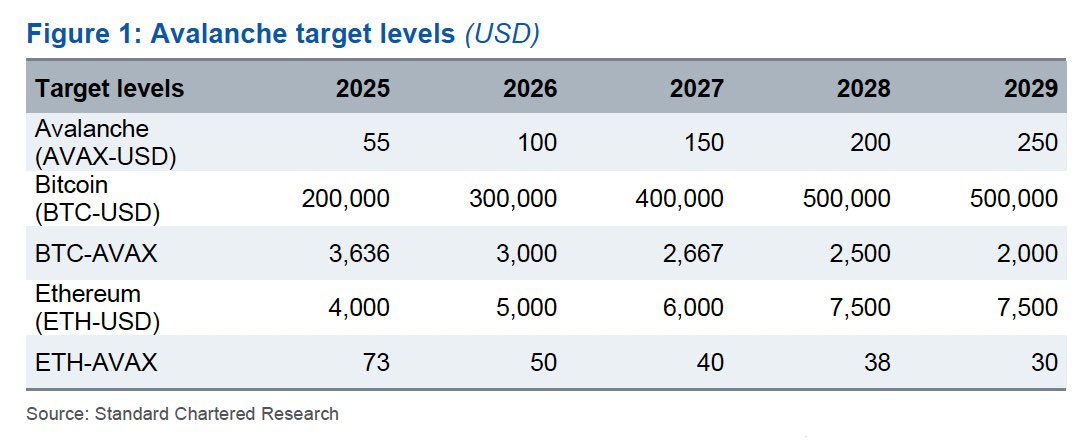

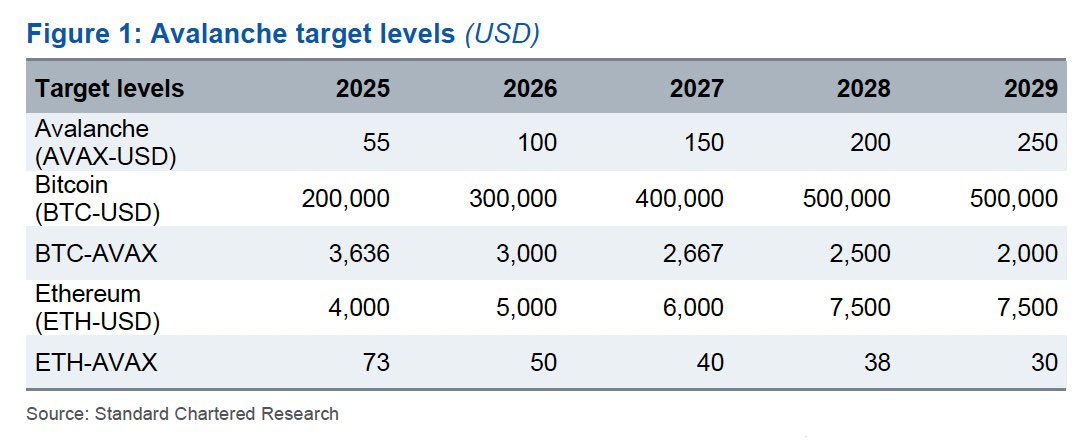

Global banking giant Standard Chartered published new five-year price projections for three leading cryptocurrencies: Avalanche (AVAX), Bitcoin (BTC), and Ethereum (ETH). According to these forecasts, Avalanche is poised to gain significant ground on both Bitcoin and Ethereum by 2029.

Ryan Rasmussen, Head of Research at Bitwise, drew attention to these ambitious targets via X. “Global banking giant Standard Chartered just published 5yr price targets for Bitcoin, Ethereum, and Avalanche,” Rasmussen wrote, pointing to a chart that outlined the bank’s estimates.

Standard Chartered expects Avalanche (AVAX) to reach $55 by the end of 2025, $100 by 2026, $150 by 2027, $200 by 2028, and ultimately $250 by the end of 2029. This projected growth represents a more than 1,200% increase from its current trading level of around $20.

Meanwhile, Bitcoin (BTC) updated its forecast and now projects BTC to appreciate from $200,000 in 2025 to $300,000 in 2026, followed by $400,000 in 2027, and finally hitting $500,000 in 2028—a level it is expected to maintain through 2029.

For Ethereum (ETH), Standard Chartered projects the token to hit $4,000 in 2025, $5,000 in 2026, $6,000 in 2027, and $7,500 by 2028, with no change anticipated in 2029. The forecast indicates steady but less dramatic growth relative to Avalanche.

In terms of comparative valuation, the bank provided ratio metrics to show how AVAX might perform against BTC and ETH. The BTC-to-AVAX ratio, which measures how many AVAX tokens equal one BTC, is expected to drop from 3,636 in 2025 to 2,000 in 2029.

This decreasing trend implies that AVAX will appreciate faster than Bitcoin over the period. Similarly, the ETH-to-AVAX ratio is projected to decline from 73 to 30 during the same timeframe, pointing to a similar outperformance against Ethereum.

Standard Chartered’s Bullish Case For Avalanche

Standard Chartered has initiated coverage of Avalanche, stating it expects AVAX to rise from its current price of roughly $20 to $250 by the end of 2029. “One positive of the tariff noise is that it gives us a chance to re-set and pick winners for the next upswing in digital asset prices,” said Geoffrey Kendrick, the bank’s global head of digital assets research, in an email to The Block on Wednesday, referencing his latest report. “And I think Avalanche will be another winner, perhaps the winner in EVM [Ethereum Virtual Machine] chains.”

Kendrick emphasized that Avalanche’s approach to scaling—particularly after its Etna upgrade, also known as Avalanche9000—positions the network for long-term success. Activated in December 2024, the Etna upgrade dramatically reduced the cost of launching subnets (which Avalanche now calls Layer 1 blockchains), slashing setup expenses from up to $450,000 to nearly zero.

Kendrick noted that these changes appear to be attracting new developer activity: “A quarter of Avalanche’s active subnets are now Etna-compatible, and developer numbers have jumped 40% since the upgrade.”

He also mentioned that some developers are migrating from Ethereum Layer 2 solutions to Avalanche due to its compatibility with Ethereum code and the lower overhead for launching new subnets or L1 chains. While fees on Avalanche can still run higher than certain Ethereum L2s like Arbitrum, Kendrick believes attracting completely new applications—especially in fields such as gaming and consumer-focused tools—will be critical to Avalanche’s growth.

“As a result, we see AVAX outperforming both Bitcoin and Ethereum in terms of relative price gains in the coming years,” Kendrick remarked, while noting Avalanche’s higher volatility levels compared to BTC.

At press time, BTC traded at $83,334.

10.8M+ daily transactions — an all-time high

10.8M+ daily transactions — an all-time high

(@el33th4xor)

(@el33th4xor)