The surge in CME Bitcoin futures open interest has helped the regulated derivatives platform attain a 25% market share in Bitcoin futures.

Cryptocurrency Financial News

The surge in CME Bitcoin futures open interest has helped the regulated derivatives platform attain a 25% market share in Bitcoin futures.

Advocates for the Bitcoin Lightning Network and decentralized protocol NOSTR fueled Kweks’ Kilimanjaro climb.

The latest price moves in bitcoin (BTC) and crypto markets in context for Oct. 30, 2023. First Mover is CoinDesk’s daily newsletter that contextualizes the latest actions in the crypto markets.

A retail central bank digital currency could add unique value to the existing payments ecosystem and enable new types of economic transactions, but further investigation is needed, Hong Kong’s central bank said.

The total value of all assets locked on decentralized finance (DeFi) protocols has surged to a three-month high of $42 billion after being at its lowest point since February 2021 just two weeks ago.

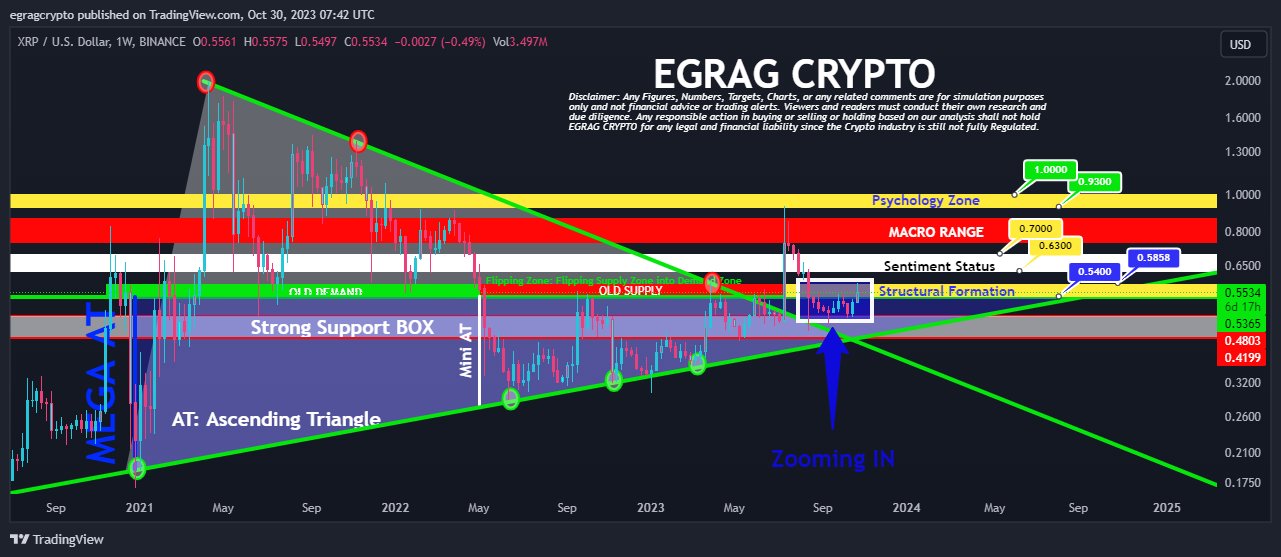

In a detailed analysis shared on social media today, renowned crypto analyst Egrag points to several bullish indicators in the XRP price structure, suggesting the potential for an imminent breakout. Egrag evaluated various timeframes, identifying a series of technical patterns and formations that bolster the bullish outlook.

“Last week’s candle closed within the confines of the Yellow structural formation,” Egrag tweeted with regard to the weekly XRP/USD chart, emphasizing the significance of recent movements within the timeframe. This observation is instrumental in understanding the underlying market structures influencing the upcoming price action.

The implication? If another weekly candle were to affirm its position within this formation, the odds of a bullish trend continuation could significantly increase. “To confirm a bullish trend continuation, we need to see another weekly candle close with a full body inside this structure,” Egrag added.

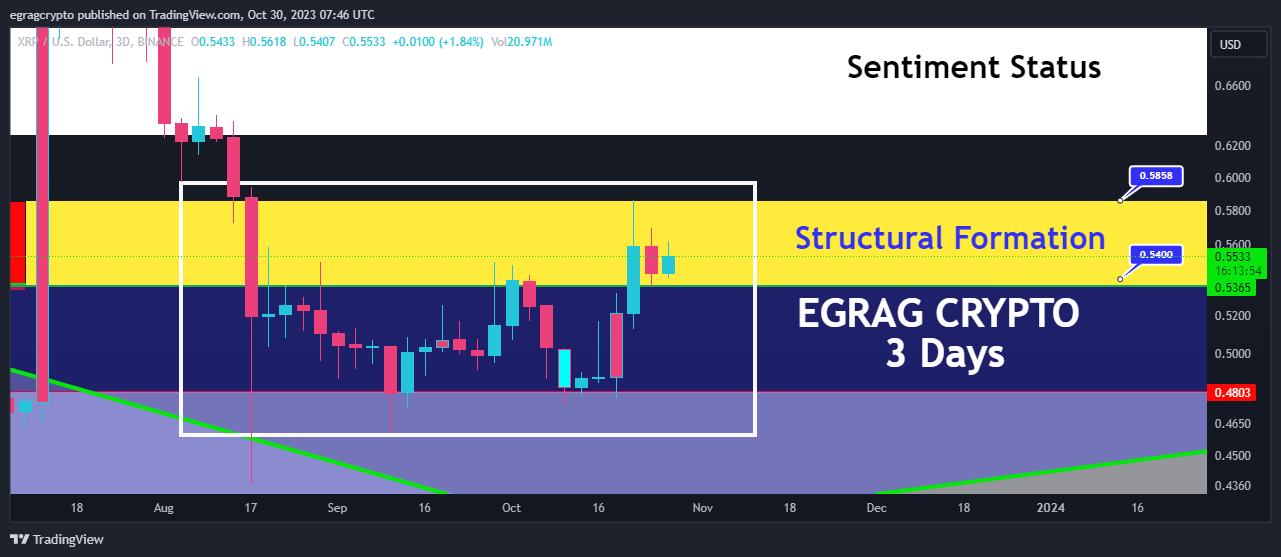

Next, his insights extend further to the three-day chart, where he keenly observes, “In just 16 hours, XRP is poised to complete the second full body candle within the structural formation, signaling a strong bullish sentiment.” This near-term projection underscores a sense of momentum that appears to be building within the XRP market.

The 1-day chart, too, garnered Egrag’s scrutiny. He highlighted the imminent completion of the seventh full-body candle within the current structure, stating this indicates an “extremely bullish trend.” This observation suggests that XRP’s bullish behavior isn’t just a fleeting phenomenon but has consistency across varying timeframes.

For traders with a penchant for shorter timeframes, Egrag’s insights into the 12-hour chart are particularly salient. While there have been multiple closures within the structural formation, he singled out the importance of the ongoing momentum: “The current candle and the next one are pivotal as they form a symmetrical triangle.”

He elaborated on the implications of this pattern, saying, “Typically, symmetrical triangle breakouts have a 50/50 chance, making this a decision point for XRP.”

Circling back to a tweet from October 27, Egrag had demarcated significant price zones, highlighting the “$0.54 to $0.58” range as a make-or-break threshold. Beyond this, he indicated the “$0.63-$0.70” range as a pivotal indicator of market sentiment shifts.

For those with an eye on the psychological dimensions of trading, Egrag’s mention of the “0.93-$1” bracket is noteworthy. He cautioned traders about this zone, advising them to “Stick to your plan and resist the temptation to let emotions or impatience dictate your actions.”

In sum, Egrag’s comprehensive analysis blends technical data with trader sentiment and psychology, providing a nuanced and detailed perspective for those invested in XRP. The coming days are likely to be watched with bated breath as traders anticipate the next big move.

At press time, XRP traded at $0.5595.

Non-fiat-backed stablecoins will not be allowed into regulated payment chains.

The Group of Seven (G7) countries will agree on a voluntary AI code of conduct for companies developing AI to reference for mitigating risks and benefits of the technology.

Singapore’s central bank and financial regulator is seeking closer cross-border collaboration for its asset tokenization project.

OPNX voluntarily dropped its defamation suit against the venture investor and crypto personality.

Ethereum (ETH), one of the leading cryptocurrencies, is displaying remarkable resilience in the face of recent market fluctuations. Despite experiencing relatively modest gains compared to Bitcoin (BTC) and other major altcoins, ETH has managed to consolidate its position above the $1800 mark.

The big question on everyone’s mind is whether Ethereum can sustain this level or if it will succumb to the prevailing market sentiment.

In the world of cryptocurrencies, prices are highly susceptible to market sentiment. Cryptocurrencies often exhibit dramatic price swings based on the emotions and perceptions of investors and traders. Positive sentiment tends to drive prices up, while negative sentiment can lead to sharp declines. In this particular instance, the catalyst for market sentiment is the upcoming US Federal Open Market Committee (FOMC).

The FOMC is a key division of the US Federal Reserve responsible for setting monetary policy in the United States. One of the primary tools at its disposal is the adjustment of interest rates. When the FOMC meetings take place, the decisions made regarding interest rates can have a significant impact on various financial markets, including cryptocurrencies.

If the FOMC decision leans towards a hawkish stance, implying an increase in interest rates, it could result in a surge of bearish sentiment across the cryptocurrency market. In such a scenario, Ethereum sellers might exert pressure, potentially pushing the altcoin below the $1700 mark.

Conversely, a dovish or unchanged policy stance could lead to a more positive sentiment, allowing ETH to maintain its current position and even experience upward momentum.

As of the latest data available on CoinGecko, Ethereum is trading at $1,816, showcasing a 1.8% gain over the last 24 hours and a notable 8.8% increase over the past seven days. While these gains may appear modest when compared to the cryptocurrency market’s usual volatility, they reflect Ethereum’s capacity to maintain a steady footing in turbulent times.

A noteworthy development in the Ethereum ecosystem is the remarkable performance of Layer 2 (L2) solutions. These scaling solutions are designed to alleviate Ethereum’s network congestion and high gas fees.

Recently, L2 solutions set a new all-time high in Total Value Locked (TVL), briefly touching $12 billion before stabilizing around $11.89 billion. This achievement surpasses the previous historic high registered back in April at $11.85 billion, signifying the increasing adoption of Ethereum’s Layer 2 solutions.

With the $1,800 threshold serving as a crucial psychological barrier, the ultimate direction of Ethereum’s price movement hinges on the delicate balance between market sentiment and the decisions of key financial institutions.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Shutterstock

Saudi Arabia’s forthcoming regional development project, NEOM, has partnered with Animoca Brands to push Web3 in the region and a potential $50 million investment deal.

Project Guardian seeks to advance digital asset tokenization pilots in fixed income, foreign exchange and asset management products.

UN scientists evaluated the activities of 76 Bitcoin mining nations during the 2020–2021 period and found that the global BTC mining network consumed 173.42 TW/hs of electricity.

Several altcoins are currently on the rise following Bitcoin’s resurgence, and popular crypto analyst Ali Martinez has singled out the Uniswap UNI token as one of those tokens that could rally further as he projects that UNI is set to break out soon from its current resistance level.

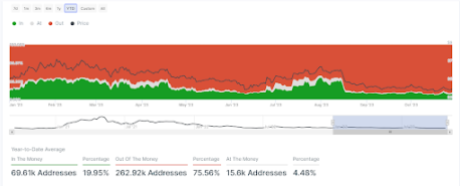

In a post shared on his X (formerly Twitter) platform, Martinez noted that the majority of UNI holders were positioned ‘Out of the Money,’ which suggests that the token was preparing for a breakout. Accompanying his post was data from the crypto analytics platform Intotheblock based on the ‘Historical In/Out of the Money’ metric.

The data shows that over 75% of the token holders are ‘out of the money’, which means that they were yet to break even in their investments as the average cost price at which they bought these tokens is greater than its current price.

More addresses are out of the money | Source: IntoTheBlock

More addresses are out of the money | Source: IntoTheBlock

Furthermore, the crypto analyst explained that selling pressure has gotten exhausted and that the UNI token has been able to build “an important support” level at around $4. This could serve as a lift-off point for the altcoin.

To further support his breakout theory, Martinez noted two supply walls that UNI “needs” to overcome in order to signal a bullish breakout. According to him, one of these supply walls is at $4.23, where data from Intotheblock shows that 7,000 addresses have bought 14.24 million worth of UNI.

The other supply wall is at $4.45, where data from Intotheblock shows that 2,000 Uniswap addresses have accumulated 10.28 million worth of UNI. Whales and institutional players may also be aware of this potential breakout and may be looking to position themselves, as Martinez noted.

The crypto analyst also recently commented on a potential Ethereum breakout. In a different post on his X platform, he said that the second largest cryptocurrency by market cap will need to overcome the huge supply wall at $1,960, where data from Intotheblock showed that 1.14 million addresses bought close to 33 million ETH.

Meanwhile, Martinez believes that now is a good time for people to accumulate Bitcoin based on his examination of the past two cycles from the market bottom and the present Bitcoin trend. According to him, a similar trajectory points to the next Bitcoin market top being around October 2025.

At the time of writing, the UNI token is trading at around $4.10, according to data from CoinMarketCap.

Sam didn’t do it. He didn’t defraud anyone, he didn’t steal customer funds – he just built a company which “turned out basically the opposite” of the product he envisioned when he founded FTX: “A lot of people got hurt – customers, employees – and the company ended up in bankruptcy.” At least, that’s his story.

The U.K. government published its final proposed rules for crypto and stablecoins on Monday.

The information will be sent to the Internal Revenue Service in early November.

The number of transactions of over $100,000 processed on the Bitcoin blockchain rose to a new year-to-date high last week.

Thailand’s second-largest lender by assets, Kasikornbank, is moving into crypto by acquiring a majority stake in the local crypto business Satang.