Polymarket, a Polygon-based prediction platform, is expanding infrastructure through a new partnership with decentralized oracle network Chainlink.

Cryptocurrency Financial News

Polymarket, a Polygon-based prediction platform, is expanding infrastructure through a new partnership with decentralized oracle network Chainlink.

Polymarket is turning to Chainlink to clean up how it resolves bets.

The world’s largest prediction market platform will use the on-chain data provider to automatically settle asset-price-related markets, cutting down on delays and tampering risks, the two companies announced Friday.

The integration is live on Polygon and will initially focus on crypto asset prices while the firms explore potential applications for more subjective markets. That means markets based on asset prices will resolve based on data directly fed from Chainlink’s decentralized oracle network.

Polymarket currently relies on optimistic oracle system UMA to determine the outcomes of its prediction markets. That has often led to controversy over governance attacks made to influence the outcomes of some markets.

Chainlink’s infrastructure combines timestamped price feeds, known as Data Streams, with automated settlement tools. That, the project said in a press release shared with CoinDesk, allows a market to settle as soon as the clock runs out.

Polymarket says it plans to expand the use of Chainlink data beyond asset prices, though subjective markets remain a challenge.

Some controversial outcomes on Polymarket, it’s worth noting, also involved more subjective markets, including decisions based on Ukrainian President Volodymyr Zelensky’s clothing.

U.S. Representative French Hill is among his House of Representatives colleagues watching from the sidelines as their Digital Asset Market Clarity Act is overhauled by senators, but he and Senator Cynthia Lummis seem to be in agreement that one of the bill's aims should be to re-cast what Congress already did on stablecoins.

So far, the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act is the marquee accomplishment for the crypto industry and its lawmaker allies in Washington. As the new law of the land, federal regulators are already beginning work to implement its oversight of U.S. stablecoin issuers.

But that was a bill authored in the Senate after years of work in the House on similar texts, so when the House passed its Clarity Act this year on crypto market structure, it tied to that bill some changes to GENIUS. The tweaks outlined in Section 512 at the very tail end of that legislation include:

“We just thought these were ways to make GENIUS stronger and better, based on work we've done in the House,” Hill said in an appearance this week at CoinDesk's Policy and Regulation event in Washington.

On the sidelines of that same event, Senator Cynthia Lummis, the staunch crypto advocate who heads the Senate Banking Committee's digital assets subcommittee, said that she anticipates the Senate's eventual market structure bill will modify the young stablecoin law. She said she wants to “be very respectful of the House's amendments.”

“So I do think that there will be some language that changes GENIUS,” she said.

Later, at a Cato Institute event on Thursday, Hill got into the topic again, saying, “I prefer the House version, but we were able to work between the two houses to outline a few changes that we would make to GENIUS, and we put them in the Clarity Act.”

The Senate Banking Committee's Republicans recently released a draft version of their bill and some senators, including Lummis, still talk about finishing their bill by the end of this month. Though its House counterpart cleared that chamber with a massive bipartisan vote — 308-122 — at least one of the Republicans on that committee, Senator John Kennedy of Louisiana, has expressed reservations about the readiness of the Senate's work.

While Hill noted that the Senate committee hasn't been working on these topics as long as the House, “I think they can get this done,” he said. Work teams from both parties in the Senate are toiling away, he said, “and they are collaborating to get to yes.”

The timeline now in mind for crypto advisers in the administration, including Tyler Williams at the Treasury Department, is turning the market structure effort into law by the end of this year — the target currently offered by Lummis.

Read More: Senators Still Hopeful for Crypto Market Structure Law by End of Year

Traders are using leverage in an attempt to lift bitcoin (BTC) back to record highs, creating a high-risk environment that could result in a derivatives unwind to the downside if price begins to shift the other way.

Market analyst Skew warned one trader intent on opening a nine-figure long position to “maybe wait for spot to carry the buying so it doesn't create toxic flows.”

Bears are also adding leverage, with a separate trader currently dealing with a $7.5 million unrealized loss after shorting BTC to the tune of $234 million with an entry at $111,386. That trader added $10 million worth of stablecoins to maintain their position, with the liquidation currently standing at $121,510.

But the major liquidation risk is present to the downside, with data from The Kingfisher showing a large pocket of derivatives will be liquidated between $113,300 and $114,500, which could potentially prompt a liquidation cascade back to the $110,000 level of support.

“This chart shows where traders are over-leveraged,” wrote The Kingfisher. “It's a pain map. Price tends to get sucked into those zones to clear out positions. Use this data so you don't end up on the wrong side of a big move.”

Bitcoin is currently trading quietly around $115,000 having entered a period of low volatility, failing to break out of its current range for more than two months.

Spot Ether ETFs recorded over $230 million in net inflows as of Thursday, recovering from last week’s net outflows of nearly $800 million.

XRP Exchange reserves have surged by 1.2 billion in just a day, presenting a bearish outlook for the XRP price. This development comes as the token looks to hold above the psychological $3 level.

A CryptoQuant analysis by CryptoOnchain revealed that XRP Exchange reserves jumped by 1.2 billion in a day across four crypto exchanges, with Binance leading the surge. Bithumb, Bybit, and OKX also experienced a major increase in their reserves, a development which CryptoOnchain noted shifted the volume of XRP’s reserves in an unprecedented manner.

Binance saw its reserve holdings increase from around 2.928 billion XRP to 3.538 billion XRP, an increase of over 610 million XRP in a single day. Meanwhile, Bithumb saw its holdings increase from 1.647 billion to 2.519 billion, Bybit’s holdings increased from 188 million to 380 million XRP, and OKX’s XRP reserves jumped from 112,000 to 233 million.

This development is typically bearish, as an increase in crypto exchanges’ reserves indicates that investors are offloading their coins. This would also explain why XRP has underperformed in recent times and has struggled to hold above the psychological $3 price level. During this period, other altcoins like Solana and BNB have outperformed XRP, reaching new local highs.

CryptoOnchain revealed that the increase in XRP Exchange reserves is a case of accumulation rather than the typical sell-offs. The analyst noted that the price chart indicates that this heavy accumulation occurred precisely at the key support level of around $2.73, a level that has previously prevented the altcoin from experiencing massive declines.

The analyst then pointed to the RSI and MACD indicators a day after the increase in the XRP Exchange reserves, which shows a decrease in selling pressure on the token.CryptoOnchain explained that this could mean that the heavy buying by exchanges was aimed at accumulation rather than immediate injection into the market.

CryptoOnchain also noted that the pattern of these large accumulations across the crypto exchanges and at a critical support level could be a sign of institutional coordination or an upcoming event. Notably, the XRP ETFs could launch next month, which would represent a significant development for the XRP price.

The analyst stated that if the current support holds and buying volumes continue, the XRP price could rally to higher resistances at $3.34 and $3.58. However, CryptoOnchain warned that if the support is broken, selling pressure could turn the increase in XRP Exchange reserves into an opportunity for massive supply.

At the time of writing, the XRP price is trading at around $3.06, up over 2% in the last 24 hours, according to data from CoinMarketCap.

PancakeSwap claims its trading competition winners were selected randomly, but blockchain records suggest over half of them belong to a cluster of linked wallets.

Gen Alpha will grow up with Bitcoin as a cultural and financial native, making it their default store of value over traditional gold investments.

Dogecoin gained around 4% to reach $0.26 despite Bloomberg’s Eric Balchunas reporting that the first US DOGE ETF faces another delay.

Solana (SOL) ripped higher on Friday, hitting its strongest price since January as digital asset treasury demand could be taking shape.

The token rallied 5% over the past 24 hours to just shy of $240. It has extended weekly gains to 18% and vastly outperformed bitcoin (BTC) and ether (ETH), which advanced just 4%-5% over the same period.

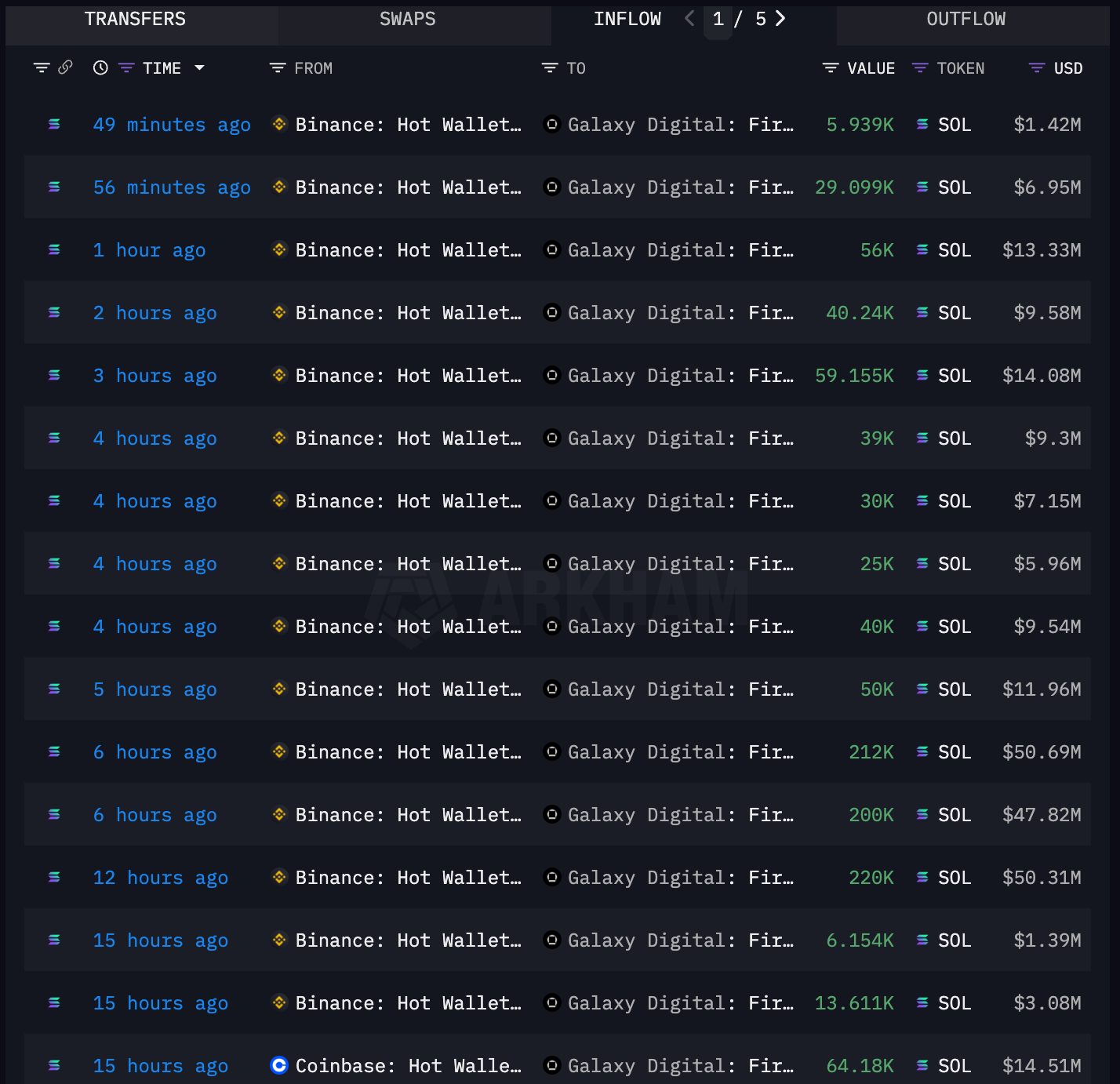

The gains occurred as digital asset manager Galaxy Digital withdrew some 3.1 million in SOL tokens from exchanges, predominantly from Binance and Coinbase, through the last two days, worth a total of $724 million, blockchain data by Arkham Intelligence showed.

The transactions may have to do with Forward Industries (FORD), the digital asset strategy company with a $1.65 billion cash pile to build a Solana treasury. Galaxy was a lead investor in the fundraising round, while its asset management division was tasked to “actively manage” Forward's war chest, according to a press release.

Solana's outperformance could continue, Bitwise CIO Matt Hougan forecasted earlier this week, as incoming demand from treasury companies and spot ETF anticipation could have an outsized impact and SOL, given its smaller market capitalization compared to bitcoin (BTC) and ether (ETH).

Mike Novogratz, CEO of Galaxy, echoed that view in a Thursday CNBC interview, saying that the market could be entering the “season of SOL.” He pointed to crypto investment firm Pantera's upcoming Solana treasury company and the potential approval of SOL ETFs, bringing in fresh money for the crypto.

His firm also chose the Solana blockchain to tokenize its stock with Superstate earlier this month.

Read more: ‘The Ingredients Are All There’: Solana May Be Set to Soar, Says Bitwise

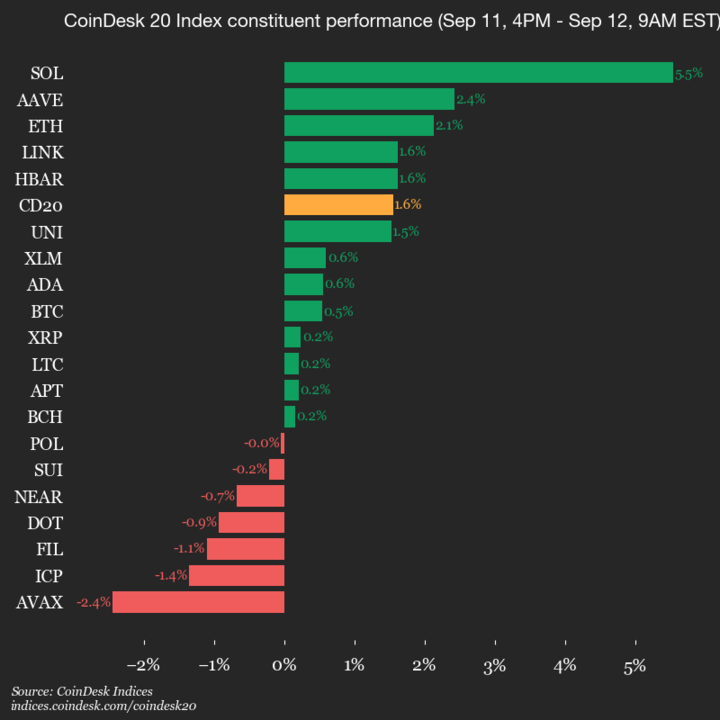

CoinDesk Indices presents its daily market update, highlighting the performance of leaders and laggards in the CoinDesk 20 Index.

The CoinDesk 20 is currently trading at 4284.12, up 1.6% (+65.55) since 4 .p.m. ET on Thursday.

Thirteen of 20 assets are trading higher.

Leaders: SOL (+5.5%) and AAVE (+2.4%).

Laggards: AVAX (-2.4%) and ICP (-1.4%).

The CoinDesk 20 is a broad-based index traded on multiple platforms in several regions globally.

CleanCore Solutions (ZONE) surged in pre-market trading Friday after announcing it purchased more than 200 million dogecoin (DOGE), pushing its total holdings past 500 million tokens.

At DOGE's current price of $0.26, up 6% in the past 24 hours, those 500 million tokens are worth about $130 million.

The move is part of the company’s plan to build a treasury of one billion DOGE within 30 days. The strategy was unveiled earlier this month alongside a $175 million private placement involving over 80 investors. Participants included Pantera Capital, GSR and FalconX, all well-known digital asset firms.

Earlier this week, Cleancore disclosed an initial purchase of 285 million DOGE, signaling the start of its accumulation effort. The latest buy suggests the company is ramping up quickly toward its one billion-token target.

Dogecoin, the meme-inspired cryptocurrency that began as a joke but has since developed a devoted community, traded 6% higher over the past 24 hours at $0.26. ZONE shares are higher by 13%.

The stablecoin market cap topped $300 billion on CoinMarketCap, but discrepancies across platforms like CoinGecko and DefiLlama highlight challenges in tracking crypto assets.

The rise of artificial intelligence and robotics is forcing us to face something we’ve all sensed coming: millions of jobs are going to soon vanish. From factory floors to law offices, from truck driving to financial analysis, AI is learning to do our work faster, cheaper, and often better. This isn’t a future problem — it’s happening now. The real question is what we’re going to do about it, because the old idea of tying survival to a paycheck is going to break.

A lot of public personalities are offering big ideas. My own favorite solution is Universal Basic Income (UBI), which I have promoted for over a decade. It’s where everyone gets a guaranteed monthly cash payment from the government, no strings attached, enough to cover the basics. UC Berkeley Professor of Finance Emeritus, Mark Garman has suggested Universal Basic Capital, giving everyone income-producing assets and dividends via a superfund. XPrize founder Peter Diamandis on X recently promoted Universal Basic Ownership, where we all own a stake in the companies driving the AI revolution. OpenAI CEO Sam Altman talks about Universal Extreme Wealth, where AI’s productivity is so massive that everyone lives in abundance and luxury.

These all have merit, and I like them all. But putting actual cash in people’s pockets through UBI is still the most practical, immediate way to keep society stable as AI takes over more of the economy.

UBI is simple. Everyone gets a monthly check — no hoops or bureaucracy. If desired, I’d also support payments in crypto and using the blockchain. Regardless, if machines are doing most of the work and generating the wealth, we should cut people in directly to the money earned. And this way, no one falls through the cracks because they didn’t fill out the right form or meet some arbitrary requirement, as often happens in the welfare system. Ultimately, it’s not just about survival —it’s about freedom. With basic financial security, people could spend more time creating, learning, caring for loved ones, or simply living without the constant grind.

Critics of UBI raise cost, inflation, or the fear that people will stop working. But real-world trials — from Alaska’s oil dividend to pilot programs around the world — tell a different story. People don’t suddenly become lazy. Most keep working, start businesses, or invest in skills. What changes is that they’re less stressed, healthier, and more willing to take productive risks.

Mark Garman’s Universal Basic Capital has appeal. Giving people a stake in a superfund derived from assets in automation-dependent businesses could build long-term wealth and make everyone a participant in market gains. It’s a way to fix the imbalance between those living off capital gains and those living off wages. But markets crash. Dividends dry up. And setting up accounts, teaching financial literacy, and managing assets adds complexity that UBI avoids.

Peter Diamandis’s promotion of Universal Basic Ownership is attractive too: let’s all directly own part of the AI-driven companies and automated industries of the future. That aligns the public’s interests with technological progress and could turn the whole country into shareholders. But convincing existing companies to give away significant equity is a steep climb. And even if they did, ownership stakes don’t reliably pay the rent without selling them.

Sam Altman’s Universal Extreme Wealth is the boldest vision — a future so abundant that everyone lives like today’s multi-millionaires. AI drives the cost of goods and services close to zero, and money becomes less important because everything is nearly free. It’s inspiring, but far off. We can’t bet the next 10 or 20 years on a perfect utopia showing up exactly when we need it —though I support the long term idea.

All these ideas share the same moral core: if AI is going to create unimaginable wealth, it can’t just pile up in a few corporate bank accounts. It has to be spread broadly or society will fracture when the jobless pick up pitchforks and revolt. But UBI is the one that can work now, to keep people worry free.

First, it’s about liquidity. People who lose their jobs to automation don’t need a stock portfolio —they need money for groceries and rent this month. Second, it’s simple. You can send cash to people today without building new systems from scratch. Third, it respects individual choice. People can decide for themselves whether to pay off debt, take a class, help their family, or start a side hustle.

The beauty of UBI is that it doesn’t block us from trying other models later. We can start with cash security, then layer in investment capital, shared ownership, crypto projects, or new distribution systems. It’s the safety net that makes everything else possible.

I’m not against a future of universal ownership or extreme wealth. I’d love to see it. But while we wait for that future — and hope it works out the way we think — UBI can make sure no one is left behind. It can keep the economy stable and buy time to build whatever comes next.

This isn’t about “free money” in the pejorative sense. It’s about recognizing that in a world where machines can produce nearly everything, our sense of human worth has to be separated from having a job. Direct cash is the fastest, cleanest, and fairest way to make sure AI’s benefits reach everyone, not just the handful of people who own the machines.

If we get this right — if we make the AI revolution work for all of us —then maybe the abundance Sam Altman talks about won’t just be a dream. It could be the natural next step.

Raoul Pal’s latest “Journey Man” episode brings back Michael Howell, CEO of CrossBorder Capital, for a sweeping tour of the liquidity landscape that has propelled risk assets like crypto for nearly three years. Both agree the global liquidity cycle is “late,” still advancing but increasingly mature, with its eventual peak most likely pushed into 2026 by policy engineering, bill-heavy issuance, and rising use of private-sector conduits.

The investment implication running through the conversation is unambiguous: long-duration assets—crypto and technology equities—remain the primary beneficiaries of ongoing currency debasement, yet the endgame is now visible on the horizon as a wall of debt refinancing and inflation risk approaches.

Howell’s high-level assessment is stark. “We’re late. It’s not inflecting downwards yet—we’re still in an upswing—but… the liquidity cycle is about 34 months old. That’s pretty mature.” In his framework, cycles typically run five to six years. Pal’s Everything Code—a synthesis of demographics, debt, and the policy liquidity needed to roll that debt—arrives at a similar destination, albeit with a slightly shorter cadence and a crucial timing nuance.

“My view is it’s been extended,” Pal says, adding that the peak “normally would have finished sometime this end of this year, but it feels like it’s going to push out.” Howell places the likely turn “around about early 2026,” with his model’s latest estimate at March 2026, while Pal is “in the camp of Q2” 2026. The difference is tactical; the thrust is the same: the late-cycle rally can run further, but investors are now operating inside the final act.

At the center of that act is what Howell calls a structural transition “from Fed QE to Treasury QE.” The US Treasury’s heavy tilt to short-dated bills over coupons lowers the average duration of paper held by the private sector. “Very crudely, we tend to think that liquidity is equal to an asset divided by its duration,” Howell explains.

Reducing duration mechanically boosts system liquidity. That issuance profile also corrals volatility and creates powerful bid auras: banks gladly absorb bills to match deposit growth, and, increasingly, so do stablecoin issuers managing cash to T-bill ladders. “If any credit provider buys government debt—particularly short-dated stuff—it’s monetization,” Howell notes. The result, in Pal’s summary, is that policymakers have shifted from balance-sheet expansion to a more complex “total liquidity” regime, where banks, money funds, and even crypto-native entities become the delivery rails of debasement.

The debate over near-term Fed liquidity hinges on reserves and the Treasury General Account. The quarterly refunding blueprint has telegraphed a rebuild of the TGA toward the high-hundreds of billions. Howell is unconvinced it happens quickly or fully, because draining that much cash would risk a repo spread spike, something the Fed and Treasury appear determined to avoid.

“Everything I hear… is they want to manage that liquidity. They don’t want to pull the rips on the markets,” he argues, adding that the Fed has effectively been targeting a minimum level of bank reserves since last summer’s stress-test changes. “The Federal Reserve controls bank reserves in aggregate completely,” Howell says. Even if the TGA edges higher, “you can find other ways of injecting liquidity… through Treasury QE or getting the banks to buy debt.”

The global overlay is every bit as important. Europe and Japan, as Howell frames it, are net-adding liquidity; China has moved decisively to ease via the PBoC’s toolkit—repos, outright OMOs, and medium-term lending—after a stop-start attempt in 2023.

Chinese 10-year yields and term premia have started to firm from depressed levels, which, paradoxically for asset allocators, “can be good” if it signals escape from debt-deflation toward reflation and a commodity up-cycle. “If you get this big Chinese stimulus continuing… that should mean stronger commodity markets,” Howell argues, with Pal adding that a revived China would restore the missing engine of the global business cycle even as liquidity remains the dominant market driver.

Japan is the outlier with a fascinating twist. Disaggregating term premia shows the selling is concentrated in the ultra-long end, not the belly or front of the curve. Howell’s inference is a duration rotation rather than a full-curve sovereign dump—“a switch from bonds into equities”—consistent with mild-inflation regimes that favor stocks. Why tolerate it?

Howell floats two possibilities: Japan “actually want[s] some inflation,” which quietly erodes debt burdens, and, more speculatively, “the Japanese are being told to ease monetary policy by the US Treasury,” keeping the yen weak to pressure China. He is careful to caveat, but the pattern—persistent yen weakness despite strong equity inflows—fits the policy-coordination narrative that Pal has long emphasized.

The U.K. and France, by contrast, look like textbook supply-shock sovereigns. Here, term premia have risen across the curve, reflecting heavy issuance, swelling welfare-state obligations, and weak growth. Howell highlights that the U.K.’s “underlying term premium [is] up over 100 basis points in the last 12 months,” a move that cannot be waved away as a single budget misstep.

The policy menu is narrow: higher taxes, eventual spending restraint (likely only enforced by a crisis or an IMF-style conditionality), and, ultimately, some form of monetization—whether relabeled QE, regulatory loosening to stuff more gilts into bank balance sheets, or de-facto yield-curve management. “Let’s not say never for [monetization] because that’s almost inevitably what’s going to happen,” Howell says.

Hovering over all of it is the dollar. On Howell’s preferred real trade-weighted lens, the dollar remains in a secular up-channel with a cyclical correction in train. Rest-of-world balance-of-payments data still show net inflows to the dollar system.

Pal and Howell agree that the administration wants a weaker dollar cyclically to ease the refinancing of the roughly half of global debt that is dollar-denominated, even if the dollar remains “fundamentally strong” as the world’s primary collateral system. That’s the paradox Pal underscores: “A weaker dollar allows people to refinance their debts… That ends up being the debasement of currency, even though you get dollar inflows.”

In that debasement regime, both men argue, long-duration, liquidity-sensitive assets lead. “You’ve got to start thinking about how to invest in the monetary inflation world,” Howell says. Pal is explicit about the winners: technology and, crucially, crypto. He frames both as living within “log trend channels” that extend higher as cycles are elongated by policy engineering.

The 2021 crypto blow-off, in his telling, was a sunset cycle; this time, the extension lengthens the price runway. Gold also fits the mosaic, but with a twist in its driver set. Pal observes that gold has decoupled from real rates and is now “highly correlated with financial conditions,” poised to break from a wedge if the dollar weakens and rates ease.

Crypto stablecoins occupy a pivotal, and underappreciated, role in the architecture. Howell calls them a “conduit” for public-sector credit creation, while warning that deposits migrating from banks to stablecoins can curb traditional credit growth. Pal widens the lens: stablecoins are effectively a “fractionalized eurodollar market down to individual level,” giving any household in any jurisdiction access to dollar liquidity and, by extension, democratizing the demand base for US bills. It is not lost on either man that Europe is scrambling for its own digital-money answer, even if politics likely forces a central-bank-led route.

The risks now crowd the 2026–2027 window. The COVID-era terming-out of corporate and sovereign debt will need to be rolled in size at meaningfully higher coupons. Howell also flags a cash-flow squeeze emanating from the corporate capex boom: “US tech companies [are] currently investing, what is it, a billion dollars a day in IT and infrastructure… over a couple of years that’s going to take about a trillion dollars out of money markets.” That drains liquidity even as profits rise. His historical analogue is the late-1980s sequence—rising yields, commodities firming, a policy signal misread, then an abrupt liquidity turn that cracked equities. He is not forecasting a crash, but he is clear that “we’re nearer the end than… the beginning.”

For now, neither man is bearish on the next three to six months. Pal’s Global Macro Investor financial conditions index points to an expansion, and Howell expects “pretty decent Fed liquidity” to persist as authorities avoid repo stress and lean on duration management.

“Through year end… generally I think it’s okay,” Howell says. “We will get wiggles… but the trend is intact and continues for a while.” The operative phrase is his earlier one: steady as she goes—into the liquidity endgame. Crypto sits squarely in that cross-current, the prime expression of monetary inflation even as the calendar inexorably advances toward a refinancing test that will decide whether today’s engineered extension ends in a soft plateau or a sharper turn.

At press time, the total crypto market cap stood at $3.95 trillion.

Bitcoin (BTC) pulled back from overnight highs above $116,000 to under $115,000 as the Dollar Index (DXY) remains steady despite expectations of an imminent Fed rate cut.

Analysts remained optimistic saying they expect new lifetime highs in BTC and outsized gains in select few tokens, such as HYPE, SOL and ENA.

Focus has already shifted to smaller names. Tokens such as MYX, HASH, PENGU, PUMP and MNT have carved out price gains in excess of 10% this week.

“The CPI + jobs combo created a classic “good news/bad data” trade: inflation prints higher, but weaker labor data preserves the easing narrative, a net positive for crypto in the near term,” Timothy Misir, head of research, BRN said in an email.

Derivatives Positioning

Token Talk

By Oliver Knight

Gemini, the crypto exchange backed by Tyler and Cameron Winklevoss, priced its initial public offering at $28 a share, valuing the company at around $3.3 billion.

The company sold 15.2 million shares, raising $425 million, it said in a Thursday press release. The IPO was 20 times oversubscribed, according to a Reuters report on Thursday.

The shares will start trading on the Nasdaq Global Select Market later Friday under the ticker symbol GEMI.

The exchange is the latest crypto native firm to go public. Rival exchange Bullish (BLSH), the owner of CoinDesk, sold shares at $37 each last month, above the expected $32-$33 range.

Gemini said in a filing pm Tuesday that TradFi giant Nasdaq (NDAQ), had agreed to buy $50 million of its Class A common stock in a private placement at a price equal to the IPO price.

Lead underwriters on the Gemini IPO were Goldman Sachs (GS), Citigroup (C), Morgan Stanley (MS) and Cantor.

Gemini raised the price range for the IPO to $24-$26, from $17-$19, in an updated S1 filing earlier in the week.

Read more: Crypto Exchange Gemini Boosts IPO Price Range to $24-$26 Per Share

Explore Michael Saylor’s Bitcoin playbook, Strategy’s debt-fueled purchases and the future outlook of corporate crypto investing.

Historical data suggests that bitcoin (BTC) has likely put in its September 2025 low, around $107,000 on the first of the month.

Looking back to July 2024, a consistent pattern emerges where bitcoin tends to form a bottom for the month within the first 10 days of each month.

The notable exceptions were February, June and August 2025, when the lows came later in the month, but even then, the market experienced a correction within those first 10 days before resuming its broader trend.

Speculatively, the reason bitcoin often puts in its low within the first 10 days of the month could be tied to institutional portfolio rebalancing or the timing of key macroeconomic events that tend to cluster early in the month.

“It’s worth noting that several futures and options markets expire on the final day of the month or the first day of the next, this can lead to short term volatility and a subsequent lull in trading activity as traders either rollover trades or reposition entirely,” said Oliver Knight, deputy managing editor, data and tokens, at CoinDesk.

Of course, past performance is not a guarantee of future results, but as Q4 approaches it is worth noting that this quarter has historically been bitcoin’s strongest, delivering an average return of 85%. October in particular has been especially favorable, with only two losing months since 2013.

Africa has its first Bitcoin treasury company, but its utility goes far deeper than publicly-listed stocks tied to BTC holdings on a balance sheet.