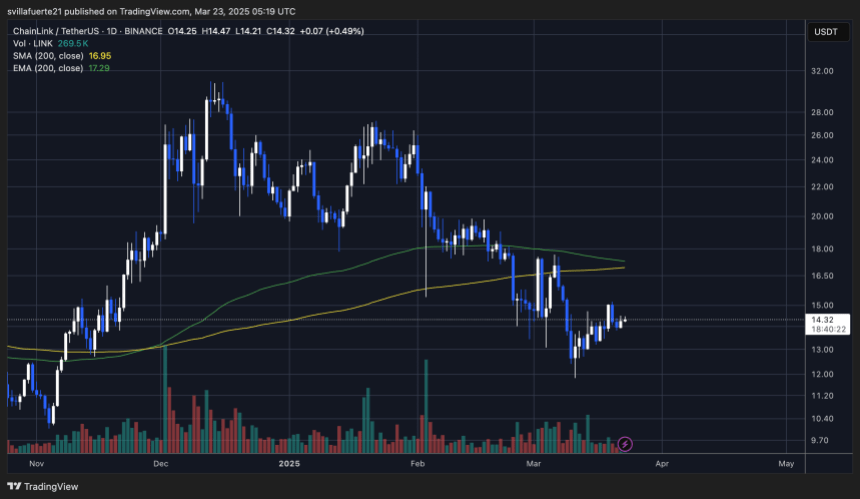

Chainlink (LINK) ended its latest session in a holding pattern, with indecisive candles and choppy intraday action pointing to a lack of clear direction. Traders now look to Bitcoin’s next move for guidance; any meaningful shift in BTC dominance could quickly tilt LINK’s price action. Until the market leader shows its hand, LINK remains on standby, hovering near key support while waiting for a decisive cue.

Falling Wedge Holds The Key To Chainlink Next Big Move

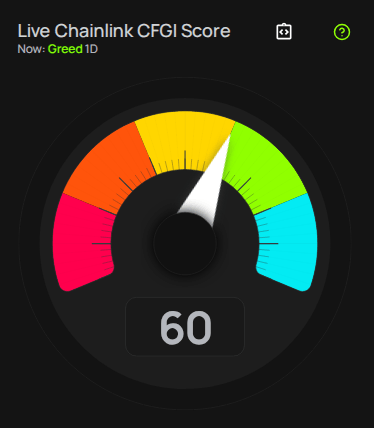

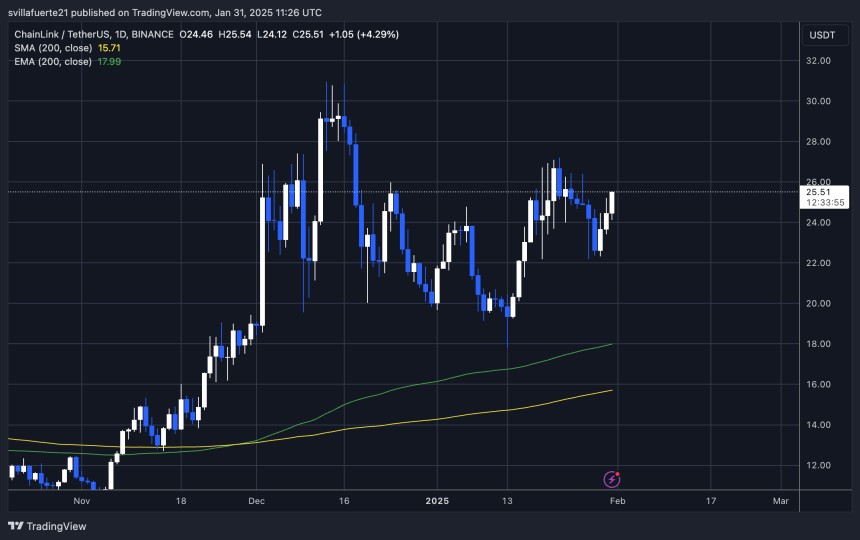

In a recent X post, CRYPTOWZRD provided an update on Chainlink’s daily technical outlook, noting that the daily candles for both LINK and LINKBTC closed indecisively. This indecision reflects uncertainty in the market as traders await clearer direction. The lack of a strong trend suggests a pause before the next significant move.

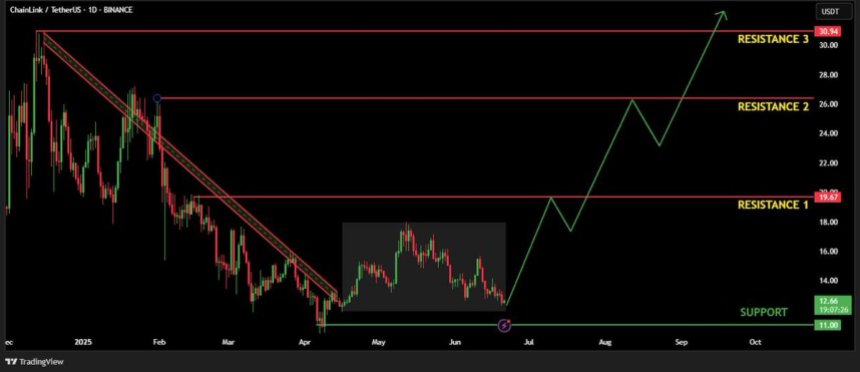

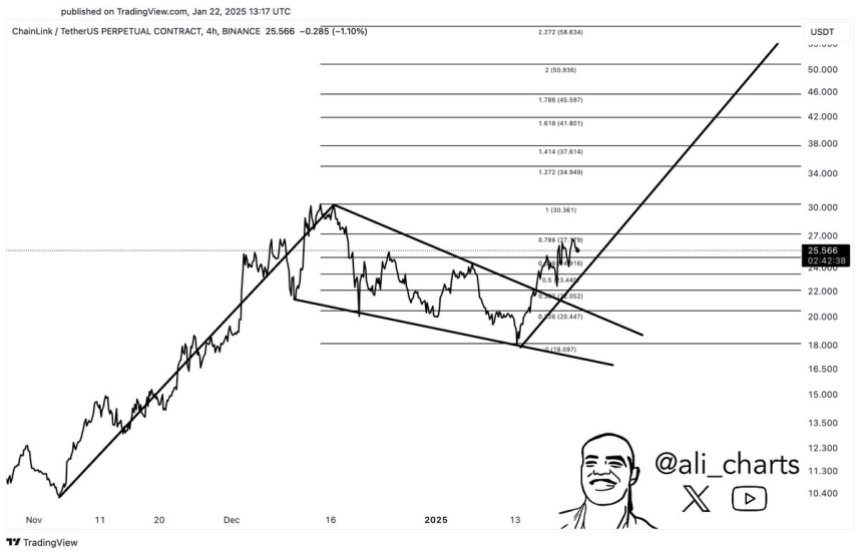

The analyst highlighted that LINKBTC is currently forming a falling wedge pattern, which is generally considered a bullish formation, especially when it appears in oversold conditions. He stressed that a breakout from this wedge is essential for Chainlink to trigger the next impulsive move upward, signaling a potential shift in momentum.

CRYPTOWZRD explained that this breakout is more likely to occur once Bitcoin dominance begins to decline. As Bitcoin’s grip loosens, altcoins like LINK tend to gain strength and follow suit. Therefore, monitoring Bitcoin dominance will be key in anticipating LINK’s next move.

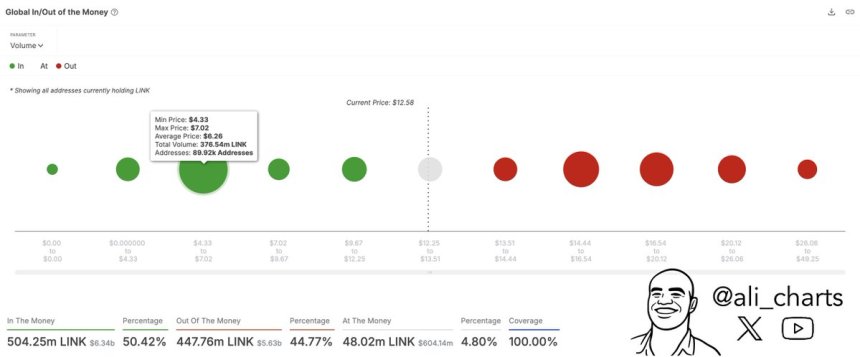

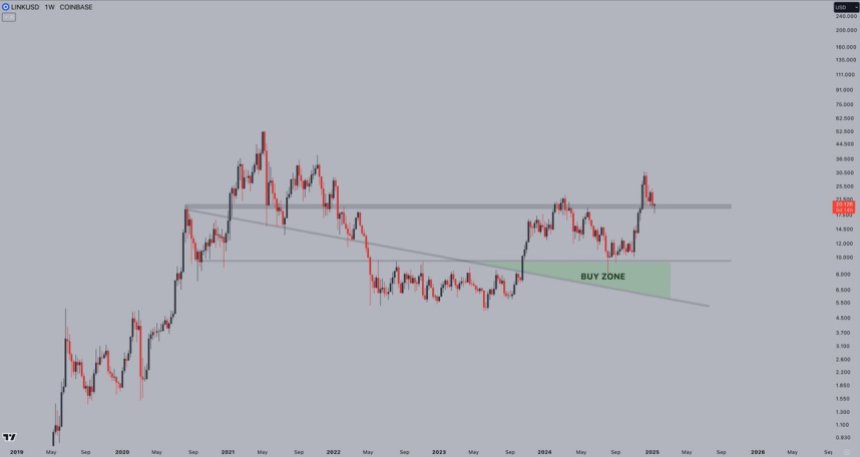

Regarding support levels, CRYPTOWZRD identified $12.50 as the critical next support target. A strong reversal from this point could ignite a rally toward the $16 resistance level or higher. This level will serve as a crucial testing ground for bullish momentum.

He concluded by mentioning that his focus remains on lower-timeframe charts to identify quick scalp opportunities. While the broader trend is developing, CRYPTOWZRD is looking to capitalize on shorter-term movements, keeping a close eye on price action and volatility.

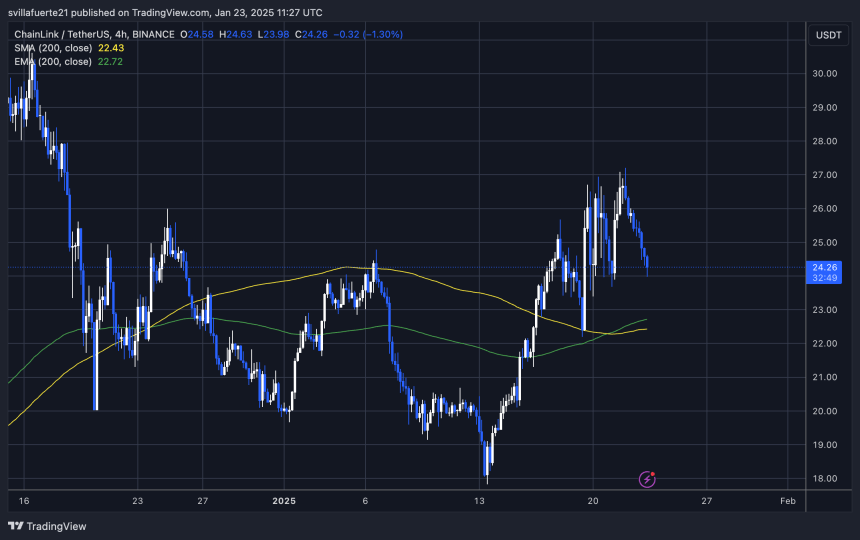

Choppy Intraday Action Keeps Bulls Cautious

Wrapping up the analysis, the analyst highlighted that LINK’s intraday chart remained sluggish and choppy, offering little in terms of clear directional bias. A possible retest of the $12.85 support level—or even a minor dip below it—could still present a bullish reversal opportunity, potentially paving the way for a push toward the $14.40 resistance target.

However, the analyst warned that if Chainlink holds below the $12.85 level, it could slip into prolonged sideways movement. This uncertain behavior will likely hinge on Bitcoin’s overall market direction, which continues to heavily influence altcoin performance. With no clear trade setup currently in play, the analyst concluded that it’s best to remain patient for a cleaner structure to emerge before making any decisive moves.