As the global financial landscape witnesses a seismic shift, reminiscent of the 2008 financial crisis and the dot-com bubble burst, alarm bells are ringing in the bond market, alerting the Bitcoin and crypto market as well.

Is A Crash Like 2008 Looming?

Renowned Chartered Financial Analyst (CFA), Genevieve Roch-Decter, highlighted the striking parallels in a recent tweet, stating, “I can’t believe I am saying this but the slump in 10-year and 30-year bonds is approaching the epic drops we saw in stocks during the 2008 financial crisis and the dot-com bubble bust.”

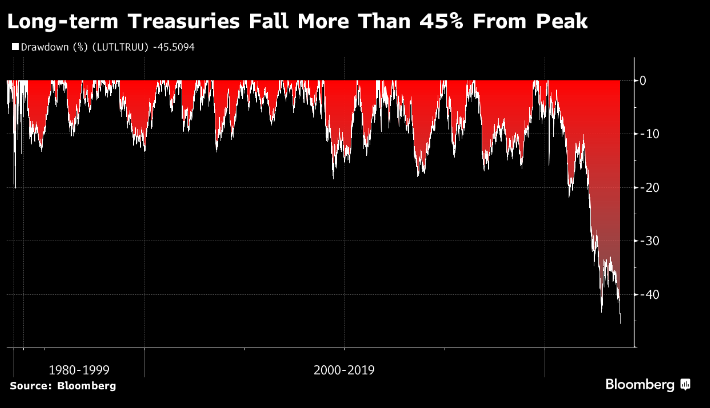

Bloomberg Surveillance’s Lisa Abramowicz reinforces this grim narrative, pointing out that “bonds maturing in 10 years or more have slumped 46% since peaking in March 2020, just shy of the 49% plunge in US stocks in the aftermath of the dot-com bust. The route in 30-year bonds has been even worse, tumbling 53%.”

Onramp, a Bitcoin asset management platform, adds further context by emphasizing the historic nature of the trend. This decline, particularly in bonds with maturities exceeding a decade, harkens back to market downturns like the dot-com bubble collapse. The Federal Reserve’s resolute stance on inflation and a fragile fiscal environment have disrupted the traditional appeal of long-maturity debt, raising questions about the possibility of a debt spiral.

The situation is further complicated by the behavior of the yield curve. Historically, an inverted yield curve has foreshadowed recessions. However, the recent correction has seen a rare “bear steepener,” marked by rising long-term yields. This phenomenon, seen in the past before recessions, raises concerns of an impending economic downturn.

“While some question the yield curve’s reliability as a recession indicator, the current bear steepening suggests that an economic downturn could be imminent. This is particularly concerning given the Fed’s ongoing commitment to restrictive monetary policy, making the situation ripe for potential market volatility and economic uncertainty, “ Dylan LeClair from Onramp notes.

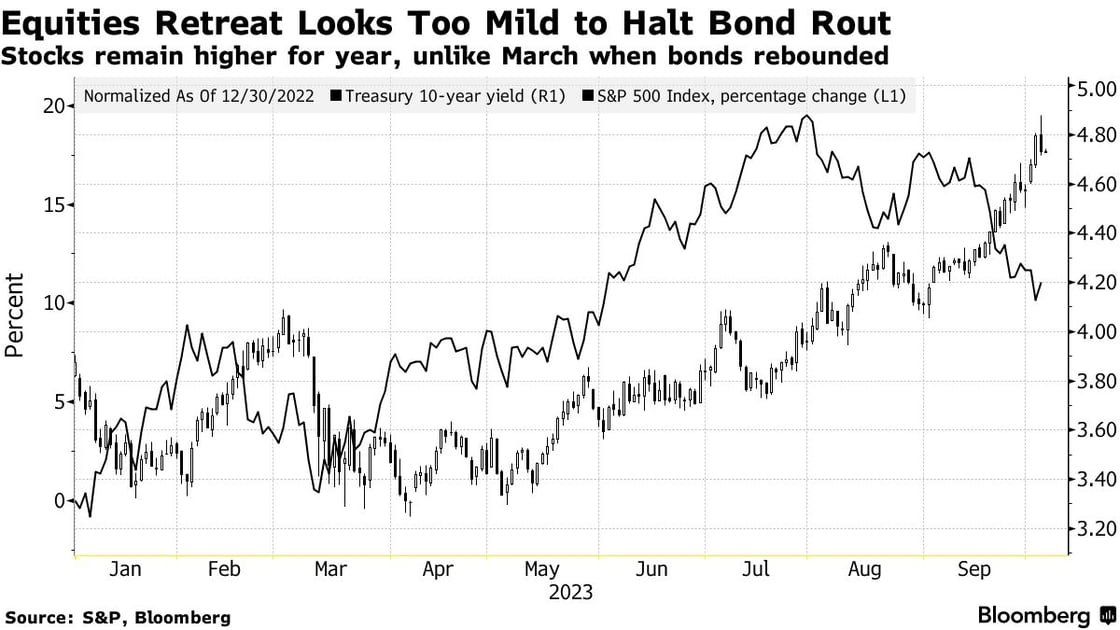

Meanwhile, Barclays’ analyst Ajay Rajadhyaksha suggests that only a stock market crash could halt the bond market’s decline. Unlike previous cycles, traditional bond backstops are dwindling, with the Fed shifting from a net buyer to a net seller, and foreign institutional buying slowing.

This highlights the stark disconnect between equity valuations and long-end bond rates, with stocks having significant room for devaluation before bonds stabilize. And if stocks crash, Bitcoin and crypto could be just as affected.

Impact On Bitcoin And Crypto

The turmoil in the bond market has far-reaching implications, including its impact on Bitcoin and crypto. Remarkably, the crypto market has never experienced such a situation, but there are general observations of how risk assets have reacted in such environments in the past.

First, rising treasury yields make risk-free returns more attractive, potentially prompting some investors to reallocate capital from risk assets like Bitcoin and crypto to treasury bills. This shift could decrease demand, putting downward pressure on their prices.

Moreover, a sharp rise in 10-year Treasury yields can signal a tighter monetary policy, weighing on risk assets. Higher yields also mean higher borrowing costs, which can impact crypto. When interest rates rise, non-interest-bearing assets like Bitcoin may seem less attractive compared to yield-bearing assets.

A significant increase in Treasury yields can also lead to reduced liquidity in other financial markets, such as the Bitcoin and crypto space. Institutional investors facing liquidity constraints may liquidate more liquid assets like BTC and altcoins causing potential price declines.

Lastly, sharp yield increases can create volatility across various asset classes as investors seek to reduce risk or cover losses elsewhere. Bitcoin and crypto are highly influenced by market sentiment and speculative behavior. The market’s interpretation of rising yields can sway investor behavior, impacting crypto prices.

Accordingly, Charles Edwards, founder of Capriole Investments, recently predicted:

The 10YR is up another 10% since! […] The Fed wants more unemployment. The job market is still too strong. They’ve raised the expected 2024 rates as a result and the 10YR has broken out to new decade highs. As long as the 10YR is breaking upwards like this, risk assets are going to see further headwinds.

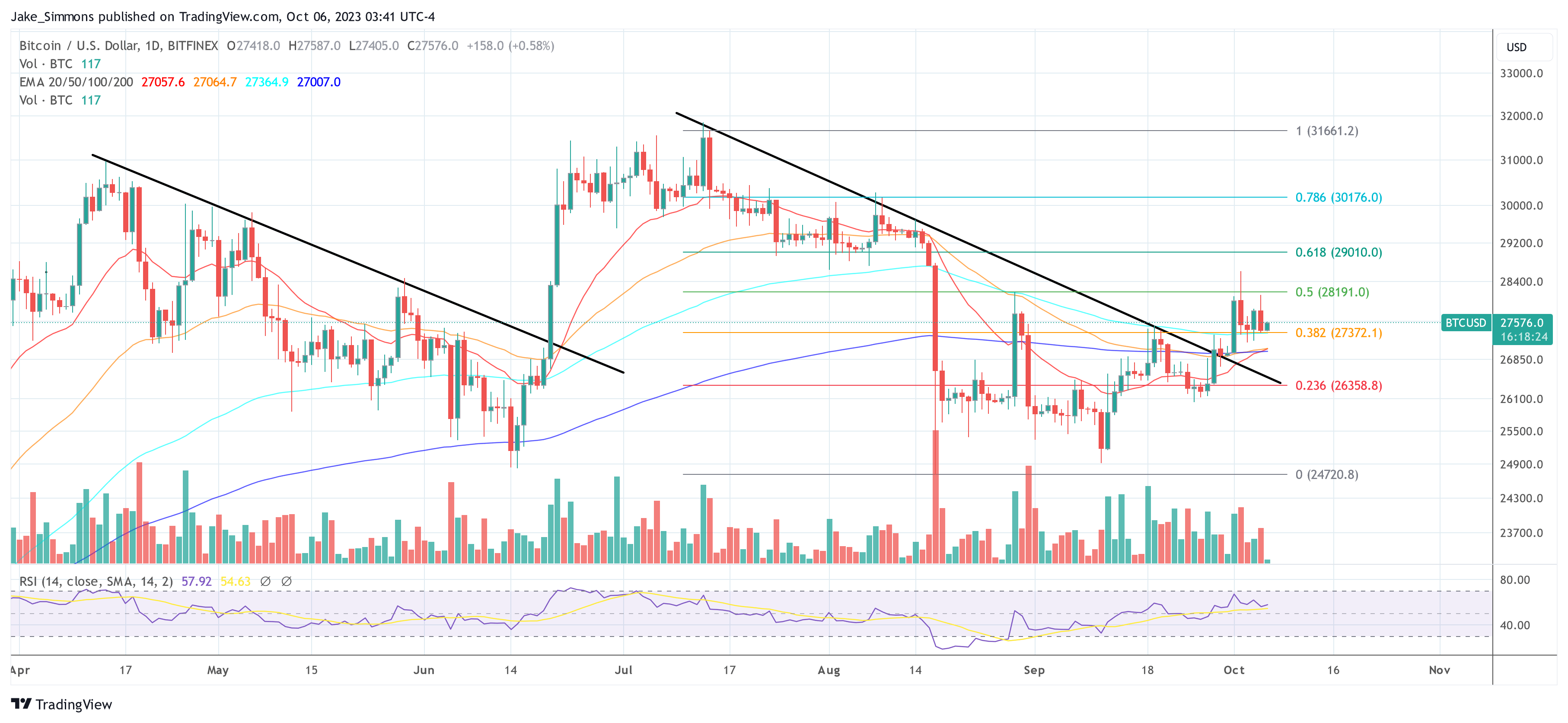

At press time, BTC traded at $27,576.