According to 10x Research, Bitcoin’s potential drop below $50,000 is linked to dwindling buy flows and accelerating sell flows.

Cryptocurrency Financial News

According to 10x Research, Bitcoin’s potential drop below $50,000 is linked to dwindling buy flows and accelerating sell flows.

Bitcoin’s price has fallen below the critical support level of $60,000, reaching a low of $57,914. Since Tuesday, Bitcoin has experienced a further 7% decline, reinforcing the ongoing downward trend. Currently, market sentiment is shifting markedly towards the bearish side.

Andrew Kang, co-founder of Mechanism Capital, has raised significant concerns regarding the pattern emerging in the Bitcoin market, reminiscent of the conditions that led to the dramatic crash of May 2021. In a detailed analysis shared via X (formerly Twitter), Kang highlighted the overlooked criticality of the current market dynamics.

Kang stated, “Most market participants are not appreciating the significance of a potential loss of a 4-month range on Bitcoin. The closest parallel we can draw is to that of the range of May 2021 where we also came off a parabolic rally of BTC and alts.”

He noted the similarities in market conditions, particularly in terms of leveraged positions, which currently exceed $50 billion. “This figure does not include the Chicago Mercantile Exchange (CME), which is higher, but compounded by the fact that in this scenario we have ranged even longer (18 weeks vs. 13), and we have not had extreme washouts yet while we had a few in the middle of the 2020-2021 bull market,” Kang elaborated.

Kang also adjusted his projections for Bitcoin’s bottom, suggesting a steeper fall than earlier anticipated: “It’s likely that my initial estimates of low $50ks were too conservative and we see a more extreme reset to $40ks.” He warned that such a pullback could significantly damage the market, necessitating a few months of consolidation and a downtrend before any reversal to an upward trend might be conceivable.

In a dialogue with Alex Krüger, a well-known macro and crypto analyst, the discussion explored the intricacies of open interest (OI) in the derivatives market, a crucial aspect of understanding market sentiment and directional biases. Krüger pointed out, “Much of that OI is not directional though,” suggesting a more complex market behavior than straightforward long and short positions.

Responding, Kang clarified the composition of OI, saying, “Each unit of OI is one long + one short. Even if there are basis trade shorts on the short leg, there’s a directional long on the other end. So yes… less directional shorts.” The conversation further delved into whether derivatives traders are delta neutral, which affects market stability.

Krüger queried about market maker positions, and Kang responded, “I can assure you that there are not many market makers in the OI that are delta neutral long perps and short spot paying funding/borrow on both ends for a negative carry trade.”

This ongoing discussion among experts reflects a deepening concern over the potential for a repeat of the May 2021 crash. During that period, Bitcoin’s price plummeted dramatically following a peak of around $64,000 in mid-April 2021. By the end of June, it had lost about 56% of its value. This crash was precipitated by a mix of factors, including regulatory crackdowns in China, environmental concerns voiced by influential figures like Tesla CEO Elon Musk, and a resulting cascade of panic selling among both retail and institutional investors.

In retrospect, the May 2021 downturn was characterized by a rapid shift in investor sentiment, driven by external shocks and exacerbated by the high levels of leverage in the market. Today, similar conditions could be forming according to Kang, with high leverage and extended periods without significant price corrections, suggesting that the market may be on the brink of another severe downturn.

At press time, BTC traded at $58,736.

The price of Bitcoin briefly dropped as low as $57,900 amid a wider sell-off in the crypto market.

On-chain data shows the Bitcoin whales have been dialing back risk on derivatives exchanges following the latest downturn in the cryptocurrency.

As explained by CryptoQuant founder and CEO Ki Young Ju in a new post on X, the Bitcoin Inter-Exchange Flow Pulse is now giving a red signal. The Inter-Exchange Flow Pulse (IFP) is an indicator that tracks the BTC movements between spot and derivatives exchanges.

When the value of this metric rises, the amount of cryptocurrency going from spot to derivatives platforms goes up. Such a trend implies that large entities like the whales are potentially looking to open up new positions in the derivatives market.

On the other hand, a decline in the indicator suggests investors are transferring fewer coins to the derivatives exchanges. This trend could signal a decreasing appetite for risk positions in the sector.

Now, here is a chart that shows the trend in the Bitcoin IFP, as well as its 90-day simple moving average (SMA), over the past decade:

As displayed in the above graph, the Bitcoin IFP had been climbing earlier, but the metric seems to have reversed its direction recently, as it’s now heading down instead. Following the latest decline, the indicator has crossed below its 90-day SMA.

Historically, the IFP observing a cross with its 90-day SMA has signified a market sentiment shift. A breakout above this line suggests the whales are willing to take risks with the asset again, which can potentially be a bullish signal.

The chart shows that such a cross occurred around both the 2018 and 2022 bear market lows. On the other hand, a plunge under the 90-day SMA usually takes place near tops, as it implies the whales are looking at derivative positions as too risky.

As the indicator has once more seen the latter type of crossover, it’s possible that the asset could end up facing some bearish momentum. This possible shift to a bearish sentiment, however, doesn’t have to last for too long.

The previous instance of the IFP dropping below its 90-day SMA in January. This crossover coincided with Bitcoin’s downturn following the spot exchange-traded fund (ETF) approval.

The bearish momentum ended up only temporary, though, as the cryptocurrency soon found a breakout that led to its new all-time high (ATH). The asset observed only a temporary effect from this crossover in 2016 before catching back an uptrend into the 2017 bull run.

It remains to be seen where this bearish Bitcoin IFP crossover will lead to this time.

Bitcoin hasn’t seen an end to its recent decline, as its price has now dropped to $61,200.

On-chain data shows the Bitcoin whales have been dialing back risk on derivatives exchanges following the latest downturn in the cryptocurrency.

As explained by CryptoQuant founder and CEO Ki Young Ju in a new post on X, the Bitcoin Inter-Exchange Flow Pulse is now giving a red signal. The Inter-Exchange Flow Pulse (IFP) is an indicator that tracks the BTC movements between spot and derivatives exchanges.

When the value of this metric rises, the amount of cryptocurrency going from spot to derivatives platforms goes up. Such a trend implies that large entities like the whales are potentially looking to open up new positions in the derivatives market.

On the other hand, a decline in the indicator suggests investors are transferring fewer coins to the derivatives exchanges. This trend could signal a decreasing appetite for risk positions in the sector.

Now, here is a chart that shows the trend in the Bitcoin IFP, as well as its 90-day simple moving average (SMA), over the past decade:

As displayed in the above graph, the Bitcoin IFP had been climbing earlier, but the metric seems to have reversed its direction recently, as it’s now heading down instead. Following the latest decline, the indicator has crossed below its 90-day SMA.

Historically, the IFP observing a cross with its 90-day SMA has signified a market sentiment shift. A breakout above this line suggests the whales are willing to take risks with the asset again, which can potentially be a bullish signal.

The chart shows that such a cross occurred around both the 2018 and 2022 bear market lows. On the other hand, a plunge under the 90-day SMA usually takes place near tops, as it implies the whales are looking at derivative positions as too risky.

As the indicator has once more seen the latter type of crossover, it’s possible that the asset could end up facing some bearish momentum. This possible shift to a bearish sentiment, however, doesn’t have to last for too long.

The previous instance of the IFP dropping below its 90-day SMA in January. This crossover coincided with Bitcoin’s downturn following the spot exchange-traded fund (ETF) approval.

The bearish momentum ended up only temporary, though, as the cryptocurrency soon found a breakout that led to its new all-time high (ATH). The asset observed only a temporary effect from this crossover in 2016 before catching back an uptrend into the 2017 bull run.

It remains to be seen where this bearish Bitcoin IFP crossover will lead to this time.

Bitcoin hasn’t seen an end to its recent decline, as its price has now dropped to $61,200.

Bitcoin has continued its recent bearish trajectory during the past day as the asset’s price has now slipped under $64,000. Here’s what the next support looks like for BTC.

According to data from the market intelligence platform IntoTheBlock, BTC is floating just above a critical on-chain demand zone. Demand zones refer to price ranges where many investors last bought their coins.

These ranges can be determined through on-chain analysis, as the average cost basis of each address on the network can be readily calculated through its transaction history.

Below is the chart shared by the analytics firm that shows the various price ranges near the current asset price in terms of the present demand.

In the graph, the size of the dot corresponds to the number of addresses bought inside the respective range. It appears that Bitcoin currently has large demand zones both just above and below itself.

According to IntoTheBlock data, the lower range currently holds the cost basis of around 1.23 million addresses for investors who bought 319,700 BTC. Now, what’s the relevance of a demand zone like this?

To any investor, their cost basis is important, so when the price tests it, they may become more prone to making some move. Naturally, if many holders share their break-even level inside a narrow range, the reaction resulting from a retest would also be large.

Because of this reason, zones of major demand are considered to be important support or resistance levels for Bitcoin. Cost basis centers above the price can act as resistance walls, while those below can provide support cushions.

Since BTC is hovering just above a major demand zone between $61,900 and $63,800 after its latest decline, it’s possible that the range could help the asset reach a bottom.

As for the source of the support or resistance effect provided by these demand zones, the answer lies in investor psychology. The holders currently in loss may be looking forward to the price hitting their cost basis to exit with their initial investment.

This selling that may appear upon a retest of many investors’ shared break-even level can pose resistance to BTC. Similarly, the investors below can react to a retest by buying more, as they could look at the drop as a dip opportunity, thus supporting the asset.

It now remains to be seen if the support zone between $61,900 and $63,800 would put an end to Bitcoin’s recent bearish momentum or not.

After the latest drawdown, Bitcoin has just entered into the on-chain demand zone, as its price is now trading around $63,600.

On-chain data shows Bitcoin is approaching the “Realized Price” of the short-term holders, a retest of which has historically been important for BTC.

In a new post on X, CryptoQuant Head of Research Julio Moreno has discussed how BTC has recently been near the Realized Price of the short-term holders.

The “Realized Price” here refers to an on-chain indicator that, in short, keeps track of the average price at which investors or addresses on the Bitcoin network acquired their coins.

When the cryptocurrency’s spot price is higher than this metric, it means that the average holder in the market is currently sitting on some profits. On the other hand, BTC’s value under the indicator suggests the dominance of losses among the investors.

Naturally, when the two are exactly equal, the market as a whole can be assumed to be holding an equal amount of unrealized profits and losses. The holders could collectively be considered just breaking even on their investment.

In the context of the current topic, the Realized Price of only a specific part of the sector is of focus: the short-term holders (STHs). The STHs are the investors who bought their coins within the past 155 days.

Below is a chart that shows the trend in the Realized Price of the Bitcoin STHs over the past couple of years:

The above graph shows that the Bitcoin price is close to the Realized Price of the STHs. This means that the margin is small, although these investors are sitting in profits right now.

Thus, it’s possible that if the cryptocurrency continues on its latest bearish trajectory, a retest of the average cost basis of this cohort could be imminent. In the past, such retests have proven relevant for the asset.

Moreno has highlighted in the chart the interactions the asset’s spot value has shown with this level during the last two years. It would appear that during two of these retests (marked with green circles), the coin found support at this level and rebounded upwards to continue the bullish momentum.

However, in the three other instances (red circles), Bitcoin failed to retest the level and observed a decline. These corrections were from 8% to 12%, and the latest occurrence of the trend was at the end of April/start of May.

With another retest possibly approaching for the cryptocurrency, it would be interesting to see which of the two patterns would follow this time around. If a breakdown of the level happens, the analyst notes, “the price could decline to about $60K.”

At the time of writing, Bitcoin is trading at around $65,400, down over 6% in the past week.

Bitcoin has observed a plunge during the past day, taking the asset’s price under $67,000. Here’s the historical support level that the asset could visit next.

As analyst James Van Straten pointed out in a post on X, the Realized Price of the Bitcoin Short-Term Holders has been going up recently and currently sits around the $64,000 level.

The “Realized Price” here refers to an on-chain metric that keeps track of the cost basis of the average investor in the BTC market. This indicator is based on the “Realized Cap” model for the cryptocurrency.

When the asset’s spot price is greater than the Realized Price, it means the investors are carrying some net unrealized profits right now. On the other hand, the coin’s value under the metric suggests the dominance of losses in the market.

In the context of the current topic, the Realized Price of a specific sector segment is of interest: the Short-Term Holders (STHs). The STHs include all the investors who bought their coins within the past 155 days.

Here is a chart that shows the trend in the Realized Price of the Bitcoin STHs over the last few years:

As displayed in the above graph, the Bitcoin STH Realized Price rapidly climbed during the rally towards the all-time high price (ATH) earlier in the year. This trend naturally makes sense, as the STHs represent the new investors in the market, who would have had to buy at higher prices as the asset climbed up, thus pushing the cohort’s average up.

Since BTC’s consolidation phase following the March ATH, the indicator’s uptrend has slowed, but its value is increasing nonetheless. After the latest increase, the metric has approached $64,000.

Now, what significance does the Realized Price of the STHs have? Historically, this indicator has taken turns acting as a major support and resistance line for the cryptocurrency.

During bullish periods, this metric can facilitate bottom formations for the cryptocurrency, thus keeping it above itself, while bearish trends generally witness the line acting as a barrier preventing the coin from escaping above it. Transitions beyond this level have generally reflected a flip trend for the coin.

This apparent pattern has held up likely because the STHs, being the relatively inexperienced hands, can be quite reactive. The cost basis is an important level for any investor, but this cohort, in particular, can be more likely to panic when a retest of their cost basis takes place.

When the sentiment in the market is bullish, the STHs could decide to buy more when the price drops to their average cost basis, believing the drawdown to be merely a “dip” opportunity. In bearish phases, though, they may react to such a retest by panic selling instead.

The chart shows that Bitcoin found support around this line during the crash at the end of April/start of May, potentially implying a bullish sentiment has continued to be dominant.

With BTC seeing a drop below $67,000 in the past day and the STH Realized Price closing in at $64,000, it will be interesting to see how a potential retest would play out this time.

At the time of writing, Bitcoin is trading at around $66,800, down over 3% in the past week.

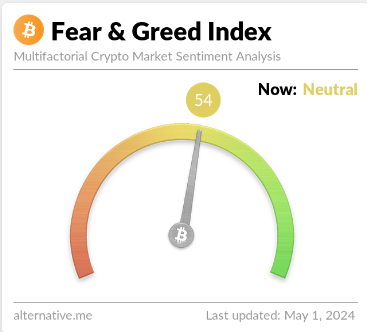

Data shows that Bitcoin sentiment has cooled off to neutral from greed following the asset’s latest plunge to the $57,000 level.

The “Fear & Greed Index” is an indicator created by Alternative that shows the average sentiment among investors in the Bitcoin and wider cryptocurrency market.

This index estimates sentiment by considering five factors: volatility, trading volume, social media data, market cap dominance, and Google Trends.

The metric uses a scale that runs from zero to 100 to represent this average sentiment. All values under 46 suggest that investors are fearful, while those above 54 imply a greedy market. The zone between these two cutoffs naturally corresponds to the territory of neutral mentality.

Now, here is what the Bitcoin sentiment looks like right now, according to the Fear & Greed Index:

As displayed above, the Bitcoin Fear & Greed Index is at a value of 54, implying that investors share a neutral sentiment currently. However, the neutrality is only just, as the metric is right at the boundary of the greed region.

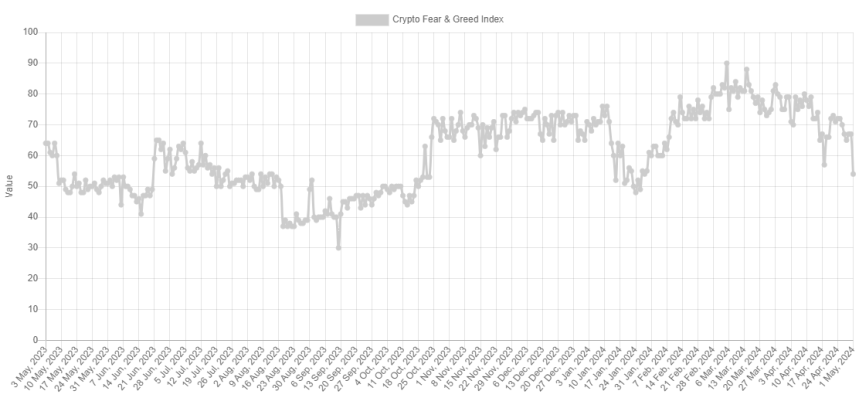

This is a significant departure from yesterday’s sentiment: 67. The chart below shows how the indicator’s value has changed recently.

As the graph shows, the Bitcoin Fear & Greed Index has been declining recently. For most of February and March, as well as the first half of April, the indicator was in or near a special zone called extreme greed.

The market assumes this sentiment at values above 75. As the asset price struggled recently, the mentality cooled off from this extreme zone and entered the normal greed region. With the latest crash in BTC, the index has seen a sharp plunge, now exiting out of greed altogether.

Historically, cryptocurrency has tended to move against the majority’s expectations. The stronger this expectation, the higher the probability of such a contrary move.

This expectation is considered the strongest in extreme sentiment zones, as well as extreme fear and greed. As such, major bottoms and tops have often occurred in these territories.

The all-time high (ATH) price last month, which continues to be the top of the rally so far, also occurred alongside extreme values of the Bitcoin Fear & Greed Index.

With the sentiment now cooled to neutral, some investors may be watching for a fall into fear. This is natural because a rebound would become more probable the worse the sentiment gets now.

During Bitcoin’s latest plunge, its price briefly slipped below $57,000 before surging back to $57,300.

On-chain data shows the Bitcoin supply in profit has plunged following the latest crash in the asset’s price towards the $65,000 level.

As analyst James Van Straten pointed out in a post on X, around 10% of the BTC supply is now in a state of loss. The on-chain indicator of interest here is the “Percent Supply in Profit,” which tracks the percentage of the total circulating Bitcoin supply holding an unrealized gain.

This metric works by going through the blockchain history of each coin in circulation to see the price at which it was last transferred. Assuming that this previous transaction involved a change of hands, the price at its moment would serve as the cost basis for the coin.

The coins with a cost basis that is less than the current spot price of the cryptocurrency would naturally be considered to be holding a profit, and as such, they would be counted under the supply in profit.

The Percent Supply in Profit adds up all such coins and calculates what part of the total supply they make up for. The opposite metric, the Percent Supply in Loss, adds up the coins not satisfying this condition.

Since the total circulating supply must add up to 100%, the Percent Supply in Loss can be deduced from the Percent Supply in Profit by subtracting its value from 100.

Now, here is a chart that shows the trend in the Percent Supply in Profit for Bitcoin over the last few months:

As displayed in the above graph, the Bitcoin Percent Supply in Profit has seen a sharp drop recently as the cryptocurrency price has gone through a significant drawdown.

The indicator’s value has dropped to around the 90% mark, which means that about 10% of the supply is currently carrying a loss. The chart shows that the last time the metric touched these levels was back on 22 March. Interestingly, the asset also found its bottom around then.

Earlier, the Percent Supply In Profit had pushed towards the 100% mark, which was a natural consequence of the price setting a new all-time high (ATH), since at fresh highs, all of the supply must be out of the red.

Generally, the investors in profit are more likely to sell their coins, so if many come into gains, the possibility of a mass selloff rises. Due to this reason, high levels of the Percent Supply In Profit have often led to tops.

Similarly, bottoms become more likely when investor profitability levels drop relatively low. The current value of 90% is still quite high, but this isn’t unusual during bull runs, as there is strong demand and ATHs are being explored.

The fact that the profitability has cooled off compared to earlier levels may be constructive for the rally’s chances to see a continuation, just like it did last month.

At the time of writing, Bitcoin has been trading at around the $65,700 level, down more than 5% over the past week.

Bitcoin has started out the new week on a rather bearish note after a flash crash sent the price below $69,000 once more. There has since been some recovery in the price of the largest cryptocurrency in the space. However, the damage has already been done as tens of thousands of crypto traders were flushed out of their leveraged positions as a result.

The Bitcoin flash crash hit support just above $68,800 but crypto traders are already feeling the brunt of the large move. In the last day, more than 81,000 traders have lost their leveraged positions and the volume of their liquidations have piled up.

According to data from Coinglass, the numbers have climbed above 81,400 crypto traders who were liquidated as a result of the crash. In total, over $223 million was also lost during this time from all of the flushed positions. Then, the single largest liquidation took place on the OKX exchange across the ETH-USD-SWAP pair. This trader alone lost $7 million when their position was liquidated.

As expected, the majority of the losses have come from long traders, with Coinglass showing a total of 70.01% of the liquidated positions being longs. This means that long liquidation volumes climbed above $156 million during the last 24 hours.

The crypto exchange with the largest liquidation volumes was the OKX exchange, accounting for 46.87%, or $104.61 million, of all liquidations. Binance came in second place with 38.72%, or $86.41 million. Meanwhile, Bybit saw the third-largest liquidation volume at 8.4%, or $18.75 million.

Naturally, the crypto assets with the largest liquidation volumes have been Bitcoin and Ethereum, with $36.1 million and $28.98 million. However, meme coins such as Dogecoin and PEPE have seen their own numbers ramp up as well.

Dogecoin’s liquidation volumes came out at $10.4 million for the 24-hour period, which put it ahead of Solana with $8.3 million. Then coming up behind Solana is PEPE, with liquidation volumes climbing as high as $7.1 million.

Across all of these cryptocurrencies, long traders continue to suffer massive losses. Even in the shorter timeframe, the trends for long traders continue to look bleak. Coinglass data shows that in the last 12 hours, long traders accounted for 85.64% of liquidations. Then, in the 4-hour and 1-hour timeframes, they account for 6.182% and 72.62%, respectively.

As for the Bitcoin price, bulls continue to struggle as resistance at $69,500 mounts. The price is currently trading at $69,450 at the time of this writing, with a 1.1% decline in the last day, according to data from Coinmarketcap.

Bitcoin has deepened its decline in the past day with its price now slipping below $63,000. Here’s where the next potential support is, according to on-chain data.

In a new post on X, analyst Ali has discussed how the Bitcoin support and resistance levels are looking like right now based on on-chain data from Glassnode.

The indicator of relevance here is the “UTXO Realized Price Distribution” (URPD), which, in short, tells us about the amount of coins (or more precisely, UTXOs) that were last purchased at any given price level that the asset has visited in its history so far.

Below is the chart shared by the analyst that shows the data for this distribution for the price levels around the recent spot value of the cryptocurrency:

From the graph, it’s visible that there are a few price levels not far from the current one that particularly stands out in terms of the amount of buying that took place at them.

In on-chain analysis, the potential for any level to act as support or resistance is based on the total number of coins that have their cost basis at the level in question.

Levels thick with coins that are situated under the current price would be probable to act as points of support, while those above the spot value could prove to be resistance walls.

As is apparent from the graph, the $61,100, $56,685, and $51,530 levels are the ones below the current price that hold the cost basis of a notable amount of the supply right now. Naturally, this means that should the decline continue further, these would be the levels to watch for a possible rebound.

Two levels above, however, are even larger than all three of these support levels: the cost basis centers around $66,990 and $72,880. Interestingly, the latter of these is the single largest acquisition level out of all the price levels listed in the chart, implying that a large amount of FOMO buying has occurred at the asset’s all-time high levels.

In the scenario that Bitcoin regains its upward momentum, these levels of high cost basis population would be where the asset could be most probable to find some trouble.

Now, as for why acquisition centers are considered relevant for support and resistance in on-chain analysis is the fact that investors are likely to show some kind of reaction when a retest of their cost basis takes place.

When such a retest is from above, the holders may decide to accumulate more, believing that the price will go up again in the future. On the other hand, they may sell instead if the retest is from below, as they may think exiting at break-even is better than risking another drop.

A large number of coins having their cost basis at the same level means a potentially large degree of one of these reactions happening and, hence, a strong support or resistance effect on the price.

Bitcoin is inching closer to the first major on-chain support level as it has now dropped to $62,700.

As Bitcoin drops below $68,000, history suggests this correction is rather tame for bull markets, as plunges to this deep on-chain level have been the norm.

As pointed out by CryptoQuant Netherlands community manager Maartunn in a post on X, BTC still has a decent margin over the realized price of the short-term holders.

The “realized price” is an on-chain metric that keeps track of the average price at which the Bitcoin investors acquired their coins. The indicator calculates this value by going through the transaction history of each coin and assuming that the last transfer of it was the last time it was purchased (that is, the price at the time is its current cost basis).

When the spot value of the cryptocurrency dips below the realized price, it means that the average investor is now in a state of loss. On the other hand, a break above implies the market as a whole has entered into net profits.

In the context of the current discussion, the realized price for only a particular segment of the investors is of interest: the “short-term holders” (STHs). The STHs include all the investors who bought their coins within the past 155 days.

Now, here is a chart that shows the trend in the Bitcoin realized price specifically for this cohort:

As displayed in the above graph, the Bitcoin STH realized price has shot up recently as the price of the asset has gone up. This makes sense, as this group includes the most recent buyers, who would continuously be buying at higher prices in an uptrend, thus raising their average cost basis.

At present, this cohort’s realized price is about $53,200. During the past day, BTC has seen a sharp drop that has taken its price below the $68,000 mark, but clearly, the STHs would still be in high profits even after this drawdown.

“In previous bull markets, the average cost basis of short-term holders was fully reset multiple times,” explains Maartunn. This trend is most prominent in the data for the 2017 bull run when the price retested this level several times.

An interesting pattern that has been held is that these retests of the level during bull trends have generally resulted in the cryptocurrency finding support and turning itself back around.

The explanation for this trend may lie in the fickle nature of the STHs. The cost basis is an important level for these investors, and when a retest of it happens, they panic and show some reaction.

During uptrends, these holders are more likely to buy more when a retest of their cost basis occurs since they may think that the same price levels that were profitable earlier will be so again in the near future.

Naturally, it’s not a certainty that Bitcoin would also end up retesting this level in this bull market. Still, a correction might reach close to it if the historical precedent is anything to go by.

Following its 7% drop in the past day, Bitcoin is trading at around $67,700.

Bitcoin is closing out the week on a rather bearish note after suffering a massive crash in the early hours of Friday. The crash pushed the price below $66,000, drawing the rest of the crypto market down with it in the process. The reason for this crash could be traced back to what started the bull run in the first place – Spot Bitcoin ETFs.

After a long strength of what seemed to be only inflows for Spot Bitcoin ETFs across the space, institutions seem to be scaling back on their buying this week. The data aggregation platform Spot On Chain, revealed that net flows into these ETF dropped drastically over the last few days.

The decline was first noted on Wednesday, March 3, when daily net inflows had experienced a 38% crash. Interestingly, Wednesday had seen the second-largest daily inflow for these Spot BTC ETFs. However, with outflows ramping up at the same time, the net inflows have begun to wane.

This trend continued on Thursday, March 14, as net inflows into the Spot ETFs registered another massive crash. This time around, it fell 80.6% compared to the prior day, which had already seen a 38% decline. As a result, the ETFs saw their worst trading day in over a week.

BTC #ETF Net Inflow Mar 13, 2024: +$684M

• The net inflow dropped by 38.3% compared to the previous day but remains the second-largest inflow per day since ETF inception.

• The cumulative total net inflow after 43 trading days is $11.82B.

• BlackRock ($IBIT) now holds… https://t.co/hziFc5Uy4v pic.twitter.com/DGsnfVecZF

— Spot On Chain (@spotonchain) March 14, 2024

Nevertheless, the ETFs are still seeing positive inflow which suggests that outflows continue to dim compared to inflows. However, if the outflows continue to rise, then Bitcoin could suffer tremendously from this, with an example of what could happen being the market crash from the Grayscale Bitcoin Trust outflows.

After falling to $65,600. The Bitcoin price is struggling to recover from the flash crash. There was a quick buy up of the dip, indicating a lot of demand for BTC at low prices. This demand has been able to brush up the price, causing it to rise once more before being rejected at $68,700.

Presently, the BTC price is circling $66,500, with the $68,000 level proving to be the next significant resistance for the price. But even if the crypto was able to beat this level, there is still the matter of the mounting resistance at $68,700, making it an important resistance level to beat.

The crash has seen Bitcoin’s price decline over 8% in the last day, bringing its market cap down to $1.33 billion. This crash has also proven detrimental for altcoins, with the likes of Ethereum, Dogecoin, and Cardano seeing an average decline of 10%.

The Bitcoin price has crashed from over $72,000 yesterday to as low as $65,500. As reported earlier today, there are several obvious reasons for this, such as the liquidation of extensive long positions on the red-hot futures market, expectations of a “higher for longer” policy by the US Federal Reserve as a result of hotter than expected inflation data and a relatively weak inflow day for the spot ETFs yesterday.

However, there is also a rumor that reveals yet another hidden reason for the crash: a failed spread trade by a hedge fund that resulted in over a billion dollars in losses. Andrew Kang, the founder of Mechanism Capital, revealed on X the intricate details of this debacle.

“Apparently a fund blew out $1b+ on the MSTR-BTC spread trade today. They covered into the close which is why BTC dumped and MSTR premium went to the highs. PNL pocketed by based Saylor and will be put back into BTC.”

Kang had earlier elucidated the precarious nature of market transitions, citing the downfall of several major players due to flawed delta-neutral strategies. “You get some really wonky stuff that happens in market trend transitions. Like large delta-neutral funds/institutions getting blown out on ‘risk-free’ spread trades,” Kang remarked, pointing to past failures of notable firms like Blockfi, DCG, Genesis, Three Arrow Capital and Alameda.

MicroStrategy, under the leadership of Michael Saylor, has notably been a leveraged play on Bitcoin, with its substantial holdings often leading to significant interest from short sellers. According to Kang, “MSTR currently has $3b of short interest – roughly 20% of its float. I imagine a lot of that float is angry tradfi boomers trying to capture the premium to NAV.”

The premium discrepancy Kang refers to—surging from 50% pre-ETF to 13% post-ETF, and recently peaking at 70%—illustrates the volatile dynamics at play between MicroStrategy’s stock value and its underlying Bitcoin holdings.

Renowned Bitcoin analyst Bit Paine and German crypto analyst Florian Bruce corroborated the narrative, pointing to the unwinding of a significant spread trade as the catalyst for the market movements. “That dip was because a fund blew up on their MSTR/BTC short,” Bit Paine remarked.

Bruce provided a clear exposition of the strategy gone awry: “A hedge fund set up a spread trade shortly before the ETF approval: Long BTC & Short MSTR. The idea behind it was that MSTR will fall through the ETF while BTC rises.” This explanation lays bare the hedge fund’s miscalculation, as the actual market response saw MSTR outperformed Bitcoin, necessitating a rapid unwinding of positions that contributed to Bitcoin’s sharp price decline.

“BTC was sold and the shorts on MSTR were closed (MSTR bought). This is probably also the reason why MSTR has just had a small mini rally and is doing less badly than other BTC ETFs. Enjoy the dip. I don’t think it will last long,” Bruce stated.

The supposed hedge fund in question, North Rock Digital, had previously outlined its contrarian strategy on X, expressing skepticism towards the valuation of crypto equities in the lead-up to ETF approvals.

“The contrarian idea […] was to short crypto equities vs long spot crypto. In our view, as we approach the ETF, crypto equities have been being used as proxies for spot exposure […] once the ETF becomes available we expect this flow to reverse as many of these holders rotate exposure into the ETF. Given the dislocated nature of many of these names (MSTR, MARA and COIN are our three favorite shorts), we believe there are several attractive shorts to pair against long spot exposure,” North Rock Digital stated in January.

At press time, BTC traded at $67,588.

On-chain data shows that Bitcoin short-term holders have panic sold $2.6 billion worth of coins in the crash following the new all-time high.

As analyst James V. Straten explained in a new post on X, Bitcoin short-term holders have shown signs of capitulation during the latest drop in the cryptocurrency’s price.

The “short-term holders” (STHs) refer to the BTC investors who bought their coins within the past 155 days. The STHs make up one of the two main divisions of the market, the other one being the “long-term holders” (LTHs).

Statistically, the longer an investor holds onto their coins, the less likely they are to sell at any point. This means that the STHs, who are relatively new hands, generally sell quickly whenever an asset crash or rally occurs. The LTHs, on the other hand, usually show resilience, only selling at specific points.

One way to track whether either of these groups is selling is through the transfer volume they are sending to exchanges. First, here is a chart that shows the trend in the Bitcoin exchange inflow volume precisely for the STHs in loss:

As displayed in the above graph, the Bitcoin STHs have transferred around $2.6 billion worth of coins in loss to exchanges in the past day, implying that some members of this cohort have capitulated.

This spike is huge, but it’s less than the loss-taking event that took place back during the price drawdown that followed the BTC spot exchange-traded fund (ETF) approval.

These loss sellers would be those who FOMO’d into the rally that took BTC to a new all-time high beyond the $69,000 level, but their conviction wasn’t strong enough that they were able to hold past the sharp crash that BTC observed shortly after.

The STHs aren’t the only ones who have exited the market in this latest price volatility; it would appear that the LTHs have also done some selling. The difference, however, is that these HODLers have made profits.

The chart below shows how the exchange transfer volume for the LTHs in profit has looked like recently.

The graph shows that the Bitcoin LTHs have participated in their largest profit-taking event since July 2021, transferring tokens worth $1.5 billion to exchanges.

Thus, it would appear that this recent volatility has shaken up the conviction of even some of the diamond hands, although these HODLers have at least still been rewarded with profits.

At the time of writing, Bitcoin is trading around the $65,800 mark, up 8% in the past week.

The flagship crypto token, Bitcoin, finally hit a new all-time high (ATH) on March 5 but quickly dipped by over 10% after this price surge. As explained by this market analyst, this sharp correction was to be expected and could become a norm heading into the bull market.

Alex Thorn, Head of Research at Galaxy Digital, noted in an X (formerly Twitter) post that the market doesn’t move to the upside unfettered, even in a bull market, and corrections are to be expected. He alluded to the 2021 bull run, where Bitcoin experienced around 13 corrections of 10% or more between 2020 and the peak when the crypto token hit its previous ATH.

Thorn also referenced the 2017 bull run, noting that the same thing occurred then as Bitcoin experienced 13 drawdowns of 12% or more. Therefore, what happened with Bitcoin recently isn’t unusual, and more corrections are likely to occur as the crypto token hits new highs on its way to the peak of this market cycle.

Meanwhile, as revealed by Thorn, something similar happened in December 2020 when BTC touched its prior ATH of $20,000, then traded 11.3% lower for the next 15 days before going on to “definitively” break its ATH. If the same thing happens now, the analyst believes that could be good for Bitcoin, stating that “some consolidation would be healthy” after its year-to-date gains.

Moreover, it is worth mentioning that Bitcoin has been on a run since the end of last year (just before the Spot Bitcoin ETFs were approved) and hasn’t slowed since then. Therefore, a significant pullback for the flagship crypto token seems long overdue.

Crypto analyst Guy Turner suggested in an X post that profit-taking could have been the cause of the pullback and that more profit-taking is likely to take place. Investors aggressively taking profit was to be expected considering that Bitcoin hitting a new ATH ultimately put all wallets holding the crypto token in profits.

Turner also noted that these corrections are healthy for a sustainable long-term market. It also allows investors to position themselves and accumulate more BTC during the dip. On the bright side, the bull market is all but confirmed, with Bitcoin hitting a new ATH. According to crypto analyst Ali Martinez, this cycle is expected to continue until sometime in October 2025.

At the time of writing, Bitcoin is trading at around $65,900, down over 2% in the last 24 hours, according to data from CoinMarketCap.

Arthur Hayes, the founder of BitMEX, in his latest essay, presents a foreboding prediction for the Bitcoin market in March, anticipating a severe correction of 30-40%. His detailed analysis, rooted in a deep understanding of market dynamics, outlines the complexities and driving factors behind this expected crash, respectively healthy but deep correction.

Hayes begins his discourse with a cautionary reminder of the nascent state of the crypto bull market, warning enthusiasts not to be overly carried away. “The crypto bull market is in its early stages, and we must not get carried away with our enthusiasm,” he says, highlighting the uncertain journey towards the inevitable collapse of the fiat financial system.

His prediction revolves around three key financial events and indicators converging in March. Hayes first points to the anticipated decline in the Reverse Repo Program (RRP) Balance to a critical level of $200 billion, a scenario he believes will trigger market anxiety about future sources of dollar liquidity. He describes this threshold as a moment of reckoning, “When this number gets close to zero… the market will wonder what is next,” underscoring the gravity of this anticipated development.

The second pivotal factor is the fate of the Bank Term Funding Program (BTFP), which is due to expire on March 12th. Hayes portrays this as a significant test for the financial system, speculating on the decision-making process of the US Treasury in the face of potential liquidity crises among banks. He articulates the market’s anticipatory stance, suggesting that “the market will start getting inquisitive many weeks before about whether or not the banks will continue receiving this lifeline.”

The final piece in Hayes’ forecast is the Federal Reserve’s meeting on March 20th, where a rate cut is expected. This decision, in Hayes’ view, is crucial for setting market expectations and influencing the dynamics surrounding dollar liquidity provision by the Fed and the US Treasury Department.

Hayes then delves deeper into his tactical trading strategy in response to these events, detailing his plans to short the crypto market using Bitcoin puts. He articulates his approach, saying, “I will look to buy a sizable put option position on Bitcoin around this time,” signaling his preparedness to leverage the anticipated market shift.

An important aspect of Hayes’ analysis is the potential impact of the US-listed spot Bitcoin Exchange Traded Funds (ETFs). He argues that the anticipation of substantial fiat capital inflows into these spot ETFs could initially propel Bitcoin’s price to soaring highs. However, he warns that this upsurge could be followed by a dramatic correction, exacerbated by a liquidity squeeze.

“Imagine if the anticipation of hundreds of billions of fiat flowing into these ETFs at a future date propels Bitcoin above $60,000,” he says, illustrating the potential for a steep decline. Hayes explains that a market already heightened by ETF speculation would be particularly vulnerable to a sharp correction, potentially worsening the downturn to 30-40% in the event of a liquidity crunch.

Hayes then shifts to discuss his tactical trading decisions in response to these indicators. He shares his plan to initially short the crypto market using Bitcoin puts, followed by a return to selling US Treasury bills and acquiring more Bitcoin and cryptocurrencies. In explaining his approach, Hayes states, “I will look to buy a sizable put option position on Bitcoin around this time,” indicating his readiness to capitalize on the predicted market downturn.

Furthermore, Hayes details his strategy for Bitcoin puts, explaining the rationale behind choosing puts expiring on June 28th and his approach to selecting the strike price. He emphasizes the importance of timing and market dynamics, noting, “I expect Bitcoin to experience a healthy […] correction from whatever level it has attained by early March.”

In his conclusion, Hayes contemplates various scenarios that could play out differently from his predictions. He considers the implications of a slower decline in the RRP, a potential extension of the BTFP by Yellen, or alternative outcomes of the Fed’s March meeting. He notes that each of these scenarios could lead to different market behaviors, necessitating adjustments in his trading approach.

At press time, BTC traded at $43,940.

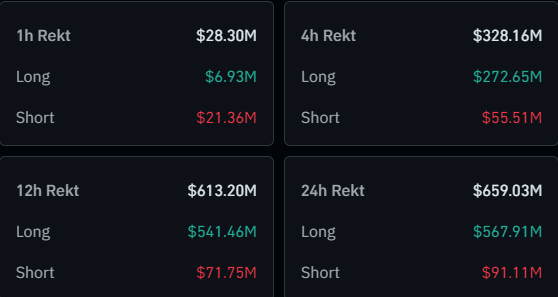

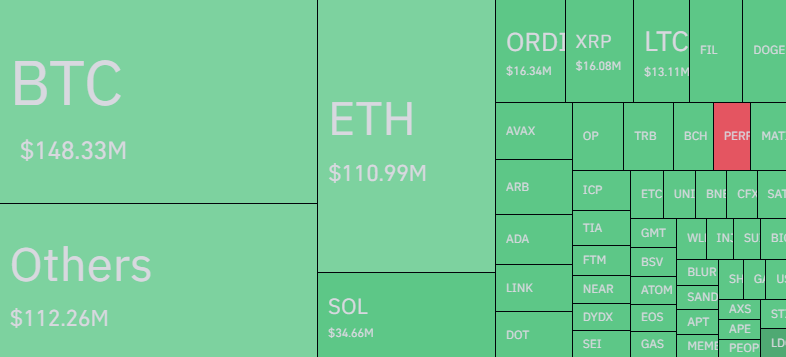

Data shows the cryptocurrency futures sector has gone through a mass liquidation event in the past 24 hours as Bitcoin has witnessed a sharp crash.

The cryptocurrency market has seen sharp price action during the past 24 hours. As is usually the case during such volatility, chaos has occurred on the futures side of the sector.

According to data from CoinGlass, almost $660 million in futures contracts have found liquidation on the last day.

“Liquidation” here naturally refers to the process that any contract undergoes when it racks up losses equivalent to a specific percentage of the position (which may differ between platforms). The exchange has to close it forcibly.

The above table shows that the longs took the brunt of this liquidation flush, as they saw contracts worth about $568 million decimated. This equals about 86% of the total liquidations in the past day.

The forceful closures have been so lopsided due to the sector observing a sharp drawdown following Bitcoin’s crash that took its price to as low as $41,500.

It’s also visible in the table that about $613 million of the total liquidations came during the last twelve hours alone, which again lines up with price action as that’s when the market was most volatile.

Regarding the individual contributions from each of the different symbols, it’s no surprise that Bitcoin-related contracts occupied the largest share of the liquidations at about $148 million.

Generally, though, BTC makes up for a huge part of the total market liquidations, but this time, the asset’s percentage share isn’t too extraordinary. Ethereum (ETH) and Solana (SOL) are the next biggest contributors to the squeeze, with about $111 million and $34 million in liquidations, respectively.

Historically, mass liquidation events like the one seen today haven’t exactly been a rare sight in the cryptocurrency sector due to the high volatility that most coins display on the regular and extreme amounts of leverage being easily accessible in many exchanges.

Recently, the interest in the derivatives side of the sector has become especially pronounced, as CryptoQuant Netherlands community manager Maartunn has talked about in a recent post on X.

As displayed in the graph, the Bitcoin futures volume has generally been higher than the spot volume during the last few years, but the gap between the two especially widened during the second half of 2023.

The indicator’s value saw some decline in the last couple of months of the year, but the recent values of the metric have still been quite high compared to the norm in the past.

Bitcoin has seen some recovery since its initial crash, as the asset is now trading around the $42,700 mark.

A crypto expert has explained why a Bitcoin pullback (possibly to around $40,000) isn’t a bad thing. This comes as there is a growing concern that the flagship cryptocurrency could soon lose all the gains it has achieved in recent times.

In a post on his X (formerly Twitter) platform, William Clemente, the co-founder of Reflexivity Research, suggested this correction was necessary as it would “shake out “weak hands” and leverage, allowing for a stronger foundation for eventual moves higher.” He further mentioned that Bitcoin’s volatility “is a feature, not a bug.”

He made this statement in relation to his assertion that the crypto token has doubled in two months with no pullbacks. Although it hasn’t exactly doubled, Bitcoin has, however, experienced a significant surge these past few months. This has come on the back of the possibility of the Securities and Exchange Commission (SEC) approving the pending Spot BTC ETF applications.

This impressive rally has indeed happened, with the flagship cryptocurrency hardly experiencing any pullback. The bulls have firmly remained in control, with the bears having to bear the brunt of this as many continue to experience heart-wrenching liquidations. However, just like with every other asset, a correction is always expected at some point, and that could be now.

Bitcoin is already facing a retracement as more longs than shorts have liquidated in the last 24 hours, according to data from Coinglass. In an earlier X post, Clemente had warned that there would “be sharp corrections along the way as the market shakes off greedy leveraged longs.”

Meanwhile, the reason for the breather from Bitcoin could also be a result of those waiting on the sidelines to see the outcome of the macroeconomic events happening this week. This includes the CPI inflation data that is set to be released on December 12, which will be closely followed by the FOMC meeting happening on that same day and December 13.

Many will be hoping that the outcome of those events is rather positive as that would further ignite the bullish sentiment that is currently reverberating throughout the crypto community. Irrespective of what happens, this sentiment isn’t expected to dwindle as many still have their sights set on January when a Spot Bitcoin ETF could be approved.

Liquidity is also flowing into the ecosystem, with digital asset investment products experiencing their 11th straight week of inflows at $43 million. Bitcoin remains the major focus of these investors, with the flagship crypto token seeing $20 million in inflows.

At the time of writing, Bitcoin is trading at around $42,000, down in the last 24 hours, according to data from CoinMarketCap.