Fidelity Digital Assets, a subsidiary of global financial services firm Fidelity Investments, has released a new paper titled “2025 Look Ahead: Is it ‘too late’ to enter digital assets?” The publication dedicates significant attention to the ongoing competition between Ethereum and Solana. Authored by Max Wadington, the section “Ethereum Outlook” provides a close look at fundamental metrics, upcoming network upgrades, and the broader implications for investors heading into 2025.

Solana Vs. Ethereum In 2025

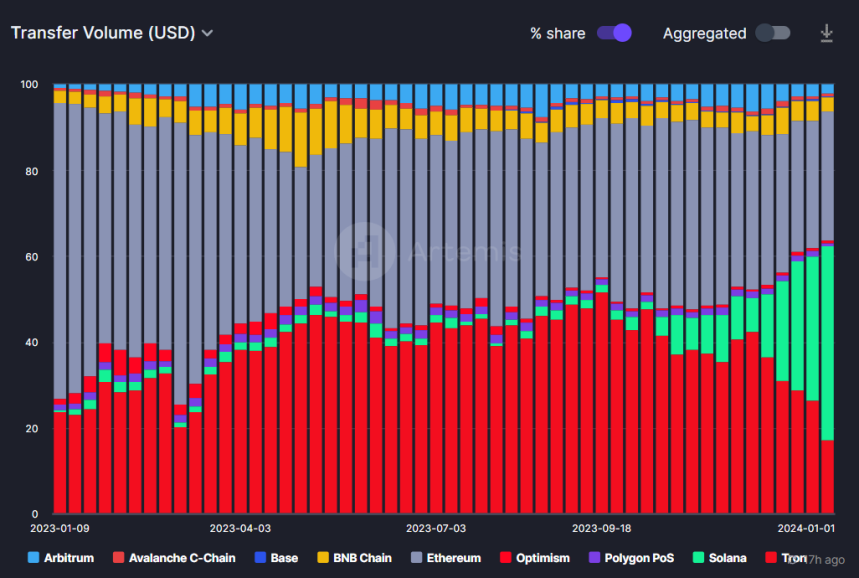

In a notable excerpt comparing Solana and Ethereum, Wadington explains: “We think fundamentals are most important for long-term investors. With that said, Ethereum has strong developer activity, total value locked (TVL), and stablecoin supply. Comparatively, Solana’s revenue and TVL are improving at a faster rate than Ethereum’s and seem to have captured significant community mind share this past year.”

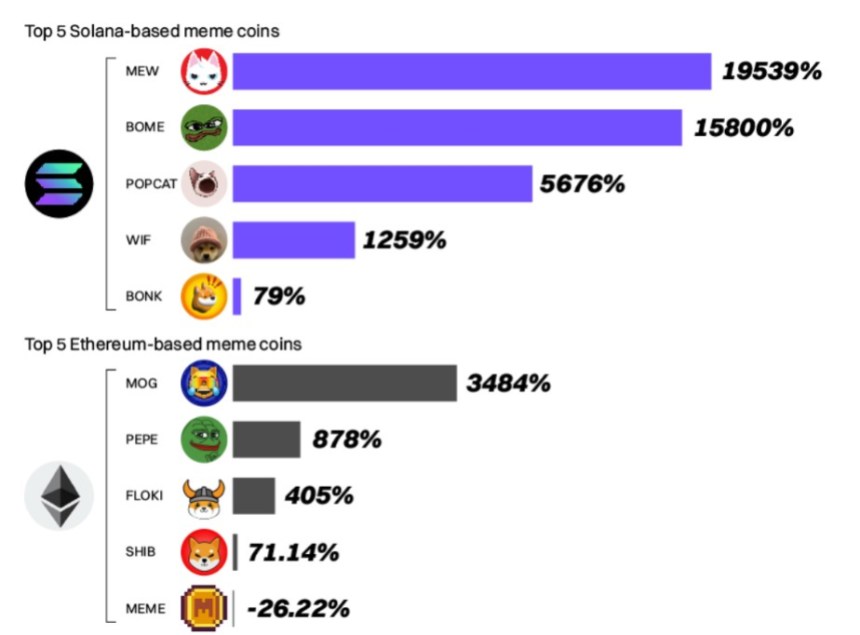

One factor complicating Solana’s growth trajectory is the provenance of its revenue, which is significantly influenced by memecoin trading. Wadington notes that while “a similar argument could be made for Ethereum’s main use case being Uniswap,” the fundamentals of Ethereum “are slightly less dependent on speculation and may be less volatile over the long term.” Thus, neither platform is risk-free, but Ether’s broader utility may afford it more resilience in bear markets.

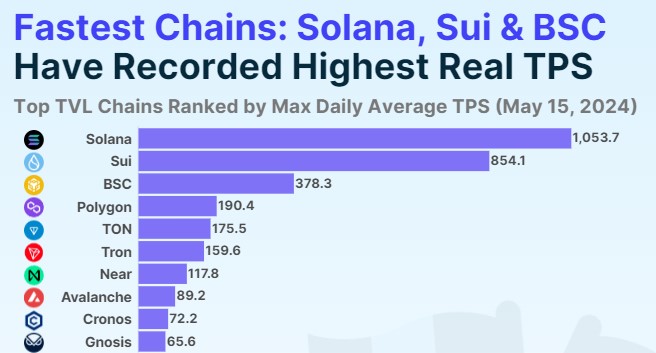

Despite this, short-term narratives and technical milestones could tip market sentiment in Solana’s favor in 2025. Specifically, Solana’s upcoming Firedancer upgrade “promises a substantial increase in transactions per second (TPS), which may directly enhance Solana’s value proposition.” Ethereum’s Prague/Electra upgrade, meanwhile, “is expected to generate less community hype as it does not significantly impact ether’s value proposition.”

Another key differentiator is Ethereum’s presence in US based spot exchange-traded funds (ETFs), a channel of accessibility that helps drive institutional and retail demand. However, Wadington highlights that this advantage “may disappear at some point under the Trump administration,” pending regulatory developments that “could either solidify Ether’s advantage in this area or completely remove it.”

Ultimately, Wadington suggests that fundamentals may reassert themselves over hype as the market progresses: “Although Solana appears to have more short-term tailwinds than Ether, its relative performance could provide significant upside for ether, similar to how Solana’s prior underperformance provided a substantial runway leading into 2024. As prices get extended throughout this bull market, investors will likely increasingly focus on fundamentals, which may sway them back into ether.”

Has Ethereum Made A Misstep?

Turning specifically to Ethereum, the paper delves into ongoing debates around Ethereum’s rollup-centric roadmap. In Wadington’s words: “The rollup-centric roadmap was designed to scale Ethereum while keeping the Layer 1 blockchain easy to run. However, since the Deneb-Cancun upgrade, there has been debate about this decision as Layer 1 fees have plummeted.”

While lower fees might appear detrimental to direct revenue for Ether holders, Fidelity’s position is that the long-term benefits outweigh the short-term revenue drop. Wadington reiterates: “We continue to believe that revenue from the blob market is unlikely to offset the dramatic decrease in revenue created by the previous upgrade in the short term, yet it still carries long-term positive benefits through improved network effects.”

In this view, Ethereum’s ecosystem stands to benefit from a mutualistic relationship with Layer 2s, which inherit Ethereum’s security and liquidity. The foundation’s priority, as Wadington writes, is ensuring “near-zero fees to keep Layer 2s within the Ethereum ecosystem.” This could foster more specialized Layer 2 projects in 2025, as developers customize entire tech stacks for niche use cases such as the Ethereum Name Service (ENS).

At press time, Solana traded at $197.