CoinShares believe the turnaround is due to “weaker than expected macro data in the U.S.”

Cryptocurrency Financial News

CoinShares believe the turnaround is due to “weaker than expected macro data in the U.S.”

Crypto is becoming an increasingly important part of Robinhood’s business, accounting for 20% of total revenue in the first quarter, the report said.

One trader expects ETH prices to hit $10,000 in 2024, a nearly 200% increase from current levels of $3,600.

BTC price action is busy making impressive achievements despite staying rangebound below all-time highs — but Bitcoin volatility catalysts are right around the corner.

Bitcoin (BTC) seems poised for a major breakout, if prominent analysts are to be believed. The world’s most popular cryptocurrency has been stuck in a consolidation phase for a record-breaking 87 days, but experts say this slumbering giant might be about to awaken with a vengeance.

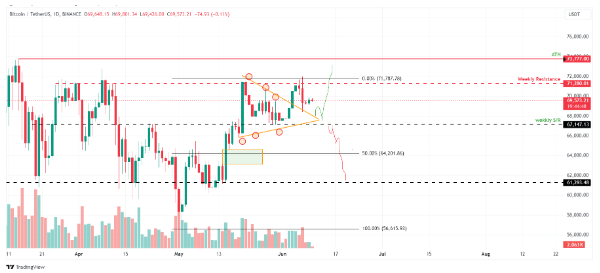

Faibik, a well-known crypto analyst, has identified a technical pattern on the Bitcoin daily chart that hints at a potential explosion. This pattern, known as a Descending Broadening Wedge, suggests a price squeeze that often precedes a significant breakout. Faibik believes that a surge past the crucial $71,000 resistance level would be a strong bullish signal, indicating a potential reversal of the recent downtrend.

$BTC Descending Broadening Wedge formation still in Play on the Daily timeframe Chart..

Once Bitcoin bulls clinch the 71.3k Crucial Resistance, the Party will start.

Trust the Process..

#Crypto #Bitcoin #BTC pic.twitter.com/gBas14jIDo

— Captain Faibik (@CryptoFaibik) June 9, 2024

The DBW on the BTC chart is a sign that the price is getting tighter and tighter, explained Faibik in a recent post. This typically leads to a breakout in one direction or another, and based on the current market sentiment, a bullish breakout seems more likely.

Using trend lines to connect the three lower highs and three higher lows, the price of bitcoin broke out of the symmetrical triangle pattern on June 4. Nevertheless, the weekly resistance at the $71,280 level refused the breakout.

At the $68,500 mark, which is the upper edge of the symmetrical triangle pattern, BTC is now finding support. Bitcoin might rise 7% to reach its all-time high of $73,777 if current support holds.

Will Bitcoin Emerge A Bullish Butterfly?

Mags, another popular crypto analyst, takes a slightly different approach. He views the current consolidation phase as the longest Bitcoin has ever experienced, surpassing previous periods before significant price increases.

The analyst compares this extended consolidation to a butterfly in its chrysalis, suggesting a potential transformation on the horizon.

Historically, Bitcoin has exhibited a pattern of consolidation around all-time highs, followed by a price discovery phase that precedes sharp price movements, the analyst said. The current 87-day consolidation period shatters previous records, potentially indicating a massive price move could be in the offing.

Mags highlights prior instances where similar consolidation periods preceded major bull runs. In 2017, for example, Bitcoin consolidated for 48 days before a breakout, while in 2020, the consolidation phase lasted 21 days before a significant price increase.

The $71.3k Resistance Level

Both Faibik and Mags agree that a breakout from the current consolidation phase could be a game-changer for Bitcoin. They advise investors to keep a close eye on the $71,300 resistance level, as a surge past this point could signal the start of a bullish trend.

Featured image from Buy Sites, chart from TradingView

Markets will increasingly price in at least one Fed interest-rate cut for 2024, QCP Capital said.

Singapore police advised businesses against paying ransom to the bad actors in case of a compromise and asked them to report the incident to authorities immediately.

The week ahead could boost market volatility with the CPI release on Wednesday, the FOMC meeting on Thursday, and a speech from Janet Yellen on Friday, one firm said.

Monthly plans on the purported mobile service provider range from $20 to $80 as of Monday.

NFTs considered as virtual assets are eligible to receive interest when deposited to exchanges according to the FSC’s guidelines published in 2023.

In an analysis released to his 280,000 followers on X, the renowned crypto analyst known as Cold Blooded Shiller (@ColdBloodShill) provided an in-depth look at the current state of Bitcoin amidst a volatile market environment. His commentary, titled “Ultimate BTC Simple Bias Guide,” unpacks the recent emotional reactions triggered by Bitcoin’s price movements and offers a strategic framework for interpreting these changes.

On Friday, the Bitcoin price plummeted from $71,900 to $68,500. This decline coincided with the release of the US Employment Situation Summary Report, a piece of economic data that typically influences market sentiments across various asset classes, including cryptocurrencies. “It’s very easy to forget that it was simply one red candle on Friday that caused a huge reaction in the emotion of the discussion on Twitter,” Shiller writes, emphasizing the often exaggerated emotional response to single events in the crypto markets.

Cold Blooded Shiller’s technical examination of Bitcoin reveals a strong underlying uptrend, despite recent price volatility. However, he identifies critical resistance and support levels that are pivotal to understanding the future movements of Bitcoin’s price.

The $72,000 price level stands as a major resistance, having thwarted Bitcoin’s upward movement five times, including the most recent rejection last Friday. Shiller elaborates, “We have resistance of the range at $72k,” indicating that a breakout above this level could potentially lead to significant bullish momentum.

Conversely, the support levels at $67,000 and subsequently at $61,000 are described as crucial for maintaining the bullish scenario. Shiller warns, “BTC needs to hold the uptrend, if we lose $67k, we’re once again going to be in a downtrend with this being confirmed as a LH [Lower High] and therefore negative market conditions continuing.” The further loss of $61,000 could, according to him, signal the end of the current bullish cycle, with implications that could extend to a broader weekly downtrend.

Analyzing the broader market dynamics, Shiller points out the absence of high time frame (HTF) bearish divergences on the Relative Strength Index (RSI), a common indicator used to predict potential market reversals. “As a positive, there are no HTF bear divs, which have typically been a strong signal for cycle tops. We’re clean on RSI,” he notes. This observation suggests that despite the testing of critical resistance levels, the market might not yet be at a cyclical peak, providing some reassurance to investors concerned about potential downturns.

Shiller’s guidance for traders is to maintain a watchful eye on the key price levels that will dictate Bitcoin’s short-term market direction. “The Daily needs to make a fresh high and break $72k; otherwise, it’s at risk of losing the Daily trend below $67k,” he advises, highlighting the importance of these thresholds in shaping market sentiment and trading strategies. This advice suggests that while the broader trend may still support a bullish stance, readiness to pivot based on key technical indicators is crucial.

In light of these observations, Shiller advises his followers to use these insights to strategically manage their investment portfolios. The current market conditions, characterized by attempts to break resistance at $72,000 and support holding at key lower levels, imply a tactical approach to investment decisions. Traders and investors are advised to set clear markers for adjusting their positions, preparing for potential shifts in market dynamics that could influence their investment outcomes.

At press time, BTC traded at $69,484.

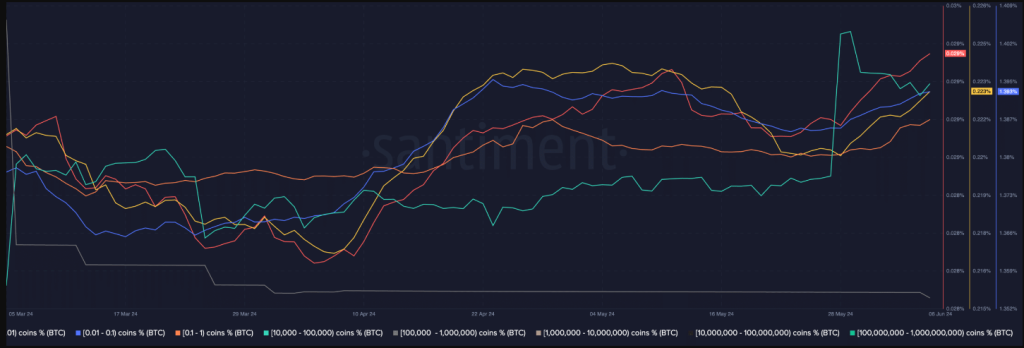

Bitcoin (BTC) finds itself in a curious position, caught in a tug-of-war between the bullish conviction of whales (large investors) and the jittery hands of short-term holders. The world’s top cryptocurrency recently surged to within a hair’s breadth of its all-time high, fueled by a buying spree from whales. However, lurking beneath the surface are potential threats that could derail this rally.

Big investors have been accumulating Bitcoin at an alarming rate, close to $1 billion worth per day according to some estimates. This insatiable appetite suggests a strong belief in Bitcoin’s long-term potential. Analysts point to this whale activity as a bullish indicator, fueling optimism that Bitcoin can break past its previous highs of around $71,000.

While you are scared, whales are buying #Bitcoin like never before. pic.twitter.com/QAVXpdWER4

— Vivek

(@Vivek4real_) June 8, 2024

The sentiment isn’t isolated to the big leagues. Retail investors, the average person on the street, are also joining the party. The number of addresses holding between 0.01 and 1 BTC has increased, indicating a broadening of interest in the cryptocurrency. This confluence of whale and retail investor enthusiasm, representing millions of users, could propel Bitcoin to new heights.

As the price climbs, a double-edged sword emerges – the MVRV ratio. This metric indicates how much profit holders are sitting on. With Bitcoin nearing its peak, the MVRV ratio has climbed significantly, suggesting many investors are now in profit territory. This profitability can be a blessing and a curse. The allure of locking in gains could entice some holders, potentially millions based on address growth, to sell, creating downward pressure on the price.

Related Reading: Cardano Bloodbath? Sell-Off Raises Fears Of Imminent ADA Price Drop

Bitcoin Miners Feeling The Squeeze

Adding another layer of uncertainty is the plight of Bitcoin miners. These digital miners dedicate significant computational power to verifying Bitcoin transactions and are rewarded with newly minted coins. However, recent times have seen a decline in miner revenue, with some reports suggesting a drop from $53.48 million to $48 million in just a few days.

If this trend continues, miners may be forced to sell their Bitcoin holdings to stay afloat. This influx of additional coins on the market could further exacerbate selling pressure and hinder the current rally.

Bitcoin Price Prediction

Meanwhile, according to the latest Bitcoin price prediction, Bitcoin is expected to rise by 28%, reaching $89,300 by July 10, 2024. The market sentiment is bullish, supported by a Fear & Greed Index reading of 72, indicating strong greed. Additionally, Bitcoin has recorded 16 green days out of the last 30, showing a consistent upward trend with a 4.16% price volatility over the same period.

The high number of green days and manageable volatility levels suggest a stable market, reinforcing the bullish outlook. This environment appears conducive to further price increases, aligning with the prediction of a significant rise. The sentiment indicators and recent price performance both point to continued optimism among investors.

Featured image from Treehugger, chart from TradingView

In the first full trading week of June, U.S. Bitcoin ETFs acquired almost as much Bitcoin as they did in the entire month of May.

Tron price is gaining pace above the $0.1150 resistance against the US Dollar. TRX is outperforming Bitcoin and could rise further above $0.1180.

Recently, Bitcoin and Ethereum saw a fresh decline below $68,500 and $3,750 respectively. However, Tron price remained stable above the $0.1120 support and even climbed higher.

There was a decent move above the $0.1150 resistance zone. TRX price cleared many hurdles and gained over 3%. There was a move above the $0.1165 level. A high is formed at $0.1170 and the price is now consolidating gains above the 23.6% Fib retracement level of the upward move from the $0.1102 swing low to the $0.1170 high.

Tron price is now trading above $0.1160 and the 100-hourly simple moving average. There is also a key bullish trend line forming with support at $0.1160 on the hourly chart of the TRX/USD pair.

On the upside, an initial resistance is near the $0.1170 level. The first major resistance is near $0.1180, above which the price could accelerate higher. The next resistance is near $0.1200. A close above the $0.1200 resistance might send TRX further higher toward $0.1225. The next major resistance is near the $0.1320 level, above which the bulls are likely to aim for a larger increase toward $0.150.

If TRX price fails to clear the $0.1200 resistance, it could start a downside correction. Initial support on the downside is near the $0.1160 zone.

The first major support is near the $0.1150 level or the 100 simple moving average (4 hours), below which it could test $0.1140. Any more losses might send Tron toward the $0.1136 support in the coming sessions.

Technical Indicators

Hourly MACD – The MACD for TRX/USD is gaining momentum in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for TRX/USD is currently above the 50 level.

Major Support Levels – $0.1160, $0.1150, and $0.1136.

Major Resistance Levels – $0.1180, $0.1200, and $0.1220.

XRP price declined heavily from the $0.5250 resistance zone. It tested the $0.4540 support zone and is now attempting to recover above $0.4880.

XRP price started a major decline like Ethereum and declined below the $0.50 support. The price even spiked below the $0.4650 support zone. A low was formed at $0.4533 and the price is now correcting losses.

There was a move above the $0.470 and $0.4750 resistance levels. The price climbed above the 50% Fib retracement level of the downward move from the $0.5271 swing high to the $0.4533 low. There is also a connecting bullish trend line forming with support at $0.4950 on the hourly chart of the XRP/USD pair.

The pair is slowly moving above the 61.8% Fib retracement level of the downward move from the $0.5271 swing high to the $0.4533 low. However, it is still trading below $0.5050 and the 100-hourly Simple Moving Average.

On the upside, the price is facing resistance near the $0.500 level. The first key resistance is near $0.5050. The next major resistance is near the $0.5120 level. A close above the $0.5120 resistance zone could send the price higher. The next key resistance is near $0.5250.

If there is a close above the $0.5250 resistance level, there could be a steady increase toward the $0.5320 resistance. Any more gains might send the price toward the $0.550 resistance.

If XRP fails to clear the $0.5050 resistance zone, it could start another decline. Initial support on the downside is near the $0.4950 level and the trend line.

The next major support is at $0.4900. If there is a downside break and a close below the $0.490 level, the price might accelerate lower. In the stated case, the price could decline and retest the $0.4740 support in the near term.

Technical Indicators

Hourly MACD – The MACD for XRP/USD is now losing pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for XRP/USD is now above the 50 level.

Major Support Levels – $0.4950 and $0.4900.

Major Resistance Levels – $0.500 and $0.5050.

Ethereum price declined heavily and tested the $3,580 support zone. ETH is now recovering and faces many hurdles near the $3,740 zone.

Ethereum price extended its decline below the $3,660 support zone. ETH even declined below $3,600 before the bulls appeared. A low was formed near $3,574 and the price is now correcting losses, like Bitcoin.

There was a move above the $3,650 and $3,660 levels. The price climbed above the 50% Fib retracement level of the downward move from the $3,838 swing high to the $3,574 low. However, there was no close above the $3,700 level.

Ethereum is now trading below $3,740 and the 100-hourly Simple Moving Average. If there is another increase, ETH might face resistance near the $3,700 level.

The first major resistance is near the $3,740 level. There is also a key bearish trend line forming with resistance near $3,740 on the hourly chart of ETH/USD. The trend line is close to the 61.8% Fib retracement level of the downward move from the $3,838 swing high to the $3,574 low.

An upside break above the $3,740 resistance might send the price higher. The next key resistance sits at $3,800, above which the price might gain traction and rise toward the $3,840 level. If the bulls push Ether above the $3,840 level, the price might rise and test the $4,000 resistance. Any more gains could send Ether toward the $4,080 resistance zone.

If Ethereum fails to clear the $3,740 resistance, it could continue to move down. Initial support on the downside is near $3,660. The next major support is near the $3,640 zone.

The main support sits at $3,580. A clear move below the $3,580 support might push the price toward $3,500. Any more losses might send the price toward the $3,450 level in the near term.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is gaining momentum in the bearish zone.

Hourly RSI – The RSI for ETH/USD is now below the 50 zone.

Major Support Level – $3,640

Major Resistance Level – $3,740

Base has topped Ethereum layer 2 leaderboards by transaction count and has been the most profitable Ethereum scaler for three consecutive months.

Bitcoin price stayed above the $68,500 support zone. BTC is now consolidating and might aim for a fresh increase above the $70,150 resistance.

Bitcoin price extended its decline below the $70,000 support zone. BTC even declined below the $69,500 level before the bulls appeared near $68,500. A low was formed at $68,409 and the price is now attempting a recovery wave.

There was a move above the $69,250 resistance zone. The price climbed above the 23.6% Fib retracement level of the downward move from the $71,900 swing high to the $68,409 low.

Bitcoin is now trading below $70,000 and the 100 hourly Simple moving average. However, there is a key bullish trend line forming with support at $69,500 on the hourly chart of the BTC/USD pair. On the upside, the price is facing resistance near the $70,000 level.

The first major resistance could be $70,150 and the 50% Fib retracement level of the downward move from the $71,900 swing high to the $68,409 low. The next key resistance could be $70,550. A clear move above the $70,550 resistance might send the price higher. In the stated case, the price could rise and test the $71,200 resistance. Any more gains might send BTC toward the $72,000 resistance.

If Bitcoin fails to climb above the $70,150 resistance zone, it could start another decline. Immediate support on the downside is near the $69,500 level and the trend line.

The first major support is $69,150. The next support is now forming near $68,500. Any more losses might send the price toward the $67,500 support zone in the near term.

Technical indicators:

Hourly MACD – The MACD is now losing pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $69,500, followed by $68,500.

Major Resistance Levels – $70,150, and $70,500.

The cross-chain bridge was exploited for $82 million over New Year’s Eve, with the funds sitting dormant since Jan. 1.

Ahmad Shadid, one of the founders of io.net, left “effective immediately” but said it wasn’t related to allegations regarding his past.