Bitcoin briefly fell below the critical $100,000 level over the weekend, reaching a low of approximately $98,200 and triggering a wave of panic selling across crypto markets. The sharp drop came after news broke of US military strikes on Iranian nuclear facilities, a move that significantly escalated the already volatile conflict between Israel and Iran. The geopolitical shock sent global markets into risk-off mode, with Bitcoin reacting quickly to the growing uncertainty.

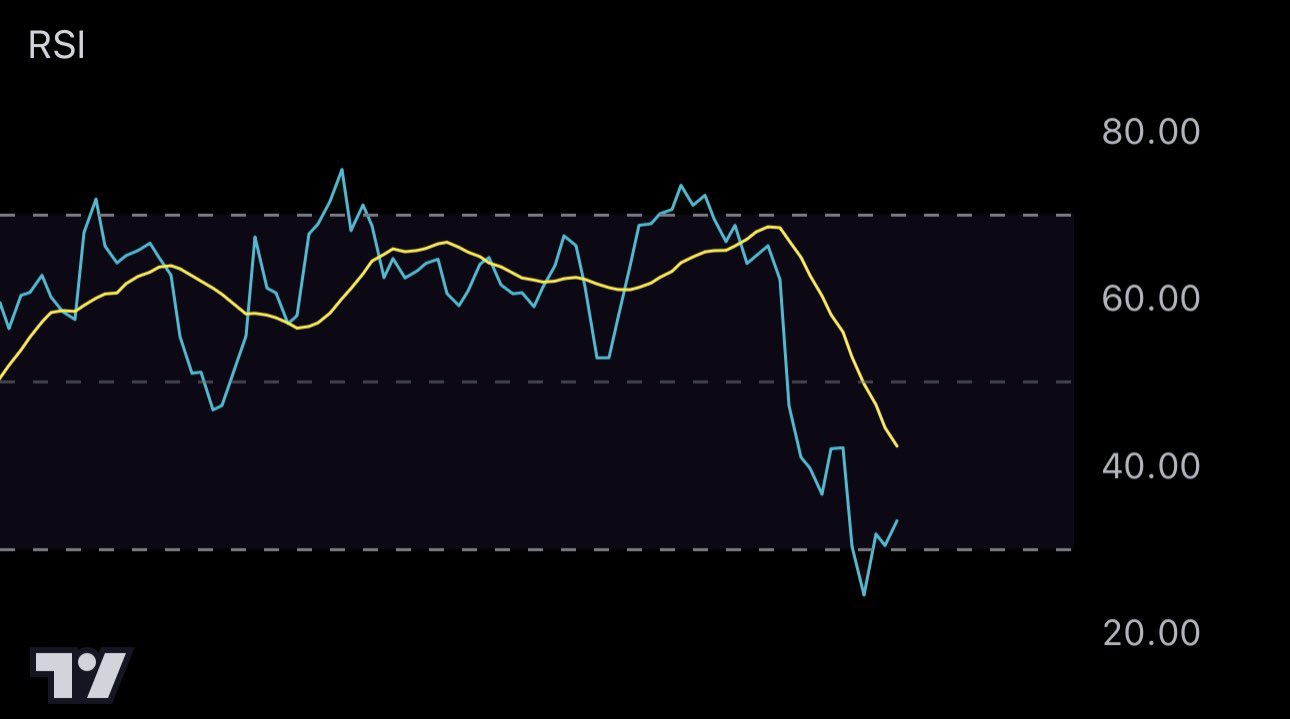

Despite the weekend dip, BTC has since reclaimed the $100K mark, but sentiment remains fragile. Investors are now watching key technical levels closely to determine the next move. According to top analyst Ted Pillows, Bitcoin must hold the daily EMA-100 to avoid further downside pressure. A decisive close below this level could open the door for a deeper correction, especially if macroeconomic and geopolitical risks persist.

As volatility spikes and fear grows, Bitcoin’s ability to maintain support at these levels may define whether the bull cycle continues or enters a prolonged consolidation phase. All eyes are now on the $100K zone, which has become a critical battleground for bulls and bears in a market driven by both technicals and global tension.

Bulls Defend $100K As Dominance Rises and Market Faces Crucial Test

Bitcoin is once again at a pivotal moment. After dipping below the psychological $100,000 level over the weekend amid growing geopolitical tensions, BTC quickly reclaimed this critical threshold, offering a glimmer of hope to market participants. Although bulls managed to push the price back up, the overall structure remains fragile, and technical indicators now carry more weight than ever.

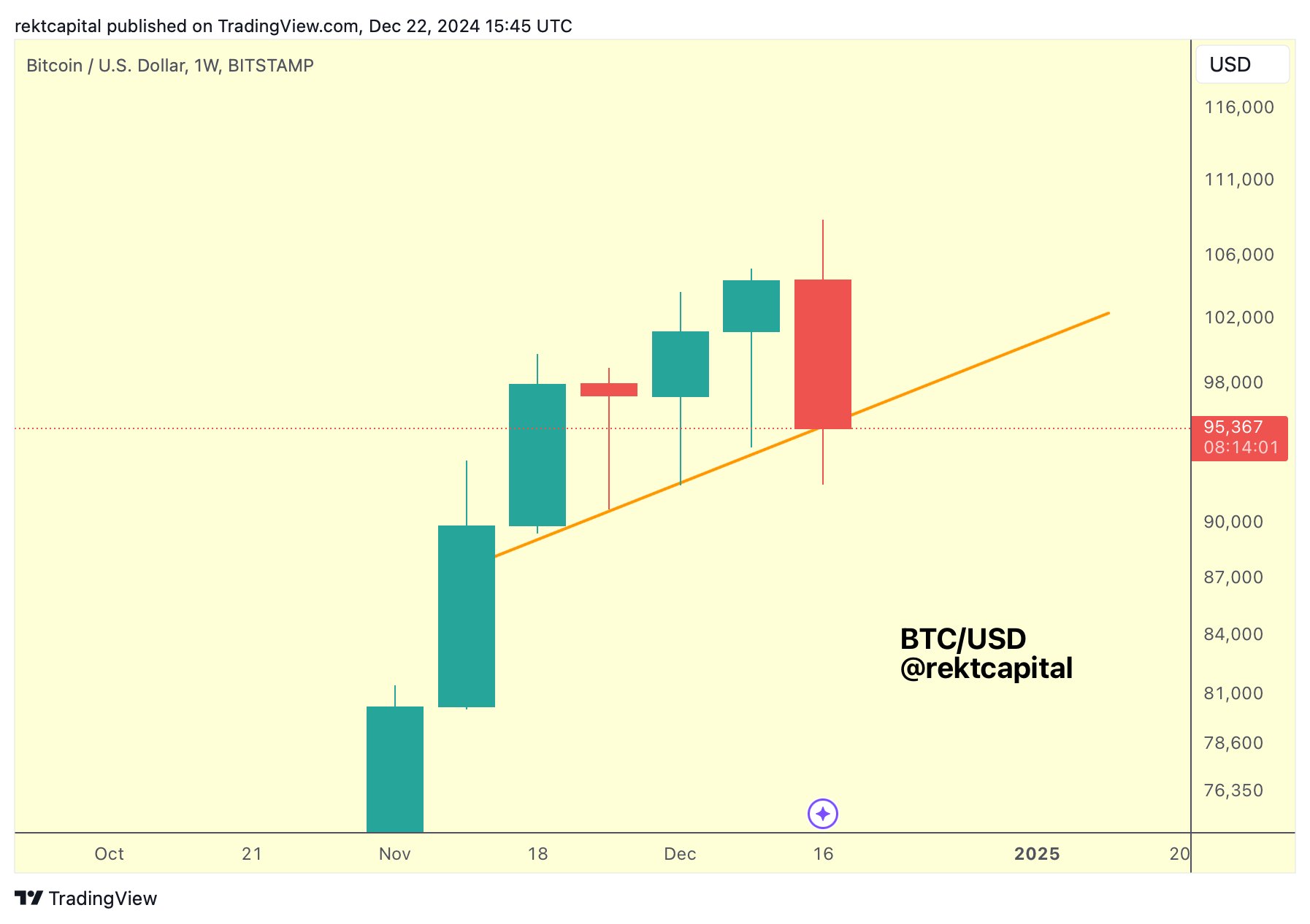

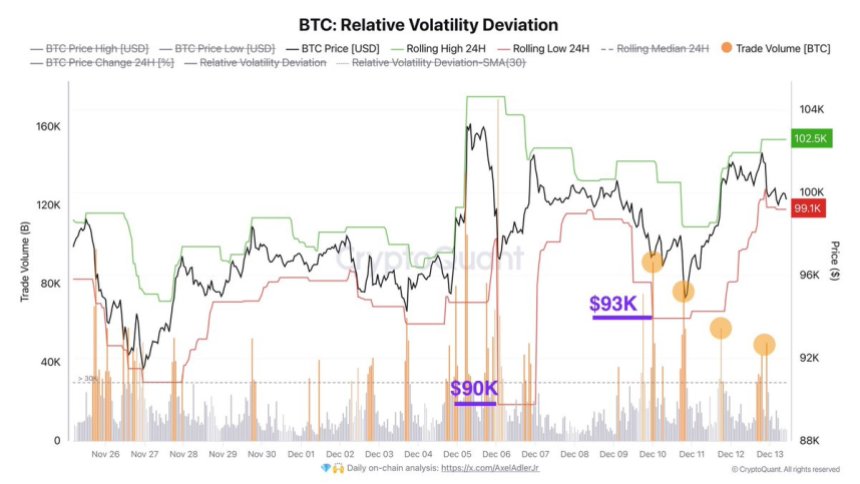

Ted Pillows noted in a recent update that Bitcoin must hold its daily EMA-100 to preserve bullish momentum. A daily close below $99,000 would confirm a break below this key support zone, likely triggering a retest of the $92,000–$94,000 region. Such a move could create significant downside pressure, particularly on altcoins, which are already lagging behind in performance. In Pillows’ words, “If Bitcoin loses this level, alts will be annihilated.”

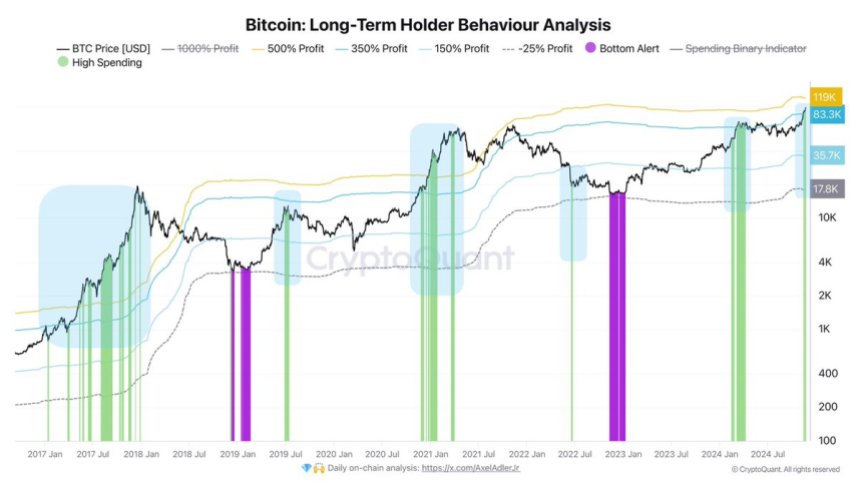

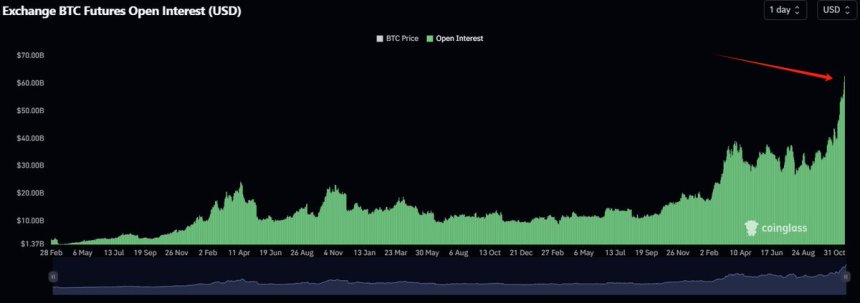

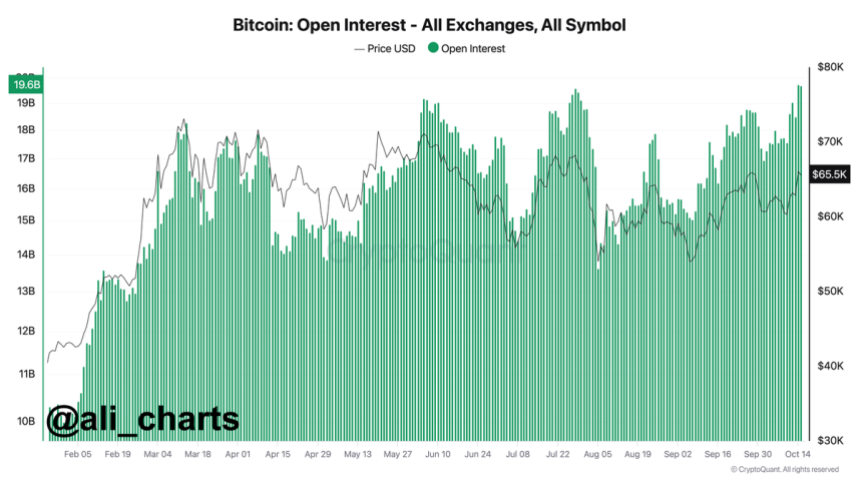

Despite the looming risks, fundamentals remain solid. Bitcoin dominance continues to hover near its highest levels of the year, reflecting growing investor preference for BTC over high-beta assets during uncertain times. On-chain metrics still indicate strong holder conviction, and macro narratives continue to favor Bitcoin as a hedge amid fiat instability and rising geopolitical uncertainty.

If Bitcoin can hold the $100K level and reclaim momentum, it could lead to renewed strength and eventually a push toward the $109K resistance zone. For now, however, bulls are on the defensive. Price action over the next few days will likely define the trajectory for the remainder of Q3, with a close watch on EMA support, macro headlines, and risk sentiment across global markets.

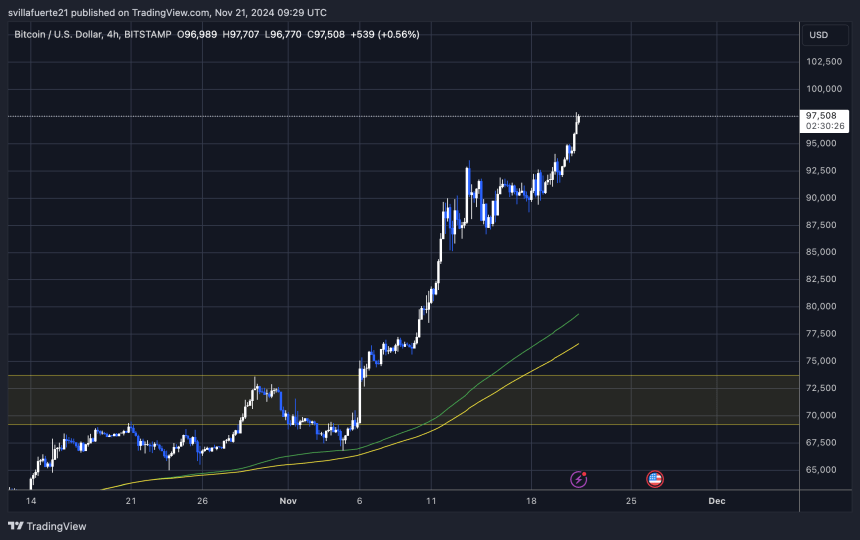

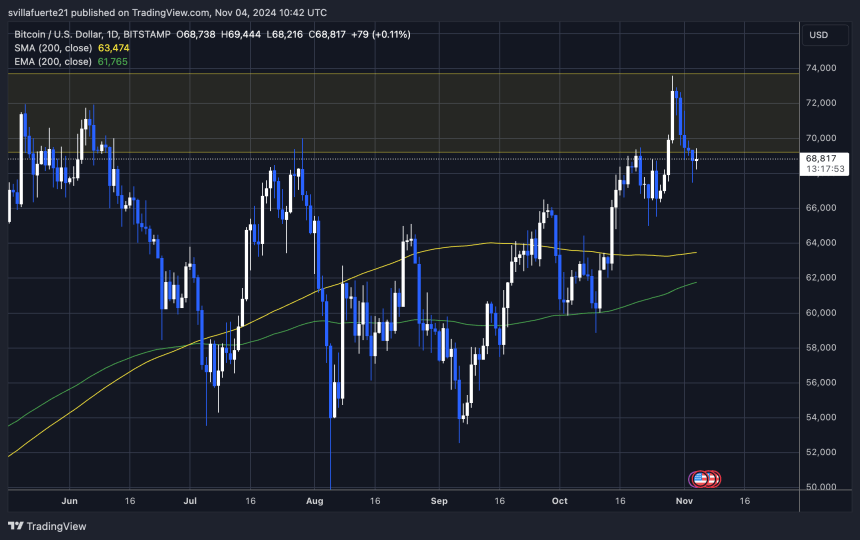

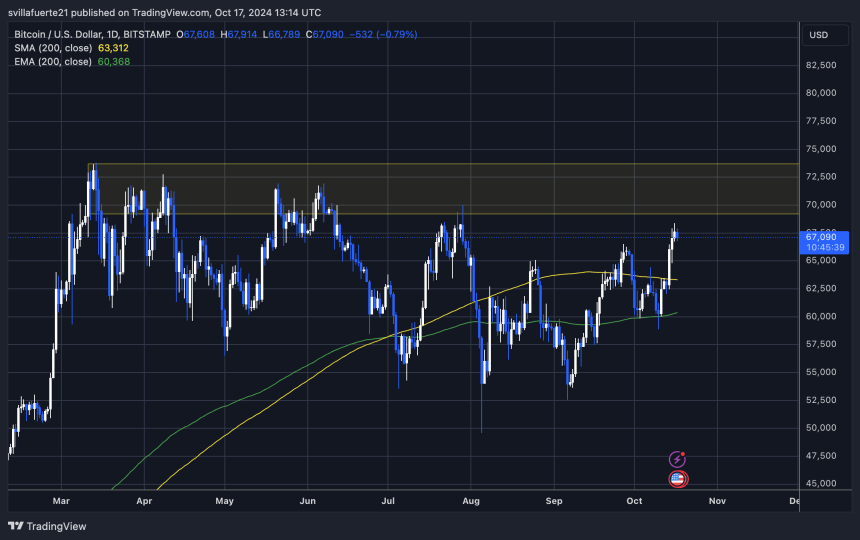

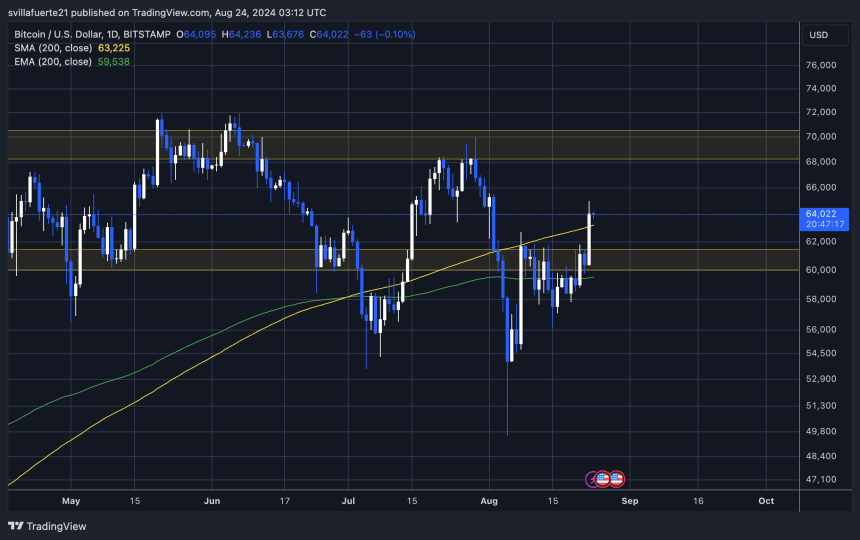

Bitcoin Struggles Below Resistance Amid Bearish Price Structure

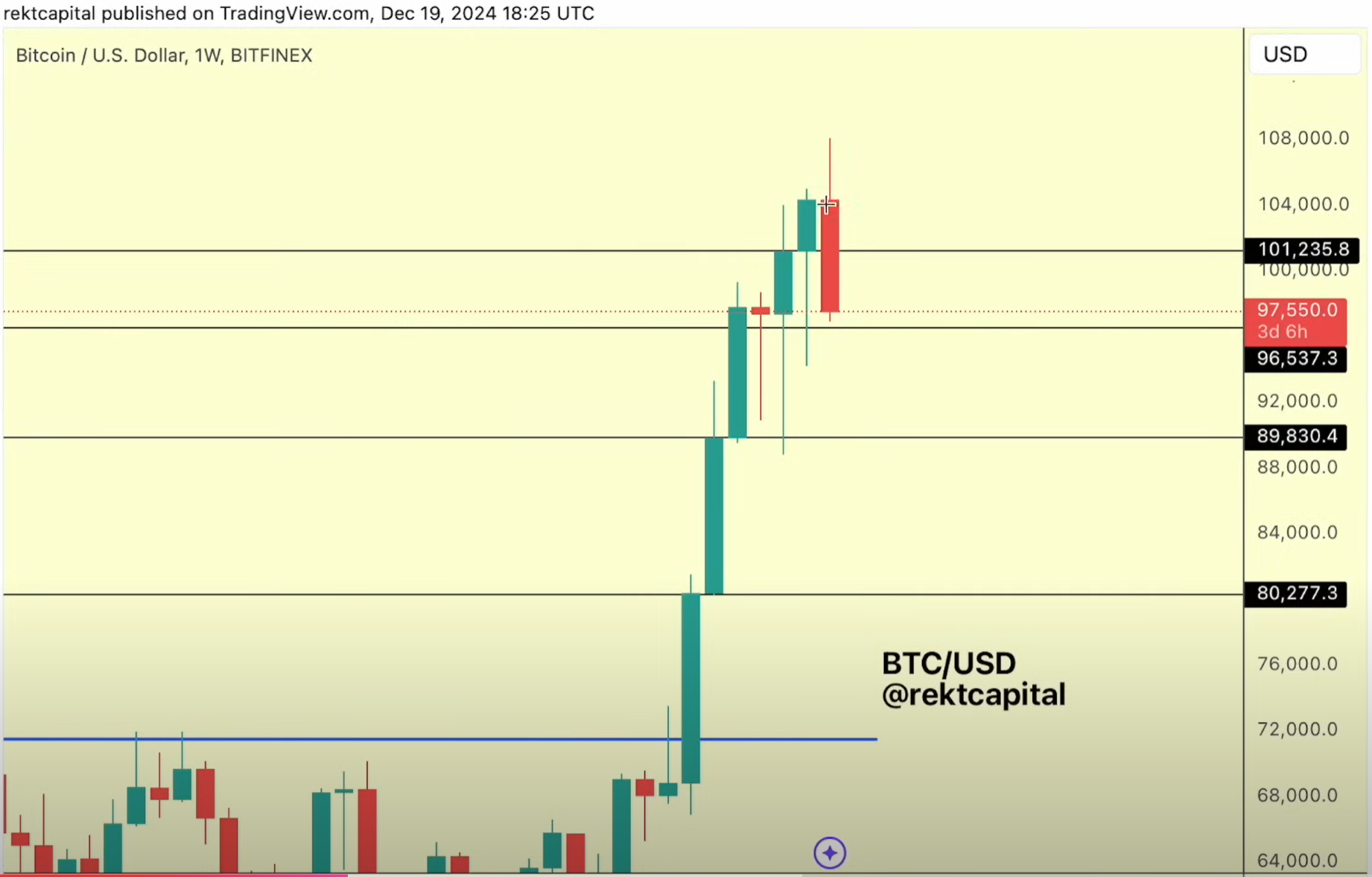

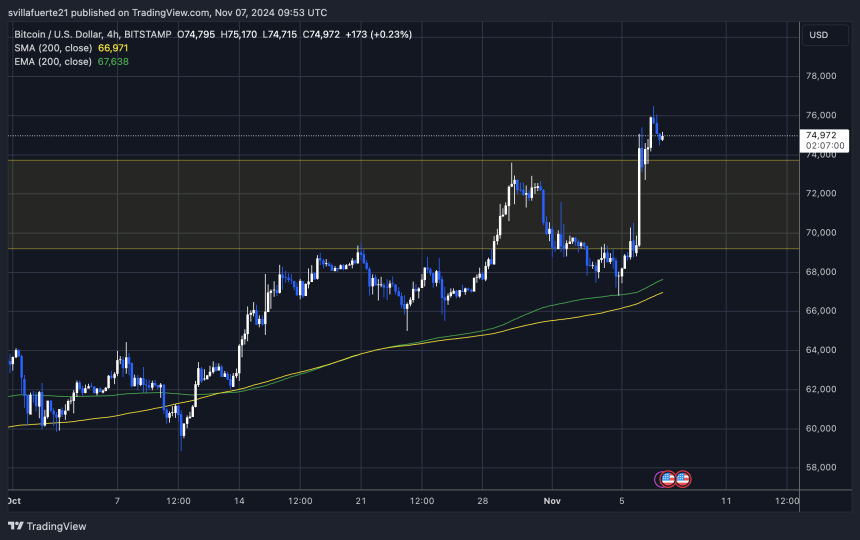

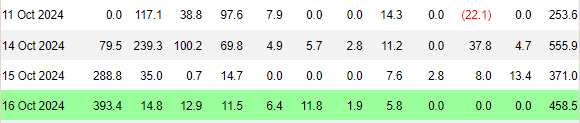

The 12-hour chart for Bitcoin reveals a bearish structure following the breakdown below the $103,600 support zone. After forming a symmetrical triangle throughout mid-June, BTC failed to break upward and instead reversed direction, confirming a downward breakout. This move triggered a sharp decline to $98,200 over the weekend, followed by a modest recovery to the current $101,250 level.

The price is now trading below both the 50 and 100-period simple moving averages, which are beginning to curl downward, signaling a shift in momentum away from bulls. The 200-period SMA, currently near $95,600, stands as the next major support if downside pressure continues. Volume has picked up notably on the red candles, adding weight to the bearish case and confirming active selling during the recent drop.

Bitcoin must reclaim the $103,600 zone and hold above it to invalidate the bearish pattern and regain control. Failure to do so could result in further downside toward $95,000 and possibly even $92,000. As long as BTC remains below the broken triangle support and the $103K resistance, the path of least resistance remains downward. Bulls face an uphill battle, and confidence may erode quickly if the $100K psychological level is breached again.

Featured image from Dall-E, chart from TradingView