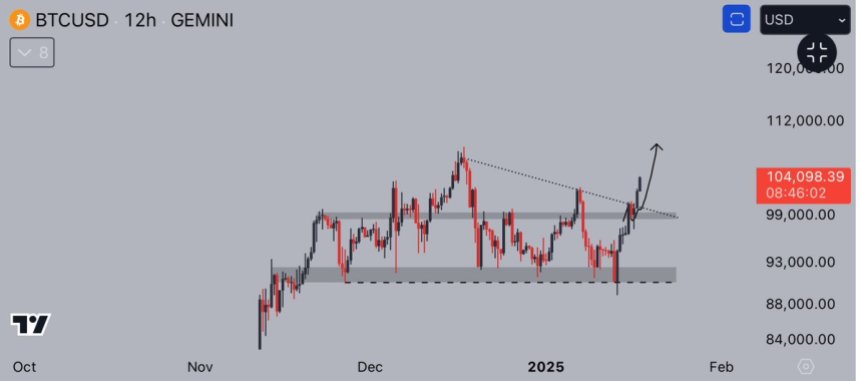

Bitcoin has been consolidating in a wide range between $100,000 and $112,000, facing heightened volatility driven by rising geopolitical tensions in the Middle East and growing macroeconomic uncertainty. Despite these external pressures, Bitcoin has held strong above the six-figure mark, signaling resilience as it prepares for a decisive move. Market sentiment is cautiously optimistic, with many traders expecting a breakout in the coming weeks.

Top analyst Daan shared a technical analysis highlighting that Bitcoin is now trading just below its all-time high, but continues to face strong resistance around the $109,000–$112,000 zone. Price has tested this level multiple times over the past month, but each attempt has failed to produce a confirmed breakout. During this period, altcoins have suffered sharp drawdowns, with many falling between 10% and 50%, underscoring Bitcoin’s dominance and investor focus.

Despite the rejections, bullish momentum is gradually building. Bitcoin’s ability to stay elevated in such a volatile environment suggests that buyers are accumulating, waiting for the right moment to push higher. A confirmed breakout above resistance could trigger a sharp move into price discovery, while failure to hold key support may lead to deeper consolidation before the next leg up.

Bitcoin Bulls Push Toward Breakout

Bitcoin has gained over 15% since early May, extending a bullish trend that began in April when the price rebounded sharply from the $75,000 level. Since then, buyers have remained in control, consistently defending higher lows and reclaiming key technical levels. This steady rise in momentum has fueled speculation that Bitcoin may soon break into new all-time highs, as market sentiment improves and capital continues flowing into crypto.

Analysts are now closely watching the $110,000–$112,000 resistance zone—a level that has held strong despite multiple breakout attempts. Daan noted that Bitcoin is trading just below its all-time high, but has already faced several failed moves above this barrier. Over the past month, price has hovered near resistance, yet hasn’t delivered a confirmed breakout. During this period, altcoins have struggled, with many dropping between 10% and 50%, further highlighting Bitcoin’s dominance and traders’ caution.

While the setup looks bullish, risks remain. A proper breakout will require not just a brief wick above $110K, but a strong weekly close or at least two consecutive daily closes above resistance. Until then, it’s wise to stay patient. Chasing before confirmation can lead to getting caught in a false breakout. Once Bitcoin breaks and holds above this level, the probability of a larger move increases significantly.

In the meantime, Bitcoin’s ability to hold near highs while absorbing macro volatility and altcoin weakness is a strong sign of underlying demand. Momentum is building—but timing matters. A confirmed breakout will be the signal that the next leg up is ready to begin. Until then, smart traders are watching and waiting.

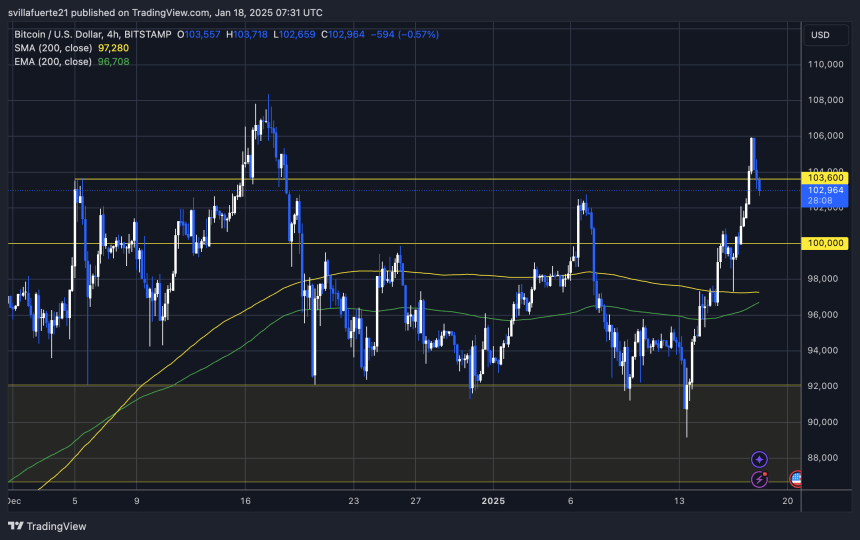

BTC Weekly Chart Shows Strong Structure

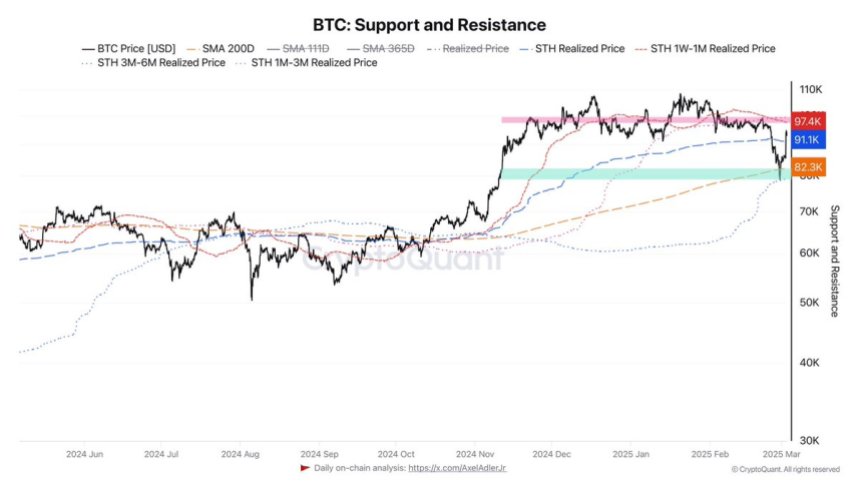

Bitcoin is currently trading at $107,319 on the weekly chart, continuing to hover just below the crucial $109,300 resistance level. Despite multiple attempts, BTC has failed to close a weekly candle above this zone—a critical milestone needed to confirm a breakout and signal the next phase of upward momentum. The $103,600 level now serves as strong weekly support, holding firm through recent pullbacks.

The long-term structure remains bullish. Price continues to trend above all major moving averages, including the 50-week SMA ($85,147), the 100-week SMA ($66,505), and the 200-week SMA ($49,239), all of which are sloping upward. This alignment reflects solid long-term strength, even as Bitcoin consolidates just below all-time highs.

Volume, however, remains relatively muted compared to the breakout seen in late 2024, suggesting that traders are waiting for confirmation before committing to new positions. Until BTC can close a weekly candle above $109,300, this range will remain intact.

If bulls succeed, the market could enter price discovery and spark renewed inflows. But if rejection continues, the $103K–$105K zone becomes critical to hold. For now, Bitcoin’s bullish structure is intact, but confirmation is still required before a larger move can begin.

Featured image from Dall-E, chart from TradingView