Apecoin (APE) is experiencing a rollercoaster ride in 2024. After plummeting to an all-time low of $1.01 in October 2023, the Bored Ape Yacht Club governance token has experienced a dramatic turnaround, buoyed by strategic whale buying and a recent partnership with the Arbitrum network.

However, with a 13% pullback in the past two days and lingering profit-taking concerns, questions remain about whether the bulls can defend key support levels and push the price back towards its former glory.

At the time of writing, APE was flashing green, trading at $1.73, which is a 0.6% and 7.5% increase in the 24-hour and weekly timeframes, data from Coingecko shows.

Riding The Arbitrum Wave

The turning point came on February 16th, when the Apecoin DAO voted to launch ApeChain, a dedicated blockchain, on the Arbitrum network. This partnership, aimed at tackling scalability issues and fostering ecosystem growth, sparked a 21% surge in APE price, pushing it to a six-month high of $1.90.

Whales Hold Firm, Retail Cashes Out

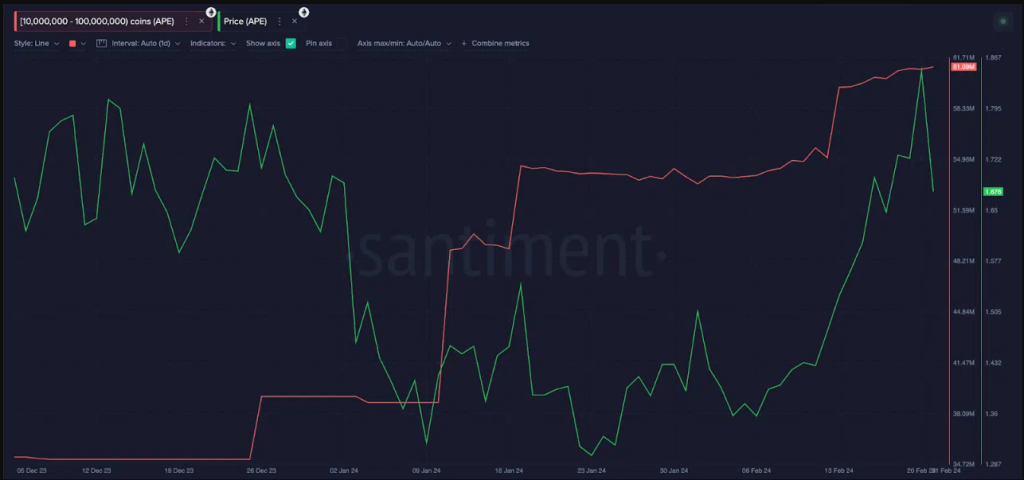

On-chain data paints a fascinating picture of contrasting investor behavior. While retail investors and swing traders were quick to lock in profits after the rally, “whales” – those holding at least 10 million APE tokens – have displayed unwavering confidence.

Since January 1st, these large investors have acquired an additional 22 million APE tokens, representing a staggering $40 million investment and bringing their total holdings to 61 million APE. This unwavering conviction suggests long-term optimism in the project’s potential.

Can The Bulls Hold The Line?

Despite the bullish whale activity, a recent pullback has cast a shadow on the optimistic outlook. The price dipped 13% in the past two days, testing the crucial $1.50 support level. A breach of this support could trigger further decline towards $1. However, a large buying cluster at $1.50, representing 9,630 investors who purchased APE at that price, could act as a significant barrier to a deeper fall.

Eyes On $2, But Hurdles Remain

Technical analysis and market sentiment suggest a potential early rebound towards $2 in the coming weeks. However, this hinges on two key factors: defending the $1.50 support and overcoming further profit-taking waves. Additionally, broader positive developments in the NFT sector could provide tailwinds for APE price.

Looking Beyond The Immediate

Congratulations to @apecoin DAO on its decision to develop ApeChain utilizing the Arbitrum tech stack!

With $APE serving as both the gas and governance token for ApeChain, Arbitrum Orbit’s customizability empowers @ApeCoin DAO with true ownership and control over this…

— Offchain Labs (@OffchainLabs) February 15, 2024

While the Arbitrum partnership and whale support are encouraging, several hurdles remain. The broader macroeconomic climate, still grappling with inflation and interest rate concerns, could impact investor sentiment across the cryptocurrency market. Moreover, the success of ApeChain itself remains to be seen, and any unforeseen challenges could dampen enthusiasm.

With a potential $2 mark tantalizingly close, Apecoin faces a critical juncture. Whether the bulls can overcome the immediate hurdles and propel the token to new heights, or if profit-taking and broader market headwinds prevail, remains to be seen.

Featured image from Pexels, chart from TradingView