Bitcoin’s correction reflects investors’ inflation concerns and highlights the potential impact of future US fiscal policies.

Cryptocurrency Financial News

Bitcoin’s correction reflects investors’ inflation concerns and highlights the potential impact of future US fiscal policies.

Fed Chair Jerome Powell’s speech later today could shake up markets as he will face questions about the central bank’s outlook on monetary policy and inflation after Donald Trump’s decisive win of the U.S. presidential election.

As the Federal Open Market Committee (FOMC) meets today, the crypto market’s focus is on the Federal Reserve’s forthcoming announcements. Scheduled for 2:00 PM ET are both the Fed Interest Rate Decision and the FOMC Statement, with Fed Chair Jerome Powell’s press conference following at 2:30 PM ET. These events are poised to have significant implications for cryptocurrencies and broader financial markets.

Market participants overwhelmingly anticipate a rate cut. According to the CME FedWatch Tool, 97.5% expect the Federal Reserve to implement a 25 basis points (bps) rate cut. This expectation aligns with recent economic indicators and reflects a consensus that the Fed will continue its cautious monetary easing.

“The Federal Reserve is expected to cut the Fed funds rate by 25 basis points at the November 7 meeting. This aligns with market expectations and follows a weaker-than-expected nonfarm payroll report,” Althea Spinozzi, Head of Fixed Income Strategy at Saxo Bank, notes.

The Fed is likely to maintain a measured approach, emphasizing gradual rate cuts over abrupt policy shifts. Chair Powell is expected to underscore a data-dependent and restrained policy stance, focusing on the nuanced dynamics of the current economic landscape. Spinozzi adds, “The Fed is likely to continue its measured approach, emphasizing gradual rate cuts rather than drastic policy shifts. Chair Jerome Powell is expected to highlight a data-dependent and restrained policy stance.”

While headline inflation appears to be easing, core components suggest persistent pressures. The overall Consumer Price Index (CPI) increased by 2.4% year-over-year in September, the lowest since February 2021. However, critical sectors like shelter and services continue to see elevated prices. Shelter prices are up 4.9% year-over-year, and services excluding energy rose by 4.7%.

“The core PCE inflation rate—a key Fed measure—has stabilized at an annualized 2.3% over both three- and six-month averages but continues to run above the Fed’s 2% target,” Spinozzi highlights. Persistent inflation in these sectors could exert upward pressure on overall inflation, complicating the Fed’s efforts to achieve its target.

The labor market remains robust despite recent disruptions from hurricanes and strikes. The unemployment rate stands firm at 4.1%, and temporary layoffs have declined in October. Wage growth is showing signs of cooling; the Employment Cost Index (ECI) for Q3 surprised to the downside at 0.8% quarter-over-quarter, the softest since Q2 2021. Year-over-year, the ECI remains elevated at 3.9%, significantly above the Global Financial Crisis (GFC) average of 2.16%. Weekly jobless claims are also well below the post-GFC average, indicating sustained labor market strength.

Overall, the US economy has exhibited unexpected robustness. Third-quarter GDP grew by 2.8% annualized, and personal consumption rose by 3.7%, the strongest quarter since early 2023. However, concerns about the sustainability of this growth persist. Real disposable income has softened, and household savings are declining, potentially limiting future consumer spending.

Adding to the complexity is the US presidential election. The victory by Donald Trump could significantly influence fiscal policies, thereby impacting the Fed’s longer-term rate path. “The Federal Reserve will be mindful of how its actions and commentary could influence financial markets that may already be experiencing quite volatile conditions,” James Knightley, Chief International Economist at ING, remarks.

For crypto traders, Jerome Powell’s commentary during the FOMC press conference on anticipated inflationary effects stemming from the Trump election is the key focus. Experts expect that the Trump presidency could lead to policies that underpin inflation, such as tax cuts and increased fiscal spending, potentially forcing the Fed to keep rates elevated.

Despite the political backdrop, the Fed is expected to proceed with the rate cut. ING analysts suggest, “Even after September’s 50bp rate cut, monetary policy is in restrictive territory, and the Fed has scope to keep cutting rates back to a more neutral level to give the economy a little more breathing space to continue growing strongly.”

The current target range for the Fed funds rate is 4.75% to 5%, well above the estimated “neutral” level of 3% to 3.5%. The consensus is that the Fed has room to normalize its policy, especially with the labor market cooling.

The crypto market will be closely monitoring not just the rate decision—which appears largely priced in—but also the Fed’s commentary on inflation, economic growth, and the potential impacts of the presidential election. Any indications from Chair Powell regarding future policy shifts could have significant implications for the Bitcoin and crypto markets.

At press time, Bitcoin traded at $75,080.

BTC price targets already include $100,000, with Bitcoin traders bracing for more volatility around the Fed interest rate decision.

Bitcoin options and futures markets display moderate optimism after a new BTC all-time high, which could be indicative of new price highs.

Bitcoin price rallies as traders react to geopolitical and economic uncertainty, as the potential outcome of the upcoming US election.

Bitcoin may have outperformed stocks in the aftermath of the Federal Reserve’s decision to lower interest rates on Wednesday, but the true winners in the crypto universe are altcoins.

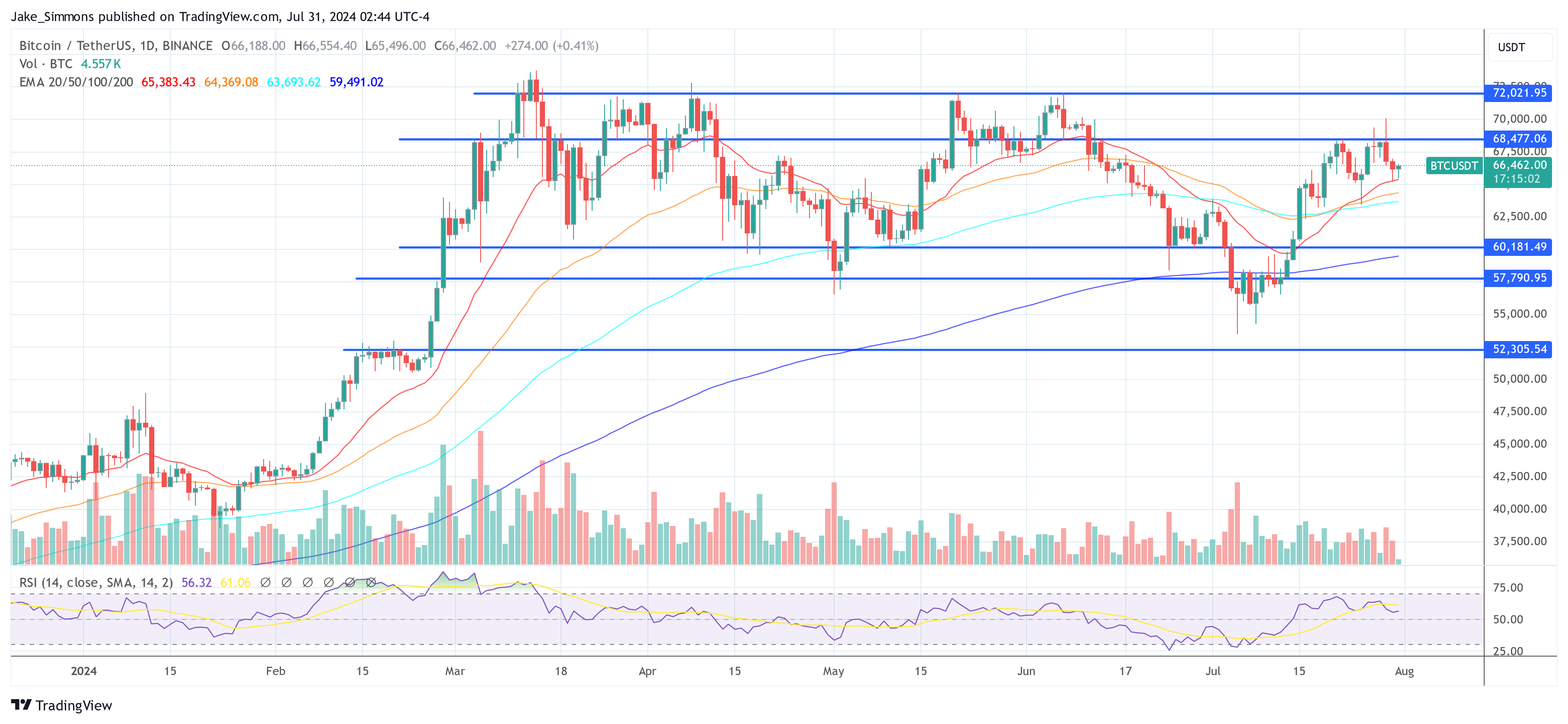

Bitcoin is trending higher at spot rates, floating above $60,000 and confirming gains of September 13. From price action in the daily chart, buyers appear to be back in the picture. The confidence follows the United States Federal Reserve’s (Fed) decision to slash rates by 50 basis points on September 18.

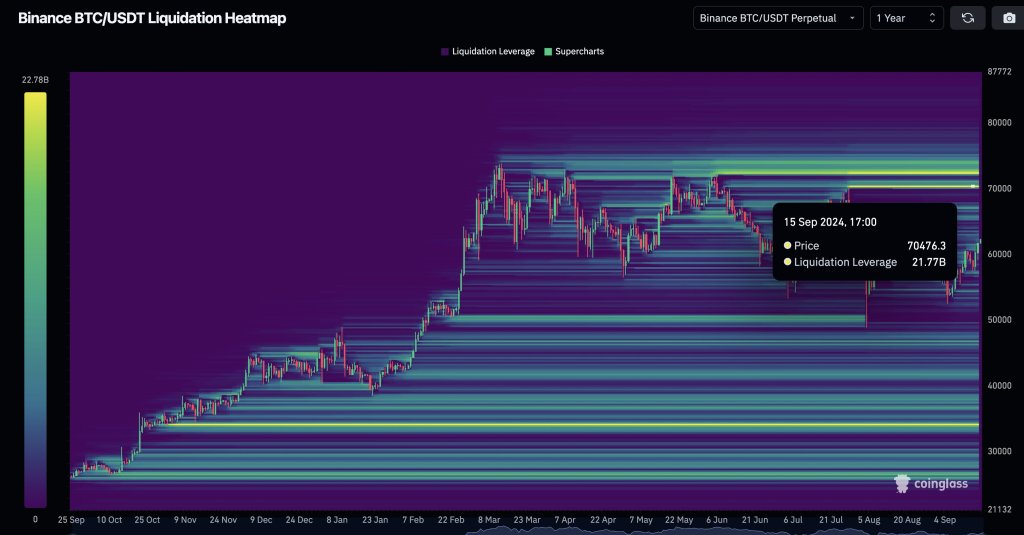

While buyers double down, flocking back to BTC, looking at the sharp uptick in trading volume over the past day, one analyst on X has identified an interesting observation if bulls continue to dominate. Citing market data and the liquidation map of Binance perpetuals, the analyst said if Bitcoin flies above $70,500, over $21 billion of shorts will be liquidated.

Liquidation happens in the perpetuals market where leverage traders aim to clip market volatility for profit. There are longs, or traders banking on bulls to press prices higher, and shots, betting for prices to drop.

These positions are leveraged in both instances, meaning they borrow funds from the exchange. The collateral, in this case, the margin, acts as an “insurance” for the exchange. As a result, they will forcefully sell it should the market move against the trader.

Looking at the state of price action in the daily chart, Bitcoin needs to expand by around 11% from spot rates of $70,500 to be hit. The immediate liquidation level is at around $66,000, marking August highs.

If this level is broken, and the leg up is rising trading volume, the resulting rally could easily be the basis for bulls to overcome the intense liquidation pressure of around $70,000 and $72,000.

Bitcoin bulls have struggled to break $72,000 since the retest in June. Accordingly, any firm and decisive close above $70,000 can trigger a short squeeze. Therefore, it is highly likely that BTC may retest $73,800 and even print print fresh all-time highs.

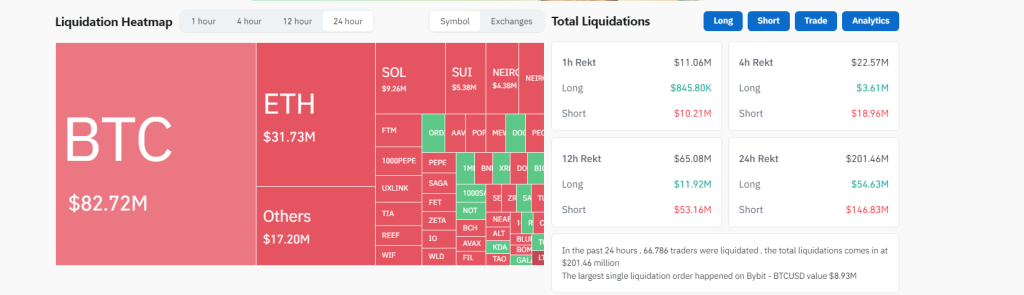

Coinglass data on September 19 shows that over $69 million of leveraged shorts have been liquidated in the last 24 hours. Meanwhile, more than $13 million worth of longs were also forcibly closed due to market volatility.

Over 66,000 crypto traders were liquidated in the past day, and the largest leveraged BTCUSD position worth over $8.9 was closed on Bybit, a perpetuals trading platform, during this period.

Bitcoin price rallies to $61,000 after the US Federal Reserve cuts rates by 50 basis points for the first time since 2020.

Market participants were uncertain about the size of rate cut prior to the Fed meeting, laying the groundwork for volatility on the markets.

Bitcoin price volatility begins with hours to go until one of the most eagerly anticipated Fed rate decisions in recent years.

Traders betting on Fed fund contracts are pricing in a 65% implied probability of rates cut to a 4.5-5% range. PLUS: Circle announces partnership with Polymarket

Bitcoin price shows strength ahead of a key Federal Reserve monetary policy decision on Sept. 18, but data suggests the momentum may not last.

Wednesday’s FOMC meeting carries uncertainty for the market, with investors still divided on the magnitude of rate cut.

Bitcoin price wobbles near $58,000 as uncertainty over the Fed’s monetary policy decision looms and traders eyeball weak economic data in China.

Bitcoin has lost more than 10% in the past two weeks as fear of a US recession, spot Bitcoin ETF outflows and the threat of miner capitulation grows.

Bitcoin traders expect BTC to rally if the Fed rolls out a 0.50% rate cut, but hedging these bullish positions is also necessary. Here is how it’s done.

The price action happened as Iran’s leadership reportedly ordered retaliatory attacks against Israel, increasing concerns about a broader conflict in the Middle East.

The price action happened as Iran’s leadership reportedly ordered retaliatory attacks against Israel, increasing concerns about a broader conflict in the Middle East.

For the crypto and broader financial market, FOMC day is upon us once again today. And analysts agree that today’s meeting will be one of the most important in recent years. Kurt S. Altrichter, a financial advisor and founder of Ivory Hill, even describes today’s FOMC meeting as the “most important of your life.” In a new post on X, Altrichter explains why.

Central to today’s FOMC meeting is the Federal Reserve’s potential indication of a September rate cut. According to Altrichter, the financial markets are almost unanimously anticipating this move, with Fed fund futures indicating a near-certain likelihood of such an outcome. “Market expectation is a strong signal for a September rate cut,” Altrichter points out, marking today’s update as a pivotal moment for financial markets.

The key question for today is: “How strongly does the Fed signal a September rate cut?” the expert explains. Investors are directed to pay close attention to the FOMC’s statement at 2:00 pm ET, especially the third paragraph, which could subtly signal the Fed’s confidence in reaching its inflation targets.

Altrichter advises, “Look at the 3rd paragraph for this key sentence: The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent.” Any modification in this wording would be a clear signal that the Fed is nearing its inflation control goals, potentially paving the way for rate adjustments.

Altrichter outlines several potential outcomes from the meeting, each associated with specific market reactions. In a dovish scenario, the Fed signals a rate cut for September. Then, Altrichter expects a broad market rally, especially in sectors less sensitive to interest rates. “Yields and the dollar should fall modestly with a modest rally in commodities,” Altrichter predicts, suggesting significant movements in standard and sector-specific indexes.

In a hawkish scenario, there will be no change in the forward guidance by the US central bank. If the Fed maintains its current stance without hinting at future cuts, the markets might experience a downturn. “Look out below and expect a sharp decline. SPX should fall by 1-2%,” he warns, noting that tech and growth sectors might relatively outperform due to their appeal during higher yield periods.

The potential adjustments in US monetary policy bear direct consequences for the Bitcoin and crypto markets. Crypto, often viewed as alternative investments, reacts sensitively to shifts in monetary policy, particularly regarding interest rates.

If the dovish scenario materializes, this could make Bitcoin and cryptocurrencies more appealing. A signal of lower future rates could drive increased investment into the crypto market, potentially leading to price increases as investors seek higher returns in alternative assets.

Conversely, should the Fed signal reluctance to cut rates, indicating a stronger economic outlook or concerns about inflation, this could strengthen the US dollar and increase yields on traditional financial instruments. Such an environment might lead to a pullback in the crypto markets, as the comparative advantage of Bitcoin and cryptocurrencies diminishes against strengthening traditional yields.

Max Schwartzman, CEO of Because Bitcoin Inc, commented via X: “FOMC is [today] & its incredibly important as we get into the end of this fed cycle… Here is how the last 11 meetings have gone for Bitcoin…”

Thus, today’s FOMC meeting is a watershed moment for financial markets globally, with significant implications for both traditional and crypto markets. As Altrichter succinctly puts it, “A Sept Fed rate cut has driven the 2024 bull market. Tomorrow’s meeting will either reinforce that tailwind or refute it. If the Fed signals a cut, the rally continues. No signal: markets could get ugly.”

At press time, BTC traded at $66,462.