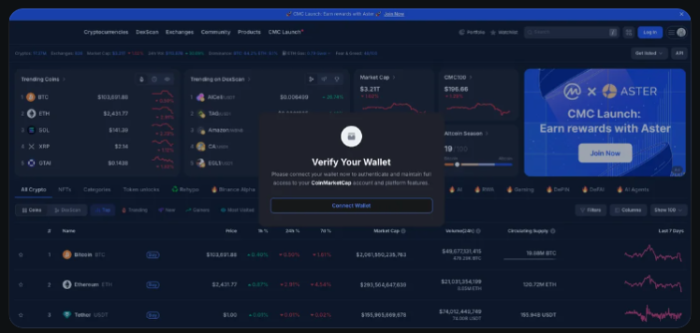

Want to check on Bitcoin’s latest price moves? Just pop over to CoinMarketCap and… enter your wallet info?

On June 20, 2025, visitors to a number of major crypto sites, including CoinTelegraph and CoinMarketCap, were prompted to connect their crypto wallets before accessing the site.

The pop-up was a hack, a wallet-stealer designed to siphon information away from users.

CoinMarketCap users can create accounts and connect wallets to track their portfolios, so the pop-up itself might not have seemed entirely out-of-place.

Users quickly uncovered the hack, and affected sites moved rapidly to limit the damage.

The incident highlights a new potential vulnerability in the growing crypto ecosystem. With such attacks, phishing can occur even on trusted platforms.

What Wallet? Hacks Exploited Common Wallet Connectivity Features

The incident involved the injection of malicious JavaScript code into CoinMarketCap’s homepage.

When unsuspecting users visited the site, they were greeted with a realistic-looking ‘Connect Wallet to Verify’ popup, mimicking standard Web3 wallet connection prompts.

Users who clicked the popup and approved the transaction gave attackers full access to their wallets.

The CMC hack reportedly had 39 victims with over $18K in losses. The script was since removed, and CMC has patched the vulnerability.

Cointelegraph Also Targeted

Just days later, on June 23, Cointelegraph, another prominent crypto news outlet, faced a similar attack.

In this case, attackers managed to compromise an ad-serving network, injecting code that produced a fake token airdrop popup promoting a nonexistent ‘Cointelegraph token’ or ‘CTG.’

The popup redirected users to a phishing site designed to harvest wallet signatures.

Once again, users who interacted and signed the transaction lost access to their funds. Cointelegraph quickly issued a warning across its social media channels and disabled the malicious script.

Both the CMC and CT hacks are part of a growing category of crypto hacks focused on compromising wallets.

Per CertiK’s quarterly report, these attacks produce the largest losses (over $1.450M in Q1 2025 alone).

Wallet compromises are not as successful as other attacks, ranking last by incident count. But when they work, hackers can make off with vast amounts quickly.

Vigilance and Knowing the Warning Signs: Key to Avoid Losses

Binance founder and former CEO Changpeng Zhao (CZ) took to X and warned users to ‘be careful when authorizing wallet connect.’

Both the CMC and CT hacks used pop-ups, one for a simple wallet connect prompt, and one for a purported crypto airdrop.

Cointelegraph’s official account also posted a warning, urging users to not click the pop-ups, connect wallets, or provide their personal information.

Crypto airdrops and crypto presales are often used by legitimate projects to develop early interest and generate buzz about new projects, making such phishing attacks more convincing.

Scammers create fakes in order to encourage investors to give away wallet information. The supposed project or token – in this case ‘CTG’ – never existed.

How do investors stay safe? Avoiding any unexpected or unusual pop-ups, even from trust sources, is a first step.

And when it comes to the crypto ICOs and presales, it’s important to get your info from trusted sources. This is where a new solution, Best Wallet, stands out.

This new app is the only Web3 wallet with a presale directory where you can browse only audited, secure presale tokens.

The wallet also employs Multi-Party Computation technology, protecting your key from phishing attacks and hacks.

Best Wallet Token ($BEST) – The World’s First and Only Crypto Presale Wallet

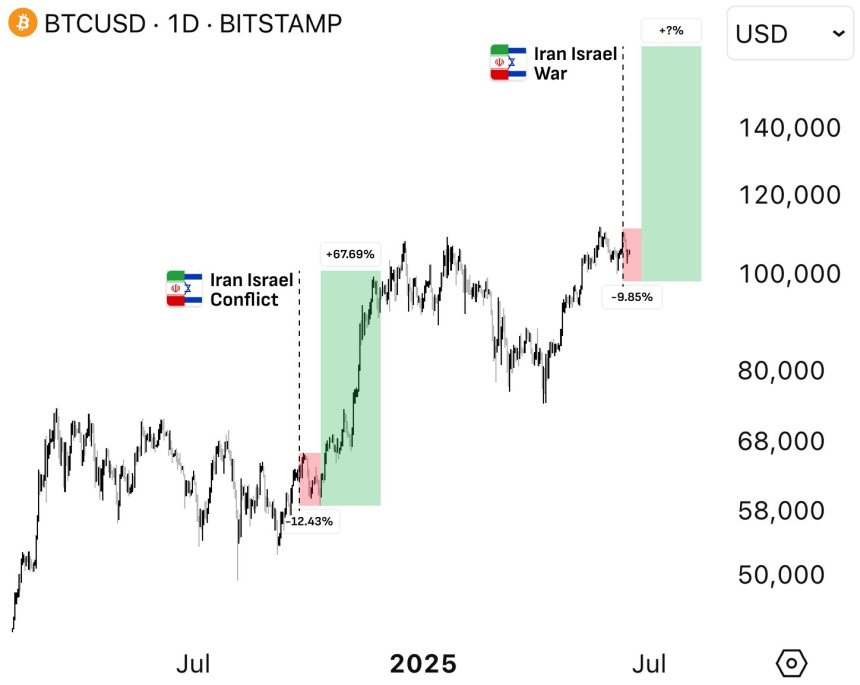

The evolution of crypto hacks is unfortunately part of crypto’s growing market and popularity.

New Web3 solutions, like Best Wallet, are evolving to tackle these security challenges, becoming a critical part of the crypto economy.

And the Best Wallet Token ($BEST) is here to power-up the Best Wallet ecosystem and provide additional perks for holders.

With $BEST, token holders can trade and swap tokens more easily, participate in community governance, and earn higher staking rewards.

The token also allows early access to the best crypto presales, gathered and vetted by Best Wallet in their ‘Upcoming Tokens’ section.

Here, investors can find upcoming crypto projects, as well as all the key information, such as whitepapers and tokenomic, needed to do research before investing.

That makes Best Wallet’s platform and token some of the handiest tools for crypto investors who want to avoid shady pop-ups and still stay ahead of the markets.

Most importantly, Best Wallet is non-custodial and privacy-focused; investors control all their wallet keys and can sign up and swap crypto without KYC.

The Best Wallet token presale has raised $13.5M so far, with the coin currently priced at $0.025225.

Note that, given its sought-after privacy-oriented wallet, the $BEST token could reach $0.05 by the end of 2026 after a successful launch, delivering 102% returns to current investors.

If you’re interested in supporting the project, now’s the right opportunity to buy the Best Wallet Token at the lowest price.

Visit Best Wallet’s Token presale today.

Security in the Age of Web3

The recent front-end Cointelegraph and CoinMarketCap hacks mark a dangerous new phase in crypto security threats.

Unlike traditional hacking methods that target backend systems or databases, these exploits weaponize the user interface, where trust is assumed but rarely verified.

Secure Web3 wallets like Best Wallet can go a long way towards mitigating such growing risks.

As always, do your own research before investing or choosing a crypto service provider. This article isn’t financial advice.

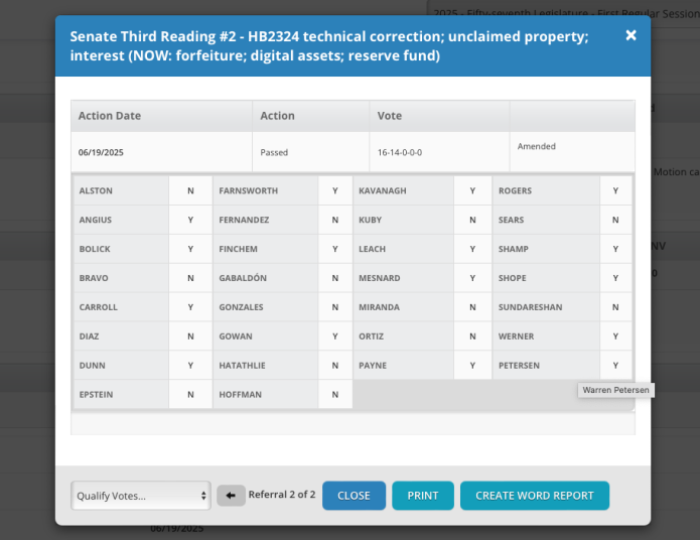

It’s worth noting that although Texas is the third US state to create a Bitcoin reserve (after Arizona and New Hampshire), it’s the first to create a publicly-funded reserve.

It’s worth noting that although Texas is the third US state to create a Bitcoin reserve (after Arizona and New Hampshire), it’s the first to create a publicly-funded reserve.

Approach One: The well-established Bitcoin playbook – buy $BTC and hold. Borrow billions to do so if necessary.

Approach One: The well-established Bitcoin playbook – buy $BTC and hold. Borrow billions to do so if necessary.

Digital form of commercial bank money – deposit token fills the role of existing deposit claims

Digital form of commercial bank money – deposit token fills the role of existing deposit claims

Exclusive crypto presale access

Exclusive crypto presale access

SOL could be moving into the mainstream, attracting attention as a yield-generating asset thanks to its staking model and institutional embrace.

SOL could be moving into the mainstream, attracting attention as a yield-generating asset thanks to its staking model and institutional embrace. Continued technological adoption and treasury-level interest could propel SOL further, though regulatory

Continued technological adoption and treasury-level interest could propel SOL further, though regulatory