Upbit has warned investors as IOST plans a layer-2 transition, with 21 billion new tokens and a tokenomics overhaul.

Cryptocurrency Financial News

Upbit has warned investors as IOST plans a layer-2 transition, with 21 billion new tokens and a tokenomics overhaul.

Oliver Michel, founder and CEO of German-based venture capitalist firm Tokentus Investment AG, has given a bullish price prediction for the XRP price. According to him, XRP could hit $10 soon enough.

Michel mentioned during an interview with Der Aktionär, a leading German finance magazine, that he expects XRP to rise to between $5 and $10 in the first wave of its parabolic move to the upside. Interestingly, he added that XRP would eventually hit three to four figures and didn’t seem worried about XRP’s current price action.

Meanwhile, Michel revealed that he is invested in the XRP tokens as he has them both in his family office and with his company, Tokentus. The same applies to Ripple shares, which he stated he purchased through an SPV (Special Purpose Vehicle).

Michel is no stranger to the XRP ecosystem, considering that his company partnered with Ripple last year in an effort to grow and increase the adoption of the XRP Ledger (XRPL). During the interview, Michel also offered his thoughts on Ripple as a “professional company” and sounded so bullish on what the crypto firm was building with its Payment service.

He used the opportunity to elaborate further on how Ripple was simplifying cross-border transactions with the help of the XRPL and XRP tokens. Ripple is known to settle these transactions through its blockchain, with XRP serving as the utility token, and these XRP tokens are then converted to the fiat currency of the recipient’s choice.

Michel stated that XRP could become the “world reserve bridge currency” once countries implement their CBDCs (Central Bank Digital Currency). Ripple’s XRPL is already being touted as the go-to chain for CBDC settlements. The crypto firm had also revealed that they were already actively working with more than 20 Central banks on CBDC initiatives.

The Tokentus founder also believes it won’t be long before other Central banks fall back on Ripple to help them implement their CBDCs. He noted that the pressure was piling up on these banks to act now to avoid an impending economic collapse. XRP is expected to play an integral role when this all happens.

Ripple’s XRPL also looks set to act as the intermediary between all these CBDCs when the time comes. Bitcoinist once reported how the network’s clawback feature boosts the prospects of CBDCs being implemented on it.

At the time of writing, XRP is trading at around $0.58, down over 1% in the last 24 hours, according to data from CoinMarketCap.

[toc]

Sui (pronounced “Swee”) is a decentralized Layer 1 proof of stake blockchain, meaning it serves as the foundational infrastructure for verifying and processing transactions, similar to Bitcoin and Ethereum. Layer 1 blockchains are the backbone that supports a specific token or a network of different tokens.

Sui was developed by Mysten Labs, a group of former Meta employees. It is designed to limit how long it takes to execute smart contracts and support scalability for decentralized applications (dApps). The network believes it has cracked the code on smart contract execution in terms of speed, high security, and low gas fees. This is possible because of the programming language it was designed with called “Move”. Move is a Rust-based programming language that prioritizes fast and secure transaction executions.

According to the whitepaper, the network is named after the element water in Japanese philosophy, a reference to its fluidity and flexibility that developers can use to shape the development of Web3. The network is focused on low latency and super scalability. This has seen it termed by supporters as “the Solana Killer.”

The Sui project was announced by Mysten Labs in September 2021, and in December 2021, Mysten Labs invested $36 million into the project. This was followed by a $300 million series B announcement led by a $140 million commitment by FTX in 2022, valuing the startup at $2 billion.

In the words of Sui Co-Founder and CEO, Evan Cheng, the current Web3 infrastructure is slow, expensive, and notoriously unreliable. Given this, Cheng said the network was created to change the Web3 game with some 5G level upgrades that would allow developers to create blockchain-powered applications with scalability that you can only associate with centralized technology hubs that dominated Web 2.0.

In other words, the Sui network was created to solve Web3 problems by simplifying and improving the creation of various applications and functions in the Web3 ecosystem, solving the most common problems in the Web3 industry: speed, security, and stability.

Sui operates as a Layer 1 blockchain focused on optimizing fast blockchain transfers. It places a high level of importance on immediate transaction finalization, making Sui an ideal platform for on-chain applications such as decentralized finance (DeFi), gaming, and other real-time use cases.

Unlike the existing Layer 1 blockchains where transactions are added one after the other, which makes it slow as more transactions are being added to the blockchain, Sui does not make every transaction go through all the computers in the network. Instead, it picks the relevant part of the data it needs to check, which eliminates the problem of congestion on the blockchain and drastically reduces gas fees to carry out transactions.

The Sui network uses a permissionless set of validators to reduce latency and a protocol called the Delegate Proof of Stake system. It has epochs (each consisting of 24 hours), during which Sui holders select a set of validators with whom they store their staked tokens. The validators are then in charge of transaction selection and approval.

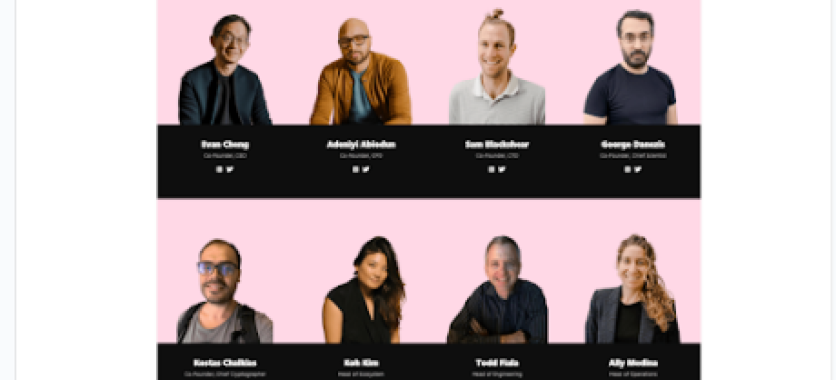

Co-Founder and CEO Evan Cheng: Cheng previously worked at Apple for 10 years, and he was also the former Head of Research and Development at Novi and Technical Director of Meta.

The Chief Scientist George Danezis: Former researcher at Novi, Meta, and previously worked at Chainspace, Microsoft.

Adeniyi Abiodun, CPO: Former Head of Product Development at Novi, Meta. Previously worked at VMware, Oracle, PeerNova, HSBC, and JP Morgan.

Kostas Chalkias: Former leading cryptographer at Novi. He previously worked at R3, Erybo, Safemarket, and NewCrypt.

Sam Blackshear, CTO: Former Chief Engineer at Novi, specializing in the Move programming language.

Sui was valued at $2 billion after FTX Ventures committed $140 million to the project. However, Sui also has other credible investors who also committed, like Binance Labs, the largest centralized crypto exchange by daily trading volume, and Coinbase Ventures, the largest crypto exchange in the United States.

Other investors included Franklin Templeton, a global leader in asset management with more than seven decades of experience, and Jump Crypto, an experienced team of builders, developers, and traders. Apollo, Lightspeed Venture, Circle Ventures, Partners, Sino Global, Dentsu Ventures, Greenoaks Capital, and O’Leary Ventures also invested in the blockchain.

SUI coin plays a crucial role within the ecosystem and serves various functions:

Transaction Speeds

Sui Network aims to solve the slow transaction problems on Web3. The network was built on a Rust-based programming language called Move, which prioritizes fast and secure transaction executions. Transactions on the Sui network are validated in epochs of 24 hours, each epoch can be validated independently rather than in blocks like it’s done on traditional blockchains.

The parallel execution of transactions increases Sui network transaction speed to 297,000 transactions per second and 400 milliseconds time of finality compared to Ethereum’s 20 transactions per second and 6 minutes time of finality or Solana’s 10,000 transactions per second and 2.5 seconds time of finality.

Focus On Web3 And Asset Ownership

The Sui network is focused on improving Web3 and Web3 experience by catering to the needs of millions of users, which includes speed and security. Sui allows users to create, upgrade, and deploy decentralized applications and non-fungible tokens (NFTs)

Scalability

Sui Network aims to make Web3 more scalable through parallel processing or execution. This means that the Sui network identifies independent transactions and processes them simultaneously. The implication is that transaction times are reduced, and it accommodates larger transactions loaded per time. It is made possible because of the Sui implementation of the Move programming language and the Narwhal-Bullshark-Tusk Consensus algorithm, which focuses on the details of a transaction rather than the entire chain of transactions.

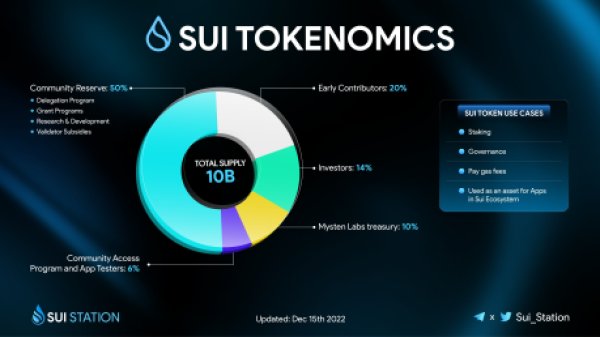

Sui’s native token is called SUI, which has several use cases. According to Coingecko, the max and total supply of SUI is capped at 10 billion coins with a current circulating supply of 1.2 billion, and it is ranked number 48 based on market cap value.

A share of the total supply of SUI was made liquid at the launch of its mainnet on May 3, 2023. Sui’s all-time high was on the day it was launched at $2.16. However, it is currently trading at $1.51, which is a 320% pump from its all-time low of $0.364 last year on October 19.

The tokenomics included 6% going to its Community Access Program and App Testers, 10% of the supply went to the Mysten Labs Treasury, 14% went to its Investors, and 20% went to Early Contributors. The vast majority of the supply, 50%, is kept in its Community Reserve. The purpose and distribution of the Community Reserve include a Delegation Program, Grant Programs, Research & Development, and Validator Subsidies, as shown in the illustration below:

Only about 5% of SUI coins were already in use when the Sui Mainnet launched, while the rest will be gradually released according to their planned schedule, as shown below:

Sui Network aims to improve Web3 by giving every Web3 user a much better Web3 experience without the struggles of slow transaction speeds. The network uses parallel execution for transactions to ensure lightning-fast speed, high security, and low gas fees.

[toc]

Monero (XMR) is one of the leading cryptocurrencies focused on privacy, zero knowledge, and censorship-resistant transactions. The Monero network operates on a proof-of-work (PoW) consensus mechanism, like Bitcoin and various other cryptocurrencies. This system incentivizes miners to contribute blocks to the blockchain. Monero’s PoW algorithm is designed to resist specialized mining equipment known as application-specific integrated circuits (ASICs). These ASICs confer a significant advantage to companies and affluent individuals, potentially leading to the centralization of the network.

In 2018, Monero became the first major cryptocurrency to deploy what is known as “bulletproofs”, a technology that greatly improved the efficiency of XMR transactions and led to at least an 80% drop in the size of the average transaction and dramatically reduced fees for the end-user.

Monero underwent an upgrade in 2019, transitioning to the RandomX algorithm. This algorithm is tailored to accommodate both CPU miners (such as laptops) and GPU miners (utilizing standalone graphics cards). Theoretically, this adjustment should foster greater decentralization within the Monero network.

Monero (formerly known as Bitmonero) traces its roots back to 2014, when it forked from the Bytecoin blockchain. Its development has been steered by a vibrant community of developers, including Ricardo Spagni (aka Fluffypony), who played a pivotal role in shaping Monero’s trajectory. The commitment to open-source principles and community-driven governance underscores Monero’s success.

Since its launch, Monero has undergone significant enhancements, including database structure migration, implementation of RingCT for transaction amount privacy, and setting minimum ring signature sizes to ensure all transactions are private by default. These improvements have bolstered the network’s security, privacy, and usability.

The Monero Project leads the charge with its dedicated Research Lab and Development Team, continuously pioneering innovative technologies. Since its launch, the project has garnered contributions from a diverse pool of over 500 developers spanning various continents.

Understanding who directly funds Monero can be tricky due to its emphasis on privacy, but it has attracted a solid base of investors. Monero has various indirect channels through which investors and institutions support and invest in the Monero ecosystem.

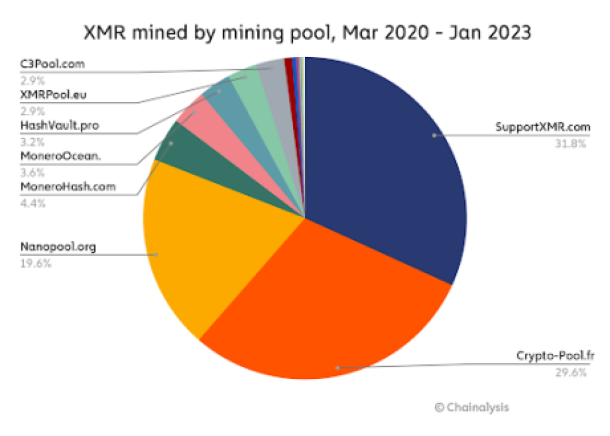

Large mining pools play a vital role in ensuring network security and processing transactions. Although they don’t directly fund Monero (XMR) Token, their involvement indicates a broader belief in Monero’s potential.

MinerGate, known for its wide user base, and SupportXMR, an open-source Monero mining pool, are actively contributing to community development. Also, Monero (XMR ) being listed on reputable exchanges like Binance and Kraken enhances accessibility and attracts large investors.

The Monero Community Development Fund (CDF) relies on donations to support developers and projects. Notable contributors include Edge Wallet and Cake Wallet, both actively contributing to the CDF.

At its core, Monero champions the right to financial privacy, offering unparalleled anonymity through advanced cryptographic techniques. Transactions conducted on the Monero network are shielded from prying eyes, ensuring the confidentiality of senders, receivers, and transaction amounts.

This commitment to privacy empowers individuals to transact freely and securely without fear of surveillance or censorship and serves as a shield against oppression in regions where financial freedom is restricted.

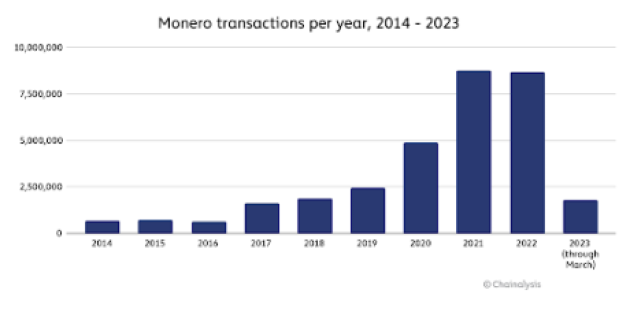

Monero has had around 32 million XMR transactions, with approximately 8.6 million in 2022, a slight drop from its peak in 2021. In comparison, Bitcoin recorded nearly 800 million transactions during the same timeframe.

Monero’s privacy features have legitimate applications in safeguarding sensitive financial information, protecting personal liberties, and preserving economic freedom.

Monero’s core privacy features are its utilization of ring signatures, stealth addresses, and RingCT. Unlike transparent blockchains like Bitcoin and Ethereum, Monero prioritizes user confidentiality, offering a level of anonymity comparable to physical cash transactions.

Despite its acclaim within the cryptocurrency community, Monero hasn’t been immune to regulatory scrutiny. Regulatory bodies have raised concerns about the potential misuse of privacy coins, leading to restrictions on their trading and listing on certain exchanges.

However, Monero remains steadfast in its commitment to privacy, offering users a secure and private means of transacting in the digital realm.

Monero’s mining mechanism sets it apart from its peers, emphasizing inclusivity and accessibility. The RandomX algorithm, optimized for general-purpose CPUs, democratizes the mining process, allowing a diverse range of hardware to participate. This approach prevents the centralization of mining power, ensuring a more decentralized network.

Monero also introduced “smart mining,” a sustainable alternative that utilizes a computer’s idle processing power to mine XMR. This energy-efficient method aligns with Monero’s ethos of accessibility and sustainability in cryptocurrency mining. It also makes use of Dandelion++ to hide IP addresses associated with nodes to avoid exposing sensitive information.

Monero’s approach to transaction handling sets it apart as a pioneer in the field of privacy-centric digital currencies. Through the utilization of split amounts and the generation of unique one-time addresses for each transaction fragment, Monero(XMR) effectively obscures the trail of funds, making it virtually impossible to trace the exact mix of currency units belonging to a recipient. This intricate methodology ensures that Monero transactions remain shrouded in secrecy, bolstering user confidence in the network’s ability to preserve financial privacy.

With features such as view keys and spend keys, Monero users have control over their accounts, allowing them to selectively grant access to specific parties while preserving the confidentiality of their financial information.

In essence, Monero’s unique blend of privacy-enhancing features, innovative transaction handling, and user-centric design sets it apart as a trailblazer in the cryptocurrency landscape.

Privacy by Default: Monero utilizes advanced cryptographic techniques such as ring signatures, stealth addresses, and Ring Confidential Transactions (RingCT) to obfuscate transaction details, ensuring unparalleled privacy.

Fungibility: Every XMR coin is interchangeable, ensuring that no history can be traced back to tarnish its value. This fungibility aspect is crucial for a currency to function effectively without discrimination based on its past usage.

Decentralization: Monero’s mining algorithm, CryptoNight, is designed to be ASIC-resistant, fostering a more decentralized mining ecosystem where individuals can participate using standard computer hardware, thus mitigating centralization risks.

Active Community: The Monero community is vibrant and passionate, constantly advocating for privacy rights and pushing the boundaries of technological innovation to safeguard financial sovereignty.

Adoption and Recognition: Despite its emphasis on privacy, Monero has garnered significant attention from both users and institutions. It has found utility in various domains, including online marketplaces, remittances, and privacy-conscious transactions. Moreover, prominent figures in the cryptocurrency space have recognized Monero’s value proposition, further solidifying its position in the digital currency landscape.

Financial Services Sector: Monero’s blockchain technology can revolutionize processes such as trade finance, lending, and asset management. Its privacy-enhancing features and technologies ensure that sensitive financial transactions remain confidential while still maintaining transparency and auditability. Additionally, Monero’s decentralized nature eliminates intermediaries and reduces costs.

Supply Chain Management: This sector stands to gain significant advantages from Monero. By leveraging Monero’s immutable ledger and privacy-enhancing features, businesses can enhance transparency, traceability, and authenticity throughout the supply chain. Monero’s blockchain ensures the integrity of goods and reduces the risk of fraud and counterfeiting.

Media And entertainment industry: These two industries can also harness the power of Monero’s blockchain for various applications. Whether it’s managing digital rights, tracking royalties, or enhancing content distribution, Monero will help secure a transparent platform for content creators, distributors, and consumers. By utilizing Monero’s blockchain, companies can streamline royalty payments, protect intellectual property rights, and create new revenue streams in the digital media landscape.

Government Institutions: Monero’s blockchain has promising applications in government services; governments can leverage Monero’s blockchain for secure voting systems, digital identity management, and transparent public services.

Cybersecurity And IoT (Internet of Things). Monero’s decentralized and immutable ledger provides robust protection against data breaches and cyber-attacks. In IoT, Monero’s blockchain can facilitate secure data exchange and device authentication, ensuring the integrity and privacy of IoT ecosystems.

Monero XMR aims to maintain scarcity and foster value appreciation like Bitcoin. With a capped total supply of approximately 18.4 million XMR coins, similar to Bitcoin, Monero aims to prevent inflation, thereby potentially contributing to sustained value appreciation over the long term.

Monero endeavors to incentivize miners and uphold network security. Utilizing a Proof-of-Work (PoW) consensus mechanism, Monero relies on miners to safeguard the network. Initially, the emission rate of XMR was high but has gradually decreased over time. Currently, with a block reward of 0.6 XMR per block as of 2022, Monero introduces a “tail emission” to sustain ongoing miner incentives.

Conclusion

Monero’s blockchain technology holds immense potential for transforming various industries by providing a secure, private, and transparent platform for conducting transactions and managing data.

With its focus on anonymity and confidentiality, Monero offers a versatile solution for businesses seeking to enhance privacy, security, and efficiency across diverse sectors. As the adoption of blockchain technology continues to grow, the potential applications of Monero are limitless, paving the way for a more secure and decentralized future.

XRP Ledger, created by Ripple Labs Inc., is an open-source blockchain technology and digital asset. This means that developers can contribute to its development and enhance its functionality. XRP serves as the native cryptocurrency of the XRP Ledger and is the commonly recognized name for it. The XRP Ledger is purposefully designed to enable swift, cost-effective, and secure transactions. It functions as a distributed ledger, where transaction records are stored across a network of validators, which are participating computers, ensuring the integrity of the ledger.

XRP has garnered significant recognition for its ability to facilitate expeditious and streamlined cross-border payments. Its primary objective is to enhance liquidity and establish connections between diverse currencies, enabling seamless value transfers for both financial institutions and individuals across international borders. Ripple, the entity responsible for XRP, has forged partnerships with numerous financial institutions to investigate the potential of XRP in the realms of remittances and international settlements.

It is imperative to emphasize that although XRP is commonly linked with Ripple, the XRP Ledger functions autonomously, separate from the company. XRP can be exchanged on different cryptocurrency platforms and stored in digital wallets that are compatible with the XRP Ledger.

Additionally, there is a diverse range of cryptocurrency exchanges that support the XRP Ledger (XRP) for individuals interested in buying, selling, or trading XRP. Some notable examples include Binance, Coinbase, Kraken, BitStamp, Huobi, and more.

In early 2011, developers David Schwartz, Jed McCaleb, and Arthur Britto were intrigued by Bitcoin but concerned about its energy consumption and scalability issues. They aimed to create a more sustainable system for value transfer. Their predictions about Bitcoin’s energy usage were proven right when estimates revealed that Bitcoin mining consumed more energy than Portugal in 2019. They also foresaw the risks of one miner or collusion of miners gaining over 50% of the mining power, which remains a concern today as mining power concentrates in China.

Undeterred, the developers continued their work and created a distributed ledger called Ripple, with a digital asset initially called “ripples” (later referred to as XRP). The name Ripple encompassed the open-source project, the unique consensus ledger (Ripple Consensus Ledger), the transaction protocol (Ripple Transaction Protocol or RTXP), the network, and the digital asset.

To eliminate confusion, the community started referring to the digital asset as “XRP.” By June 2012, Schwartz, McCaleb, and Britto completed the code development and finalized the Ledger.

The XRP Ledger represents a pioneering blockchain technology that places a strong emphasis on scalability and interoperability. This focus enables the ledger to offer a wide array of possibilities for diverse applications that surpass the realms of traditional financial systems.

By demonstrating the capacity to handle substantial transaction volumes and foster seamless connectivity among different assets, the XRP Ledger stands poised to bring about a revolution across multiple industries and ignite innovation. Its scalable and interoperable nature creates opportunities for novel use cases and transformative solutions within the blockchain ecosystem.

Consensus Ledger

Functioning as a distributed and decentralized ledger, the XRP Ledger stores the transaction history across an independent network of validators. Every validator preserves a copy of the ledger, and transactions undergo validation and agreement via the consensus algorithm. This approach ensures that the ledger’s transaction history is securely stored and that transactions are verified and approved through a collaborative process among validators. By employing this distributed and decentralized framework, the XRP Ledger establishes a reliable and transparent system for recording and validating transactions.

Gateways and Interoperability

The XRP Ledger enables the establishment of gateways, which are entities responsible for issuing and redeeming assets on the ledger. These gateways play a crucial role in bridging various currencies and assets, fostering seamless interoperability across different financial systems.

By facilitating the transfer and exchange of diverse assets, the gateways enhance the connectivity and compatibility between different forms of value representation. This feature of the XRP Ledger promotes greater efficiency and accessibility in cross-border transactions and opens up opportunities for enhanced liquidity and streamlined financial operations.

Transaction Speed and Scalability

Engineered with scalability and rapid transaction settlement in mind, the XRP Ledger (XRP) is adept at processing a substantial number of transactions per second. With the capability to settle transactions within a matter of seconds, the ledger is well-suited for a wide range of use cases that demand swift and efficient transaction execution.

Its high scalability and speedy transaction settlement empower businesses and individuals alike to conduct seamless and timely transactions, fostering enhanced productivity and responsiveness in various applications and industries.

Consensus Algorithm

Within the XRP Ledger, a distinctive consensus algorithm known as the Ripple Protocol Consensus Algorithm (RPCA) is employed. Diverging from conventional proof-of-work (PoW) or proof-of-stake (PoS) algorithms, RPCA relies on a group of trusted validators to authenticate and validate transactions. These validators assume the crucial role of collectively establishing consensus regarding the sequence and legitimacy of transactions on the network. By leveraging this innovative consensus mechanism, the XRP Ledger ensures the integrity and reliability of its transaction validation process, providing a secure and efficient environment for conducting business.

Native Cryptocurrency (XRP)

XRP operates as the inherent digital currency of the XRP Ledger, serving multiple purposes, such as facilitating transactions, offering liquidity, and bridging diverse currencies. As a medium of value exchange, XRP can be transferred between various entities on the XRP Ledger, enabling seamless transactions and facilitating the exchange of value. This versatile cryptocurrency plays a vital role in supporting the functionality and efficiency of the XRP Ledger ecosystem.

Undoubtedly, the XRP Ledger, along with its native currency XRP, has made a notable impact on the financial industry, bringing forth a range of positive innovations across various important aspects such as:

Decentralized Finance (DeFi)

The XRP Ledger’s utilization of smart contracts and tokenization creates possibilities for decentralized finance (DeFi) applications, paving the way for the development of groundbreaking financial services like lending, borrowing, and decentralized exchanges. With its rapid and scalable nature, the XRP Ledger provides an ideal foundation for constructing DeFi applications, potentially extending financial services to underserved communities and diminishing dependence on conventional intermediaries.

Asset Tokenization

The capacity of the XRP Ledger to tokenize tangible assets like real estate, art, and commodities has the potential to unleash liquidity for assets that have historically lacked it. Through the representation of these assets as digital tokens on the ledger, fractional ownership becomes feasible, enabling enhanced accessibility and transferability. This breakthrough can introduce fresh investment prospects and enhance market efficiency.

Cross-Border Payments

The swift transaction settlement and economical fees offered by the XRP Ledger make it an attractive choice for cross-border payments. Its efficient currency-bridging capabilities simplify and expedite international transactions, potentially reducing expenses and enhancing liquidity for financial institutions. This can result in expedited and cost-effective remittances, benefiting both businesses and individuals.

Liquidity and Market Efficiency

The XRP Ledger’s utilization of XRP as a bridge currency and liquidity tool has the potential to bolster market efficiency and enhance liquidity for diverse assets. By enabling seamless value exchange across different currencies, the XRP Ledger contributes to improved market liquidity, simplifying the process of buying, selling, and trading assets for users. This heightened liquidity has the capacity to foster more efficient markets and enhance the process of price discovery.

The distribution of XRP tokens by Ripple Labs is a nuanced process that goes beyond a simple monthly release schedule. Currently, the majority of XRP is held in 16 escrow contracts, and their release is influenced by multiple factors, such as market conditions and ecosystem adoption. The original 55-month distribution projection was an estimate, and Ripple has the ability to adjust the pace based on their assessment.

Certainly, this distribution strategy impacts the price of XRP. A significant influx of XRP could potentially exert downward pressure on its value. However, attributing price fluctuations solely to this factor would be narrow-minded. The overall market sentiment towards cryptocurrencies, demand from financial institutions, regulatory developments, and news related to Ripple all contribute significantly. To truly understand the price action of XRP, a comprehensive analysis of these intertwined factors is necessary, recognizing the intricate interplay between Ripple’s distribution strategy and the dynamic cryptocurrency landscape.

XRP has a fixed supply of 100 billion tokens, making it a pre-mined cryptocurrency with no possibility of additional token creation. Only a fraction of the tokens are actively traded, while 20 billion went to the founders. The distribution involves 55 smart contracts that release 1 billion tokens monthly over 55 months, resulting in a monthly increment of 1 billion tokens. The circulating supply is around 53.7 billion tokens, with the remaining held in escrow.

Over 60% of the total supply is concentrated in the top 100 wallets, raising decentralization concerns. Ripple owns 6.5 billion XRP, adjusting the circulating supply to approximately 47 billion tokens.

XRP exhibits a mild deflationary trend from burning fees, reducing the total supply to about 99,988,221,902 XRP.

Purchasing XRP coins can be a relatively straightforward procedure; however, the available choices cater to diverse levels of experience and comfort. Here is a breakdown of different approaches tailored to meet your specific requirements:

Beginner-Friendly Exchanges

Coinbase and Binance are user-friendly platforms suitable for newcomers. They provide intuitive interfaces, clear instructions, and customer support to assist users throughout the process.

Peer-to-Peer (P2P) Exchanges

Platforms like Paxful are P2P exchanges that enable direct XRP purchases from other individuals. This decentralized approach offers privacy and flexibility but requires caution when evaluating counterparties and following safety measures.

Decentralized Exchanges (DEX)

Uniswap is an example of a DEX platform that operates on blockchains. They facilitate direct peer-to-peer trading without intermediaries, providing enhanced security and control over funds. However, using DEX platforms will require compatible wallets.

Tracking Prices of XRP Ledger (XRP)

To effectively track the prices of XRP Ledger (XRP), the digital asset native to the XRP Ledger, and stay up to date with its market movements and fluctuations, there are several reliable methods and platforms that you can utilize, such as widely recognized cryptocurrency tracking platforms like CoinMarketCap

CoinMarketCap is a highly regarded platform for monitoring cryptocurrencies, offering extensive data on a diverse range of digital assets, such as XRP Ledger (XRP). Users can explore the XRP page on CoinMarketCap to access up-to-the-minute price updates, historical data, market trends, and other pertinent information relating to XRP. CoinMarketCap serves as a trusted resource for individuals seeking to track and analyze the performance of XRP Ledger within the global cryptocurrency market.

The Ripple vs. SEC legal dispute, which began in December 2020, has a profound impact on XRP. The SEC accuses Ripple of conducting an unregistered securities offering through XRP sales, while Ripple argues that XRP is a utility token for cross-border payments and not a security. This ongoing battle has caused turbulence for XRP, resulting in price volatility and adoption uncertainty. The outcome of the case will have significant implications for XRP and the broader cryptocurrency industry.

The lawsuit has led to a hesitant market as businesses and individuals are cautious about embracing XRP due to the uncertainty surrounding its classification. The resolution will determine whether XRP’s utility as a token will prevail or if the SEC’s classification as a security will cast a long shadow over its future. As the market awaits a definitive answer, the trajectory of Ripple’s digital creation remains uncertain.

XRP Ledger (XRP) boasts an established name, a decentralized network, and lightning-fast, low-cost transactions. This has cemented its role as a preferred bridge currency for cross-border payments.

Despite facing legal challenges, XRP has an impressive track record as one of the pioneering cryptocurrencies, gaining widespread adoption among major financial institutions through RippleNet. The community’s dedication and the project’s foundational strengths provide a solid basis for potential success. However, the outcome of the SEC lawsuit will be a crucial determinant in shaping the future of XRP, whether it will be positive or negative.

Nevertheless, navigating the world of XRP necessitates careful consideration. While some may prioritize user-friendly platforms for entry, experienced traders might seek advanced features offered by decentralized exchanges (DEXs).

Regardless of your experience level, remember that cryptocurrencies remain volatile, and responsible investing practices are paramount. Consider these factors, research, and choose the path that aligns with your personal financial goals and risk tolerance.

The Kaspa (KAS) blockchain is a decentralized, open-source, and scalable Layer-1 solution often referred to as “Bitcoin 2.0” or “the next Bitcoin.” However, Kaspa is unique in its own way despite functioning very similarly to Bitcoin. Just like Bitcoin, Kaspa is a proof of work (PoW) cryptocurrency, but unlike other traditional blockchains, Kaspa implemented the GHOSTDAG protocol.

This protocol is unique in the fact that it does not have orphan blocks created in parallel. Rather, it allows them to coexist and orders them in consensus. This makes Kaspa the first of its kind to do this, with the blockDAG (Block Directed Acyclic Graph) protocol being a generalization of Nakamoto’s consensus.

The founder of Kaspa is Yonatan Sompolinsky, a Ph.D. in Computer Science at Havard University and a member of the Maximal extractable value (MEV) research team. He was also in Ethereum’s whitepaper and rumored to be in Ripple’s whitepaper as well.

Sompolinsky had direct input in creating Ethereum’s technology design, having designed the GHOSTDAG protocol earlier. Interestingly, the founder’s 2013 paper on the GHOSTDAG protocol is cited in Ethereum’s whitepaper.

The development team is made up of very talented individuals such as Cryptography Researcher Elichai Turkel, Doctoral student Shai Wyborski, Developer Ori Newman, Master of Computer Science Michael Sutton, and Developer Mike Zak. They have all contributed to the implementation and ongoing development of the Kaspa blockchain network.

At the very base of its technology, Kaspa is very similar to the Bitcoin network in the way it’s structured. Some of these similarities are outlined below:

Related Reading: What Are The Top 8 DeFi And Web3 Wallets To Use In Crypto?

One major difference between both networks is that Kaspa solves the issue of scalability that continues to plague Bitcoin. This means that while both networks use a proof of work mechanism, Kaspa is able to carry out transactions at a faster rate as well as cheaper fees.

The Blockchain Trilemma refers to the three critical aspects of blockchain technology, which are security, scalability, and decentralization. This trilemma continues to plague leading blockchains such as Bitcoin and Ethereum, and they continue to battle these issues. This is because, in order to ensure security and decentralization, something had to give, and in both cases, it was scalability.

However, Kaspa, on the other hand, is one of the few blockchains to solve the blockchain trilemma, as it is decentralized, scalable, and secured. It solves the blockchain trilemma issues through its integration of proof of work (PoW) and the blockDAG structure.

Most blockchains that digitally process transactions do so in the form of blocks, hence the name blockchain. Kaspa, however, deviates from this because it does not store digital transactions in blocks. Instead, it does so using a complex mathematical structure called a DAG (Directed Acyclic Graph).

In a DAG (Directed Acyclic Graph), vertices are present instead of blocks. So, instead of referring to different units as forming blocks, each different vertice forms edges when connected to each other. The blockchain then relies on present transactions to validate and confirm transactions that come after it.

Kaspa does not discard previous blocks of information; therefore, it is more secure and scalable. Its mining relies on kHeavyHash, which is a form of optical mining algorithm that is energy efficient and works well with mining equipment such as FPGAs and GPUs.

Efficient Proof of Wook: Kaspa is a one-of-a-kind blockchain that has managed to maintain its Proof of Work mechanism while also solving the blockchain trilemma. To put this in perspective, blockchains such as Ethereum have had to move from Proof of Work (PoW) to Proof of Stake (PoS) in an effort to solve their scalability issues and make them faster.

However, since Kaspa already solved the blockchain trilemma, this makes it highly scalable while maintaining a truly decentralized system. Its utilization of the optical-mining-ready kHeavyHash algorithm also helps to ensure the consensus and security of the network.

Instant Transaction Confirmation: Kaspa was designed to be cheaper and faster than Bitcoin, where full confirmation of a transaction takes an average of 10 seconds, with each transaction visible to the network in one second. This is significant when compared to Bitcoin, which takes an average of 10 minutes to confirm a transaction.

Security: When it comes to security, Kaspa did not just employ the same security principles and methodology as Bitcoin, it took it a step further as it replaced the SHA-256 PoW encryption with kHeavyHash, while inheriting all the security properties of SHA-256. Thus, its network is still secured by a robust network of decentralized volunteers (miners) who validate and sign transactions just like Bitcoin.

Cheaper Fees: Not only does the Kaspa Blockchain network confirm transactions fast, but it is also significantly cheaper than Bitcoin. This is because the blockDAG network generates multiple blocks every second for posting transactions to the ledger, whereas Bitcoin generates one block every 10 minutes. Transaction fees on Kaspa cost less than a cent, while transaction fees on Bitcoin cost an average of $4 at the time of this publication.

Scalability: Kaspa solves scalability issues with its blockDAG network’s ability to generate and confirm multiple blocks per second, as mentioned above. But perhaps the most interesting part of what Kaspa does is that it is able to confirm so many blocks (vertices) per second without altering or giving up its decentralized nature.

KAS coin is the native token of the Kaspa blockchain, whose main objective is to power the whole network. It is used to pay for transaction fees and other forms of developer’s fees, and it is also used as an incentive to reward miners. Its block rates are rapid and promise swift rewards, as well as offering profitable mining with lower hash rate requirements compared to Bitcoin.

The Tokenomics of Kaspa (KAS)

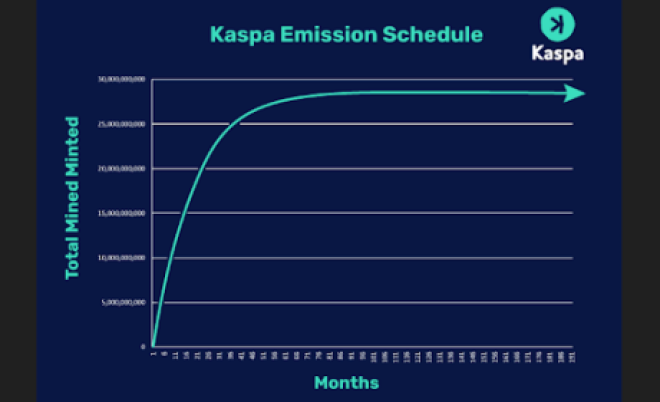

Kaspa’s native cryptocurrency, KAS, has a maximum or total supply of 28.7 billion coins that are not pre-mined. This means all of the tokens in circulation have been free-mined by miners on the blockchain. It has a circulating supply of 22.5 billion at the time of publication, and estimates are that with the current halving model, the last KAS coin will be mined in 2037.

The Kaspa network utilizes an open crowdfunding and voting governance model, which means that KAS holders can contribute to the network for development, marketing initiatives, education, etc.

This sense of shared responsibility and ownership motivates the community to come together and work toward collective goals.

KAS Price History And Progress

Kaspa launched its mainnet along with its token two years ago, on November 7, 2021. Initially, the price of its native token, KAS, remained stagnant until July 2022, when it pumped from $0.0001840 to $0.0005890. It then traded sideways for months before going on another rally, triggering a 694% increase in price.

Following this, the KAS price rose to almost $0.01 per coin in just a year after its launch in November 2022. The price dipped a bit and started off trading 2023 with $0.005278 per coin. KAS would then go on to hit a new all-time high of $0.154 in November 2023, exactly two years from the month it launched.

Kaspa (KAS) is up 61,331% since its all-time low of $0.00017105 on May 26, 2022, according to Coingecko. This is significant because the surge to its new all-time highs took place during a bitter bear market, causing the coin to outperform the rest of the crypto market.

This immense growth in such a short time has led to some of Kaspa’s investors referring to it as ‘Bitcoin 2.0’ or ‘The next Bitcoin.’ Its similarities with Bitcoin have also fueled the belief that it is the next Bitcoin. With a market cap of $2.38 billion, Kaspa is currently the 38th-largest cryptocurrency in the space and the 7th-largest Proof of Work (PoW) blockchain.

Kaspa (KAS) solving the blockchain trilemma with the ability to be scalable and still be decentralized gives it an edge over blockchains such as Bitcoin. Its native KAS coin also has important use cases like powering the entire Kaspa blockchain protocol and being used for transaction fees. This ensures that the coin is always in demand as the Kaspa network usage grows.

Additionally, features like fast transactions, top-notch security due to its encryption with kHeavyHash, and a robust network of decentralized volunteers (miners) who validate and sign transactions make it an appealing choice for investors looking for an alternative to Bitcoin while enjoying the security and decentralization of Bitcoin.

The captivating Binance Smart Chain (BSC) Network has morphed into a powerful force within the blockchain ecosystem, offering various benefits and opportunities for users and developers alike. Introduced by Binance, a top player in the global cryptocurrency exchange realm, BSC provides a robust and efficient infrastructure for decentralized applications (dApps) and digital asset transactions.

The key advantage of the BSC network is its high-speed and low-cost transactions. With its standout consensus mechanism, BSC achieves fast block confirmations, enabling quick and seamless transfers of digital assets. This scalability advantage makes BSC an attractive choice for users who value speed and efficiency in their transactions.

The Binance Smart Chain (BSC) offers several advantages that have contributed to its popularity and growth within the blockchain ecosystem. Here are some key advantages of the BSC network:

High Speed and Low Transaction Fees: BSC is known for its fast block confirmations, which result in quick transaction processing times. This speed is achieved through its unique consensus mechanism. Additionally, BSC’s low transaction fees have made it a preferred platform for developers and users.

Compared to other popular blockchain networks, BSC offers significantly lower transaction costs, making it more accessible for individuals and businesses of all sizes. This cost-effective system has aided the exponential growth of decentralized finance (DeFi) applications on the BSC network by providing a wide range of financial services to users around the world.

Scalability: BSC has been designed to handle high transaction volumes, allowing for the smooth and efficient execution of decentralized applications (dApps). This advantage enables BSC to accommodate the growing demands of users and developers without compromising performance.

Compatibility with Ethereum: The compatibility of BSC with the Ethereum Virtual Machine (EVM) has made it easy for developers to port their existing Ethereum-based projects to BSC, expanding the pool of available applications.

This opens up a world of possibilities, as it expands the range of applications available on BSC, offering users a greater selection of innovative and diverse decentralized applications to choose from. This interoperability has fostered innovation and attracted a diverse range of projects, including decentralized exchanges, yield farming platforms, and NFT marketplaces.

The close integration between BSC and the Binance exchange also creates a host of advantages for users. The seamless connection between these two platforms facilitates effortless token swaps and transfers.

Related Reading: Celestia Network: How To Stake TIA And Position For 5-Figure Airdrops

This integration enhances overall liquidity, ensuring that users have quick and convenient access to a diverse range of digital assets. Whether it’s trading, diversifying portfolios, or exploring new investment opportunities, the close relationship between BSC and Binance empowers users with a seamless and detailed experience in the world of digital assets.

Decentralized exchanges (DEXs) on the Binance Smart Chain (BSC) network provide traders with a range of features and opportunities to enhance their trading experience. Here’s an elaboration on the features of DEXs on BSC:

Automated Market Makers (AMM): DEXs on BSC leverage AMM protocols to enable token swaps. AMM algorithms automatically set token prices based on supply and demand dynamics within liquidity pools. This feature eliminates the need for traditional order books and enables continuous liquidity, allowing traders to execute swift and efficient trades.

Yield Farming: Yield farming is a popular practice in the decentralized finance (DeFi) space, and many BSC DEXs offer yield farming opportunities where traders provide liquidity to specific token pairs by depositing their assets into smart contract-based liquidity pools. In return, they receive liquidity provider (LP) tokens, which represent their share of the pool.

Traders can then stake these LP tokens in yield farming programs to earn additional tokens or rewards. Yield farming enables traders to earn passive income by utilizing their idle assets effectively.

Liquidity Pools: These are fundamental components of DEXs on BSC which consist of pairs of tokens that are used for trading. Traders can contribute their assets to these pools and become liquidity providers.

By providing liquidity, traders help ensure that there is sufficient liquidity available for trading. In return for their contribution, liquidity providers earn a portion of the trading fees generated by the DEX. This incentivizes traders to provide liquidity, as they can earn fees from the trading activity in the pool.

Token Trading: DEXs on BSC offer traders the ability to trade a wide range of tokens. These tokens can include native tokens of projects built on the BSC network, as well as tokens that have been bridged from other blockchains, including Ethereum.

Traders have access to various trading pairs, allowing them to buy and sell tokens directly from their wallets. The availability of diverse tokens and trading pairs provides traders with abundant opportunities to explore various markets and investment opportunities.

Additionally, the Binance Smart Chain (BSC) is a modified Ethereum fork which simply means that it is compatible with the Ethereum network. Both of these blockchain networks have similar infrastructure, which is why they have the same address in your wallet.

This is to ensure that your funds are not permanently lost when you send them via the wrong network. Simply put, if you send a token to your ETH via the BSC network, the funds will still be on the blockchain and you’ll be able to retrieve them.

How To Get Started On The BSC Network

To buy and sell tokens on the Binance Smart Chain (BSC) network, you will first need to get a Metamask wallet and fund it with BNB tokens. MetaMask is a popular browser extension wallet commonly used for interacting with blockchain networks like Ethereum and Binance Smart Chain (BSC). It is available as a browser extension for popular browsers such as Google Chrome.

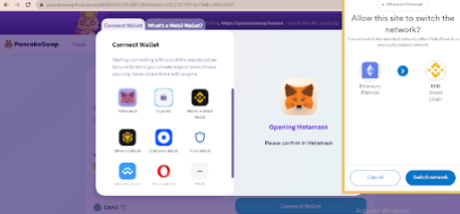

Ensure your Metamask Wallet has been added to your browser as an extension by clicking on the “Add to Chrome” icon on the top right as shown below:

Once installed and set up, MetaMask allows users to manage their cryptocurrency wallets, interact with decentralized applications (DApps), and securely execute transactions on supported blockchain networks directly from their browsers. (Make sure to write down your seed phrase on a piece of paper and keep it safe. Do not store it online).

Next, add the BSC network to your Metamask wallet by following the instructions provided on the Metemask website here.

Getting BNB Tokens To Trade On The BSC Network

Once that is done, you need to fund your wallet with BNB before you can begin trading on the BSC network. You can buy BNB on centralized exchanges such as Binance, copy your wallet address from Metamask, and then send the BNB from Binance to your Metamask wallet.

You can also purchase BNB directly within the Metamask wallet using traditional payment methods such as credit or debit cards, PayPal, bank transfer, CashApp, etc.

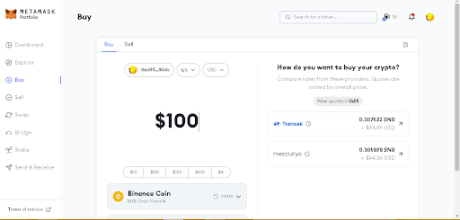

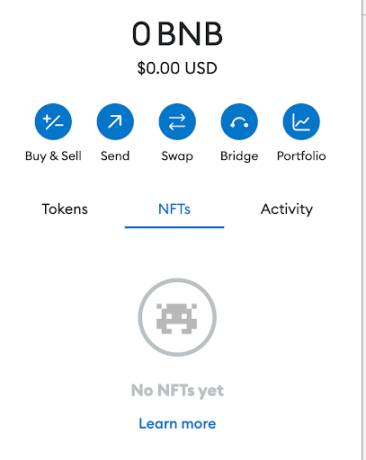

Just click on the “Buy/Sell” button within Metamask which will open up the interface. Here, you can put how much BNB you want to buy in terms of dollar terms, pick your payment method, and then click “Buy”.

Note that to buy crypto directly within Metamask, you will need to provide info such as your country and state. However, it is a straightforward process that only takes a minute.

It’ll only take a couple of minutes at most for your BNB to arrive in your wallet. Once the BNB arrives, you are all set to begin trading tokens on the BSC network. So head over to Pancakeswap to get started on your trading journey.

How To Trade Tokens On The BSC Network Using PancakeSwap

PancakeSwap is the leading decentralized exchange on the BSC network. Here, users are able to buy and sell a large range of tokens, and it is a straightforward process.

Make sure you are on the correct Pancakeswap website to prevent your wallet from being drained. The next step is clicking on the “Connect Wallet” option on Pancakeswap at the top right corner as illustrated below:

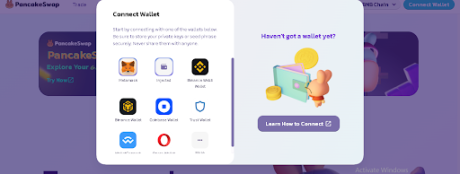

Connect to your preferred wallet as shown below. (In this case, it’s Metamask):

Once connected, switch Metamask to the BSC network. (If you’re already on the BSC network, you do not need to switch):

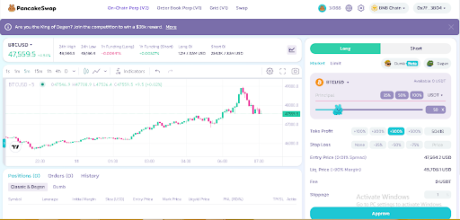

With MetaMask connected to the BSC network, go to PancakeSwap, then you can start trading on the BSC network using PancakeSwap. Search for the token you want to purchase using the name or the contract address.

Set slippage to auto to avoid having to manually set it with each swap. Once done, pick how much BNB (at the top) you want to convert to the new token (at the bottom), click on “Swap,” and confirm the transaction in your Metamask wallet.

Once the transaction is confirmed, the tokens will be sent to your wallet. To convert your tokens back into BNB, repeat this process by putting the new token at the top and picking BNB at the bottom. Click Swap and BNB will be sent to your wallet.

Buying And Selling Tokens With The Metamask Wallet

BSC Network users can also buy and sell tokens using the Metamask extension wallet already connected to the BSC network.

To do this, make sure you’re connected to the BSC network and have BNB to swap and pay for gas fees. Then navigate to the “Swap” button as shown below. This will take you to the Swap interface inside Metamask.

Here, you can also search for tokens using the name or the contract address, just like on Pancakeswap. Input the amount of BNB you want to swap, confirm that you have the correct token, and then click “Swap.” Once the transaction is confirmed, the tokens you just bought will be sent to your wallet.

Tracking Token Prices On The BSC Network

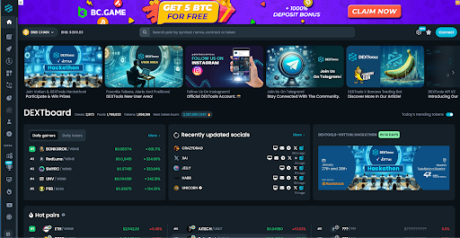

BSC network users can leverage on-chain tools such as Dextools to access detailed market insights about a particular token such as price and contract information to enable them to make informed trading decisions.

Dextools offers a range of features that are particularly beneficial for users on the BSC network. One notable feature is the ability to check charts, providing real-time and historical price data for various tokens. These charts enable users to analyze price trends, trading volumes, and other relevant metrics, helping them identify potential entry or exit points for their trades, as shown below:

In addition to charting capabilities, Dextools provides a “Contract Audit” feature that is especially valuable for BSC users. This feature allows users to check the audit score of a smart contract before investing in a token. Audits assess the security and reliability of a contract’s code, highlighting potential vulnerabilities or risks.

By accessing the audit score through Dextools, users can evaluate the level of trustworthiness and credibility of a token’s underlying smart contract, minimizing the chances of falling victim to scams or vulnerabilities.

Conclusion

The BSC network has become popular within the blockchain ecosystem due to its advantages and has attracted a diverse range of projects and users. BSC’s compatibility with Ethereum facilitates seamless token transfers between the two networks, enhances diversification of development and usage, and promotes collaboration within the broader blockchain ecosystem.

Additionally, it offers interoperability, allowing developers to easily port existing Ethereum-based applications and assets to BSC. This compatibility grants access to the extensive Ethereum ecosystem, enabling users to leverage the infrastructure and liquidity of Ethereum while benefiting from BSC’s faster transactions and lower fees.

BSC’s combination of interoperability, accessibility to liquidity, and enhanced transaction efficiency makes the BSC network a compelling choice for both developers and users, solidifying its position as a prominent player in the evolving blockchain landscape.