An analyst has pointed out how the Bitcoin Tom Demark (TD) Sequential has just given a signal that could be bullish for the asset’s price.

Bitcoin TD Sequential Is Flashing A Buy Signal Right Now

In a new post on X, analyst Ali Martinez has discussed about the TD Sequential signal that has just formed for Bitcoin on its daily chart. The “TD Sequential” here refers to an indicator from technical analysis (TA) that’s used for locating probable tops and bottoms in any asset’s price.

The indicator consists of two phases: setup and countdown. The end of each of these phases is assumed to coincide with a signal for a turnaround in the cryptocurrency.

In the first phase, the setup, candles of the same color in the chart are counted up to nine. These candles don’t need to be consecutive, just that there should be nine of them. Once the ninth candle is in, the setup is said to be ‘complete,’ and the price can be considered to have reached a reversal.

The second phase, the countdown, picks up right where the setup left. It works almost exactly in the same manner, with the one exception being that candles here are counted up to 13 instead. Following these 13 candles, the asset arrives at another point of likely trend exhaustion.

Naturally, where the price would go after the end of either phase depends on the polarity of the candles involved in the phase’s completion. Green candles imply a reversal to the downside, while red ones suggest the formation of a bottom.

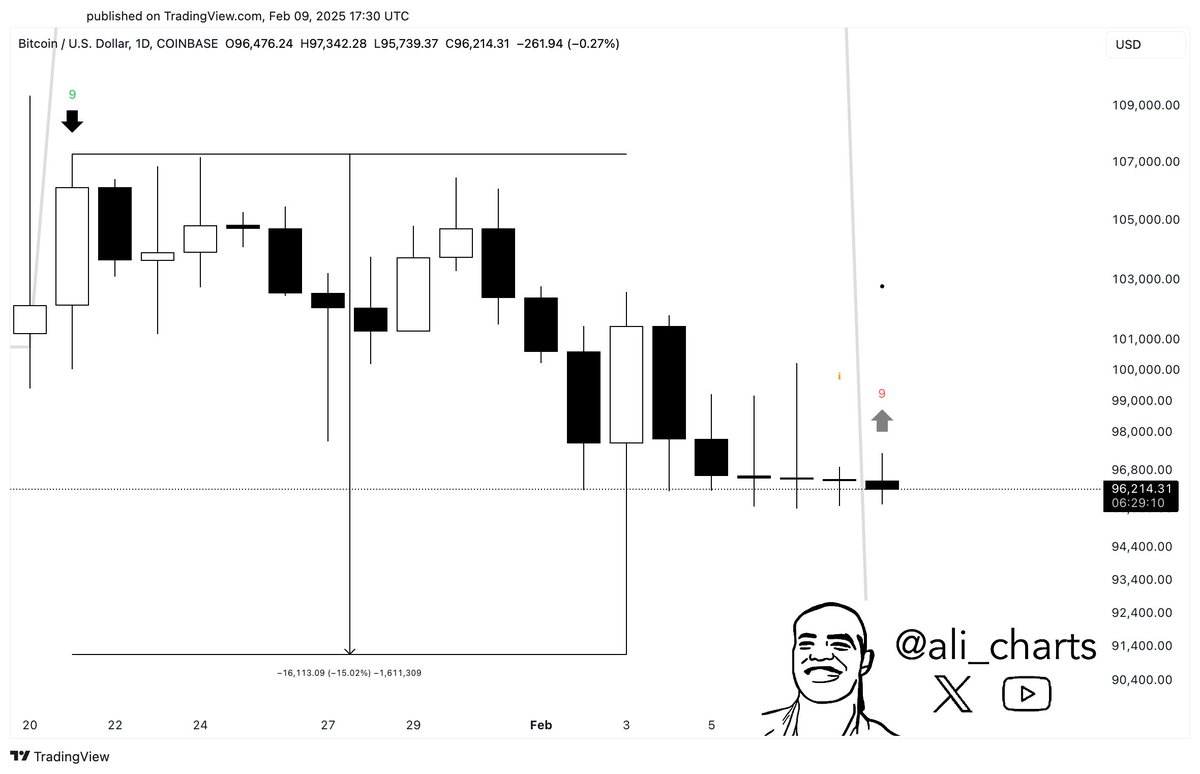

Bitcoin has recently formed a TD Sequential signal of the first type. Here’s the chart shared by Martinez that shows the pattern in the coin’s daily price:

From the graph, it’s visible that the 24-hour price of Bitcoin has finished a TD Sequential setup with nine red candles recently, which suggests the asset may be due a bullish reversal. In the chart, the analyst has also highlighted the last signal that the indicator gave for the cryptocurrency. It would appear that this previous signal was a sell one and it was also right on the mark as it coincided with last month’s price top.

Given this pattern, it’s possible that the latest TD Sequential signal would also end up holding for Bitcoin. If so, it might finally help the asset shove off its recent bearish winds.

Speaking of the TD Sequential, another top coin, Cardano (ADA), has also formed a signal recently, as Martinez has pointed out in another X post. As displayed in the below chart, the pattern is a bullish one for ADA as well.

BTC Price

Bitcoin slipped under the $95,000 level yesterday, but the asset has made some quick recovery in the past day as its price is now trading around $97,700.