Curve clocked annualized revenues of nearly $37 million during the past 30 days, according to Token Terminal.

Cryptocurrency Financial News

Curve clocked annualized revenues of nearly $37 million during the past 30 days, according to Token Terminal.

Curve Finance’s native token, CRV, saw a dramatic 30% price drop a week ago. The crash, which included the massive liquidation of Curve Finance CEO’s lending positions, left many investors concerned. Whales took advantage of Curve’s struggle and loaded their bags with millions of tokens.

On June 13, CRV price saw a massive drop and a high liquidation risk that alarmed the crypto community. As a result, Curve Finance’s native token reached a negative milestone after dropping nearly 40%. The token went from hovering between the $0.35-$0.37 price range to its new all-time low (ATL) of $0.20.

Since then, Curve Finance’s team has worked to solve the issues and stabilize the token’s price. Over the weekend, the token started its recovery, reclaiming the $0.30 support level.

However, CRV’s price fell below the support zone as the new week started, retracing to the $0.27-$0.29 levels. Curve continued its upward trajectory on Tuesday afternoon, printing nine hourly green candles.

Nearly a week later, the token has bounced over 40% from the drop. After momentarily rising above the $0.355 mark today, CRV is currently trading around the $0.33 range.

Despite investors’ concerns, whales took the opportunity to snatch CRV at a discounted price. On-chain analytics firm Spot On Chain revealed that six whales accumulated over 50 million CRV during the dip.

Per the report, the whales bought 55.26 million Curve tokens, worth around $19.4 million. 5 of the 6 wallets are first-time accumulators, which made the first-time purchases of the token surge this week.

Since the price recovery, the whales have made around 8%, or $1.43 million, in unrealized profit. The biggest gainer bought 4.34 million tokens at an average price of $0.288, representing a 21.84% ROI.

Various market watchers have forecasted a bullish future for CRV’s price. As the price started to retest the $0.3 price range, crypto trader Follis suggested that Curve Finance’s token would perform remarkably.

The trader says the token will ” be one of the first alts to pull a 2x off the lows.” He highlighted that the token’s “-40% nuke” was linked to Michael Egorov’s liquidation event. Additionally, he pointed out that in 5 days, the token had recovered nearly 50% of its price.

Crypto analyst CrediBull stated that Curve Finance’s token has “already printed a clear 5 wave impulse.” To the analyst, this suggests that CRV is “structurally more bullish” than tokens like CVX. CrediBull forecasted a $2 target for the token based on this performance.

Another trader shared a similar opinion, stating that CRV is “looking good for some relief.” To Sanchez, the liquidation dip looked like the last leg down in a five-wave pattern. He believes the recent daily performance “should be good for a decent bounce.”

Curve Finance’s native token, CRV, saw a dramatic 30% price drop a week ago. The crash, which included the massive liquidation of Curve Finance CEO’s lending positions, left many investors concerned. Whales took advantage of Curve’s struggle and loaded their bags with millions of tokens.

On June 13, CRV price saw a massive drop and a high liquidation risk that alarmed the crypto community. As a result, Curve Finance’s native token reached a negative milestone after dropping nearly 40%. The token went from hovering between the $0.35-$0.37 price range to its new all-time low (ATL) of $0.20.

Since then, Curve Finance’s team has worked to solve the issues and stabilize the token’s price. Over the weekend, the token started its recovery, reclaiming the $0.30 support level.

However, CRV’s price fell below the support zone as the new week started, retracing to the $0.27-$0.29 levels. Curve continued its upward trajectory on Tuesday afternoon, printing nine hourly green candles.

Nearly a week later, the token has bounced over 40% from the drop. After momentarily rising above the $0.355 mark today, CRV is currently trading around the $0.33 range.

Despite investors’ concerns, whales took the opportunity to snatch CRV at a discounted price. On-chain analytics firm Spot On Chain revealed that six whales accumulated over 50 million CRV during the dip.

Per the report, the whales bought 55.26 million Curve tokens, worth around $19.4 million. 5 of the 6 wallets are first-time accumulators, which made the first-time purchases of the token surge this week.

Since the price recovery, the whales have made around 8%, or $1.43 million, in unrealized profit. The biggest gainer bought 4.34 million tokens at an average price of $0.288, representing a 21.84% ROI.

Various market watchers have forecasted a bullish future for CRV’s price. As the price started to retest the $0.3 price range, crypto trader Follis suggested that Curve Finance’s token would perform remarkably.

The trader says the token will ” be one of the first alts to pull a 2x off the lows.” He highlighted that the token’s “-40% nuke” was linked to Michael Egorov’s liquidation event. Additionally, he pointed out that in 5 days, the token had recovered nearly 50% of its price.

Crypto analyst CrediBull stated that Curve Finance’s token has “already printed a clear 5 wave impulse.” To the analyst, this suggests that CRV is “structurally more bullish” than tokens like CVX. CrediBull forecasted a $2 target for the token based on this performance.

Another trader shared a similar opinion, stating that CRV is “looking good for some relief.” To Sanchez, the liquidation dip looked like the last leg down in a five-wave pattern. He believes the recent daily performance “should be good for a decent bounce.”

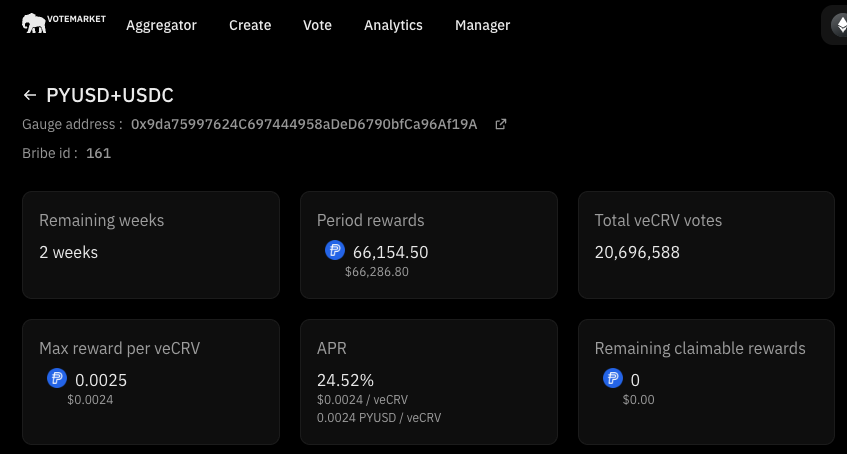

In a landmark move, PayPal, the payment processor, has incentivized PYUSD liquidity on Curve Finance, the world’s largest stablecoin decentralized exchange (DEX) by trading volume.

This development, which Stake DAO first captured on January 10, sent shockwaves through the crypto community, with many experts predicting that Curve is on its way to becoming the go-to platform for institutional and corporate trading of on-chain stablecoins.

PayPal’s decision to incentivize PYUSD liquidity on Curve is a significant step forward for adopting stablecoins and promoting decentralized finance (DeFi) protocols in general. By providing attractive rewards for liquidity providers, PayPal is signaling its commitment to the growth of this rapidly evolving sector.

As part of its incentive program, PayPal has deposited vote incentives worth $132k in PYUSD on Votemarket, a vote incentive platform. These rewards are designed to encourage users to increase their liquidity on Curve. In addition, PayPal will offer direct rewards to liquidity providers distributed in PYUSD, with an APY of 11%.

Observers note that the $66,000 allocated weekly to Votemarket could direct at least $55k in CRV, a governance token on Curve Finance, to the PYUSD-USDC pool.

With PayPal’s endorsement, Curve may attract even more liquidity and cement its position as a leader in on-chain stablecoin trading. It is unclear whether other Wall Street heavyweights on the wings are ready to enhance liquidity via Curve or other DeFi protocols. Their involvement will validate Curve and DeFi’s potential, accelerating adoption among institutional investors.

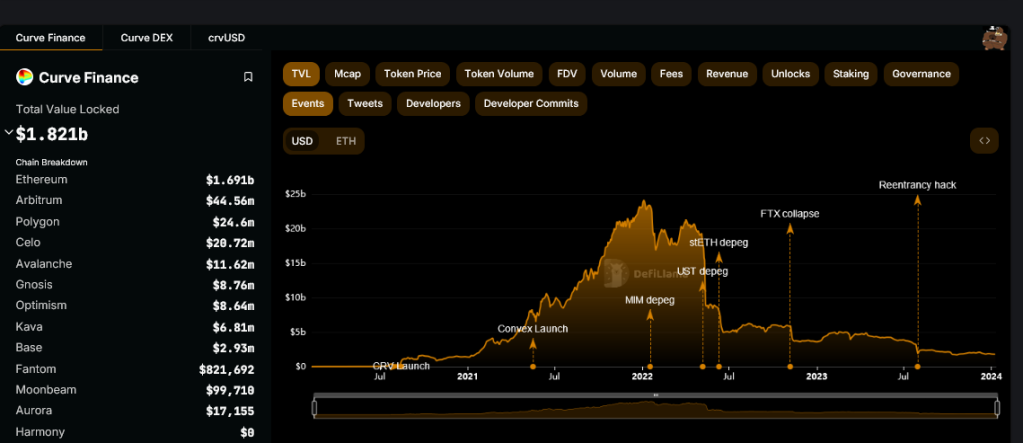

According to DeFiLlama data on January 10, Curve has a total value locked (TVL) of $1.82 billion, with a big chunk of this in Ethereum. The protocol has deployed in Ethereum layer-2s and other Ethereum Virtual Machine (EVM) compatible platforms, including Arbitrum.

For now, CRV, the native token of Curve, remains under pressure. Looking at the performance in the daily chart, the token is down 30% from recent December peaks, sliding when writing.

From price technical analysis, any break above $0.75 could spark more demand, lifting the token to new 2024 highs. Presently, CRV is trending inside a bear candlestick, signaling general weakness. In the short term, sharp losses below $0.45 might trigger a sell-off. CRV risks dropping to September 2023 lows of around $0.40 in that case.

Curve Finance, a decentralized liquidity pool for stableswap and stablecoin trading, has disclosed a strategic partnership that will see the decentralized exchange (DEX) launch on the TRON network.

Decentralized Exchange, Curve Finance has solidified its position as the second largest DEX, following the announcement of its integration into the TRON network.

Curve Finance’s recent alliance with the TRON network has prompted a substantial investment from TRON DAO Ventures, a venture capital firm established by the TRON network. On Thursday, August 17, TRON Founder, Justin Sun purchased $2 million worth of CRV, the native token of the DeFi protocol.

Similarly, Curve Finance has stated that it will be launching on the BitTorrent Chain (BTTC) network, a peer-to-peer network blockchain scaling solution for file and data sharing. The Integration of the protocol into TRON DAO and BTTC networks aims to fuel the development of innovative DeFi projects and the growth of DeFi ecosystems.

Curve Finance is widely known for its role in stable coin trading by providing low slippage exchanges through automated market maker (AMM) algorithms. By aligning with the protocol, TRON and BTTC will benefit from lower financial costs and indirect backing from prominent blockchains Curve DAO supports including Avalanche, Ethereum, and Arbitrum.

Justin Sun welcomed the newly formed alliance with enthusiasm. He commented that Curve Finance plays a pivotal role in the DeFi ecosystem and blockchain industry and looked forward to new innovative solutions promoted by the partnership.

“Curve is an essential DeFi infrastructure for the blockchain industry. Our thoughts are with the team and the users affected. As a community, let’s support and strengthen the security measures to protect our decentralized ecosystem,” Sun stated.

The decentralized finance (DeFi) landscape was previously shaken up following news of a hack on the DEX. On July 30, Curve Finance fell victim to a reentrancy attack that exploited vulnerabilities in its smart contract codes, resulting in a loss of $62 million.

Following the news of the hack attack, the CRV token declined and the majority of the DeFi ecosystem was in panic. However, Curve Finance has reportedly recovered 70% of the funds and to recover the rest of the stolen funds, the protocol has placed a bounty on the attacker, promising $1.85 million to anyone able to reveal the hacker’s identity.

Curve Finance has also promised to compensate victims of the security breach. The DEX has stated that it will distribute reimbursements fairly as they determine the extent of damages and work toward recovering the stolen funds.

Curve Finance (CRV), a leading decentralized finance (DeFi) protocol, announced significant progress in its recovery efforts following a recent hack that resulted in losing $73.5 million across several projects within its factory pools.

The attack on July 30 exploited a critical security flaw known as a “reentrancy vulnerability,” allowing malicious actors to drain funds from Curve’s smart contracts.

In a significant effort, Curve Finance has successfully retrieved 70% of the funds affected by the hack. While this achievement marks an important milestone, an active investigation is underway to recover the remaining balance and hold the perpetrators accountable.

Understanding the gravity of the situation, Curve Finance has also taken proactive measures to ensure a fair and transparent distribution of the recovered funds to affected users.

The protocol is diligently working to measure the respective shares of each impacted account, aiming to facilitate an equitable restitution process that prioritizes user protection and trust restoration.

Curve Finance’s recovery efforts are further bolstered by their recent announcement of a $1.85 million bounty. This generous reward will be granted to anyone who can provide accurate information leading to the identification and apprehension of the attackers holding the remaining funds.

By offering this substantial bounty, Curve Finance actively encourages community participation and collaboration to expedite the investigation and bring the perpetrators to justice.

Following a thorough investigation, Curve Finance discovered that the exploit primarily targeted the aleth, peth, mseth, and crveth pools.

The vulnerability stemmed from a bug within the vyper 0.2.15-0.3.0 version, which the protocol promptly identified as the root cause of the breach. By swiftly pinpointing the issue, Curve Finance was able to take immediate action to mitigate any further risk to its users.

It is important to note that all other pools on Curve Finance have been confirmed as safe and unaffected by the exploit, according to Curve’s update. This assurance gives users the confidence to continue utilizing the platform, knowing that their funds remain secure within these pools.

Alongside the technical remediation, Curve Finance collaborates with security experts, auditors, and the broader DeFi community to conduct thorough audits and implement additional security measures.

This collaborative approach aims to reinforce the protocol’s resilience and prevent similar incidents in the future. Overall, Curve Finance’s recovery of 70% of the hacked funds, coupled with its ongoing investigation and bounty initiative, underlines the protocol’s commitment to user protection and the broader DeFi community.

According to Token Terminal data, Curve Finance’s circulating market cap currently stands at $518.76 million, reflecting a decrease of 22.29% over the analyzed period.

The fully diluted market cap, which represents the potential future market value of the project, is estimated at $1.97 billion.

Curve Finance’s total value locked (TVL), a crucial indicator of the protocol’s popularity and user engagement, currently amounts to $2.44 billion. Despite a decline of 35.19% over the analyzed period, Curve Finance maintains a substantial TVL, highlighting its significance within the DeFi landscape.

Featured image from iStock, chart from TradingView.com

Curve DAO (CRV) has continued to decline recently. Here’s what on-chain data says regarding if a rebound is probable for the coin anytime soon.

In a new insight post, the on-chain analytics firm Santiment has recently discussed how the underlying metrics related to CRV have looked. The first relevant metric here is the “Supply Distribution,” which tells us the percentage of the Curve DAO supply each investor group holds.

In particular, the cohort of interest here holds between 10,000 and 100 million tokens of the asset. This is an extensive range covering the likes of the sharks and whales.

Here is a chart that shows the trend in the holdings of this CRV group over the past year:

As displayed in the above graph, the indicator’s value has shot up recently, implying that sizeable Curve DAO investors, such as the sharks and whales, have sharply expanded their reserves.

About two weeks back, these holders had been carrying a combined 33% of the circulating supply, but today that value has risen to 41%. “This is a massive ascension and is now the most by far that these sharks and whales have held in well over a year,” notes Santiment.

This accumulation from these key investors has come right after the big plunge that Curve DAO observed, suggesting that they find the current levels a worthy buying opportunity. Naturally, this is a positive sign for the cryptocurrency’s price.

The next indicator of interest here is the “whale transaction count,” which keeps track of the total number of CRV transfers happening on the chain carrying a value of more than $100,000.

When Curve Dao had observed its plunge earlier, the value of this indicator had registered a sharp spike. This means that the whales had been actively making moves back then.

Since then, however, the metric’s value has returned to normal, suggesting that these humongous investors aren’t showing any extraordinary activity.

As these investors had made many transfers earlier for selling purposes, the indicator calming down could imply that this cohort has stopped applying selling pressure.

“With prices still significantly lower than two weeks ago, a follow-up whale transaction spike may be a foreshadow to a quick recovery,” explains the on-chain analytics firm.

CRV has been at relatively high levels recently in terms of the development activity (that is, the amount of work that the Curve DAO developers have been putting into the public GitHub repository).

Generally, a high development activity implies that the coin is still being backed by its developers, which can be one of the signs to look out for to know if a project is still alive and kicking. Santiment said:

By no means is 10-14 notable GitHub submissions per day breaking any records, but it is indicative of a team that is still looking to innovate, improve, and move past the recent FUD news that negatively impacted the crowd’s perceptions of it.

Curve DAO is trading around $0.59 at the time of writing, down 3% in the last week.

In a strategic move to bolster the decentralized finance (DeFi) sector, Binance Labs, the venture capital and incubation arm of Binance, has committed a substantial $5 million investment in Curve DAO Token (CRV).

The Ethereum-based CRV token is the backbone of the Curve ecosystem, which has established itself as the largest stable swap and second-largest decentralized exchange (DEX).

As part of the partnership, Curve will explore the deployment of its protocol on the BNB Chain, the thriving ecosystem powered by its native token, BNB. This strategic alignment aims to leverage the strengths of both platforms, further fueling the growth of DeFi on the BNB Chain.

Yi He, Co-Founder of Binance and Head of Binance Labs, expressed enthusiasm about the collaboration, stating:

Curve is the largest stableswap, and as a key protocol in DeFi, it has contributed to the steady growth of the space in 2023. Given the recent events that have impacted the protocol, Binance Labs has offered our full support to Curve through our investment and strategic collaboration. We view this cooperation as a starting point and look forward to working together to further propel the growth of the DeFi ecosystem.

Curve Founder, Michael Egorov, acknowledged the significance of the collaboration, stating:

BNB Chain has earned a significant presence in DeFi and is well-positioned to deploy Curve’s current and future products on its chain. We look forward to collaboratively fostering innovation and growth across the DeFi ecosystem.

According to Binance Labs’ announcement, Curve’s Automated Market Maker (AMM) platform has revolutionized liquidity provision in DeFi, offering hundreds of incentivized liquidity pools with low slippage and transaction fees.

With the support and strategic investment of Binance Labs, the protocol seems poised to accelerate its mission to transform DeFi by increasing liquidity, reducing transaction friction, and expanding its ecosystem.

Deploying Curve to BNB Chain brings numerous advantages to both Curve and the BNB Chain ecosystem. One key benefit is enhanced scalability, as BNB Chain offers high throughput and low latency, providing a robust infrastructure for DeFi protocols like Curve.

By deploying on BNB Chain, Curve can leverage the network’s capabilities to handle more transactions and accommodate the growing user demand.

Another advantage is the lower transaction fees offered by BNB Chain. This cost-efficiency appeals to users seeking to minimize expenses when interacting with Curve. By deploying on BNB Chain, Curve users can enjoy reduced transaction fees, enhancing the overall affordability of using the Curve protocol.

The cross-chain interoperability of BNB Chain also enables seamless integration of assets and protocols from different blockchains, creating opportunities for Curve to collaborate with other projects and protocols within the BNB Chain ecosystem.

Deploying Curve to BNB Chain can expose the protocol to the extensive Binance ecosystem. Binance, one of the world’s largest cryptocurrency exchanges, operates its ecosystem on BNB Chain.

This exposure opens doors to potential partnerships, collaborations, and increased visibility among Binance users, further strengthening Curve’s position in the market.

Overall, deploying the platform to BNB Chain aligns with its goal of expanding its presence across multiple chains and reaching a broader user base.

By leveraging the advantages of BNB Chain, such as enhanced scalability, lower transaction fees, access to a large user base, cross-chain interoperability, and exposure to the Binance ecosystem, the protocol can contribute to the growth and development of the DeFi ecosystem.

Featured image from iStock, chart from TradingView.com

Curve DAO (CRV) encountered notable obstacles in reestablishing its market equilibrium subsequent to a recent breach in its network security.

After a network intrusion that jeopardized a portion of Curve DAO’s (CRV) smart contracts and caused a monetary setback of $50 million, the value plummeted drastically.

This occurrence prompted numerous investors to bet against their CRV tokens, exacerbating the downward pressure on its valuation.

Based on a recent analysis of the price trends, the value of Curve DAO experienced a favorable support level close to the $0.56 threshold. On August 1st, there was an instance of rejection for the lower price, indicating that buyers are accumulating at this reduced price point.

In the face of ongoing security concerns, a separate analysis anticipates a substantial 42.1% surge in CRV’s price, propelling it to $0.81 once the security issues are effectively addressed and resolved.

Conversely, contrasting predictions foresee a potential 15.7% decline, bringing the value down to $0.48. This shift in sentiment is attributed to a significant number of investors diverting their attention toward competing options within the CRV ecosystem.

Examining the daily chart, a notable trend emerges as the CRV price experiences its second reversal from a horizontal support level, indicative of the emergence of a double bottom pattern. Presently, this bullish reversal has facilitated an 8% upsurge, driving the price to its current value of $0.614.

Within the framework of the double bottom pattern, an expectation arises for buyers to steer the prices upwards by 20%, seeking to challenge the upper trendline of the channel pattern.

The true confirmation of a trend reversal lies in a bullish breakout from this resistance level, which would fortify the validity of the emerging pattern.

The double bottom pattern is a technical chart pattern observed in financial markets, characterized by two consecutive troughs forming near a common horizontal support level.

This pattern suggests a potential trend reversal from a downtrend to an uptrend, as the initial downtrend exhausts itself and buyers regain control, leading to a bullish breakout when the price surpasses the pattern’s resistance level.

Should the CRV breakout materialize, a subsequent rally could ensue, targeting an initial goal of approximately $0.08. Following this milestone, a subsequent price objective of $1.1 might come into play, underscoring the potential magnitude of the trend reversal that the double bottom pattern could potentially signify.

With a CoinGecko listing of $0.603, the price of CRV demonstrated a 2% decline over the past 24 hours, while it managed a 1.7% increase over the last seven days.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from CCN.com

Curve DAO (CRV) has established itself as a prominent DeFi platform, renowned for providing ample liquidity, particularly for stablecoins. However, an unfortunate security breach occurred over the weekend, causing a significant decrease in both the total funds entrusted to Curve and the value of its native token, CRV, which serves as a means of transaction within the protocol.

According to a report from Bloomberg, this decline in CRV’s price has put the substantial sum of over $100 million in loans at risk of being liquidated, posing a serious challenge for Curve Finance’s founder, Michael Egorov.

As news of the potential liquidation of the Curve Founder’s assets spread, the sentiment among investors turned increasingly fearful, resulting in a notable impact on the CRV market’s price action in recent days. Many are now questioning whether there is any hope for a recovery.

According to CoinGecko, the price of CRV currently stands at $0.563, reflecting a decrease of -2.40% in the last 24 hours. Additionally, over the past seven days, CRV has experienced a significant decline of 22.1%.

Despite the recent uptick, a bearish sentiment overshadows the CRV token’s prospects. Notably, a fundamental support level lies at the $0.5 mark, which underwent testing in November and December 2022.

Furthermore, a potential positive price response might be witnessed at the $0.32 support level from October and November 2020.

An intriguing observation comes from the CRV price report, highlighting a sudden spike in previously dormant Open Interest (OI) charts within the past 48 hours. This occurrence coincided with a period of losses for the Curve DAO token on the chart.

A noteworthy development emerged during the recent rebound from $0.5 as the OI continued its ascent. This phenomenon raises the question: could this point to a direction toward bullish sentiment?

As the CRV token navigates these mixed trends, market participants contemplate the interplay between short-term gains, historical support levels, and the evolving Open Interest dynamics. The complex mosaic of these factors will likely shape the sentiment and direction of CRV’s journey in the days to come.

Egorov Responds To Contagion Concerns Amidst CRV Incident

Meanwhile, Egorov talked to Bloomberg in the same report, shedding light on his strategic approach to mitigate the impact of the ongoing liquidation threat. He shared his focus on diminishing the sizes of his loans as a precautionary measure.

Speaking about the potential contagion effects of the situation, Egorov conveyed his perspective in an email to the publication:

“I cannot comment much about contagion effects apart from saying that we, and I personally, work on minimizing or eliminating the impact,” he wrote. “In any case, I think we and all DeFi will come out stronger surviving this event.”

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Bankless Times

Following the recent exploit of Curve Finance pools, there have been genuine concerns about the stability of the decentralized exchange and the Decentralized Finance (DeFi) ecosystem. A new report has emerged, raising questions about Curve founder Michael Egorov’s $100 million loan positions.

These positions have garnered significant interest, as they are backed by about 47% of the entire CRV circulating supply. With the price of CRV dwindling, these debts appear to be at risk of liquidation, putting the Curve protocol, CRV investors, and the overall DeFi space on edge.

On Tuesday, August 1, crypto research firm Delphi Digital released a series of tweets, detailing the loan positions being held by Michael Egorov. According to the report, the Curve Finance founder has around $100 million in loans across various lending protocols backed by 427.5 million CRV tokens.

Egorov has a 63.2 million USDT loan backed by 305 million CRV tokens on Aave. Delphi Digital revealed that the position has a liquidation threshold of 55% and is eligible for liquidation at 0.3767 CRV/USDT.

For context, the CRV currently trades at $0.608595, according to CoinGecko data. This means that a 38% price decline will cause a liquidation of Egorov’s position on the Aave protocol.

Meanwhile, the Curve founder has 59 million CRV backing a loan of 15.8 million FRAX on Frax Finance. Although this debt is much lower than his Aave position, it poses a much more significant risk to CRV due to Fraxlend’s Time-Weighted Variable Interest Rate.

Delphi Digital also noted that liquidation of the Frax loan position can occur regardless of CRV’s price. According to the research firm, the loan is currently at 100% utilization, which allows the interest rate to double every 12 hours.

While the interest rate currently stands at 81.20%, Delphi Digital said that it can potentially increase to the maximum of about 10,000% APY in 3.5 days. This high-interest rate could result in the eventual liquidation of the debt.

So far, Michael Egorov has tried to stabilize his positions and the utilization rate twice, repaying a total of 4 million FRAX on July 31st. However, the utilization rate remained at 100%, as users swiftly remove liquidity as soon as he makes the payment.

To address this, the Curve founder deployed a new Curve pool on Tuesday, August 1. This pool consists of stablecoin crvUSD and Fraxlend’s CRV/FRAX LP token, seeded with 100,000 CRV rewards.

This is to incentivize liquidity toward the lending market, decrease the utilization rates, and ultimately reduce the liquidation risks.

According to Delphi Digital, this pool attracted $2 million in liquidity and lowered the utilization rate to 89% four hours after launch.

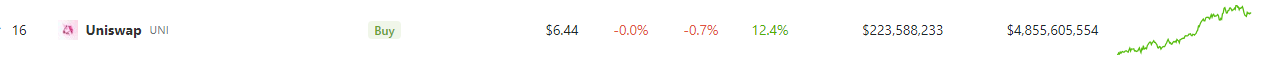

Uniswap (UNI) has experienced a remarkable, bullish surge in its price amidst mounting sell-pressure on cryptocurrency exchanges. Bullish crypto traders have actively placed orders to buy 1.3 million UNI tokens, driving the price to $6.43, one of the highest levels in the past four months.

CoinGecko data indicates that the token experienced a minor 0.07% drop in the past 24 hours but a notable seven-day rally of 12.4%.

Recent data compiled by Santiment also reveals a noteworthy and sudden surge in Uniswap’s Age Consumed, indicating significant movement of tokens in the last few days.

With the UNI token price soaring to a remarkable four-month peak, investors are now contemplating the opportune moment to secure profits. The rapid surge in value has led some market participants to consider early profit-taking strategies.

Investors and analysts closely examine on-chain data to understand better the market sentiment and the possibility of imminent sell-offs, focusing on a critical metric known as “Age Consumed.”

Age Consumed represents the total number of days since each token unit was last moved. It provides valuable insights into the activity of long-term holders and short-term traders.

A significant increase in Age Consumed indicates that tokens previously held for an extended period are now being moved, potentially suggesting profit-taking or a shift in investor sentiment.

In the case of UNI, the Age Consumed skyrocketed from 11.66 million on July 22 to 292.71 million by the end of July 30. Such a surge in Age Consumed suggests a notable movement of previously dormant UNI tokens, raising questions about the intentions of long-term holders and the potential impact on the token’s price.

The bullish sentiment around Uniswap has been further fueled by a significant exploit that impacted another cryptocurrency token, the Curve Stablecoin Pools (CRV) token. The exploit led to a steep 20% plunge in the price of CRV, causing traders to pivot towards Uniswap’s UNI token.

Meanwhile, Uniswap’s UNI perpetual futures are now trading at a 20% premium, indicating that traders strongly believe in Uniswap’s potential to gain more market share in the aftermath of the CRV exploit. Moreover, the funding rates for UNI perpetual futures have surged to 19%, showcasing the optimistic sentiment among traders regarding the future performance of the UNI token.

The aftermath of the Curve Finance exploit has had varying impacts on different DeFi platforms. While Curve Finance’s total value locked (TVL) dropped significantly from $3.2 billion to $1.8 billion, Uniswap’s TVL remained steady at around $3.8 billion. This stability in TVL demonstrates Uniswap’s resilience and strong fundamentals even during market turbulence.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Bitcoin-Bude