What are BRC-20 Tokens?

BRC-20 tokens are a novel standard on the Bitcoin blockchain, BRC-20 tokens were inspired by Ethereum’s ERC-20. Like Ethereum’s ERC-20 strands for Ethereum Request for Comment, BRC-20 also strands for Bitcoin Request for Comment.

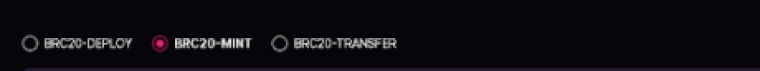

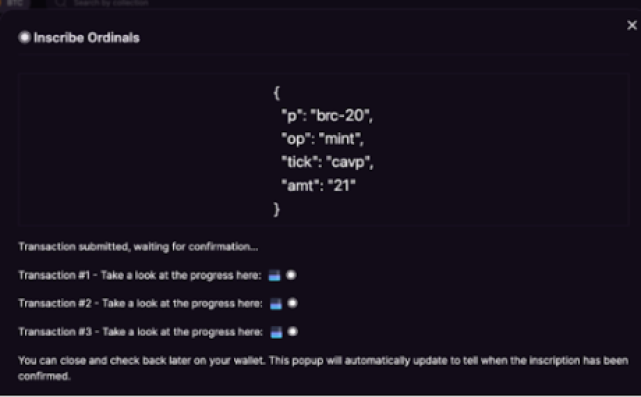

BRC-20 tokens allow the creation, minting, trading, and transfer of fungible tokens or assets on the Bitcoin blockchain through the Ordinals protocol. The Bitcoin Ordinals protocol is a numbering system that allows users to attach extra data to satoshis, the smallest unit of Bitcoin.

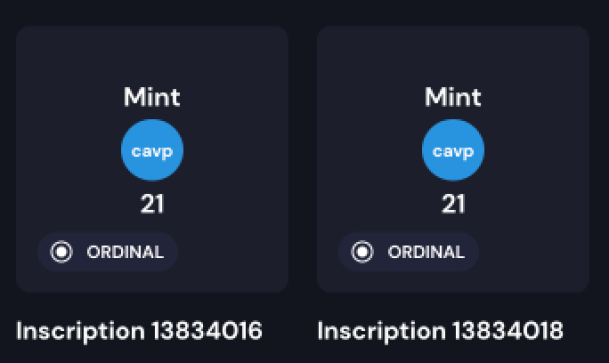

The process of attaching extra data to satoshis is called inscription, BRC-20 tokens do not need smart contracts to execute transactions as ERC-20 tokens do, their transactions are done through JSON inscriptions on satoshis through Bitcoin Ordinals.

Differences And Comparison Between BRC-20 And ERC-20

Ethereum’s ERC-20 might have inspired the creation of BRC-20 on the Bitcoin blockchain, but make no mistake, they are not the same, and we are going to explore that in this section of this article.

Operation: One of the key differences between BRC-20 and ERC-20 is that BRC-20 tokens find their home within the Bitcoin blockchain while ERC-20 operates on the Ethereum blockchain.

Implementation: BRC-20 and ERC-20 are both implemented differently; however, BRC-20 is experimental, meaning it has not undergone the BIP process. It only implements changes in the Bitcoin protocol, while ERC-20 has undergone the EIP process, which was approved by the Ethereum community before implementation after being scrutinized.

Security: They are both secure as they are both secure by the top two blockchains in the crypto space, but BRC-20 is secured by the Bitcoin blockchain and ERC-20 is secured by the Ethereum blockchain.

High Gas Fee Or Transaction Fees: They both have high gas fees if you are trading on decentralized exchanges (DEXs).

Wallets: Their wallets are different, you can store your BRC-20 token on wallets that support the Bitcoin Taproot upgrade like Unisat, Xverse, CoinW, and Alex. While ERC-20 tokens are stored on Ethereum-supported wallets like Metamask, Exodus, Trust wallet, Atomic, MyEtherWallet, and all EVM compactable wallets

Smart Contract functionality: BRC-20 tokens do not rely on smart contracts to execute transactions, but ERC-20 tokens do.

Token Value Drive: BRC-20 tokens are token values driven by inscriptions, and ERC-20 token values are driven by utilities and speculations.

Fungibility: BRC-20 tokens are semi-fungible because they are only interchanged in set increments. For example, BRC-20 tokens are being sold in sets, so you can’t buy 1003 xBRC-20 tokens (x being the token) if the only people sell decide to sell in sets of 250, 500, 750, and 1000 depending on how many tokens they want to sell. Meanwhile, ERC-20 tokens are fully fungible because they can be exchanged in any quantity.

Functions: The BRC-20 token standard is majorly to create meme tokens currently, while the ERC-20 token standard is used for a good number of fungible tokens on Ethereum, including stablecoins, governance tokens, wrapped tokens, and utility tokens.

Pros of the BRC-20 Token Standard

The fact that BRC-20 tokens are built on the most secure blockchain in the crypto space Bitcoin, should help you understand these tokens are going benefit from the security that the Bitcoin Blockchain provides.

The interoperability with the Bitcoin network is one of the major advantages of the BRC-20 tokens, as they enjoy and leverage the widespread acceptance of Bitcoin as the most successful crypto, which has contributed to the BRC-20 token’s overall success. Also, this compatibility with Bitcoin gives the BRC-20 standard access to utilize the existing infrastructure the Bitcoin network already has, including its wallets and exchanges.

BRC-20 standard is still in its early stages, so there is huge potential for growth in the future, and as more people keep adopting and investing in BRC-20 tokens

Cons of the BRC-20 Token Standard

In the same way, as the BRC-20 token standard enjoys the benefits of the Bitcoin network, they are still going to be affected in the areas where Bitcoin lags behind. This is because Bitcoin is not as scalable as some other blockchains like Ethereum. As BRC-20 tokens keep gaining popularity and awareness there are concerns about congestion, which could lead to potential higher gas or transaction fee issues.

Another consideration is that BRC-20 tokens run on ordinals protocol, a protocol that is still in its early phases of development, which means there is a possibility of it being vulnerable or having glitches as the technology evolves.

The Bitcoin Request for Comment (BRC-20) token standard is still in its early stage of development, so it is safe to say it is still semi-fungible compared to the ERC-20 token standard. It has some limitations, like it being sold and bought in sets, you are limited to what is available in the DEX marketplace, and you can’t buy any amount you want, whether in large or small quantities.

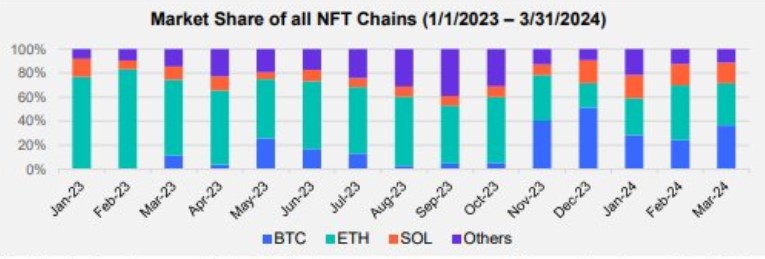

BRC-20 Tokens DEX Exchanges

This article is going to cover how to trade Bitcoin Request for Comment (BRC-20) tokens on UniSat, the most used decentralized exchange (DEX) to trade BRC-20 tokens. You can also check out other DEX like Xverse and Alex.

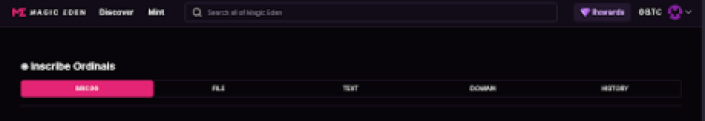

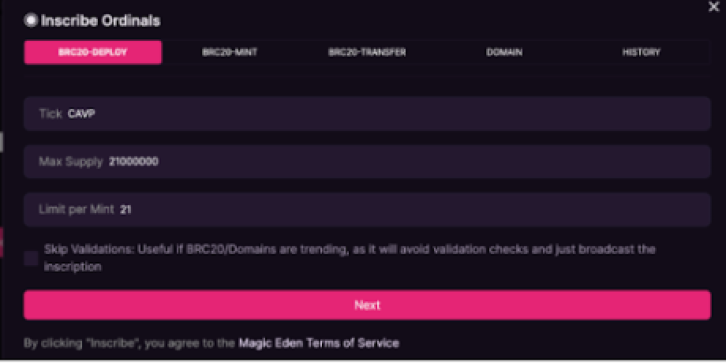

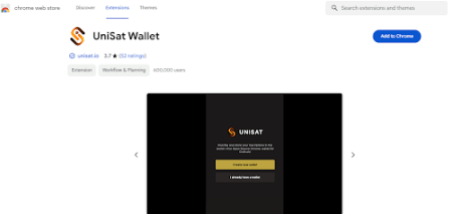

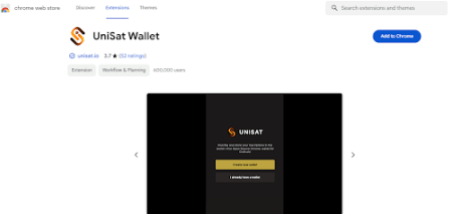

How To Install And Set up UniSat Wallet

To trade on a decentralized exchange (DEX) you need a wallet, go to your Chrome browser and search for the UniSat Wallet extension as shown below, click on “Add to Chrome” to download and add the UniSat Wallet extension to your Chrome browser.

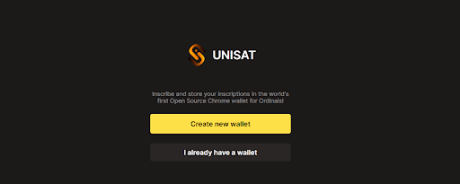

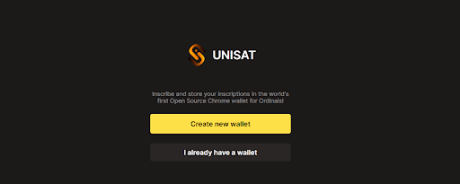

Click the “Create new wallet” button to create your UniSat Wallet.

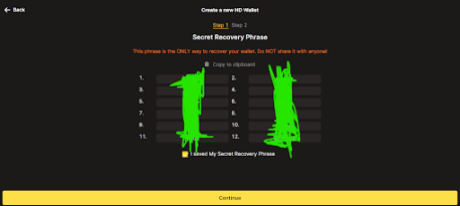

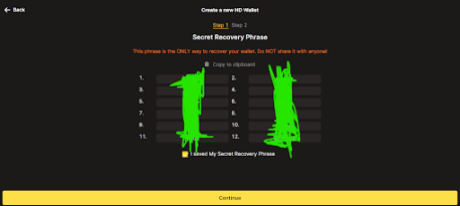

Create your password, use a password you can remember, as you would need your password to make transfers and click on the “Continue” button. The Secret Recover Phrase page will pop up. Write down your secret phrase and keep it in a safe place because anyone who has access to your secret phrase has access to your wallet. Then click on “Continue”.

Expect you are a crypto genius I would advise you to leave the Step 2 page the way it is, just click on “Continue”. The“Compatibility Tips” will pop up check the boxes and click on “Ok”

You have now successfully created your UniSat wallet, where you can receive, send, and buy crypto.

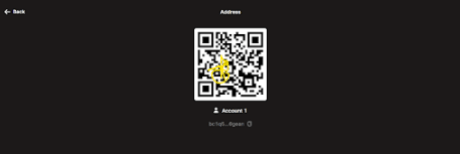

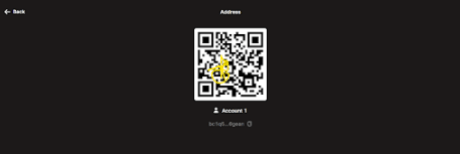

When you click on “Receive” you will be given a QR code that you can scan on your phone and also an option to copy your wallet address manually.

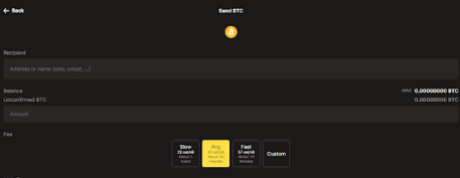

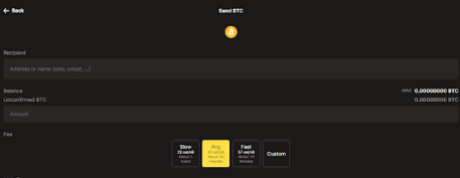

When you click on “Send”, you will see where to fill in the Recipient address you want to send your Bitcoin to, and underneath it is where you will input the amount of Bitcoin you want to send. You can choose the transfer speed you want, but note that the faster the transfer, the higher your gas fee or transaction fee.

I would not recommend that you use the “Buy” feature as it is too expensive, and it is better to buy your Bitcoin on a centralized exchange and send it to your UniSat wallet.

How To Buy, Sell, and Trade on UniSat

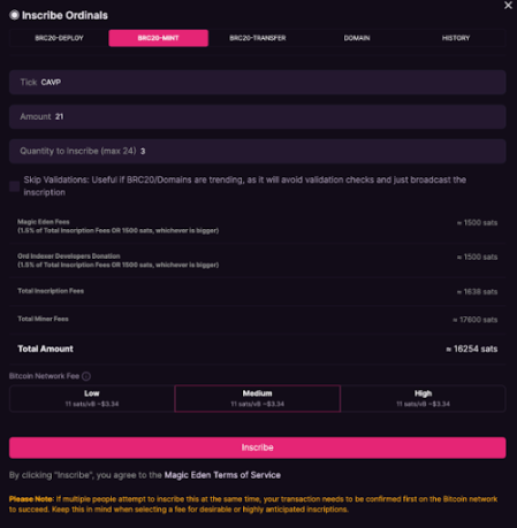

To buy, sell, and trade BRC-20 tokens you need Bitcoin in your wallet for gas fees and Bitcoin to buy the BRC-20 token. So go to any centralized exchange of your choice like Binance, OKX, or ByBit to buy your Bitcoin, copy your UniSat wallet, paste it into the recipient address on the centralized exchange, and send the Bitcoin.

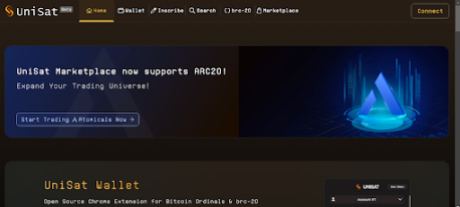

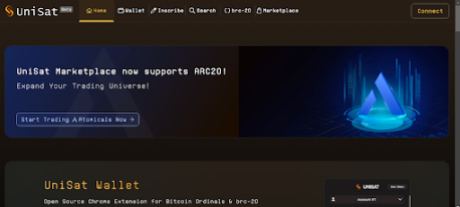

Now that your wallet has been funded it is time to trade, go to the UniSat website, and click on “Connect”.

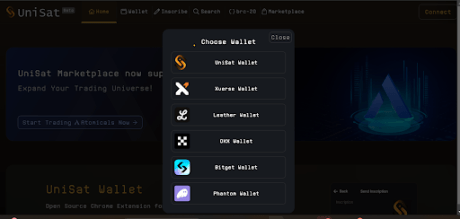

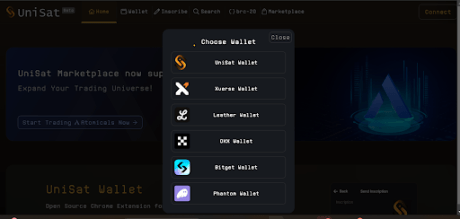

Click on “UniSat Wallet”, and connect your UniSat Wallet.

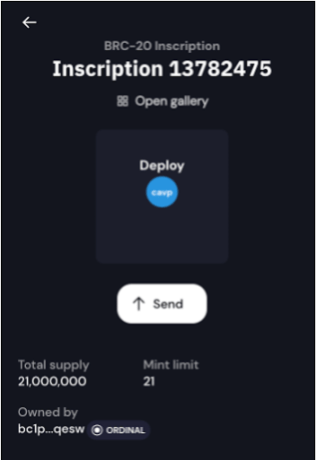

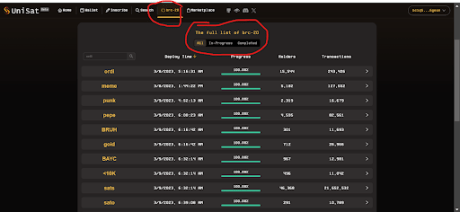

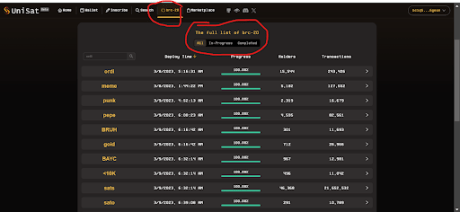

Once your UniSat Wallet is connected, Click on “brc-20”, as shown below, to see the full list of BRC-20 tokens you can trade on UniSat.

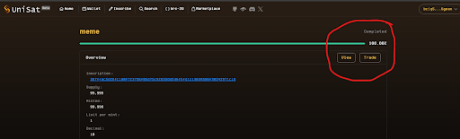

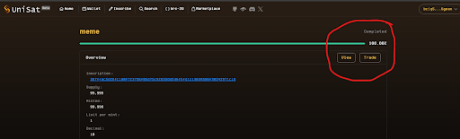

Click on any of the BRC-20 tokens you which to buy, for example, I clicked on the “meme” token below. There are buttons on the top right of the screenshot circled in red “View” and “Trade”.

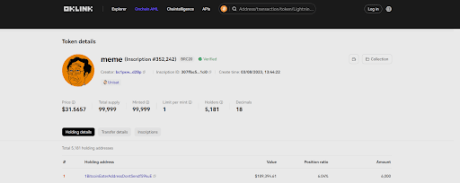

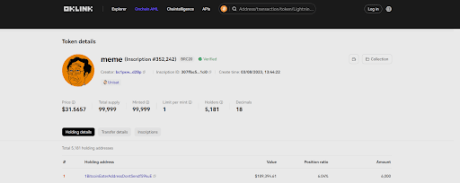

If you click on View, it will take you to OKLINK where you can see the meme BRC-20 inscription with all its details, Total Supply, Limit per mint, Holders, Minted tokens, and Price.

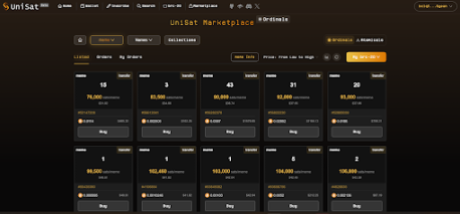

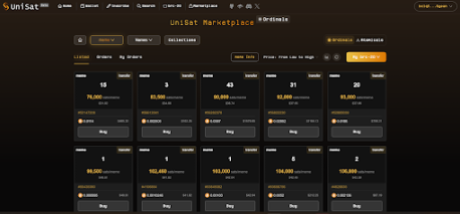

When you click on Trade, it will take you to the UniSat Marketplace, where you will see all the listed meme token inscriptions you can buy.

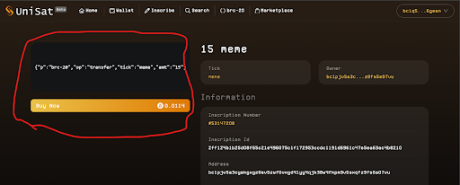

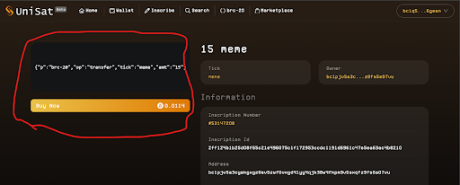

Click on any of the sellers that have the exact number of meme inscriptions you want to buy or any of the sellers that come close to how many meme inscriptions you want to buy. After selecting a seller, the buy page below with the “Buy Now” button will pop up.

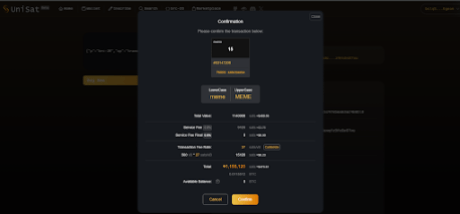

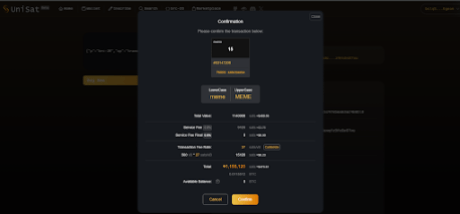

Click on “Buy Now” and the confirmation page to confirm your order will pop up, click on “Confirm” and you have bought the BRC-20 token.

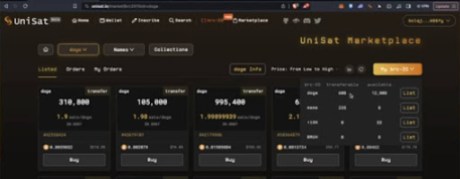

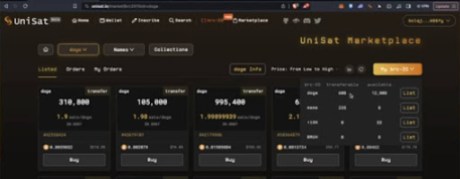

After buying your BRC-20 and you want to sell, go to the marketplace, click on “my brc-20”, click on the inscription you want to sell, and then click on the list.

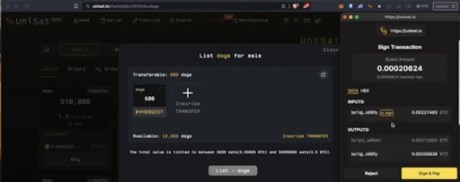

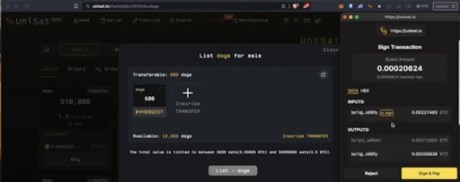

Click on the plus button, input the exact number you like to sell, and click on “Next”.

Click “Next again”.

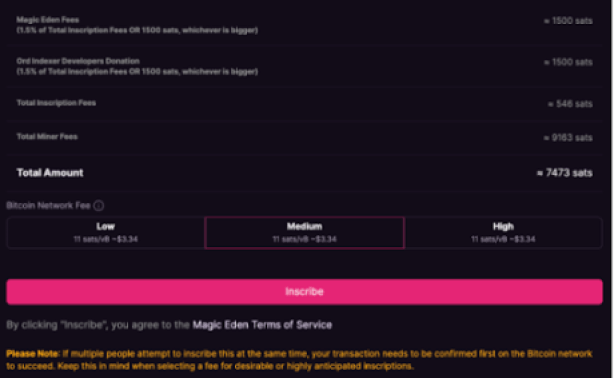

“Sign and pay”, and “Done”, your inscriptions will be listed. When your order gets picked up, your inscription will be sold, and the money will be transferred to your wallet.

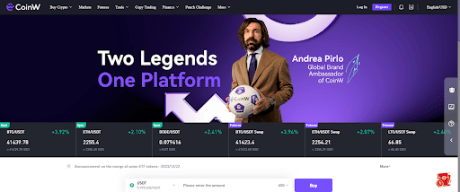

Use CoinW To Track The Price Of Your BRC-20 Tokens

CoinW is a centralized crypto exchange where you can track your BRC-20 and use the charts to make well-informed decisions on the token you want to buy.

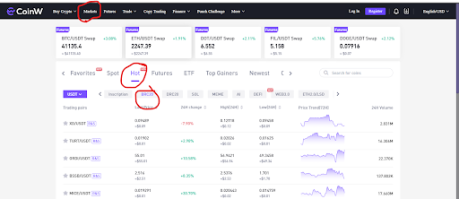

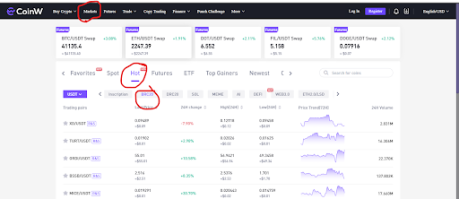

To search for BRC-20 tokens, click on “Market”, click on “Hot”, and then click on “BRC-20”, as shown below.

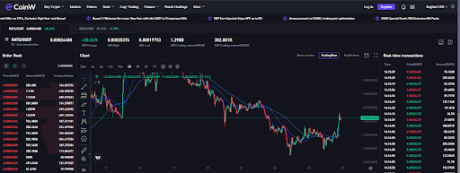

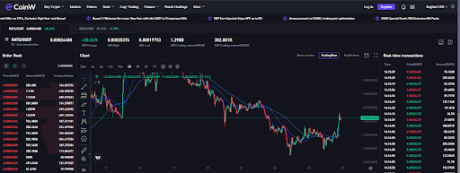

For example, I clicked on ORDI, as you can see in the chart below.

Here is another example with RATS, another BRC-20 token on the list.

Conclusion

In conclusion, BRC-20 tokens provide a novel avenue for tokenization within the Bitcoin blockchain, expanding its utility beyond traditional cryptocurrency transactions. They offer a seamless integration of additional data onto satoshis, enabling a broader range of use cases and applications.

With BRC-20 tokens, the Bitcoin ecosystem gains enhanced functionality and opens up possibilities for innovative decentralized finance (DeFi) solutions. By leveraging the Ordinals protocol, BRC-20 tokens contribute to the growing diversity and maturity of the blockchain industry as a whole.