Bitcoin has reclaimed the $90,000 mark, fueling renewed optimism across the crypto market. With sentiment shifting and bullish calls returning, many investors are once again eyeing a move toward six figures. However, not everything is as it seems beneath the surface. Despite the impressive price surge, risks remain, particularly as global tensions between the United States and China escalate. The ongoing trade war and geopolitical friction are injecting volatility into markets, creating a fragile backdrop for risk assets like Bitcoin.

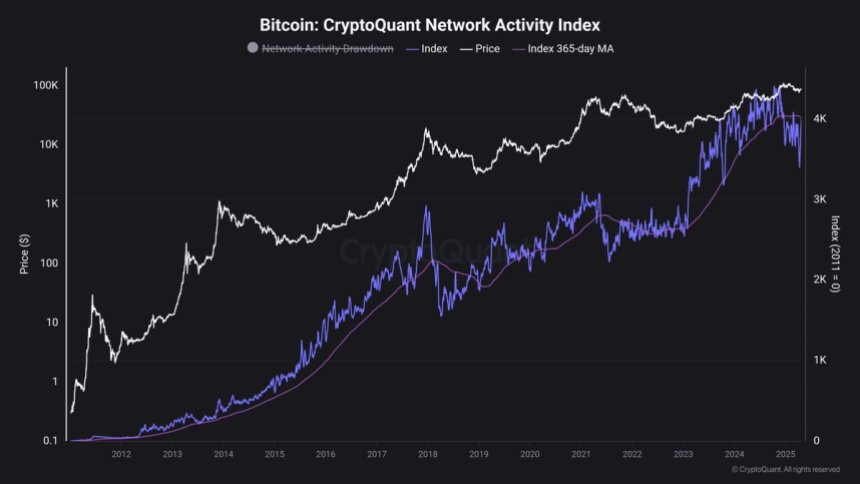

Top analyst Maartunn shared a stark view of the current state of the Bitcoin network, revealing on-chain metrics that paint a different picture. According to his analysis, the latest move higher is primarily driven by leverage and derivatives rather than strong organic demand. He noted that the Bitcoin network is, in his words, “a ghost town,” with very little new activity or visible inflows from real users.

This disconnect between price and on-chain fundamentals suggests that the current rally may lack sustainability. As such, investors should approach the next phase of Bitcoin’s price action with caution, especially if macroeconomic conditions worsen or derivative positions begin to unwind.

Bitcoin Faces Resistance: On-Chain Activity Lags Behind

Bitcoin is now facing critical resistance as bulls attempt to reclaim the $95,000 level, a zone that could define short-term momentum. The recent breakout above the $88,600 resistance marked a key shift in market sentiment, with bulls taking control and pushing price action into a new range. However, to maintain this momentum, sustained demand will be essential. Analysts warn that a healthy retracement may occur before the next leg up, especially considering current market conditions.

Volatility and uncertainty continue to dominate the landscape, with fear still lingering despite the recent rally. Much of this caution stems from ongoing global tensions and the unstable macro environment that has unfolded since US President Donald Trump’s re-election in November 2024. With tariffs rising and trade negotiations with China growing increasingly tense, investors remain hesitant to commit fully to risk assets.

Top analyst Maartunn shared a sobering on-chain analysis on X, highlighting a disconnect between Bitcoin’s price action and network activity. According to his findings, the recent surge is largely driven by ETF flows and rising open interest in the derivatives market—factors that often precede a reversal rather than a sustainable rally. Maartunn describes the current state of the Bitcoin network as a “ghost-town,” noting a lack of new visible on-chain demand.

This divergence between price and network fundamentals raises questions about the sustainability of the current move. For Bitcoin to push convincingly past $95K and set up a run toward $100K, stronger spot demand and an uptick in real user activity will likely be necessary. Until then, traders should remain cautious and watch key support levels closely.

Price Action Details: $95K In Sight

Bitcoin is trading at $93,600 after several days of bullish price action that saw it reclaim key resistance levels. The price has now entered a consolidation phase around the $93K level, as bulls prepare for a potential breakout toward $95K. A sustained move above that mark would open the door for a push toward the highly anticipated $100K milestone, signaling renewed strength across the crypto market.

However, the path forward remains uncertain. While short-term sentiment appears optimistic, Bitcoin must hold above the $90K support level to maintain bullish structure. A failure to do so could trigger a drop back toward the 200-day moving average near $88K—a level that has served as a key pivot for market structure over the past months.

This zone is being closely watched by both traders and long-term holders, as a breakdown below $90K would likely undermine the current recovery momentum. As consolidation continues, the next few sessions will be critical in determining whether BTC has enough strength to break higher or if a short-term correction is in store. For now, all eyes are on $95K as the next hurdle in Bitcoin’s push to reclaim market dominance.

Featured image from Dall-E, chart from TradingView