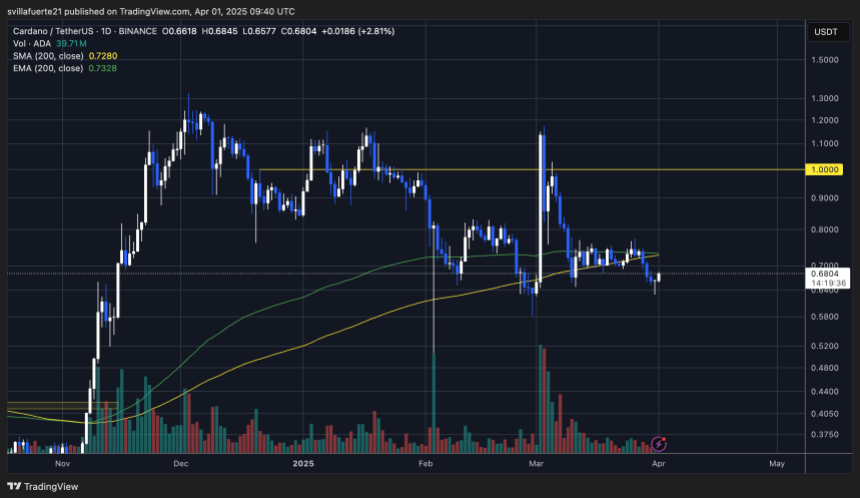

The Cardano price performance has been nothing short of shambolic since the start of May, falling from the lofty heights of $0.85 in less than two months. According to data from CoinGecko, the altcoin’s value has declined by more than 24% in the past month.

While the price of ADA saw an explosive growth at the beginning of the second quarter, the token is now back where it started in April — just above the $0.5 mark. Interestingly, the signs are pointing to further decline for the Cardano price over the next few weeks.

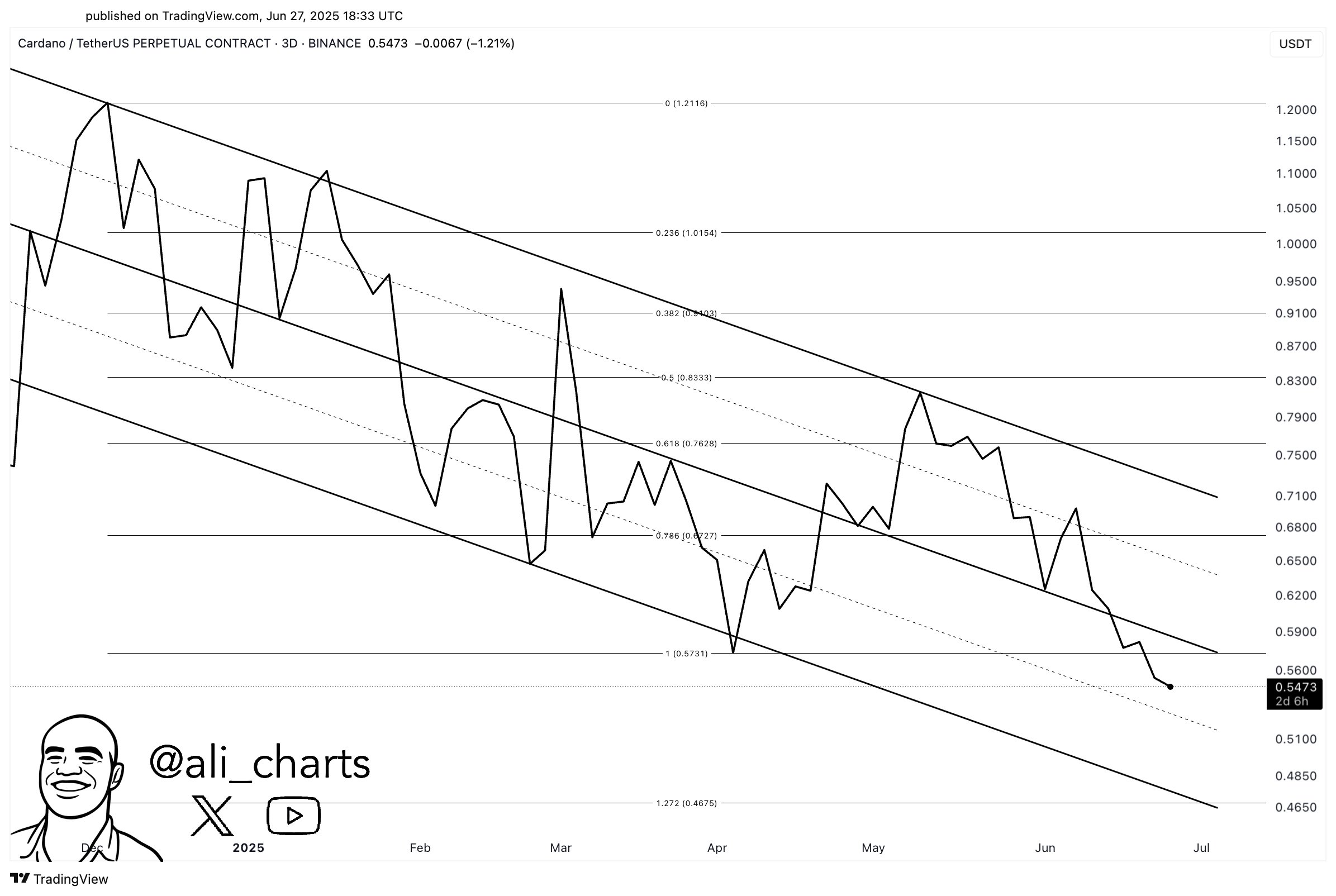

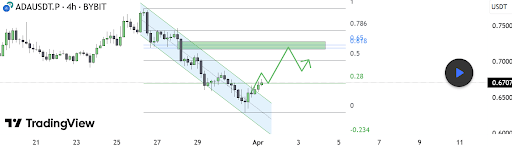

ADA Price Stuck In Descending Channel

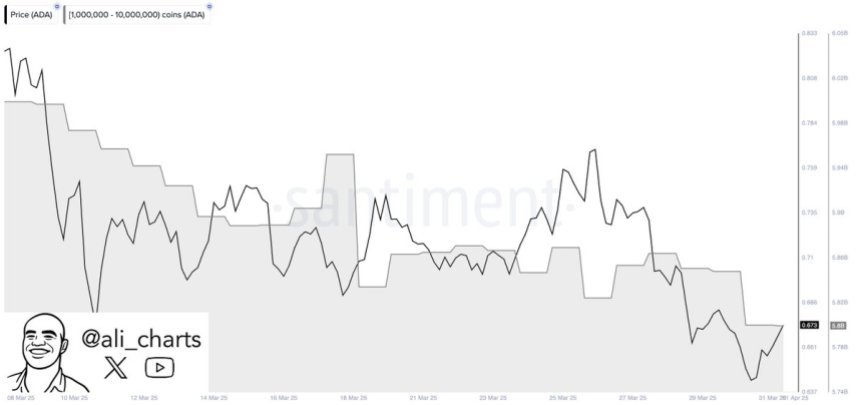

On Friday, June 27, prominent market analyst Ali Martinez took to the social media platform X to share an ominous prediction for the ADA token’s price. According to the crypto pundit, the Cardano price could be heading to around $0.47 for its next support.

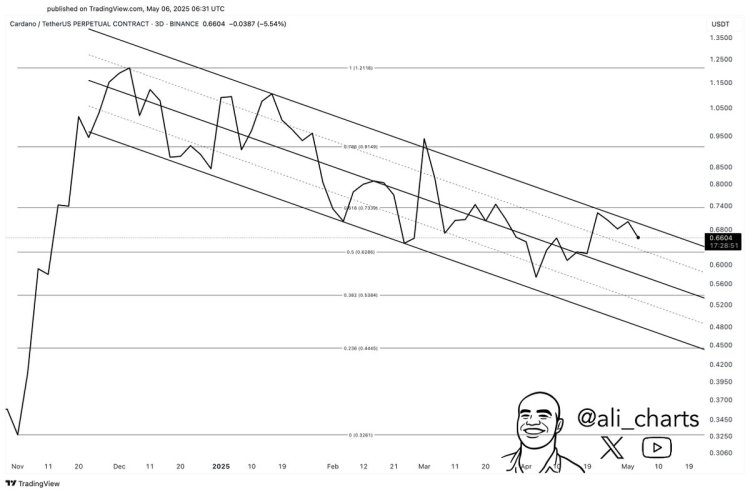

This bearish projection revolves around the appearance of a descending channel pattern on the three-day Cardano chart. A descending channel is a chart formation in technical analysis characterized by two major trendlines: the upper line acting as the resistance level and the lower line acting as the support level.

The space between these trendlines serves as the channel within which prices move over a period. Typically, the formation of a descending channel suggests the persistence of a downward price trend and lower highs. At the same time, traders can use this pattern to identify optimal entry and exit points.

The Cardano price chart above, for instance, shows that the altcoin price has been in a downward trend since last November. The token seemed to have turned its fortune around after finding support at the lower trendline in early April and running back above the $0.8 level.

However, the Cardano price failed to break the upper trendline at the beginning of May and has since been experiencing a downturn. According to Martinez, the ADA token could fall to as low as $0.47 — around the lower trendline — to find a support cushion.

Moreover, the 1.272 Fibonacci level — used in technical analysis to identify price targets and support or resistance levels — is also around the lower trendline. Ultimately, this means that the Cardano price could fall even lower than its current price point.

Cardano Price At A Glance

As of this writing, the ADA token is valued at around $0.56, reflecting a 1.3% price jump in the past 24 hours. According to CoinGecko data, the price of Cardano is down by more than 3% in the last seven days.