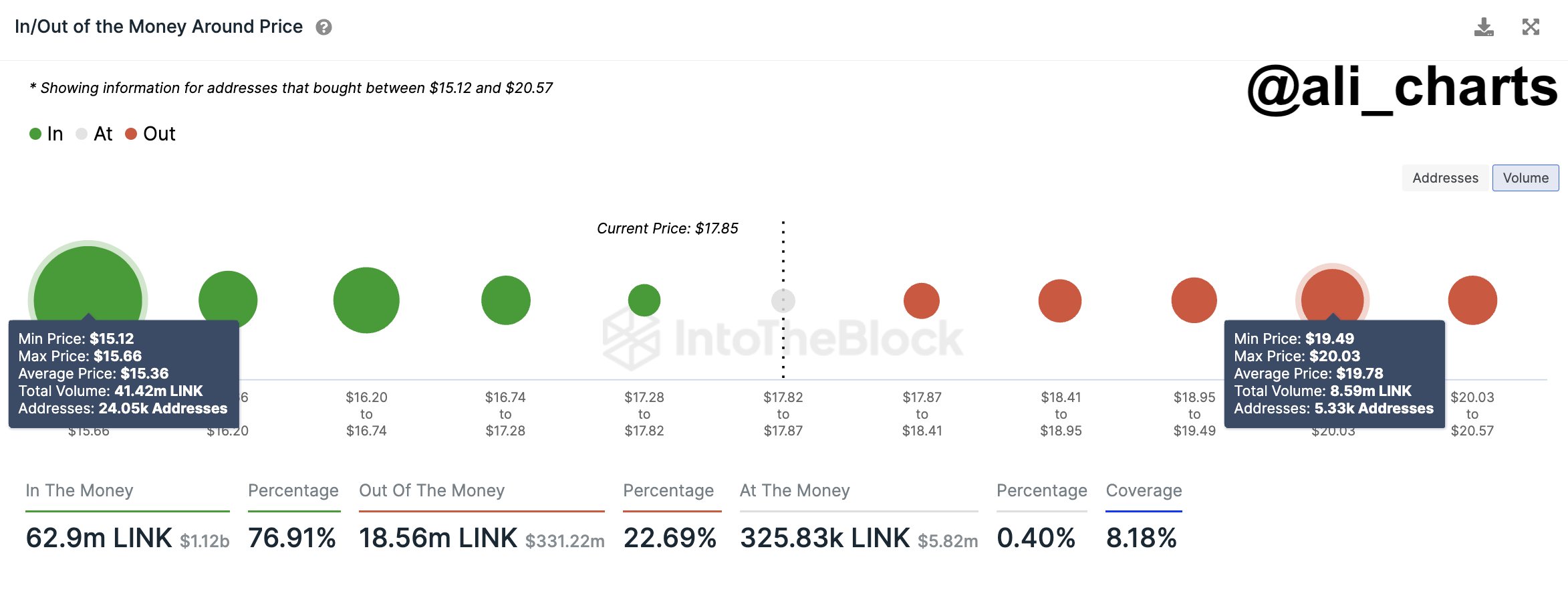

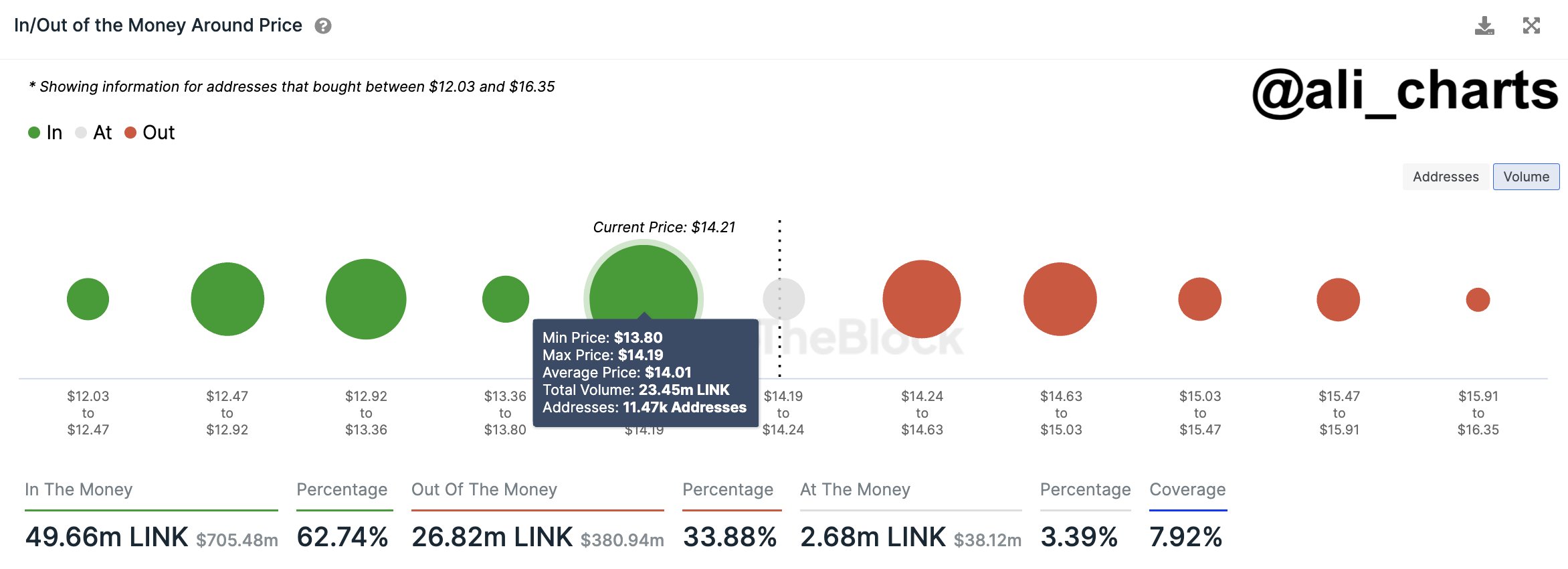

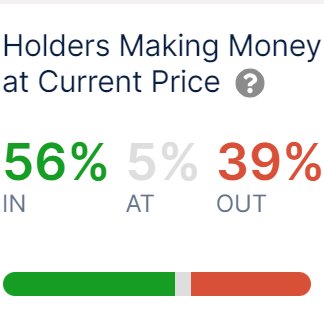

As displayed in the above graph, the Chainlink 30-day MVRV ratio has recently taken a sharp plunge and dipped under the 0% mark. The 0% mark is where the market cap and realized cap are exactly equal, so below it, the latter would be greater than the former.

When this is the case, the investors are carrying losses. This recent plunge into the negative has naturally come for the metric as the cryptocurrency’s price has plummeted, putting the 30-day buyers underwater.

In the chart, Ali has highlighted a specific pattern that Chainlink appears to have followed regarding this indicator, plunging deep into the negative territory. “Each time Chainlink MVRV 30-Day Ratio has dropped below -12.24% since August 2022, it’s signaled a prime buying opportunity, averaging 50% returns!” notes the analyst.

Recently, the indicator has declined towards 17.54%, meaning it’s below this level, which has historically led to profitable buying windows for the coin. It remains to be seen whether the pattern followed in the last two years will hold this time as well.

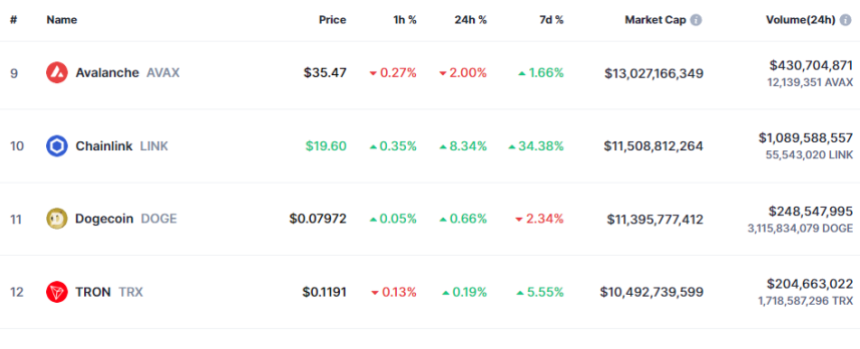

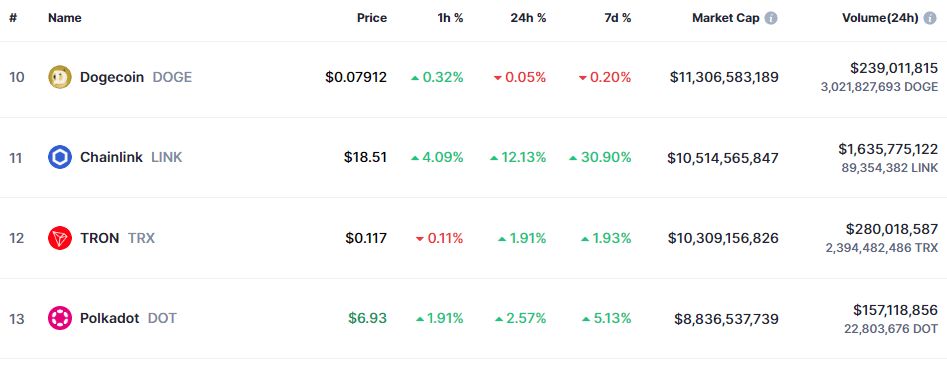

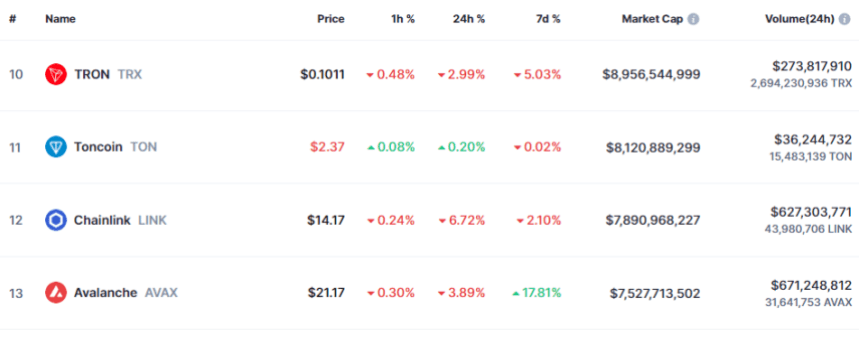

LINK Price

The past week has been terrible for Chainlink investors. The asset’s price has plunged by more than 23%, coming down to just $13.3 now.

800,000

800,000