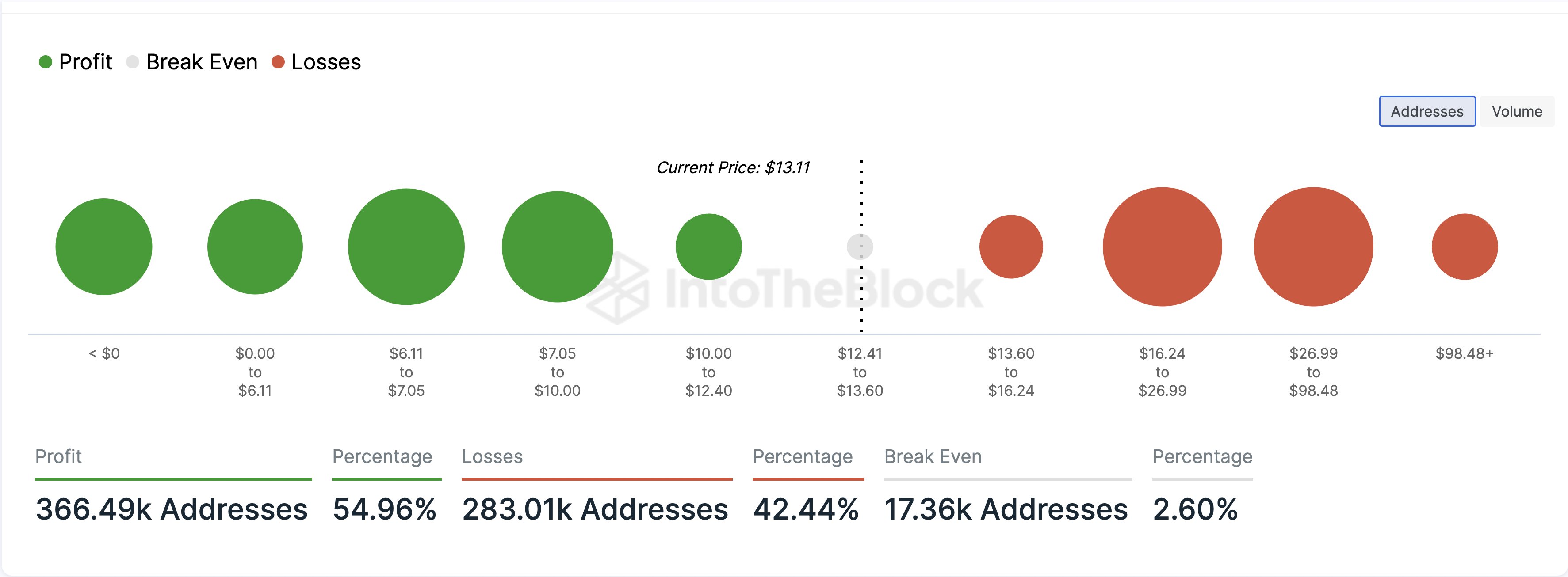

An analyst has pointed out how Chainlink might be breaking out of a bull flag right now, which could suggest a rally toward $20.

Chainlink Is Escaping Out Of A Bull Flag Pattern Currently

In a new post on X, analyst Ali pointed out a breakout that may be forming in the LINK price chart. The relevant technical pattern here is the “bull flag,” which, as its name implies, looks like a flag on a pole.

This pattern forms when the asset’s price goes through a pullback after seeing a sharp rally and consolidates inside a region. The initial trend acts as the “pole,” while the parallel trendlines of the consolidation region make up the “flag.”

The flag’s length (the distance between the parallel trendlines) is always at most half the length of the pole. If it’s not, then the pattern isn’t that of a bull flag.

Inside the flag, the price feels resistance at the upper line and support at the lower one. A successful break out of the resistance zone generally indicates that the asset is ready to continue the initial uptrend.

According to the analyst, the chart below shows that such a pattern is forming for Chainlink.

As displayed in the graph, Chainlink had earlier been consolidating inside what seems to have been a bull flag, but with the recent surge, the asset has seen a break out of the pattern.

When Ali shared the chart, LINK had been trading just under the $15 mark. The analyst had noted that a retest of the breakout zone could happen soon, around $14.

The cryptocurrency has indeed made such a retest since then, as its price has observed some retrace. Ali believes the price could rally towards the $20 mark, continuing the bullish momentum from earlier. From the current asset price, such a jump would imply profits of almost 42% for Chainlink.

It remains to be seen whether the bull flag pattern holds for the cryptocurrency this time and if a return to a bullish trend occurs.

LINK Has Seen A Rally Of 185% In The Past Month

Regardless of the recent pullback that the asset has seen from above the $16 mark, its returns for the last 30 days are still incredible, as they currently stand at a whopping 85%.

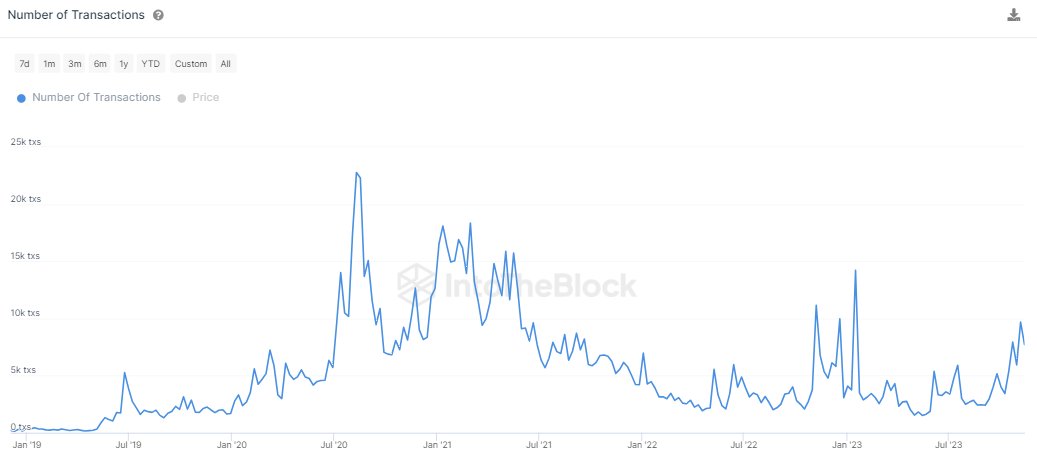

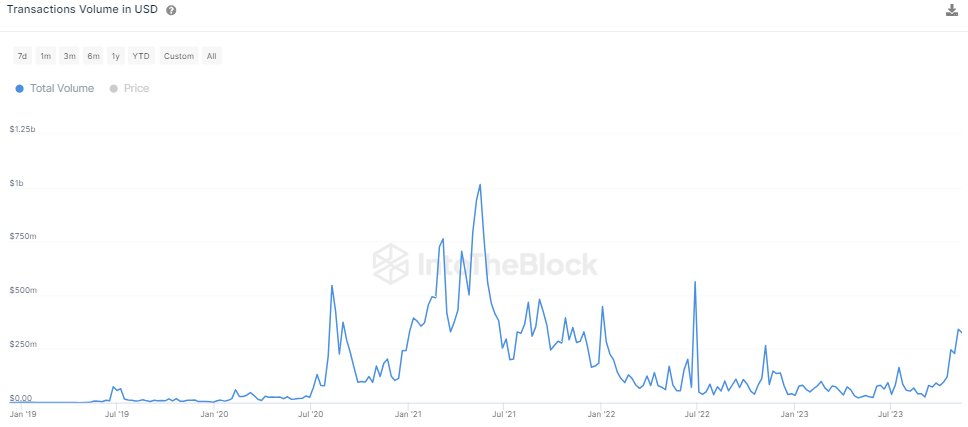

The below chart shows what the performance of the asset has looked like during this period.

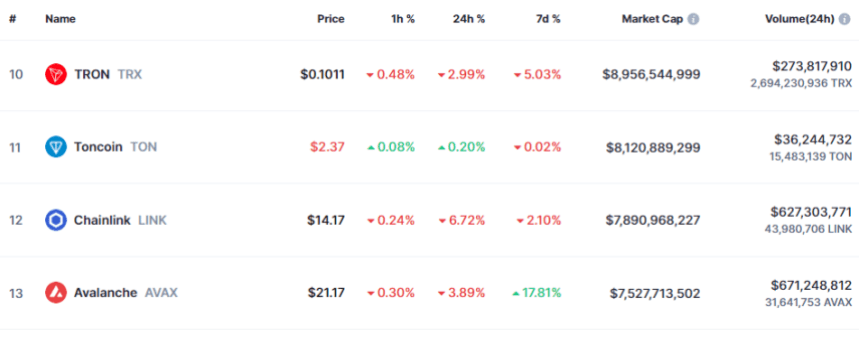

With such large returns, Chainlink has naturally outperformed most of the other top assets recently, and it’s no wonder that the cryptocurrency has also significantly improved its standing in the market cap list.