What do the latest crypto IPOs mean for the market? Aaron Brogan of Brogan Law breaks it down in today’s Crypto for Advisors newsletter.

Then, Jean-Marie Mognetti, CEO of CoinShares, provides insights from their latest investor insights survey about what clients are looking for from their advisors in terms of crypto support in Ask an Expert.

Please note that there will be no newsletter next week. We are taking the week off in lieu of the holidays — we wish you a happy Canada Day and Independence Day for those celebrating. We will be back on July 10th.

– Sarah Morton

Unknown block type “divider”, specify a component for it in the `components.types` option

Cryptocurrency and the Public Markets

Cryptocurrency is typically viewed as an alternative to traditional securities markets. Lately, this trend may have reversed, as cryptocurrency is increasingly a factor in public equity markets.

Since January, there have been three major crypto IPOs:

May 14, 2025 – eToro Group Ltd., a trading platform, raised approximately $619 million in its initial offering, valuing the company at about $5.6 billion. Its market cap has since decreased slightly to $5.17 billion.

May 16, 2025 – Galaxy Digital Inc. uplisted from the Toronto Stock Exchange to Nasdaq, raising approximately $602 million in a mixed primary and secondary share sale priced at $19 per share. The deal valued the company at just over $8 billion. Its market cap has since settled at approximately $7.19 billion.

June 5, 2025 – Circle Internet Group Inc., the issuer of USDC, raised approximately $1.05 billion in its IPO, selling 34 million shares at $31 apiece. The offering initially valued the company at about $8 billion, but a sharp post-offering rally has pushed its market cap to $43.9 billion.

Each of these IPOs is remarkable, considering the extremely punitive regulatory environment of just one year ago, but Circle is in a class of its own. Circle raised the most money, and in the immediate aftermath, its stock popped by many multiples, indicating overwhelming demand. The pop was so extreme, in fact, that some felt the firm “left money on the table” and questioned the motives of the bankers involved.

In the wake of Circle’s success, a number of other cryptocurrency firms are considering public offerings. On June 6, Gemini announced that it had submitted a confidential S-1 to the SEC, and on June 10, it was reported that Bullish followed. Numerous other firms, including Kraken, BitGo and ConsenSys, have reportedly also considered public turns.

Yet, for these aspirants, the $20 billion question remains: Why has Circle exceeded expectations? Here are my three theories:

1. Public Market Comps

Circle was not the first crypto company to outperform. Most famously, Michael Saylor’s MicroStrategy (d/b/a Strategy) has, in recent years, become a bitcoin holding company with a rump software business. Currently, Strategy holds 592,100 bitcoin, valued at approximately $62 billion, compared to about $460 million in annual revenue from its legacy business lines.

Strategy is a publicly traded company, allowing retail customers with brokerage accounts to purchase its stock and gain exposure to bitcoin. In theory, its market cap should be the sum of (1) the value of its bitcoin, plus (2) some de minimis premium for the rest. Generously, this might be $66 billion. But in reality, its market cap is $101 billion, prompting commentators to suggest that “the U.S. stock market will pay $2 (or more) for $1 worth of crypto.”

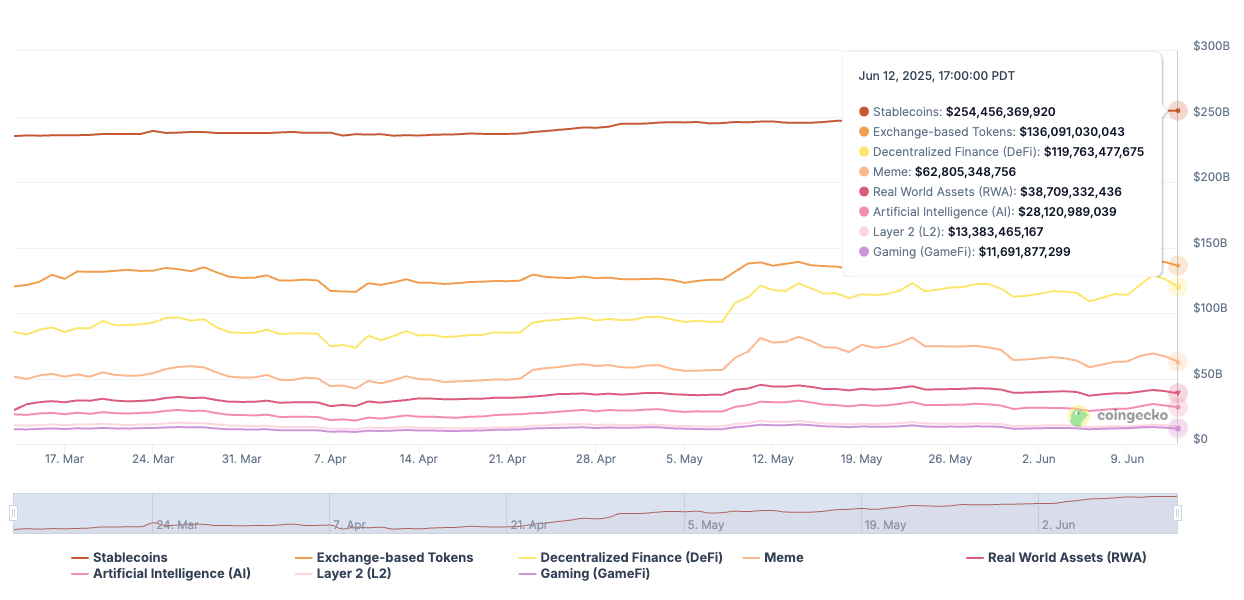

Circle’s business model involves buying conventional vanilla financial assets (mostly short-dated U.S. Treasury bills) and then issuing cryptocurrency — roughly the opposite of Strategy — but it may benefit from the same premium.

2. The GENIUS Act

Over the past several months, Congress has advanced the GENIUS Act, a piece of legislation intended to govern the regulatory treatment of stablecoins. This bill passed through the Senate last week and is expected to become law in the near future.

In this theory, GENIUS will bring regulatory clarity, enabling the stablecoin ecosystem to thrive. In particular, the bill includes a prohibition on yield, which will disallow stablecoin issuers from passing on the yields they earn from holding collateral to token holders. Perhaps this increases issuers’ value.

Complicating this, however, is the likelihood that the bill will bring increased competition from banks, such as JPMorgan’s recently announced tokenized deposits. Per Stablecon founder Nik Milanović, “If I were Circle, I would be concerned about bank issuers of stablecoins.”

3. Treasury Instability

Finally, there is the macro. Market factors have pushed up Treasury yields in recent months, and if this trend continues, it could be very lucrative for stablecoin issuers. Most issuer revenue comes from yields on the collateral they hold, so when those go up, the issuers benefit.

Importantly, the biggest risk these issuers face is rates returning to zero, in which case they would lose the majority of revenue and may not be solvent for long. Perhaps a rerating of the quality of U.S. sovereign debt has increased the long-term value of this class of business.

Looking Forward

Of course, Circle’s rise could be froth, too. Circle’s market cap is now more than half that of Coinbase. For 10-K enthusiasts, this is a bit puzzling, as Coinbase has a contractual right to half of Circle’s reserve revenue, as well as other business lines.

For further reading, view the coverage of the Circle IPO.

– Aaron Brogan, founder and managing partner, Brogan Law

Unknown block type “divider”, specify a component for it in the `components.types` option

Ask an Expert

Q. What does the survey data say?

A. The survey reflects a clear shift in investor behavior: digital assets are no longer a side conversation. They’ve entered the core of how investors think about wealth — and they’re not waiting for permission. Nearly 9 in 10 crypto holders plan to grow their allocation this year. That’s not hype, that’s commitment. However, what stood out most was the tension: investors are clearly seeking guidance, yet they don’t always trust the advice they’re being offered. We’re seeing a generation of investors who are self-directed, well-informed, and fully engaged. They’re not rejecting the role of the advisor, but they are raising the bar. They want intelligent, transparent conversations about crypto, and they expect their advisor to keep pace with them. That’s a reality the industry has to face head-on.

Q. What does this mean for advisors?

A. It’s an opportunity for advisors to strengthen client trust by expanding their expertise. Clients aren’t just asking for access to crypto — they’re asking whether their advisor actually understands it. And if 29% of them say a lack of experience or poor communication around risk would make them walk away, that’s not a marginal issue. Advisors still play an essential role, but the model has evolved. What clients want is strategic insight and transparency. They want someone who has taken the time to understand the ecosystem and can speak fluently about risk, custody, and product structure. If an advisor can do that, they’re not just protecting client capital, they’re earning long-term trust. That’s the difference between offering a product and earning a relationship.

Q. What specific type of support are clients looking for?

A. Clients are seeking guidance that strikes a balance between opportunity and caution. The most valued support isn’t about picking tokens — it’s about managing risk, navigating regulation, and accessing secure vehicles like ETFs or trusts. Over half of the investors we spoke to say that risk oversight is one of the most important roles an advisor can play in the crypto space. That’s a huge opening. Especially for younger or sub-HNW investors, crypto is where they’re building — and they need informed guidance. Advisors who step into that role thoughtfully can help shape the next phase of wealth creation.

– Jean-Marie Mognetti, CEO, CoinShares

Unknown block type “divider”, specify a component for it in the `components.types` option

Keep Reading

- The US Federal Housing Finance Agency is reviewing whether crypto holdings like bitcoin could be used to qualify for mortgages.

- Texas has become the first U.S. state to create a publicly funded, stand-alone bitcoin reserve.

- The U.S. Federal Reserve Board announced on June 23 that it will no longer include reputational risk in its bank examination programs, removing a barrier for banks to support crypto companies.