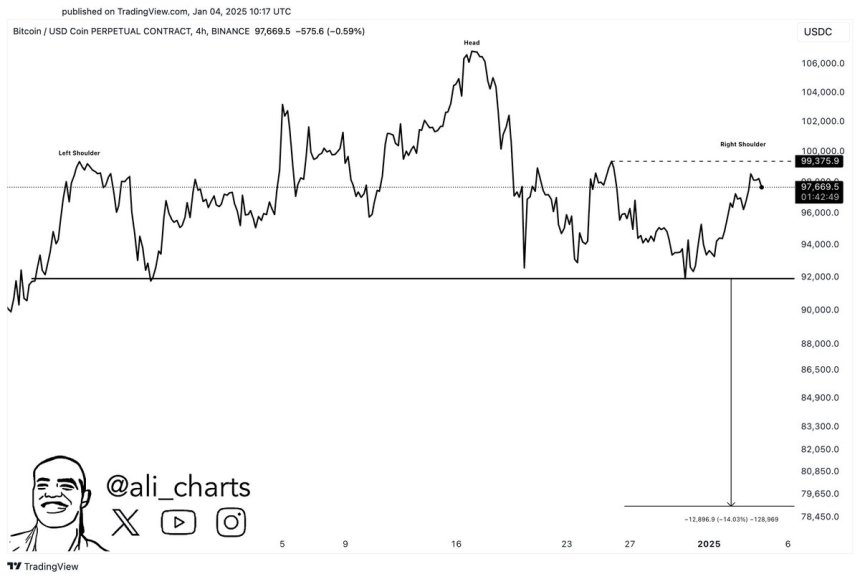

Bitcoin has shattered previous records, soaring past the $100,000 milestone for the first time ever to reach an all-time high of $104,088 late Wednesday in New York. The flagship cryptocurrency had dipped to $94,587 on Wednesday but staged a remarkable comeback. Several key factors contributed to this unprecedented surge:

#1 Fed Chair Powell Compares Bitcoin To Gold

In a significant acknowledgment from the traditional financial sector, Federal Reserve Chair Jerome Powell discussed Bitcoin during the New York Times DealBook Summit. When questioned about the perception of Bitcoin as a symbol of faith or lack thereof in the US dollar and the Federal Reserve, Powell offered a nuanced perspective.

“I don’t think that’s how people think about it,” Powell remarked. “People use Bitcoin as a speculative asset, right? It’s like gold. It’s just like gold, only it’s virtual. It’s digital. People are not using it as a form of payment or as a store of value. It’s highly volatile. It’s not a competitor for the dollar; it’s really a competitor for gold.”

This comparison to gold, a traditional store of value, was probably seen by many as another strong legitimization of Bitcoin in the financial ecosystem.

#2 Russia’s Putin Signals Openness To Bitcoin

Adding to the momentum, Russian President Vladimir Putin made comments during the Russia Calling forum that many interpret as an endorsement of Bitcoin.

“Who can ban Bitcoin? Nobody,” Putin stated. “And who can prohibit the use of other electronic means of payment? Nobody. Because these are new technologies. And no matter what happens to the dollar, these tools will develop one way or another because everyone will strive to reduce costs and increase reliability.”

The backdrop to Putin’s comments includes speculation about a forthcoming “Bitcoin Space Race” between global superpowers. President-elect Donald Trump, during his election campaign and at the Bitcoin 2024 conference in Nashville, pledged to establish a Strategic Bitcoin Reserve in the United States. He even suggested that part of the US debt could be “paid off” with Bitcoin.

David Bailey, CEO of BTC Inc and advisor to Trump’s team, emphasized the urgency of this initiative on X: “The Bitcoin Space Race is here. […] It couldn’t be more clear what’s happening. It must be a national priority to stand up the Strategic Bitcoin Reserve in the first 100 days of the Trump admin. We need an aggressive plan to grow USA’s proportional ownership of the Bitcoin supply.”

#3 Strong Spot Demand And Institutional Interest

The surge was underpinned by robust spot market activity and significant institutional participation. During the ascent, open interest in Bitcoin futures skyrocketed by more than $4 billion, according to data by Coinalyze. Funding rates also reached unprecedented levels, surpassing peaks seen two weeks ago when Bitcoin first hit $99,500.

Importantly, the rally was driven by spot markets and not only derivative speculation, indicating a healthy and sustained demand. The infamous “Great Sell Wall” at $100,000, which had previously resisted upward movement, was decisively breached on the second attempt.

Market analysts are speculating that major players like Michael Saylor may have been behind the substantial buying pressure. Notably, MARA Holdings, Inc., the largest publicly traded Bitcoin mining company by market capitalization, recently raised $850 million through an offering of zero-coupon convertible senior notes due 2031. While unconfirmed, there is a strong possibility that MARA utilized these funds to accumulate Bitcoin during the price run-up.

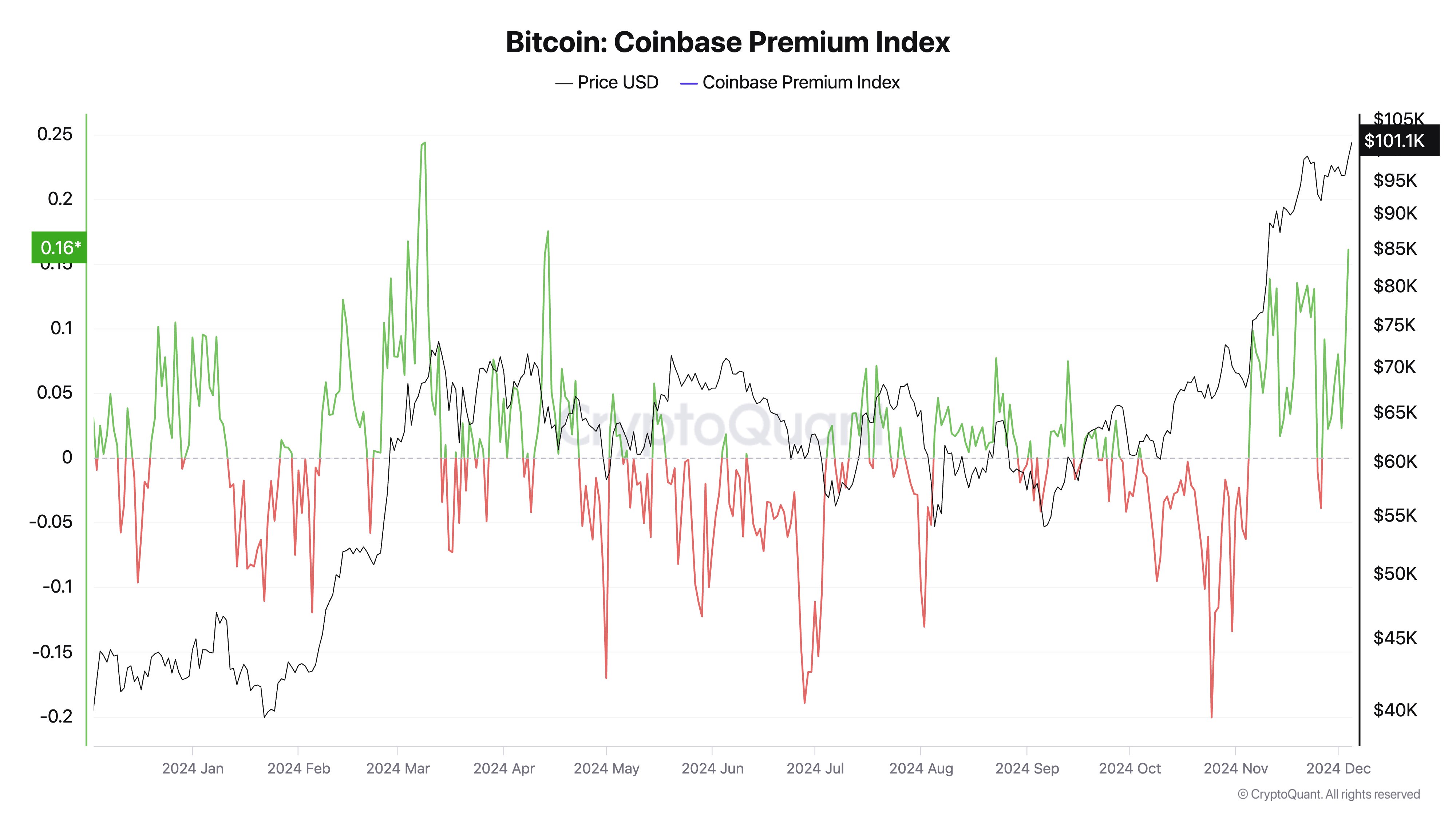

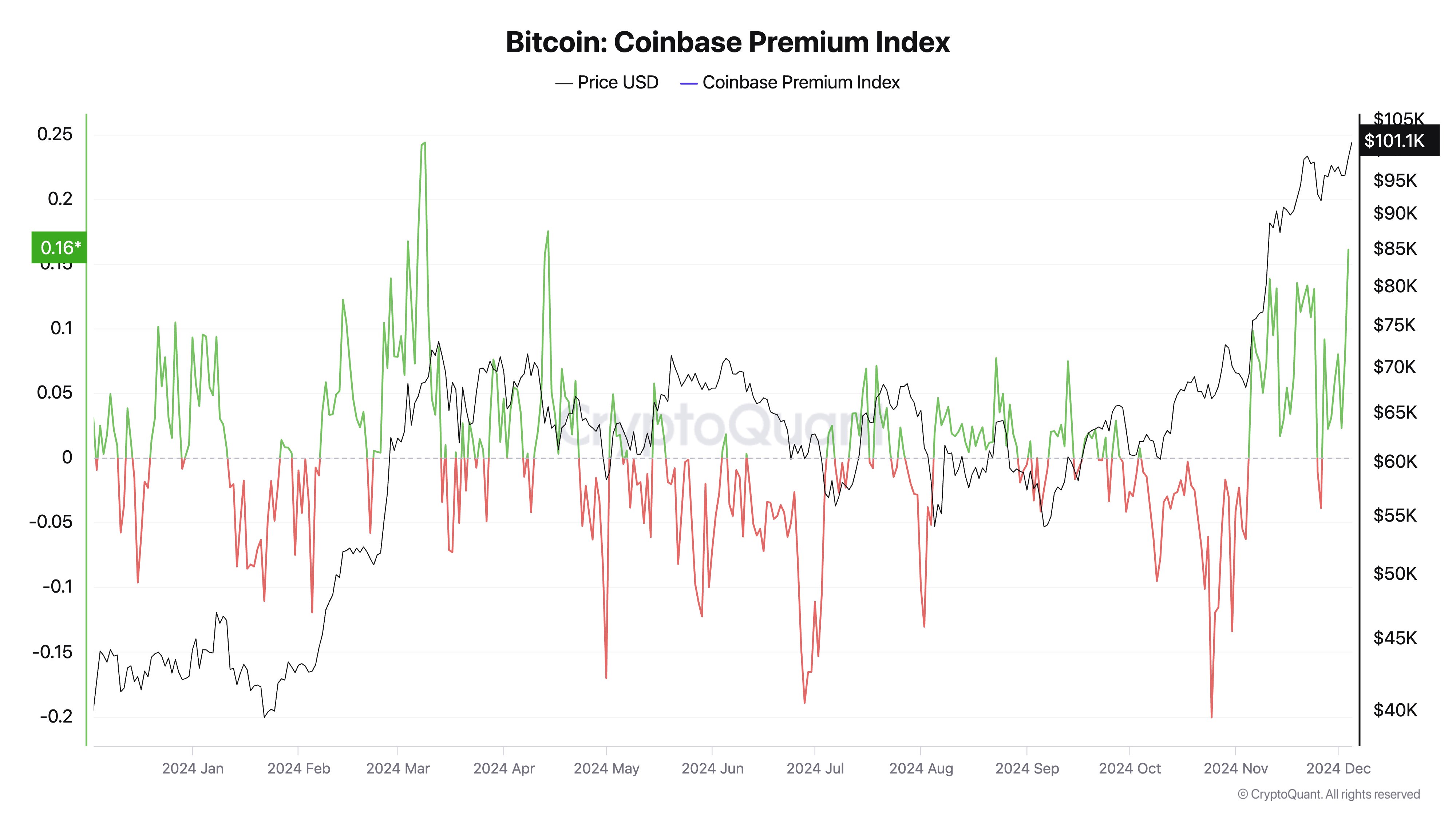

Supporting this notion, CryptoQuant reported: “Bitcoin passes $100k as institutional demand drives the market. The Coinbase Premium Index highlights sustained buying pressure from US investors.”

#4 Retail Market In Disbelief

Despite the bullish momentum, retail traders appear to be in a state of disbelief. On-chain analytics firm Santiment observed that while whale accumulation continues to strengthen, retail sentiment remains cautious.

Santiment noted: “With whale accumulation continuing to look strong, the only factor holding back $100K BTC history being made is retail traders’ excitement.” The firm highlighted that the start of December saw increasing skepticism and expectations of a significant price retracement following November’s historic gains. However, the current social media landscape reflects “hesitance and uncertainty from traders,” with a ratio of negative to positive commentary.

“With numerous indications over the years that crypto markets move the opposite direction of the crowd’s expectations, we should feel encouraged by our fellow traders’ FUD and high profit-taking,” Santiment added. “There may be a bit more of a battle between bulls and bears at this level, but we could see the long-awaited milestone come to fruition very shortly as long as key stakeholders continue their collection of more and more BTC.”

At press time, BTC traded at $102,681.

$0.85mm/btc is the floor (@DavidFBailey)

$0.85mm/btc is the floor (@DavidFBailey)