Joe McCann, a hedge fund founder with experience of more than 25 years, has been up to some interesting research as far as meme coin investing is concerned. His flagship fund, called the Technology Master Fund, is ranked third in the world in terms of 12-month cumulative returns. This is as of March 2024.

When the world was jumping into trending meme coins, McCann developed a pretty unique method of catching the bull by its horns. He merged the traditional Wall Street methods of mitigating risk and the frenzy of the meme market to build a new ‘Meme Street’ investing ethos.

McCann believes that one of the key skills of a trader is to stay as unemotional as possible, especially when the markets are tanking. If not, it can lead to very poor trading decisions.

Plus, seeing as the memecoin market is filled to the brim with euphoria, it can be very difficult for investors to get a hold of their thoughts. This is where a more risk-measured and systemic approach like Meme Street comes in handy.

What Are the Rules of Meme Street?

The biggest difficulty in trading meme coins for institutional investors is liquidity. That’s why McCann only takes large exposure in blue-chip meme coins. These are the biggest cryptocurrencies that have maintained over $1B market cap mark for at least 90 days.

Another rule of Meme Street is to limit the exposure of the entire fund to just 2% for coins that are not a part of the top 20% of the total crypto market cap.

Once these ground rules have been established, McCann goes on to analyze the best meme coins just as any other asset class using technical analysis and data.

McCann’s $BONK Trade

In 2023, McCann observed that stablecoin funds were flowing from Ethereum to Solana. Now, Solana had not crossed the $30 mark for the most part of 2023. A shift in funds could have helped $SOL hold its resistance and see the prices soar, which is exactly what happened.

Now, investors would use this game to park their funds in high-beta coins for a steep risk-to-reward possibility. The challenge was to find out which asset investors would sit on. McCann placed his bet on $BONK, which, lo and behold, saw a massive rally in Q4 2023.

Exiting a position is also crucial. Now, since Bonk was still in a price discovery mode, there were no technical indicators to suggest an exit. To solve this, McCann started studying real-time order flows to see if there is any slowdown in Solana’s inflows.

McCann built a system that could identify large order flows into a particular asset (say Solana) and then use this information to decipher whether this flow can be attributed to accumulation or distribution. If data suggested distribution trends, it would be safe to exit a meme coin trade.

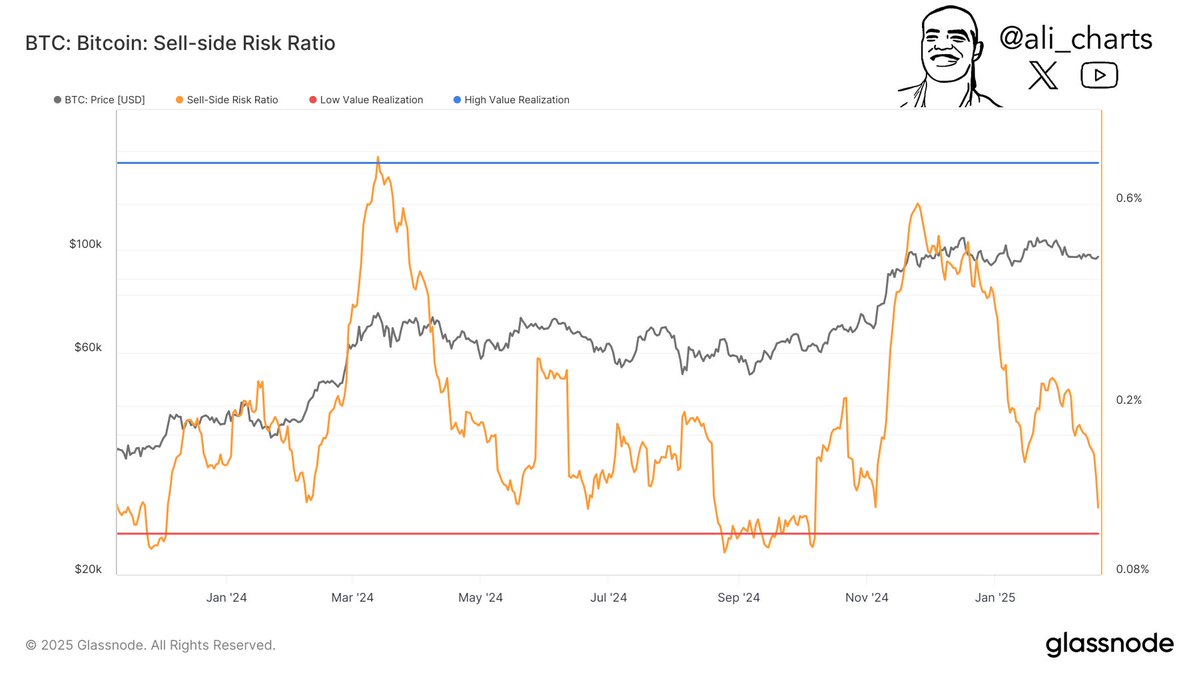

McCann’s Outlook for 2025

McCann is bullish on Bitcoin and Solana in 2025, primarily due to increasing institutional interest. Several countries have been aggressively buying $BTC as a part of their strategic reserves. Solana, on the other hand, is a cheaper, faster, and more user-friendly alternative to Ethereum.

However, he also has a word of caution for those looking to buy into hype for quick gains. McCann believes the period of easy money is over, and only strategic traders will survive in 2025.

Investing in meme coins doesn’t have to be super risky, especially when a systemic investing method similar to Meme Street is now launching for meme coins. Enter Meme Index ($MEMEX).

What Is $MEMEX?

Meme Index ($MEMEX) brings the good old stock market concept of index funds to meme coins. It offers a total of four different meme coin baskets, each with a varying degree of volatility, risk, and profit potential.

Depending on your risk appetite and analysis (a slow market would mean you should go for safer investments, for instance), you can choose one or more $MEMEX baskets.

Here’s a brief rundown of the four indexes on offer:

- Meme Titan Index: Contains well-established meme coins with a market cap of over $1B. Perfect for risk-averse and new meme coin investors.

- Meme Moonshot Index: Meme coins that are about to surge past $1B in market capitalization. This provides a balanced mix of risk and reward.

- Meme Midcap Index: Coins with a market cap between $50M and $250M. Riskier than the above two but also more rewarding.

- Meme Frenzy Index: Cryptos that are likely to explode. A very volatile index, ideal only for real risk-takers.

Needless to say, these meme coin baskets, even the riskiest Meme Frenzy one, significantly reduce the total amount of risk you put on by diversifying your investment across various coins.

So, you’re less likely to go bust if a meme coin doesn’t perform as well. Because others in the basket will still ensure you end up in green.

Why Can $MEMEX Be the Next Crypto to 100x?

As McCann said, the current market conditions aren’t screaming bullishness, meaning ‘buy and HODL’ wouldn’t probably work as well as it does in bullish conditions. Times like these require smart investing. Exactly what $MEMEX brings to the table.

Furthermore, investors who have been so far skeptical of entering the meme coin space because of its volatility and dare we say pump-and-dump nature will consider $MEMEX as their chance to finally set foot in meme coins.

For more information, check out $MEMEX’s whitepaper and its X feed.

Meme Index is currently in presale, where it has already raised over $3.8M. You can get 1 $MEMEX for just $0.0164239 if you get in now, but hurry up because prices increase in the next 18 hours. If this is your first crypto presale purchase, here’s a guide on how to buy $MEMEX.

As always, we urge you to do your own research before investing your hard-earned money. The crypto and memecoin markets, after all, are quite volatile and unpredictable in the short term. Also, this article isn’t a substitute for professional financial advice.

BNB (@cz_binance)

BNB (@cz_binance)