After weeks of consistent buying pressure and bullish sentiment, Chainlink (LINK) is now facing a critical moment. The price failed to reclaim the $18 resistance level and has since dropped more than 16%, showing signs of weakening momentum. This recent rejection has sparked concerns among investors and traders, as downside risk intensifies in the short term.

Top crypto analyst Ali Martinez shared a technical analysis pointing to a potential retracement toward lower demand levels. According to Martinez, the recent failure to break above key resistance may trigger further selling pressure, especially if broader market conditions remain uncertain. He suggests that LINK appears to be losing its bullish structure and could be preparing to revisit lower support levels before any meaningful rebound.

Chainlink’s current position highlights a shift in sentiment, as bulls struggle to hold key zones. While the broader market remains relatively stable, LINK’s inability to maintain higher levels could signal an early sign of deeper correction if volume and momentum do not pick up.

With volatility returning to the altcoin space, the coming days will be decisive for Chainlink. Holding above interim supports will be key if bulls want to regain control and avoid further losses.

Chainlink Struggles As Momentum Fades: Downside Risks Grow

Chainlink (LINK) is showing signs of exhaustion after weeks of upward movement, now trading under mounting pressure as the market grapples with renewed volatility and global financial uncertainty. Bulls remain active, defending key demand zones and continuing to call for a breakout, but fading momentum and growing fear are starting to weigh on sentiment.

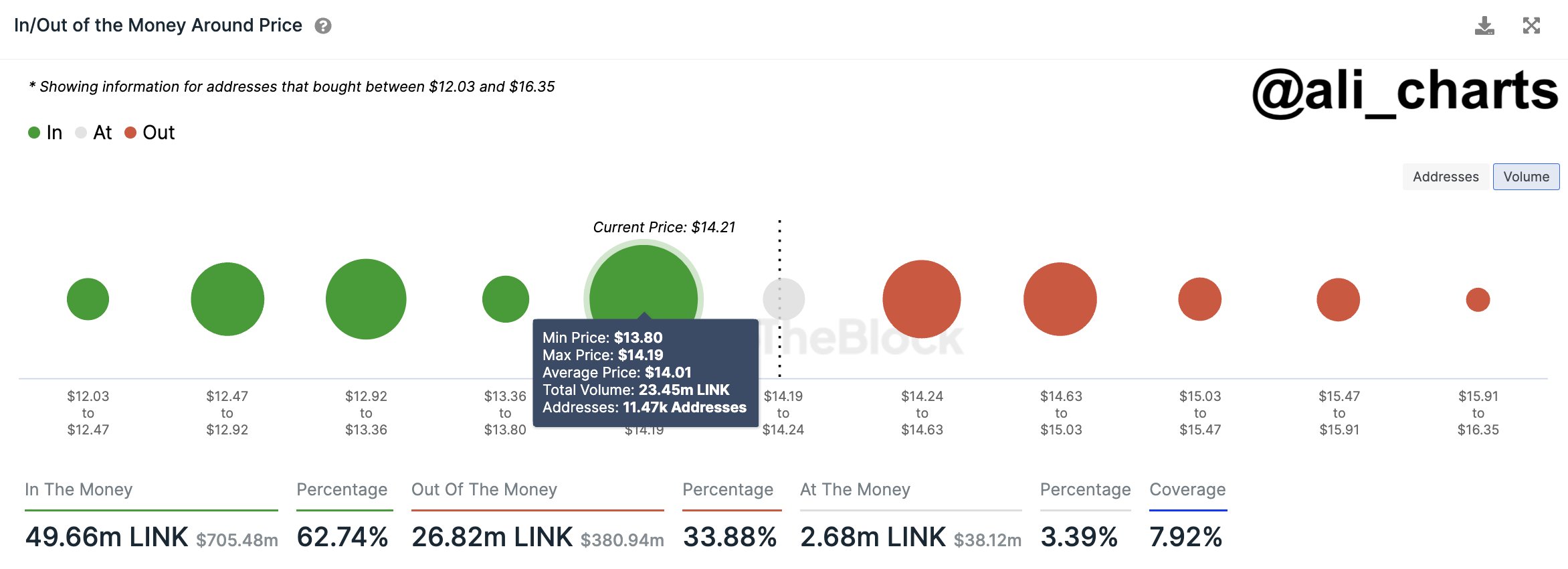

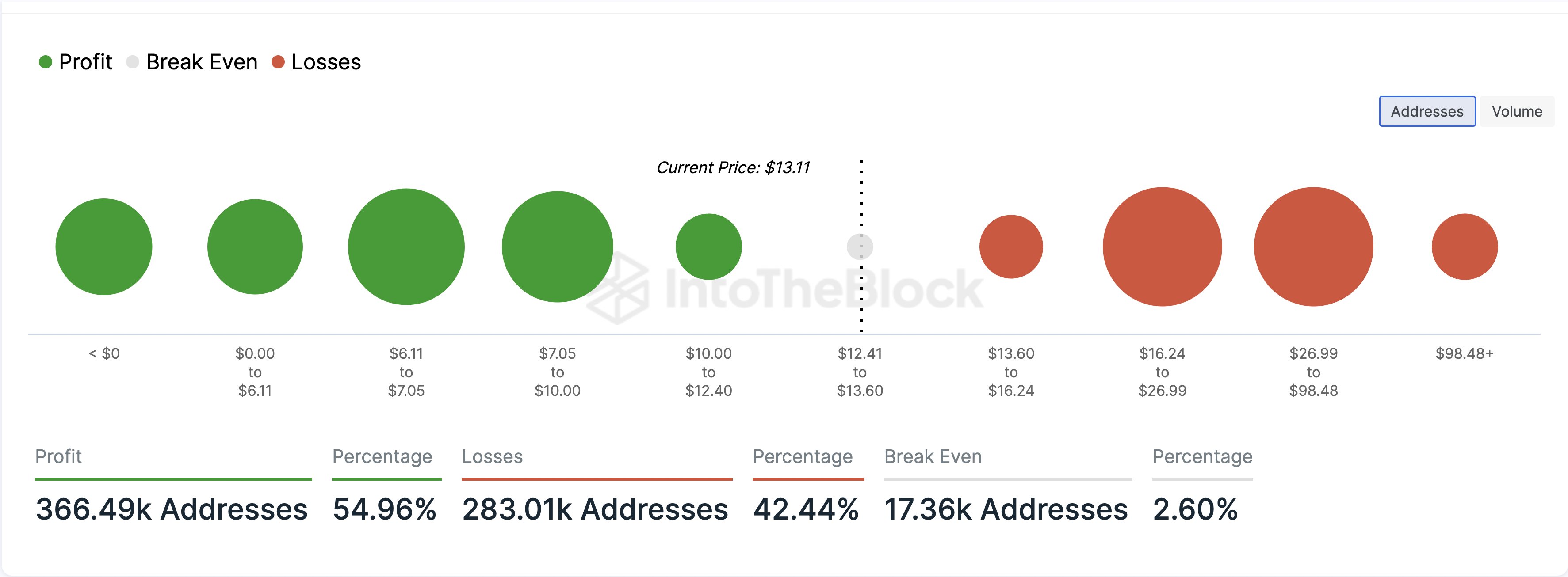

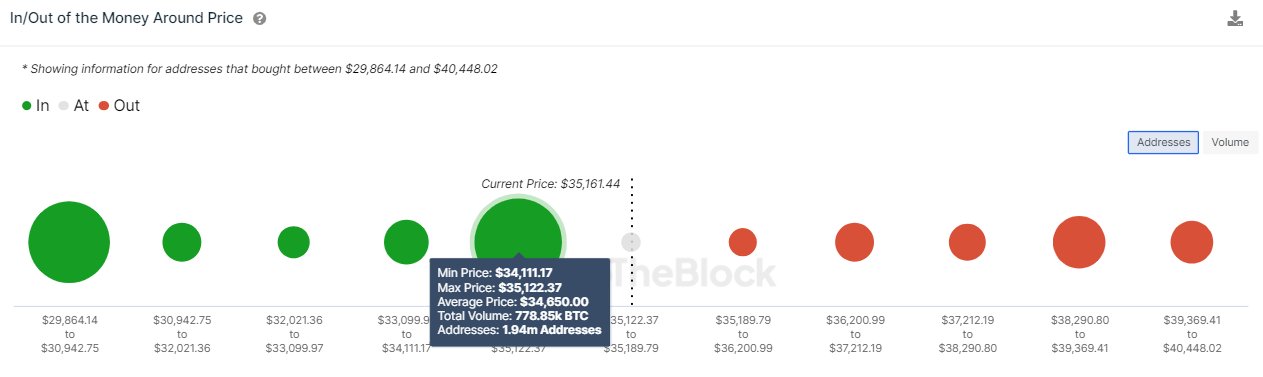

The failure to breach the $18 resistance level marked a turning point. Since then, Chainlink has slipped over 16%, losing critical support zones and entering a vulnerable technical position. According to Martinez, this rejection could be the start of a deeper correction. Martinez’s analysis suggests that LINK is now poised to revisit the $10 level — a psychological and structural support that aligns with historical price behavior.

The next few trading sessions will be crucial. If bulls can’t reclaim higher levels or at least stabilize price action above $14, the selling pressure could accelerate. Adding to the uncertainty is a broader lack of clarity in global markets, with investors closely watching central banks, inflation data, and geopolitical developments for guidance.

While some traders are still positioning for a bounce, the current structure points to caution. Chainlink’s performance in the coming days could either confirm a local top or offer a high-risk, high-reward entry point if support holds and momentum returns. Either way, the $10–$12 range may soon be tested, and how LINK responds there will define its next major trend.

LINK Faces Pullback As Buy Pressure Weakens

Chainlink (LINK) is under pressure after failing to hold above the $17.50–$18 resistance zone. The daily chart shows a sharp rejection near the 200-day SMA (currently at $17.79), followed by a 16% drop that pushed LINK below the 200-day EMA ($16). This move confirms a breakdown of bullish momentum and highlights growing downside risk as traders reassess short-term expectations.

Volume has picked up during the recent pullback, suggesting active profit-taking or renewed selling interest. The current support zone lies around $14.80–$15.00, a region previously tested in late April and early May. If bulls fail to hold this level, the next major support rests closer to $13.20, potentially opening the door for a deeper correction toward the $10 mark—an area cited by analyst Ali Martinez.

To regain momentum, LINK must first reclaim the $16 zone and flip the 200 EMA back into support. A daily close above both the 200 EMA and SMA would shift sentiment and restore the bullish structure. Until then, traders should watch for continuation signals or further weakness, especially if broader market volatility persists. LINK is in a make-or-break phase, with the next few days likely to set the tone for its short-term trajectory.

Featured image from Dall-E, chart from TradingView