How to Earn Cryptocurrency in 2021: 5 Popular Ways Compared

Are you looking to earn cryptocurrency in 2021?

You are in the perfect place!

2020 has been an excellent year for crypto, and the industry has been booming in 2021 as well, reaching an almost $1 trillion market cap by the end of January.

Since the space has gone through major changes recently, users can earn digital assets in numerous ways in 2021.

In this article, we have selected and compared the best methods to earn bitcoin this year and completed our calculations to determine the most profitable ones.

As a result, you will be able to pick the right method by the time you reach the end of this guide.

Let’s dive in!

Disclaimer: All our tests are theoretical and based on historical and projected market data. For all our examples, we will use a $10,000 investment and calculate how much we can make off it with each method.

What Is the Best Way to Earn Crypto in 2021?

Based on our tests, the most profitable methods to earn crypto rank in the following order:

- Hodling: 1900% ROI with moderate risks and easy difficulty

- Staking: 124.79% ROI with moderate risks and easy difficulty

- Trading: 16.19% ROI with low risks and moderate difficulty

- Lending: 6.98% ROI with low risks and easy difficulty

- Mining: -11.11% ROI with moderate risks and high difficulty

If you are willing to take some risks, holding cryptocurrency for longer periods is an excellent choice, along with staking. As it’s easy to get started, both staking and crypto hodling are beginner-friendly ways to earn digital assets.

For those looking for decreased risks, cryptocurrency trading – without risking too much capital and using stop orders to protect their positions (like in our example) – and lending are excellent strategies.

On the other hand, Bitcoin mining is only worth considering for those with access to cheap electricity or the necessary capital to set up a mining farm.

Based on our results, we believe that holding coins, lending on DeFi platforms, as well as digital asset trading – with a shift to social- and copy-trading, and simplification – will experience increased popularity in 2021.

While staking will remain a favorable option to earn cryptocurrency among users, we expect it to become less popular in the future.

On the other hand, due to the negative and very limited potential for profits as well as the high difficulty to get started, cryptocurrency mining won’t be so popular as before in 2021 and beyond.

In the meantime, we recommend taking a look at Nominex to get started with cryptocurrency trading, holding NMX coins, and digital asset staking.

1. Bitcoin Mining

Risks: Medium

Earning Potential: Very low

Difficulty: Hard

Bitcoin mining is one of the oldest ways to earn crypto.

Cryptocurrencies based on the Proof-of-Work (PoW) consensus mechanism use decentralized blockchain networks in which miners leverage their computing power to maintain the ecosystem.

In exchange for verifying transactions and adding new blocks to the chain, Bitcoin miners receive block rewards and a share of transfer fees.

Bitcoin mining has been a lucrative business model to earn crypto in the past, but its profitability has decreased significantly in recent years.

The mining space has been dominated by large farms that have access to cheap electricity and loans to bulk-order new generation hardware.

Furthermore, the BTC hashrate has been hitting record-high levels lately (which indicates an intense competition between miners), while May’s halvening decreased the rewards from each newly mined block from 12.5 BTC to 6.25 BTC.

For that reason, Bitcoin mining has moderate risks while it can be difficult to get started for new users (as they have to learn how to set up and operate their equipment).

With that said, let’s see how much you can earn from mining Bitcoin in a year.

How to start mining?

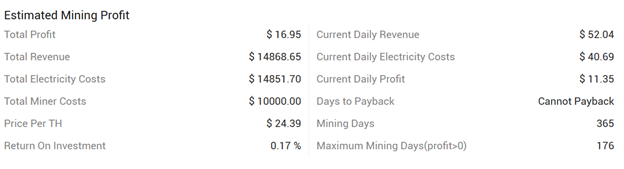

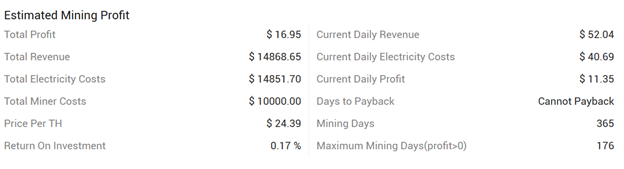

To start out, we need to cover some upfront costs to purchase mining hardware. For our example, we will use Bitmain’s Antminer S19 Pro ASIC miner, which has a 110 TH/s hashrate, consumes 3,250 W, and costs $2,684 at the current market price.

Based on our budget of $10,000, we could buy nearly four S19 Pro miners.

Since that would cost $10,736, which exceeds our budget, we will adjust the hashrate and the power consumption to reflect the $10,000 investment (the last rig will have a hashrate of 80 TH/s while consuming 2,360 W for $1,948).

In addition to our rig, we also have to take the following expenses into account:

- Electricity costs: The costs of the electricity the mining equipment uses when running. We will use the world average of $0.14/kWh for our example.

- Mining pool fees: The fees mining pools charge for their service. We will use a 2% fee here, which we will deduct from our total revenue.

For our example, we will use BTC.com’s mining calculator.

As a side note, we will utilize the current Bitcoin price to calculate our projected earnings and a difficulty increase of 2% every two weeks.

We used the average for all our rigs’ statistics and inputted them in the calculator (e.g., one miner costs $2,500 on average).

As you can see, we only made $16.95 in 365 days without even deducting the mining pool’s fees, which will provide us with a $-280.5 ($14,571.2 – $14851.70) result.

Furthermore, we didn’t take our mining rig’s costs into account. As new hardware models appear on the market every day, our equipment’s value will decrease over time. Let’s say we are lucky and we can sell each for $1,500 ($6,000 in total) after a year of use.

As a result, our mining operation would provide us with a $2,572 loss and a Return on Investment (ROI) of -11.11% ($20,571 revenue vs. $23,143 expense).

However, if we could operate our mining farm from a place with cheap electricity prices, our business could potentially become profitable. For example, with electricity costing $0.08/kWh, we could make a $3,793 profit ($20,571 revenue vs. $16,778 expense) with a 22.6% ROI.

Earn crypto with Trading

Risks: Varies (low in the case of our example)

Earning Potential: Medium

Difficulty: Medium

Cryptocurrency trading refers to the practice in which traders enter into quick, short-term positions to profit on digital asset price movements.

Crypto trading has been around since the industry’s early stages, with excellent products and services built over the years to benefit traders.

As a result, there are plenty of cryptocurrency exchanges where users can trade digital assets.

With that said, we recommend checking out the cryptocurrency trading platform Nominex that allows both beginner and veteran traders to make (potential) profits on the rising digital asset market.

The platform offers demo accounts where users can test their skills and expand their knowledge of the cryptocurrency market, while also providing 10 beginner-friendly video lessons in the Cryptotrading Camp.

Furthermore, users can earn a total of 1,120 USDT and 109 NMX tokens each day by participating in demo trading tournaments without any risks.

The risk level for cryptocurrency trading is based on the strategy users utilize. In our test, we will use only a small part of our capital for each position with stop orders in place to limit our risks. Also, we will only trade on the spot market without any leverage.

Since it’s very hard to predict the ROI of cryptocurrency trading, we will use a fixed model to calculate how much we can earn while trading crypto. For that reason, we have to take the following into account:

- Win/loss ratio: The proportion of trades we win. In this example, we will win 50% and lose the other half of our trades.

- Risk/reward ratio: It shows the potential rewards for every dollar we risk. Here, we will use a 3:1 ratio, meaning that we will gain $3 for every $1 we risk. With every winning trade, we will make 3% and lose 1% for every position where our strategies didn’t work out as expected (before deducting exchange fees).

- Exchange fees: The fees the cryptocurrency exchange charges for each trade we make on the platform. It’s important to note that service providers deduct this cost instantly after entering into a position or exiting one.

- Trading frequency: This refers to how often we make trades. Let’s place 30 trades a month (360 a year).

- Average position size: The average amount we use to enter into a position. Let’s keep this at $500 (5% of our initial capital).

With the above factors, we can calculate our average profits and losses, as well as our total revenue, expenses, and ROI.

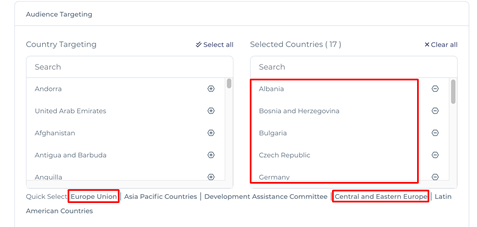

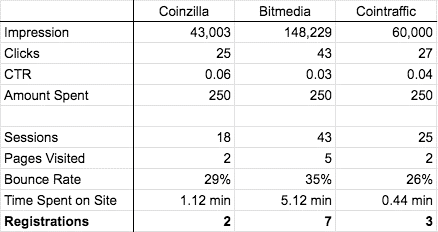

Comparing trading fees on exchanges

Compared throughout three different crypto exchanges (Nominex, Binance, Huobi), you can see the results in the following table:

|

Nominex |

Binance |

Huobi |

| Trading fees (taker) |

0.1% |

0.1% |

0.2% |

| Average trading fees per winning trade |

$1.015 |

$1.015 |

$2.03 |

| Average trading fees per lost trade |

$0.995 |

$0.995 |

$1.99 |

| Average profits per winning trade |

$13.985 |

$13.985 |

$12.97 |

| Average losses per lost trade |

$5.995 |

$5.995 |

$6.99 |

| Total income |

$2,517.3 |

$2,517.3 |

$2,334.6 |

| Total expense |

$1,079.1 |

$1,079.1 |

$1,258.2 |

| Total profit |

$1,438.2 |

$1,438.2 |

$1,076.4 |

| ROI |

14.38% |

14.38% |

10.76% |

Trading the native tokens of exchanges

Now let’s see how much we would make when holding the native tokens of each exchange (NMX, BNB, HT) and using them to cover our trading fees (for Huobi, we will hold 500 HT).

|

Nominex |

Binance |

Huobi |

| Trading fees (taker) |

0.050% |

0.075% |

0.12% |

| Average trading fees per winning trade |

$0.5075 |

$0.7612 |

$1.218 |

| Average trading fees per lost trade |

$0.4975 |

$0.7462 |

$1.194 |

| Average profits per winning trade |

$14.4925 |

$14.2388 |

$13.782 |

| Average losses per lost trade |

$5.4975 |

$5.7462 |

$6.194 |

| Total income |

$2,608.65 |

$2,562.98 |

$2,480.76 |

| Total expense |

$989.55 |

$1,034.32 |

$1,114.92 |

| Total profit |

$1,619.1 |

$1,528.66 |

$1,365.84 |

| ROI |

16.19% |

15.29% |

13.66% |

As you can see, while Huobi provided us the most discounts (since their fees are the highest among the three exchanges), we generated the most profits and the best ROI on Nominex.

Also if you obtain partner level ‘MAX’, Nominex grants the opportunity to trade with 0 commission, which means that ROI will increase even further.

To predict future earnings more precisely as well as expand your skills and knowledge, we recommend testing and implementing multiple trading strategies with Nominex’s demo account.

Since you can use up to 10,000 virtual USDT to trade cryptocurrencies, there are no risks involved.

If you are up for the challenge, be sure to participate in either a demo or a real trading tournament to win USDT and NMX tokens every day.

Hodling Crypto

Risks: Medium

Earning Potential: High

Difficulty: Easy

Similar to the previous methods, “holding” crypto is among the oldest and most popular ways to earn digital assets.

While cryptocurrency trading refers to quick, frequent, and short-term buys and sells, holding or investing in digital assets means a longer commitment for users (ranging from a few months to several years).

With this method, you purchase a cryptocurrency and hold it inside your wallet for moderate to longer periods before selling it.

It’s important to mention that digital assets can be subject to intensive price swings, which can increase the volatility and the risks for investors.

As we can’t provide a precise prediction on future digital asset prices, we will take the historical values of the cryptocurrencies we analyze into account.

In this section, we will show potential earnings ($10,000 investment) for Bitcoin (BTC) and two exchange tokens: Binance Coin (BNB) and Huobi Token (HT).

As a bonus, we will also show some example calculations for Nominex’s native NMX token, which is being distributed to investors and traders at the moment.

|

Bitcoin |

Binance Coin |

Huobi Token |

| Initial price (December 2, 2019) |

$7,303 |

$15.23 |

$2.88 |

| Final price (December 2, 2020) |

$19,180 |

$30.65 |

$4.03 |

| ROI |

162.63% |

101.25% |

39.93% |

| Total profits |

$16,263 |

$10,124 |

$3,993 |

The table above clearly shows excellent profits for all three coins, with Bitcoin taking the lead and BNB and HT closely following the cryptocurrency in terms of earnings.

Now let’s see how NMX has performed for early investors in terms of price.

Nominex started the official distribution of NMX in February with an initial value of 0.1 USDT. By now, the cryptocurrency’s price has increased to around 2 USDT, which means a 1900% ROI and $190 000 in profits for early adopters who invested $10,000 in the coin in the beginning.

As a result, NMX’s gains outrank the other three cryptocurrencies we have analyzed earlier (in terms of investing).

To learn more about the rewards and potential earnings for holding NMX, we recommend taking a look at the following page on Nominex’s website.

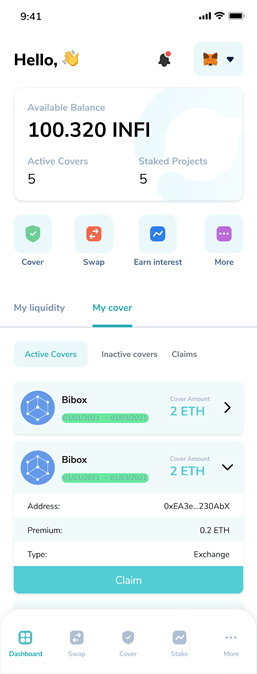

Staking

Risks: Medium

Earning Potential: High

Difficulty: Easy

The Proof-of-Stake (PoS) consensus mechanism is becoming increasingly popular among cryptocurrency projects, especially with the launch of Ethereum 2.0.

Unlike the PoW model, PoS and its variants don’t require validators to leverage their computational power via mining rigs to maintain the blockchain.

Instead, validators lock up a specific amount of their tokens to verify transactions and add new blocks to the chain in a process called staking.

In exchange, stakeholders get rewards on their coins, which allows them to make a passive income (similar to DeFi lending) with the cryptocurrency they hold.

To maximize their chances, stakeholders can join staking pools and services where users combine their tokens to share the profits.

However, contrary to lending stablecoins, staking comes with higher risks for investors as the cryptocurrencies they lock up can be subject to increased price swings and inflation.

For the same reason, crypto enthusiasts have more earning potential with staking as their coins could increase in value while they are locked up.

In our example, we will use TRX for staking, the native token of the highly-scalable, DPoS-based (Delegated Proof-of-Stake) TRON crypto project, which has been widely popular among stakeholders.

Compare staking efficiency

We will compare earnings from TRX staking across three platforms: Nominex, Atomic Wallet, and Staked.

To calculate the projected profits from staking, we have to take the following factors into account:

- APY: The annual interest stakeholders earn on the coins they lock up. This is 9% for Nominex (based on our results from the calculator on the crypto exchange’s website), 5% for Atomic, and 7.9% for Staked.

- Price movements: The increase or decrease in the value of the digital assets users stake. We will base this one on the TRON price changes between December 2, 2019 and December 2, 2020.

- Pool fees: Pools usually charge a percentage-based fee, which they deduct from the profits stakeholders earn. While there are no fees for staking on Atomic, Staked charges a 10% fee, and Nominex uses tiered commissions for its staking service based on the number of NMX coins users hold. For Nominex, we will compare three different fee rates, Starter (10%), Pro (6%), and VIP (3%).

Now let’s see the results!

|

Staked |

Atomic |

Nominex Starter |

Nominex Pro |

Nominex VIP |

| Fees |

10% |

0% |

10% |

6% |

3% |

| APY |

7.9% |

5% |

9% |

9% |

9% |

| TRX price change (one year) |

+100% |

+100% |

+100% |

+100% |

+100% |

| Total profit |

$21,422 |

$21,000 |

$21,620 |

$21,692 |

$21,746 |

| Staking ROI |

114.22% |

110% |

116.2% |

116.92% |

117.46% |

As you can see in the above table, despite that it charges no fees for staking TRX, Atomic ranks at the last place in terms of profitability.

On the other hand, Staked secures a second place among service providers, while Nominex offers the best ROI for stakeholders, especially for VIP users.

In addition to all that, Nominex users can obtain rewards for team farming in the referral program and rewards for providing liquidity to the pool by staking NMX LP.

DeFi Lending

Risks: Low

Earning Potential: High

Difficulty: Easy

With the rise of the DeFi industry, cryptocurrency lending has become a reality.

By lending digital assets on DeFi services, users provide liquidity to the platform. In exchange, lenders generate a passive income on the coins they lend.

DeFi lending has gained widespread popularity in the crypto space due to the fact that it comes with minimal risks (especially if one lends stablecoins) while offering much better interests than traditional finance solutions (e.g., savings accounts, government bonds).

In our example, we will compare crypto lending on Compound, Aave, and dYdX for the DAI and USDC stablecoins, using the 30-day average of lending rates to predict our earnings for a one-year investment.

To predict how much we can earn, we have to look at the Annual Percentage Yield (APY) for each coin we lend, which indicates the real rate of return on our investment (ROI).

|

Compound |

Aave |

dYdX |

| APY/ROI (DAI) |

3.05% |

4.23% |

6.86% |

| APY/ROI (USDC) |

3.67% |

4.87% |

6.98% |

| Total profits (DAI) |

$305 |

$423 |

$686 |

| Total profits (USDC) |

$367 |

$487 |

$698 |

Providing a nearly 7% ROI to investors, dYdX is the clear winner for both DAI and USDC lending while Aave secures second place and Compound ranks third.

Disclaimer: We would like to emphasize that our examples and tests included in this article are based on simple predictions, and real-world strategies might provide different results. For that reason, we recommend everyone to do their own diligence and keep their risks at a minimum to earn crypto successfully in 2021 and beyond.

Passive ways to earn cryptocurrency in 2021!

Cryptocurrency technology invented several new roles and technical positions such as master nodes, lightning nodes, and even mining nodes that are capable of earning cryptocurrency passively and have an almost regular income. Additionally, in recent years several types of affiliate programs are introduced that users can join to monetize their funds passively, like lending or staking, which are discussed above.

In this section passive ways by which cryptocurrency investors can earn crypto and have a regular income would be introduced. These ways include:

– Mining (discussed above in detail)

– Staking (also discussed above)

– Lending (also discussed above)

– Running a Lightning Node

– Affiliate programs

– Running Masternode

– Taking advantages of forks

– Developing trading bots

Running a lightning network

In recent years several solutions are introduced for the problem of scalability in Bitcoin, Ethereum, and other major cryptocurrencies. Lightning networks include networks of transactions that are not directly applied to the main blockchain, so they are way faster than regular transactions. These networks provide bidirectional channels by which regular daily transactions could be accomplished faster than ordinary payments because they are stored on blockchain layer 2, and not mainnet.

However, this is a technical opportunity for people to run a network of transactions on another layer of blockchain, which provides liquidity as well as receiving transaction fees. What is amazing about this type of earn cryptocurrency is that you don’t even need to look at market news to make money from cryptocurrencies by occupying this status.

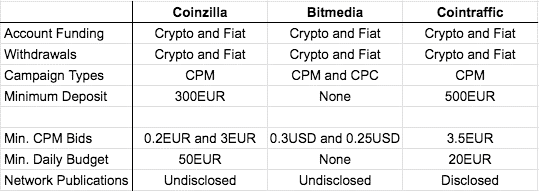

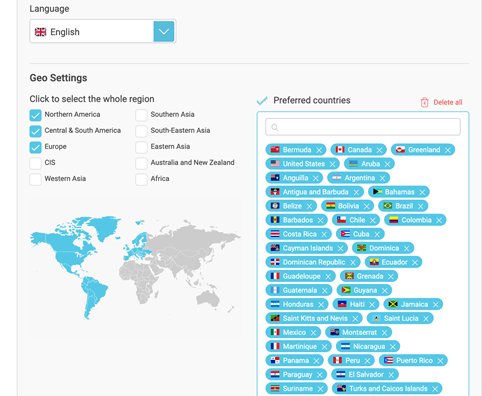

Affiliate Programs

Another technical event that offered new opportunities to earn cryptocurrency passively in recent years was the development of new major cryptocurrency exchanges. These enterprises have to manage to join a highly competitive market in which their competitors offered several types of advantages and technical improvements in advance. So new cryptocurrency exchanges try to offer affiliate programs by which they accelerate their growth in various regions of the world. People, social network influencers, and cryptocurrency content networks and communities are potential partners of these exchanges which are targeted by their affiliate programs.

While traders and those who are playing with their funds in the cryptocurrency market should have an active situation against market news and fall or peak of price, cryptocurrency exchanges and individuals joined to their affiliate programs can earn cryptocurrency without directly being under the effects of price changes. Users in these programs are only required to add some new users to the exchange network. However, in many cases, other requirements are having a network of cryptocurrency users with more than 2,000 users and/or being an influencer on social media networks with at least 5,000 followers/subscribers.

However, affiliate programs help those people who are active in various crypto forums and groups to make money by adding new members to a certain exchange customer database. Some of these programs, unlike what you can find on major exchanges like Binance and OKEx, are designed to be easy. While OKEx requires at least $100 purchase from all 10 invited persons to activate an affiliate program for a user, and Binance requires an already existing subscribers channel, Nominex users with only 30USDT can enjoy its affiliate program and earn cryptocurrency passively.

Running Masternode

Decentralized networks require some nodes that act somehow like a server: providing access to the network. These nodes are known as masternodes and are incentivized by various cryptocurrency networks to earn cryptocurrency passively only by providing technical resources for the network’s activity. However, to run a masternode users need to have a large technical investment.

However, with the development of cryptocurrency networks and the emergence of large technical facilities, the masternodes market is becoming harder and harder to join. Since it requires large technical investment and deep knowledge about crypto networks, it is not recommended for all users, particularly newcomers and beginners.

Taking Advantage of Forks

When a hard fork occurs in a traditional cryptocurrency network, users of the old blockchain receive identical amounts of cryptocurrency on the new blockchain. This passive earn cryptocurrency only occurs once in a few years but could provide a relatively large amount of passive income. As you might know, in recent years Bitcoin Cash hard fork provides such an opportunity for Bitcoin users.

To take advantage of this type of event, users should have large amounts of cryptocurrency on the old network before the hard fork takes place. That means only users with enough funds in the right time and place can make the most out of this type of passive earn cryptocurrency. But just consider those whales with thousands of Bitcoins in their wallets when they realized that luckily they own the same amount of Bitcoin Cash to understand how this type of passive income could be sweet!

Developing Trading Bots

Another type of providing passive income that is used by large firms and financial institutions includes developing trading bots that take advantage of many events in the cryptocurrency market. However, it requires a deep knowledge of both technical analysis and financial market mechanisms as well as programming and computer science, which are very unlikely to be found in a single person. Trading bots are simply online software that monitors the market and finds trading opportunities and executes trades according to profitable algorithms. While they sound just like a great opportunity for many programmers and technical analysts to employ such trading bots, their technical details are not so easy and they remain almost exclusively in the hands of large firms with professional technical teams.

However, trading bots are capable of making frequent trades and algorithmic trades with low profits, since they are capable of making more than hundreds and thousands of profitable trades in a single day.

Closing Thoughts

The cryptocurrency market is a new financial market that in the recent decade showed it is not a temporary trend and could be considered as a technical development that will develop in the course of time. Like any other market, the cryptocurrency market provides trading opportunities by which users can earn cryptocurrency and make profits. But it is not the end of the story as several types of roles and statuses are required to run cryptocurrency networks that are incentivized by earning cryptocurrency passively, without the need to participate in market tradings.

In this article of Nominex various types of earning cryptocurrency are explained in detail and evaluated by their different factors. Nominex is a new cryptocurrency exchange platform that provides many opportunities to earn cryptocurrency for its users in different forms. Users can join different types of affiliate programs to enjoy earning cryptocurrency passively.

Image by Miloslav Hamřík from Pixabay