The Avalanche (AVAX) network has gained prominence as a leading blockchain platform, providing users with a robust infrastructure for token transactions. It is a Layer 1 blockchain protocol that provides a high-performance platform for decentralized applications (dApps) and smart contracts.

Avalanche strives to provide users with a fast, secure, and scalable ecosystem for token transactions. It is a blockchain platform that aims to address the blockchain trilemma of scalability, security, and decentralization, thanks to its unique Proof of Stake (PoS) mechanism. Avalanche is commonly regarded as a viable alternative to Ethereum.

Avalanche serves as a leading light in the Web3 ecosystem by innovating a secure network that doesn’t compromise scalability or decentralization. The network possesses a remarkable characteristic in the form of its consensus protocol, referred to as Snow.

This protocol employs an innovative method known as “Snow consensus”, which enables the network to achieve nearly instantaneous transaction finality. Utilizing the “Snow consensus” method enables the network to achieve rapid confirmation times and efficient throughput by collectively validating transactions through a network of validators, overcoming the limitations of the blockchain trilemma. By addressing the challenges posed by the blockchain trilemma, Avalanche is actively working towards providing robust security and stability to the dynamic advancements in Web3.

This prominent network provides developers and investors with an advantageous blend of cost-effectiveness, high transaction speeds, dependability, and the scalability necessary for widespread acceptance. Avalanche’s commitment to sustainability and environmental consciousness further enhances its appeal. Consequently, it comes as no surprise that Avalanche has emerged as a prominent force in the Web3 ecosystem, commanding a significant presence.

How does Avalanche Work?

Avalanche’s platform sets itself apart from other blockchain projects through three fundamental design aspects: its distinctive integration of subnets, consensus mechanism and utilization of multiple built-in blockchains.

Subnetworks (subnets)

One capability that makes Avalanche innovative is Subnets, a game-changing technology that empowers developers to create projects on networks that they can design to fit their needs. Subnets are deeply customizable and inherit speed and security from Avalanche’s Primary Network.

Subnetworks, composed of groups of nodes, play a crucial role in achieving consensus on the chains within Avalanche’s platform. Each subnetwork is responsible for validating a specific set of blockchains. Additionally, all validators within a subnetwork must also validate Avalanche’s Primary Network.

It is also important to note that the Avalanche blockchain can reportedly process 4,500 transactions per second (depending on the subnet), a significant improvement over Ethereum’s less than 20. Avalanche’s native token is AVAX, which is used to secure the network and pay transaction fees.

Avalanche Consensus

Avalanche Consensus is a novel protocol that builds upon Proof of Stake (PoS) to achieve agreement among nodes in a blockchain network. When a user initiates a transaction, it is received by a validator node that randomly selects a subset of validators to check for consensus.

Through repeated sampling and communication, validators reach an agreement. Validator rewards are based on Proof of Uptime and Proof of Correctness, which consider staked tokens and adherence to software rules. Avalanche’s consensus resembles an avalanche, where a single transaction grows through repeated sampling and agreement.

Built-in Blockchains

Avalanche is built using three different blockchains in order to address the limitations of the blockchain trilemma. Digital assets can be moved across each of these chains to accomplish different functions within the ecosystem.

- i. The Exchange Chain (X-Chain) is the default blockchain on which assets are created and exchanged. This includes Avalanche’s native token, AVAX.

- ii. The Contract Chain (C-Chain) allows for the creation and execution of smart contracts. Because it is based on the Ethereum Virtual Machine, Avalanche’s smart contracts can take advantage of cross-chain interoperability.

- iii. The Platform Chain (P-Chain) coordinates validators and enables the creation and management of subnets.

Unique Features of Avalanche Network

The Avalanche ecosystem has experienced consistent growth, drawing the attention of a considerable number of projects, developers, and users. This expanding ecosystem fosters a dynamic and diverse trading environment, granting traders the opportunity to access an extensive range of assets and trading prospects. Participating in trading activities on the Avalanche network provides a multitude of significant advantages derived from the platform’s exceptional and unmatched features and capabilities. These include:

Enhanced Liquidity

The liquidity on the Avalanche network is strengthened as it continues to attract an expanding user base and an ever-growing assortment of projects. This heightened liquidity is important to traders, as it guarantees the presence of ample buyers and sellers within the market. Consequently, this diminishes slippage and fosters price stability, empowering traders to execute trades at their desired prices with minimal adverse effects.

Cross-chain Interoperability

Avalanche facilitates cross-chain interoperability through its support for the Ethereum Virtual Machine (EVM), enabling smooth interaction and compatibility with assets and decentralized applications (dApps), built on the Ethereum network.

This cross-chain interoperability broadens the horizons of trading opportunities, granting traders access to a wider selection of assets and the ability to leverage the liquidity present in other blockchain networks.

Security

Security is a top priority for the Avalanche network, and it implements robust Byzantine fault tolerance (BFT) mechanisms. These measures safeguard the network against malicious attacks and guarantee the integrity of transactions.

As a result, users can confidently participate in token transactions and interact with dApps on the Avalanche network, knowing that their security remains uncompromised.

Ecosystem Expansion

The expanding market depth on Avalanche empowers traders to broaden their asset selection, granting them access to a more extensive array of trading options. As adoption gains momentum, an increasing number of projects and tokens are introduced on the platform, enriching the diversity of available assets.

This diverse assortment of assets facilitates portfolio diversification and facilitates the exploration of various investment opportunities, accommodating a wide range of trading strategies and individual preferences. Avalanche works with a wide variety of Ethereum DApps and infrastructure projects, including Trader Joe and UniSwap.

How To Get Started On The Avalanche Network

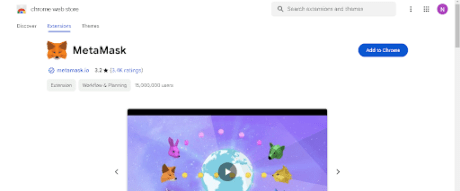

In order to engage in token transactions on the Avalanche (AVAX) network, users are advised to acquire a Metamask wallet. Metamask is a widely utilized browser extension wallet that facilitates interactions with blockchain networks such as Ethereum. It can be easily accessed and installed as an extension on popular web browsers like Google Chrome.

To add your Metamask Wallet to your browser as an extension, simply click on the ‘Add to Chrome’ icon located in the top right corner, as depicted below:

After you have installed and set up MetaMask, you can use it to manage your cryptocurrency wallets, interact with decentralized applications (DApps), and safely perform transactions on supported blockchains directly from your browser.

Remember to write down your seed phrase on paper and keep it in a secure place. Avoid storing it online or on your device.

Afterwards, you can add the Avalanche (AVAX) network to your Metamask wallet by following the instructions provided on the Metamask website here.

Trading On The Avalanche (AVAX) Network

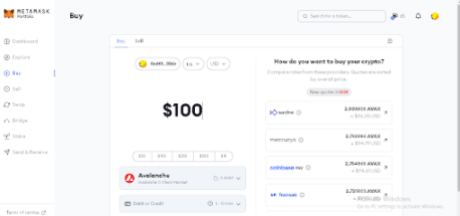

In order to execute trades on the Avalanche Network, users will need to fund their wallet with AVAX tokens. AVAX is the native cryptocurrency for the Avalanche Network, and it functions as the primary medium of exchange for transactions, gas fees and liquidity provision on the platform. Hence, users should ensure a sufficient amount of AVAX tokens in their wallet to cover the cost of trading on the Avalanche network.

Users have the option to purchase AVAX on centralized exchanges like Binance. Once you have obtained AVAX, you can copy your wallet address from Metamask and proceed to send the AVAX tokens from Binance to your Metamask wallet.

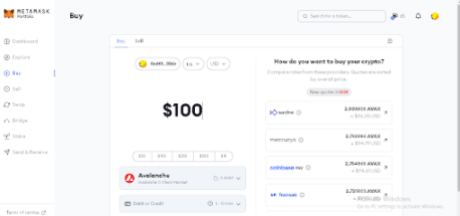

You can also buy AVAX directly from your Metamask wallet. Click on the buy/sell button within Metamask to open the interface. Here, you can put how much AVAX token you intend to buy in terms of dollar amounts, pick your payment method, and then click “Buy”.

Kindly note that if you wish to buy cryptocurrencies directly within Metamask, you will need to provide information such as your country and state of residence. Rest assured, the process is quick and uncomplicated, typically taking just a minute to complete.

The arrival of your AVAX tokens in your wallet should take no more than a few minutes. Once they are successfully deposited, you are ready to commence trading tokens on the Avalanche network.

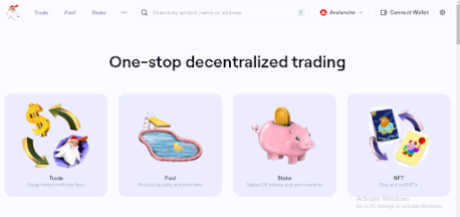

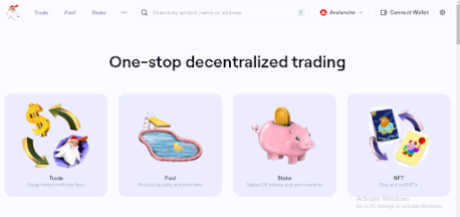

Now, it’s time to visit Trader Joe, and embark on your trading journey.

How To Trade Tokens On The Avalanche Network Using TraderJoe

Trader Joe is a decentralized exchange (DEX) on the Avalanche network. It allows users to trade tokens directly from their wallets using liquidity pools. Trader Joe prioritizes user control, security, and privacy while providing a user-friendly trading experience.

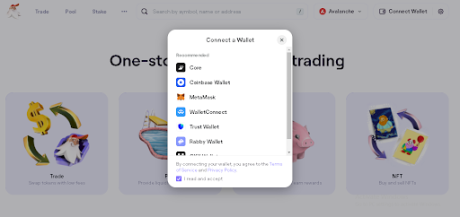

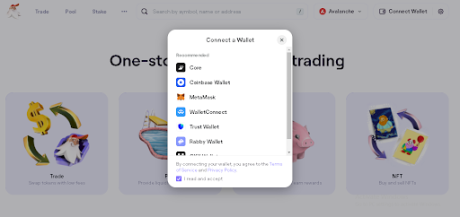

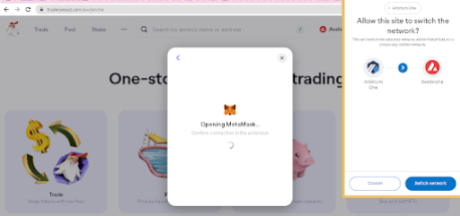

Make sure to be on the right Trader Joe website so as to protect your assets from malicious activities. The first step on the website is clicking on the “Connect Wallet” option at the top right corner, as shown in the image below:

Connect to the preferred wallet option (Metamask) as presented in the image below:

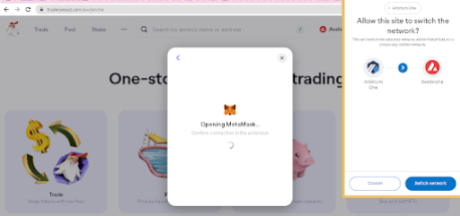

Once connected, switch Metamask to AVAX (no need to switch if you’re already on the AVAX network):

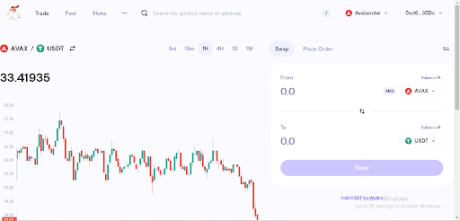

After connecting MetaMask to the Avalanche network, go to Trader Joe, and then you can start trading on the Avalanche (AVAX) network using Trader Joe.

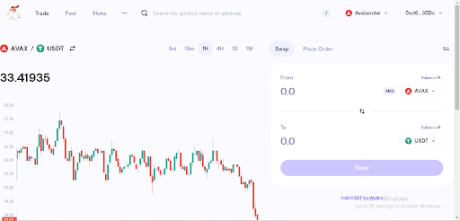

Once you reach the Trader Joe interface, you can proceed by choosing your desired tokens. Since Trader Joe follows a token-to-token trading model, simply click on the “select token” button to pick the trading pair you wish to trade against. Users can search tokens by name, symbol or contact address:

Buying and Selling Tokens With The Metamask Wallet

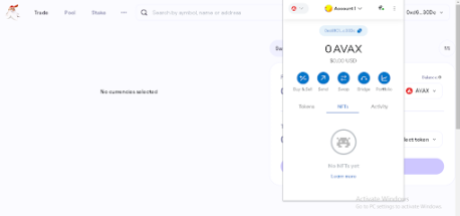

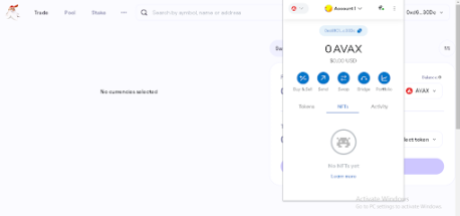

Users of the Avalanche (AVAX) Network have the option to purchase and sell tokens directly through the Metamask extension wallet, which is already connected to the Avalanche network.

To proceed, ensure that you are connected to the Avalanche network and possess AVAX tokens for swapping and paying transaction fees. Next, locate the “Swap” button, illustrated below, and click on it. This action will redirect you to the Swap interface within Metamask.

Using the image above as a guide, you can also search for tokens using the name or the contract address, just like on Trader Joe. Input the amount of AVAX you want to swap, confirm that you have the correct token, and then click “Swap.”

Once the transaction is confirmed, the tokens you just bought will be sent to your wallet.

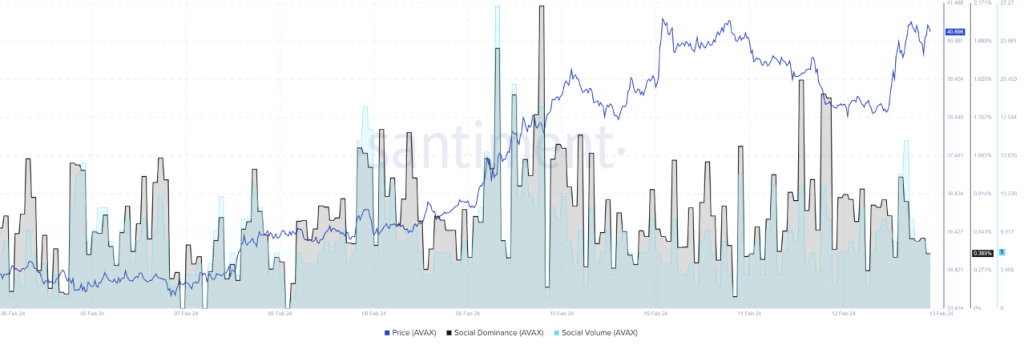

Tracking Token Prices on The Avalanche Network

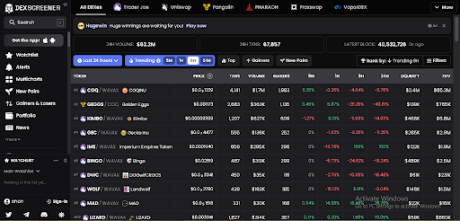

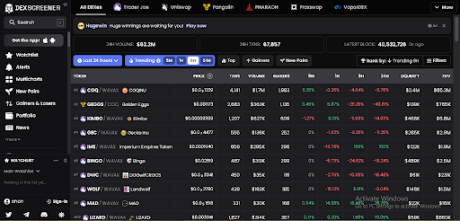

Utilizing on-chain tools such as Dexscreener, users of the Avalanche network can access extensive market insights for specific tokens. These insights encompass crucial data like price information and contract details, equipping users with reliable and up-to-date information. By leveraging these insights, users can make informed trading decisions and engage in the market with confidence.

Dexscreener also allows Avalanche users can stay updated on token metrics and market dynamics, thereby improving their trading strategies and enhancing their overall trading experience. It provides valuable information such as price data, market cap, token supply, contract details, etc, that empowers users to make more informed decisions and navigate the market properly.

Dexscreener provides a range of beneficial features specifically designed for users on the Avalanche network. One standout feature is its advanced charting functionality, which offers real-time and historical price data for a diverse selection of tokens.

Through these charts, users can access valuable information about price trends, trading volumes, and other essential metrics. This empowers them to identify optimal entry and exit points for their trades with accuracy and certainty.

Conclusion

In conclusion, the Avalanche network provides a robust ecosystem for decentralized finance (DeFi) and token trading. With its fast transaction speeds, low fees, and high scalability, Avalanche offers an efficient and user-friendly platform for buying, selling, and trading tokens.

The network supports various decentralized exchanges, such as Trader Joe, and provides on-chain tools like Dexscreener to empower users with market insights. It is important for users to stay informed, exercise caution, and adapt to the evolving landscape of the Avalanche network to make the most of its features and opportunities.

https://t.co/811uVwOIg9

(@avax) February 12, 2024