Ethereum (ETH) is making headlines as it trends toward the $4,100 mark, reaching a new yearly high of $4,096. This milestone, just $3 above the previous high set in March, signals a potential resurgence for the second-largest cryptocurrency by market capitalization. The price action has caught the attention of analysts and investors, particularly as Ethereum continues to outperform expectations in a market dominated by volatility and uncertainty.

Key metrics from IntoTheBlock shared by analyst Ali Martinez shed light on the network’s activity, revealing a surge in large Ethereum transactions. Historically, such increases in transaction volume have been linked to significant price movements, suggesting that Ethereum’s current uptrend could have more room to run. These developments hint at growing interest from institutional players and high-net-worth investors, further solidifying Ethereum’s position as a market leader.

The next few weeks promise to be pivotal as Ethereum approaches the year’s end. Will it sustain its momentum and close the year with a breakout above $4,100? Or will it face resistance and retrace? With on-chain activity and market sentiment aligning in Ethereum’s favor, all eyes are on its next move as traders and investors position themselves for what could be an exciting close to 2024.

Ethereum Transactions Surge With Price

Ethereum continues to dominate market discussions after pushing to new yearly highs on Friday. The cryptocurrency surged past $4,096, surpassing its previous peak set in March. This upward momentum has reignited investor interest, but Ethereum’s price isn’t the only thing on the rise—its network activity is booming as well.

According to data by analyst Ali Martinez (IntoTheBlock), large Ethereum transactions are experiencing a significant uptick. Martinez highlights that weekly transaction volume has skyrocketed by over 300%, reaching an impressive $17.15 billion yesterday. This surge in network activity signals increased confidence among institutional players and high-net-worth investors, who often precede retail adoption during major bull runs.

Such growth in transaction volume historically correlates with sustained upward price movements, suggesting Ethereum’s rally may not be over. As the second-largest cryptocurrency by market cap, ETH appears well-positioned to continue setting new highs if these trends persist.

Despite this optimism, ETH faces a key milestone ahead—its all-time high of $4,878, set in November 2021, is still 20% away. While Ethereum’s recent breakout has invigorated bulls, analysts caution that reaching and sustaining prices near the ATH will require significant buy-side pressure and broader market strength.

If the current trajectory holds, Ethereum could approach its ATH sooner than expected, further solidifying its status as the go-to blockchain for decentralized applications and financial innovation. For now, investors are closely monitoring Ethereum’s price action and network data to gauge whether this rally has the momentum to break new ground or if a pullback is imminent.

ETH Pushing Above $4k

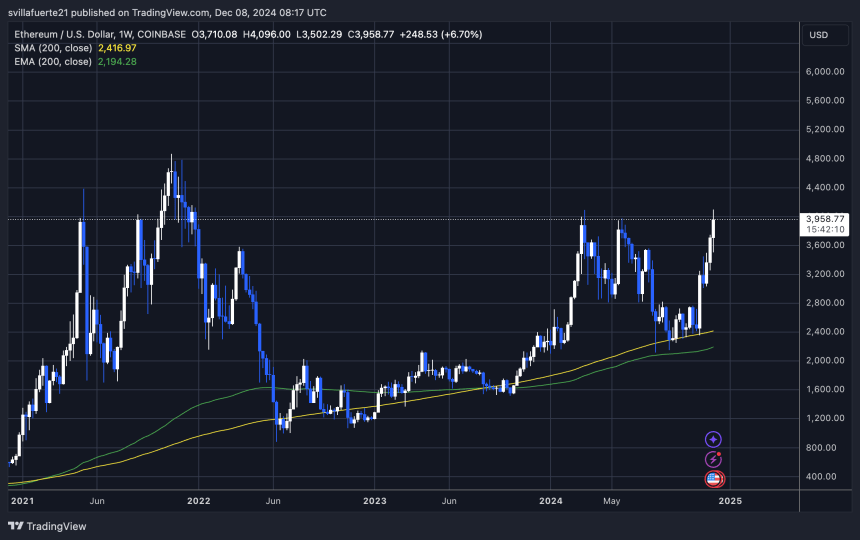

Ethereum is currently trading at $3,960, showing resilience after reaching a local high of $4,096 just two days ago. This rally has brought Ethereum back into the spotlight, with investors eyeing key levels that could dictate its next move.

A weekly close above the critical $4,000 mark would signal the highest weekly close for ETH since December 2021, a major milestone for the second-largest cryptocurrency. Such a close would reinforce the bullish sentiment surrounding Ethereum, potentially attracting more buy-side pressure and setting the stage for a continued rally toward its all-time high of $4,878.

On the flip side, failure to achieve a weekly close above $3,880—its previous highest weekly close—could indicate waning momentum. In this scenario, Ethereum may enter a consolidation phase as traders take profits and the market digests recent gains. Consolidation below this level would likely keep ETH range-bound in the near term, with $3,880 and $4,000 acting as pivotal resistance levels.

The next few days will be crucial as ETH navigates this critical juncture. A decisive weekly close will likely determine whether Ethereum extends its current rally or pauses to consolidate, offering traders opportunities and challenges in this dynamic market.

Featured image from DALL-E, chart from TradingView