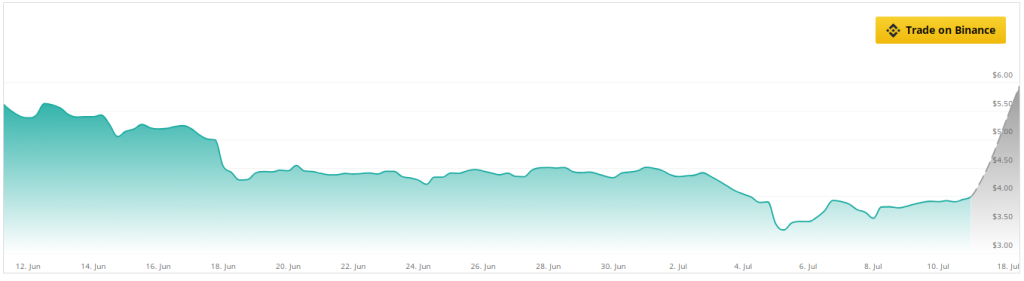

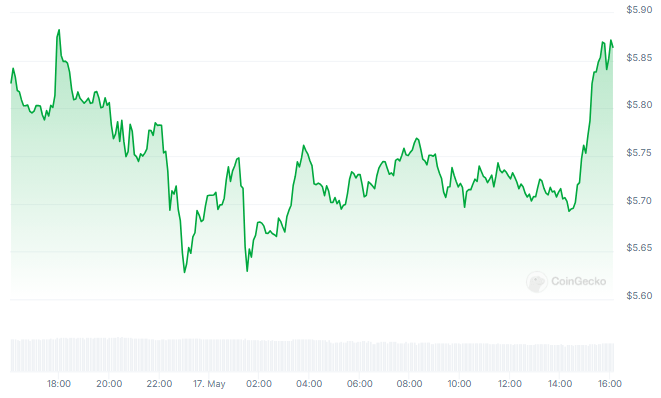

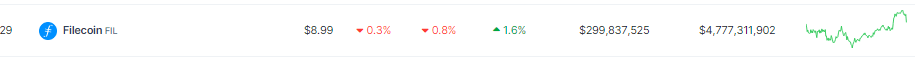

Filecoin remains beaten up by the current market’s heavy volatility as it continues pointing downwards. According to the latest market data, FIL plummeted by 18% since last week, representing a significant slash in value.

Investors remain shaken by the current market losses of the token. However, several developments might repair the lost trust in the token, but it remains to be seen what impact they might have on the future performance of FIL.

A Series Of Wins For Filecoin

Despite having a bad start in August, the ecosystem still has aces up its sleeve that might turn the tide.

Yesterday, the X account Cricimiento announced that they are partnering with the Filecoin Foundation to “help advance Argentina’s crypto ecosystem” at Aleph, a crypto event in Argentina that aims to turn the country into the world’s crypto capital.

@FilFoundation is joining forces with Aleph!@Filecoin decentralized storage ensures secure and efficient data management using blockchain technology.

Catch the team this August to see how they are helping advance Argentina’s crypto ecosystem!

pic.twitter.com/vEAUATRPec

— Crecimiento

Aleph (@crecimientoar) August 2, 2024

The event will be held this month, with major crypto institutions supporting the event. This will give the Filecoin Foundation a chance to enhance the reach of the organization as the prime provider of decentralized storage within Web3.

Filecoin Station also presented another win for the platform. Back on August 2, Station announced that a whopping 16,911 participants had participated on the platform in July. This number only represents addresses that finished a job on the platform, but it remains significant as it shows active use of Filecoin’s network.

The Station Network reached a new record 16,911 participants* in the network in July 2024. Thanks so much to everyone who runs a Station as we work to let anyone join and contribute to Web3.

*(defined as unique FIL addresses completing jobs) pic.twitter.com/jSyri9dMZi

— Filecoin Station (@FilecoinStation) August 2, 2024

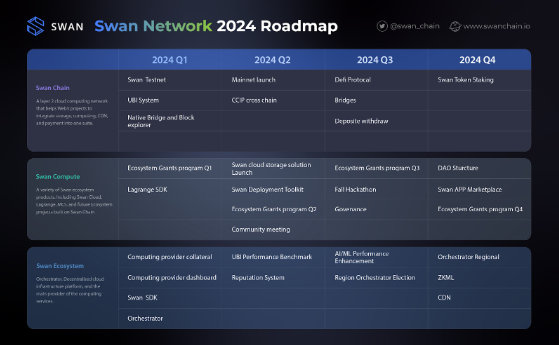

With a big emphasis on improving Filecoin’s ability to store data for Web 3, they also released a roadmap for Spark, a step-by-step network upgrade that will improve user and developer experience on the platform.

Features like better data quality, a public grant write-up system, new tools for the public, and incentives for investors will be rolled out within this mount.

The Spark upgrades will cement Filecoin as a top provider of decentralized storage. Its entry into the world of AI last month will also help boost the token’s influence in the AI and data storage industry.

Slowing Bears Might Slow Weekly Losses

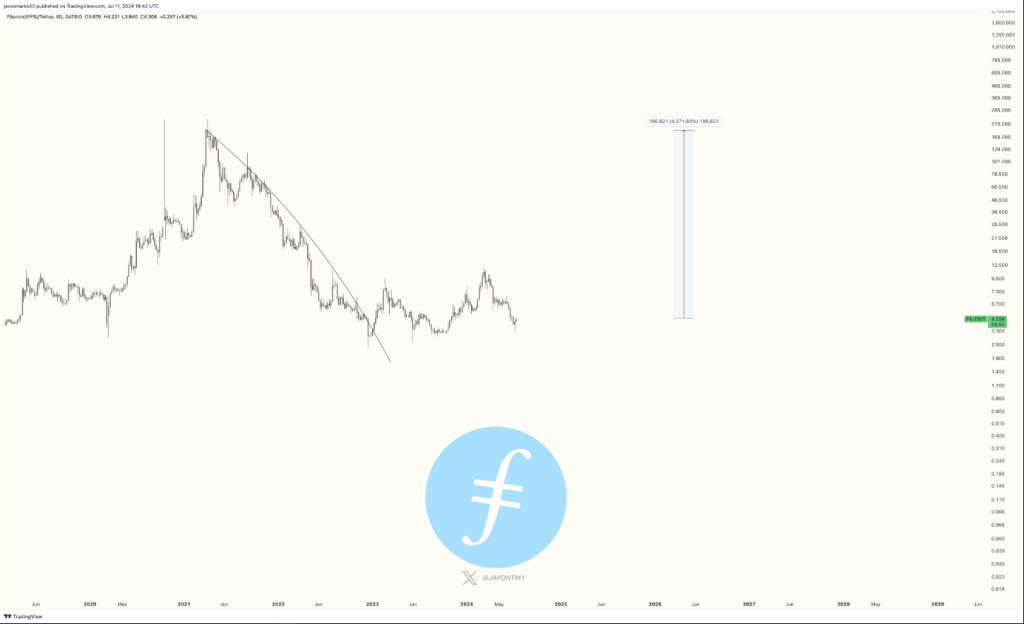

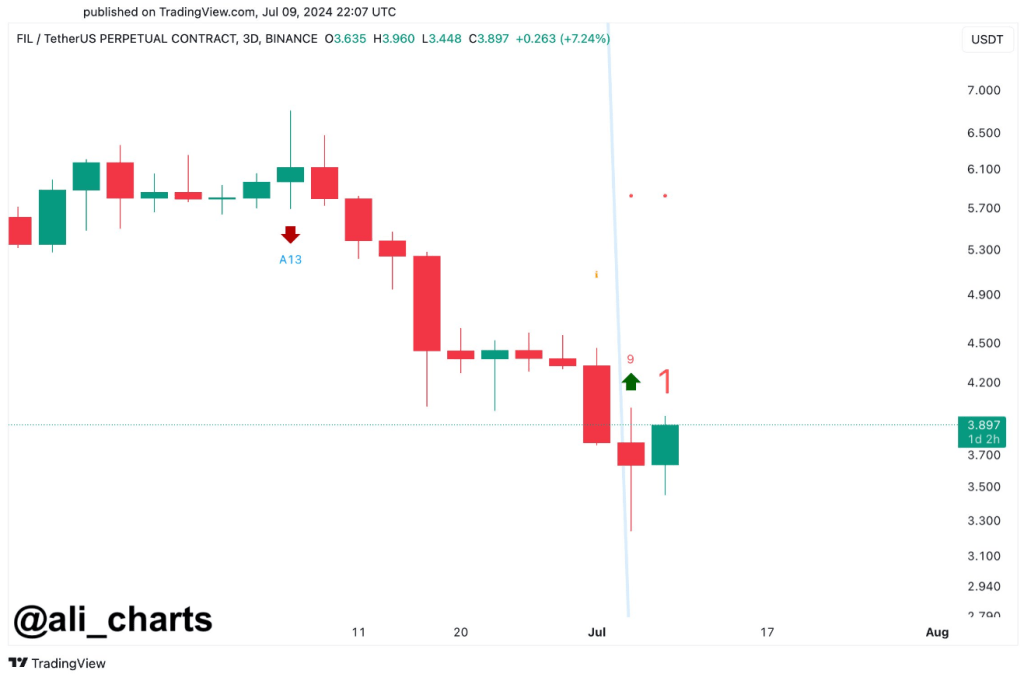

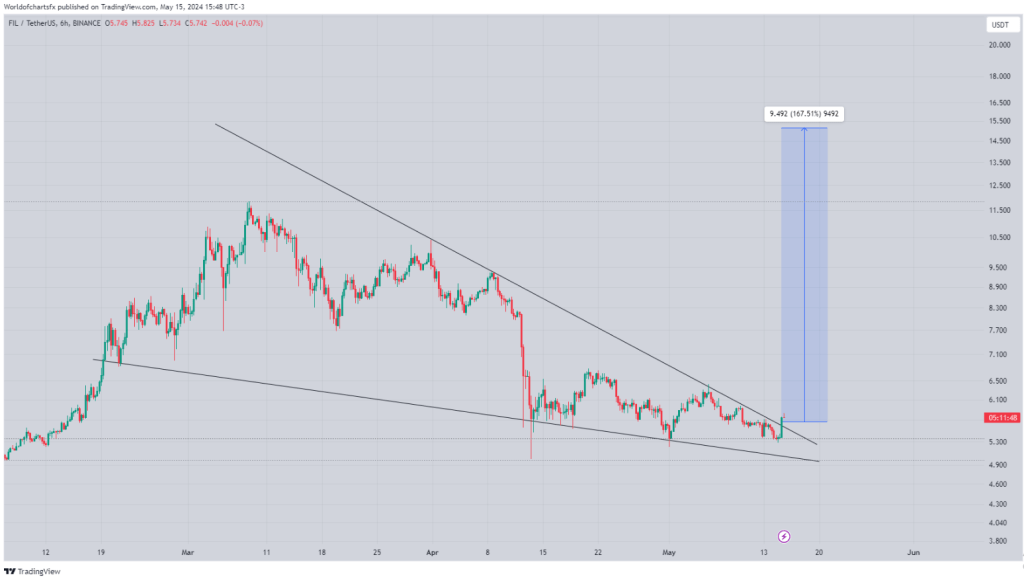

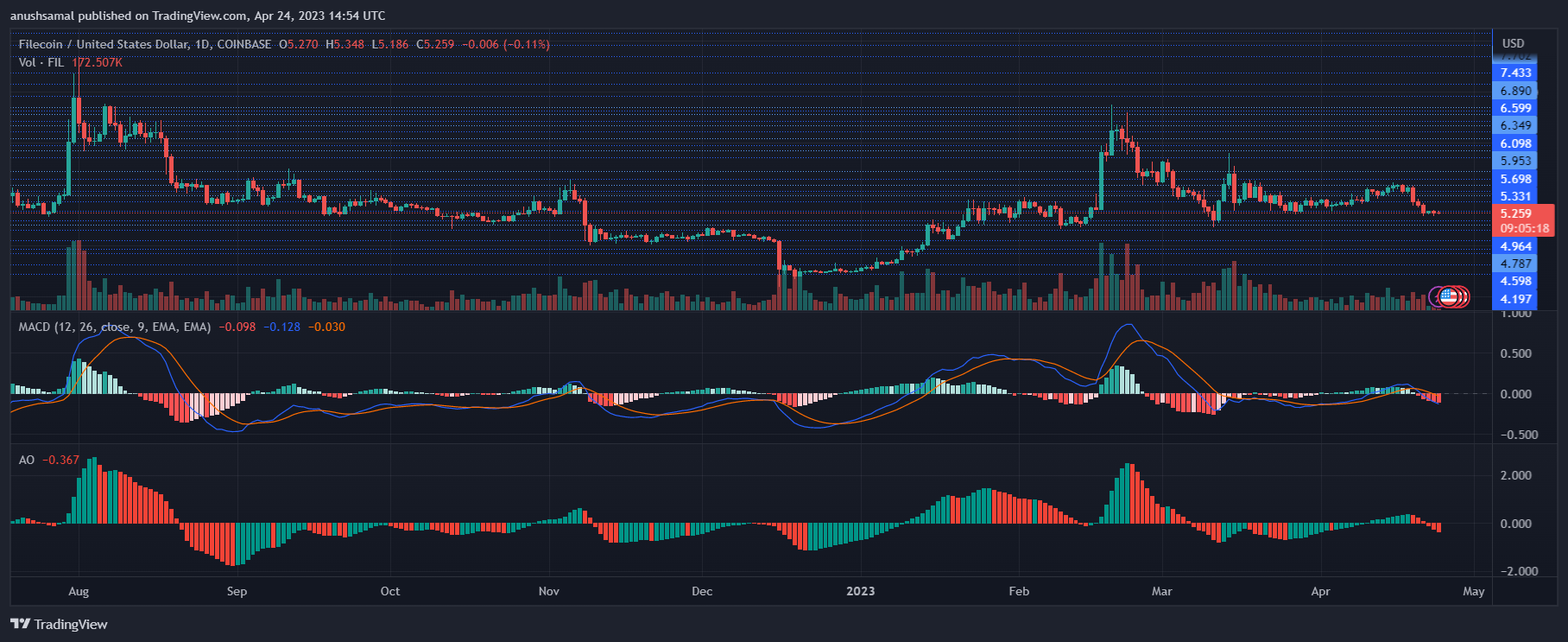

Filecoin bulls are still struggling with deflecting the current market downturn FIL is experiencing. But with the token’s current support at $3.570, we might see a resurgence within the medium to long-term.

The token’s current trajectory is still troubling. However, if the bulls can defend its current support level, the token has a chance to retake early July levels– around $4.394. Stabilizing the token’s price will be the bull’s consolation price as it gives them a strong support for any upwards movement.

Investors and traders, however, should remain cautious as the market conditions remain in favor of the strong downward pressure present within the market.

Featured image from Pexels, chart from TradingView

MARKS (@JavonTM1)

MARKS (@JavonTM1)