Cardano (ADA) is currently consolidating near a critical support zone that could shape the direction of its price action in the coming weeks. After a sharp 15% drop since Wednesday, ADA is showing signs of weakness as broader market sentiment sours amid rising geopolitical tensions. The conflict between Israel and Iran has injected significant volatility and uncertainty into global markets, spilling over into the crypto space.

ADA’s recent losses reflect this risk-off environment, as investors become more cautious and liquidity thins. The failure to hold above key resistance earlier in the month has turned previous support levels into pressure points for bulls. If ADA fails to defend the current range, further downside into lower support zones could follow quickly.

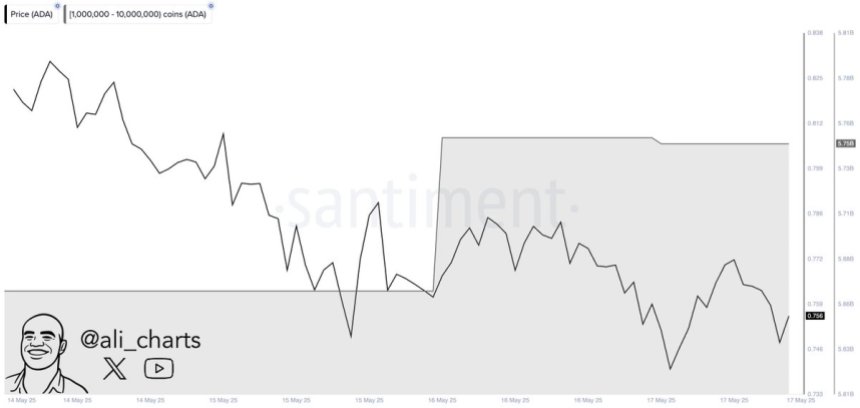

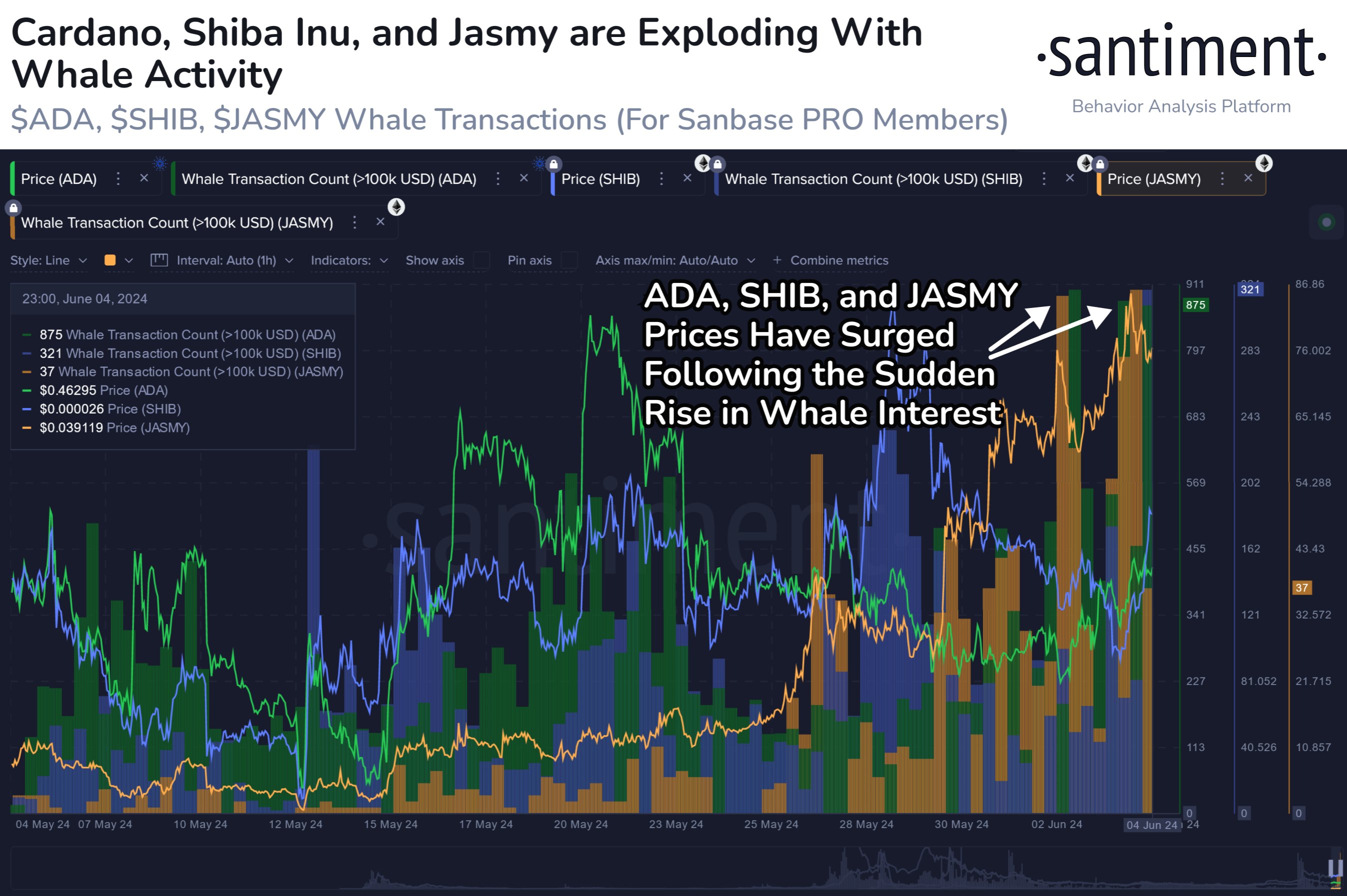

According to on-chain data from Santiment, Cardano whales have offloaded more than 270 million ADA over the past week. This significant distribution adds to the selling pressure and suggests large holders may be anticipating more downside, or at the very least, reducing exposure amid macroeconomic instability.

Whale Activity And Macro Risks Weigh On Price

Cardano remains one of the most underperforming large-cap altcoins in 2025, currently trading 85% below its yearly highs and 107% off its peak from last year. Despite a few short-lived rallies, ADA has struggled to maintain momentum and attract sustained demand. The broader altcoin market has shown signs of weakness, with capital continuing to concentrate around Bitcoin and Ethereum, leaving ADA vulnerable at key support levels.

Analysts are calling for a decisive move as ADA consolidates at a critical price zone that could define the coming weeks of action. If bulls fail to step in, Cardano could see further downside toward historical support levels. The situation is further complicated by global tensions and rising macroeconomic uncertainty. Geopolitical instability—most notably the Israel-Iran conflict—has triggered risk-off sentiment across global markets, driving volatility in crypto.

Adding to the bearish pressure, top analyst Ali Martinez shared on-chain data showing that whales have sold over 270 million ADA in the past week alone. This large-scale distribution from deep-pocketed holders highlights a loss of confidence or, at minimum, a defensive repositioning amid the current uncertainty.

For ADA to regain bullish momentum, it must defend current levels and break through resistance with strong volume support. A sustained recovery in broader altcoin sentiment could provide the tailwind ADA needs. However, with external macro risks looming and whale activity suggesting caution, investors should remain vigilant. Unless Cardano can show strength at these key levels, the road to recovery may be longer and more volatile than expected.

Cardano Struggles At Support Amid Broader Market Weakness

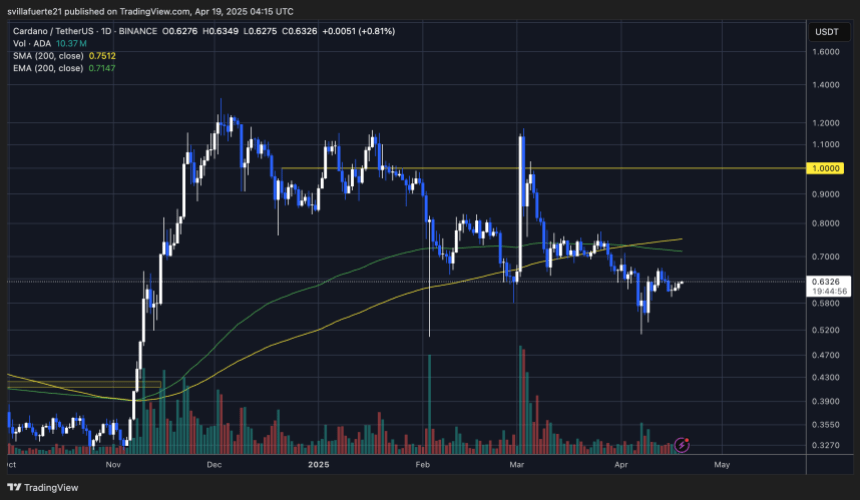

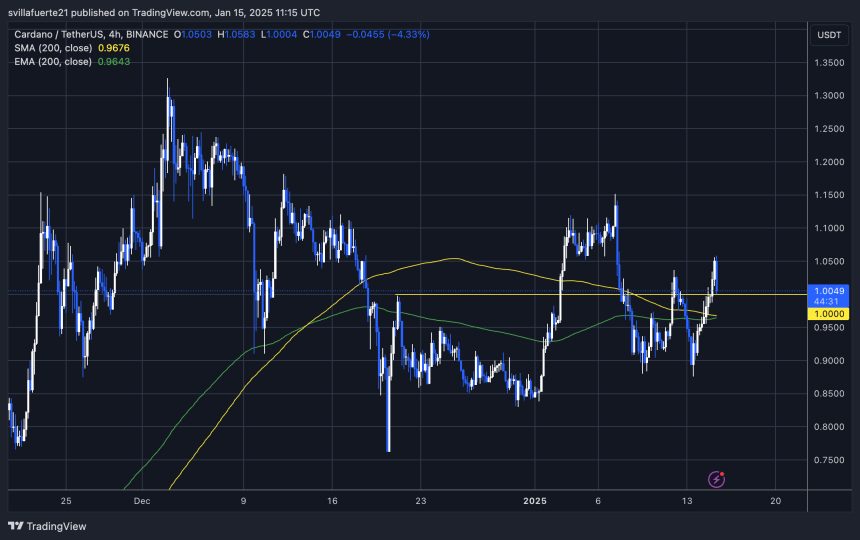

The daily chart for Cardano shows a concerning technical picture as the token trades at approximately $0.6368, nearing its critical support range. After briefly attempting to break above $0.75 in late May, ADA has since reversed course, printing a series of lower highs and failing to reclaim its key moving averages. Currently, it trades below the 50-day, 100-day, and 200-day simple moving averages, indicating a bearish structure across multiple timeframes.

The $0.63–$0.64 level now stands as a crucial zone. A breakdown below this level could open the door to further downside, potentially revisiting March lows near $0.58 or even the psychological $0.50 level if broader market sentiment continues to deteriorate. The declining volume and failure to hold above key averages signal waning bullish momentum.

Adding to the weakness, recent whale activity has raised red flags. On-chain data from Santiment revealed that whales have sold over 270 million ADA in the past week, fueling speculation about a lack of confidence among large holders.

To regain strength, ADA must hold current support and break back above the 100-day SMA around $0.70. Until then, Cardano remains vulnerable to further declines as investors grow more risk-averse amid macro uncertainty.

Featured image from Dall-E, chart from TradingView