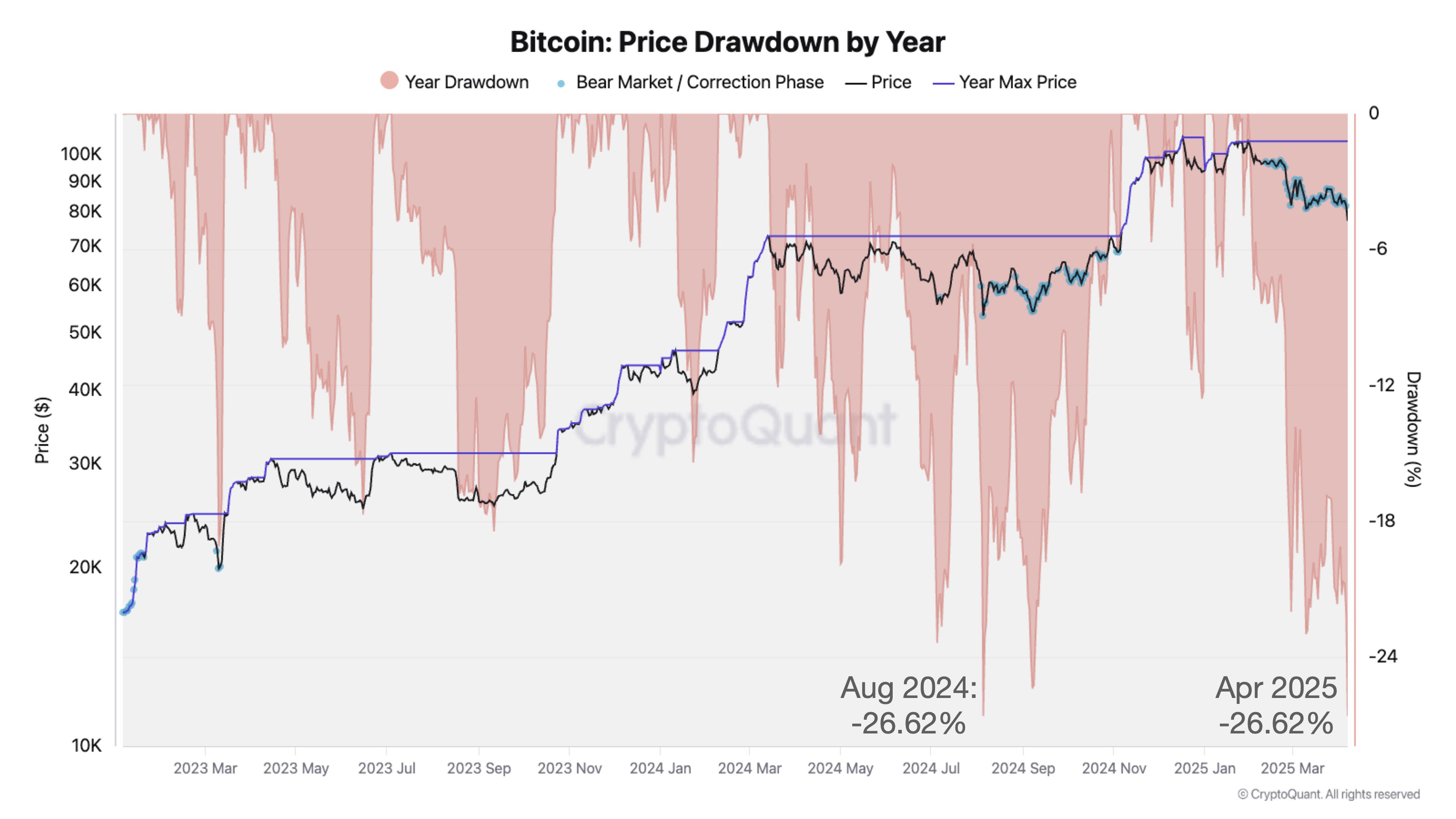

The market volatility, fueled by the ongoing tariff war, saw Bitcoin (BTC) trade below the $75,000 mark for the first time since November. Despite recovering from the dip, the flagship crypto risks more short-term volatility if it doesn’t reclaim key support levels soon.

Bitcoin Hits 5-Month Lows

Bitcoin ended the week with a price drop below the $80,000 support zone, closing Sunday below the $78,500 mark. In the early hours of Monday, the largest cryptocurrency by market capitalization continued bleeding toward the $74,500 support zone before bouncing.

Amid the 9.1% correction, Bitcoin registered its lowest trading price in five months, touching November 6 levels. Market watcher Daan Crypto Trades noted that BTC has been trading below its Bull Market Support Band for the past few weeks, attempting to get back above this level but ultimately facing rejection.

According to the trader, “This is a good metric to gauge high timeframe market momentum. So far this cycle, price has traded below it shortly a few times (2023 & 2024) but never traded away from it for much more than ~20%,” suggesting that bull would like to reclaim this region.

Analyst Rekt Capital noted that BTC’s current correction is “very close to equaling the retracement depth of the Post-Halving pullback of almost -33%.” The ongoing retrace has seen Bitcoin drop 31% since January’s all-time high (ATH) of $108,786. However, he considers that Bitcoin could bleed into the $70,000 support before hitting the correction’s bottom.

“Whenever Bitcoin’s Daily RSI crashed into the sub-28 RSI levels – that wouldn’t necessarily mark out the price bottom. In fact, historically, the actual price bottom would be -0.32% to -8.44% lower than the price when the RSI first bottomed,” he explained, adding that Bitcoin is forming its second low, 2-79% below the first low.

If it follows the same pattern and drops 8.44% below the first low, investors could see Bitcoin’s price bottom at around $69,000-$70,000.

Another 10% Correction Ahead?

Moreover, Rekt Capital outlined the key levels to reclaim after BTC’s weekly close below the $80,650 support. The analyst noted that Bitcoin already has “upside wicked into this level to tag it as potential new resistance” this week.

As a result, it must recover last week’s close level if BTC wants to challenge 2025’s Weekly Downtrend, and it also needs to hold Sunday’s daily close level of $78,500.

Bitcoin failed to Daily Close above the Downtrend. In fact, price continued to form new Lower Highs in its already extended series of Lower Highs. On the latest rejection, BTC landed into the ~$78,500 lows. Continue to hold this level as support, and BTC has a chance at challenging the $82,500 level in the short term.

The analyst detailed that Bitcoin generally needs to close above the $78,500 level to “build a base here for a potential short-term rebound.” On the contrary, a daily close below this level would see BTC positioned for a bearish retest after closing below it for two consecutive days.

He concluded that “turning this level into a confirmed resistance would send price into additional downside continuation,” which targets the pre-halving highs price range between $69,000 and $72,000.

As of this writing, BTC trades at $79,200, a 1% increase in the daily timeframe.