Binance Coin (BNB), the native token of the world’s largest cryptocurrency exchange, has experienced a notable surge of 7% within the past 24 hours.

This upward movement reflects the overall positive trend in the market and places BNB ahead of the top five cryptocurrencies in terms of performance. Interestingly, an important milestone has been achieved as BNB surpassed its previous yearly high of $645 from March, as the token reached a high of $673 as of Tuesday.

BNB Primed For Bullish Surge To $1,000?

Renowned market expert “Sheldon The Sniper” believes that BNB is positioned to be one of the leading altcoins in the ongoing bull market, with a target of $1,000 if the current uptrend continues.

Expressing an optimistic outlook, Sheldon states that Binance’s token “is looking extremely bullish” and is expected to surpass its previous all-time high of $686, which was reached in May 2021, despite being currently down 2.2% from that level.

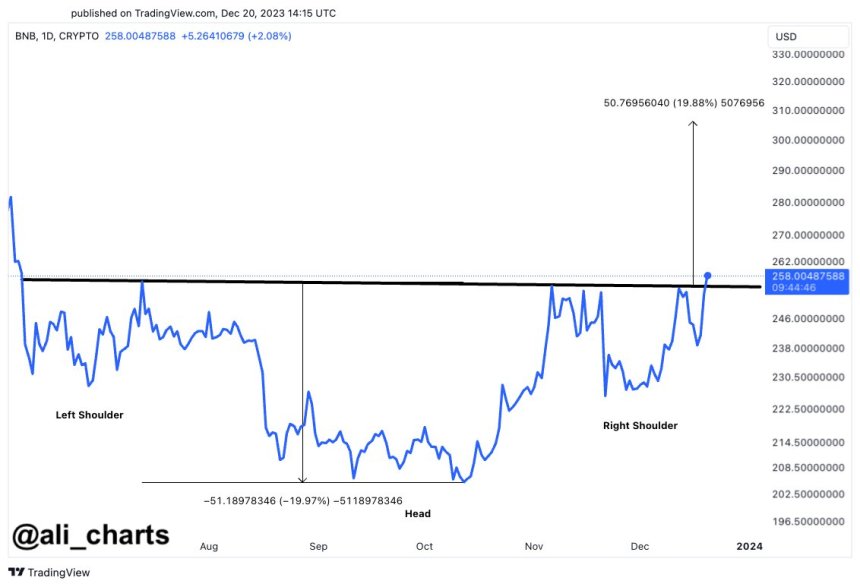

Another crypto analyst known as Kaleo draws attention to the distractions surrounding Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) and emphasizes that BNB is on the verge of entering a “phase of price discovery.”

Kaleo reminds that BNB played a significant role as an early leader in the previous bull market, suggesting a potential repetition of history in the current market cycle. During the 2021 bull market, BNB experienced substantial growth of 50% in late 2021.

In addition, following the exchange’s CEO Changpeng Zhao’s conviction in April, the regulatory scrutiny surrounding Binance has significantly reduced. This positions the crypto platform and its native token favorably to capitalize on anticipated institutional inflows and a surge in trading volume.

Trading Volume Soars To $2 Billion, Market Cap Hits $100 Billion

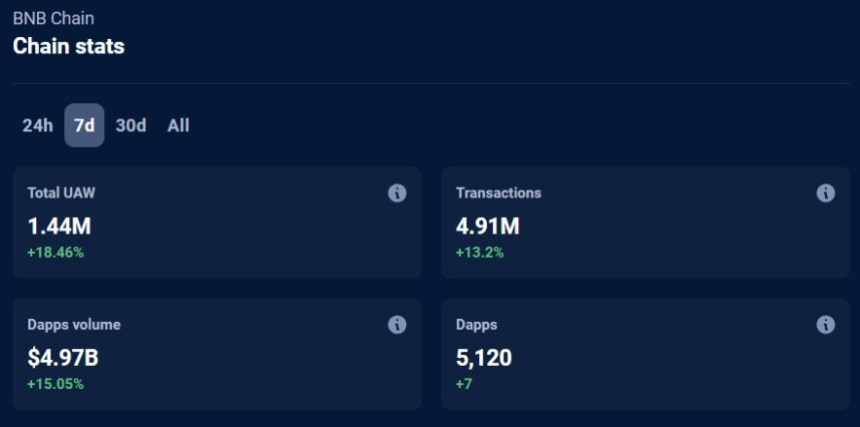

Data from CoinGecko reveals a substantial 15% increase in BNB’s trading volume over the past 24 hours, reaching an impressive $2.3 billion compared to the previous day’s trading session.

The market capitalization of Binance Coin currently stands at $102 billion, indicating a notable uptrend as it has gained over $6 billion within a 24-hour period, highlighting the renewed interest and inflow of capital from investors.

The sustainability of BNB’s uptrend remains uncertain, and it is crucial to monitor key levels in various potential scenarios, including sustained bullish momentum or a price correction.

If the bullish trend continues, the next significant resistance levels in the BNB/USD daily chart are at $671 and $676. These levels represent three-year hurdles for the token and must be overcome for further upward movement.

Conversely, it is essential for bulls to defend the $633 level, as a breach between this support level and the current price of $668 could result in a significant loss of gains if a retest occurs.

In sum, Binance Coin has showcased a significant performance in the market, outperforming major cryptocurrencies and achieving new milestones.

With experts expressing optimism about its future, BNB’s potential to surpass its previous all-time high and lead the current bull market is generating considerable excitement among traders and investors.

Featured image from Shutterstock, chart from TradingView.com