A crypto analyst on TradingView, known as ‘Tradecitypro,’ has published a detailed Fantom (FTM) report, breaking down the cryptocurrency’s price action across the daily and 4-hour timeframe. After accurately predicting Fantom‘s surge above $1, the analyst highlights key price levels, market trends, potential price movements, and bullish technical indicators for FTM’s next parabolic trend.

Fantom Daily Timeframe: Signs Of Trend Weakness

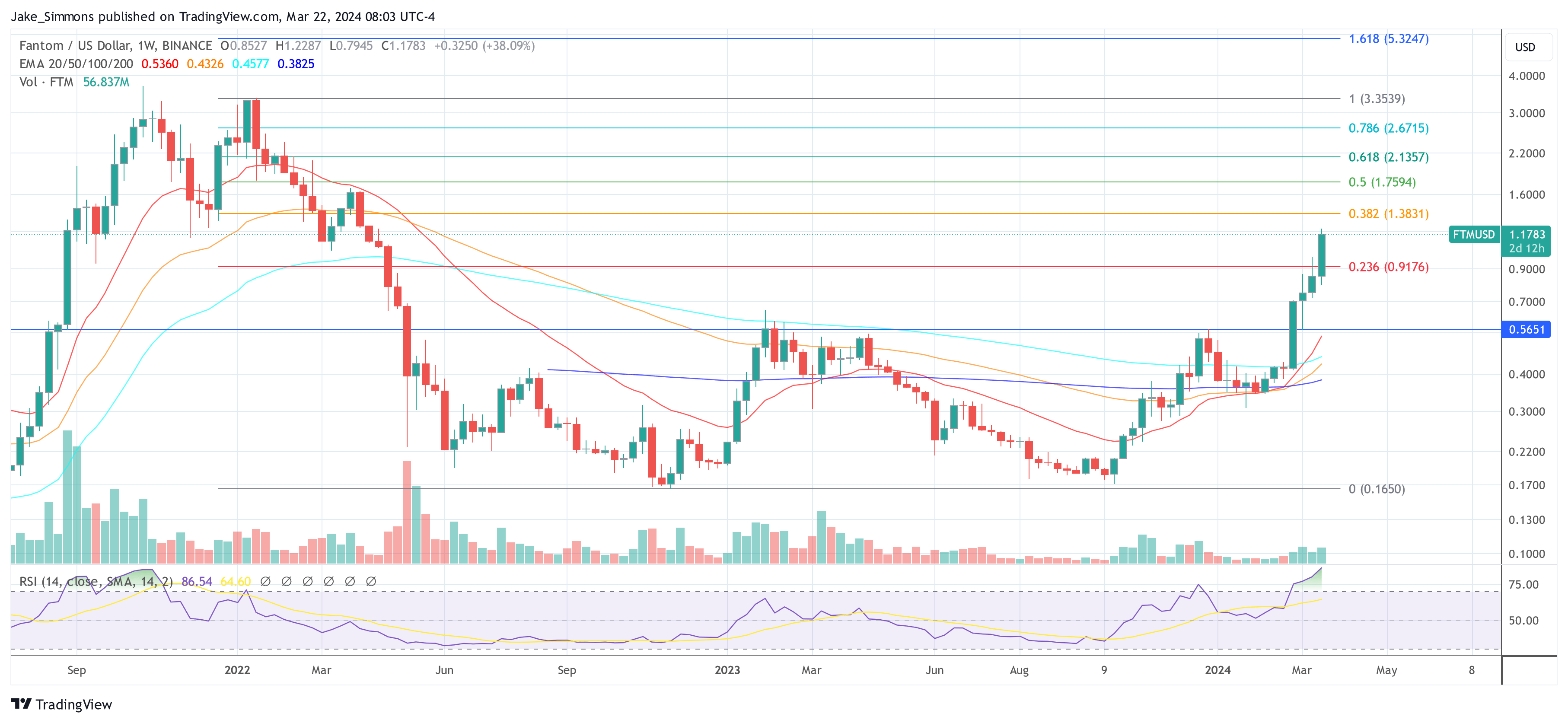

After correctly forecasting FTM’s price breakout at $0.84, the TradingView analyst has revealed that the cryptocurrency is now following a parabolic uptrend, supported by a curved ascending trendline. According to the analyst, Fantom’s price has reacted multiple times to this distinctive trendline, ending price corrections and resuming its upward momentum.

During the last bullish surge during Fantom’s uptrend, the cryptocurrency broke past the 0.7707 resistance and rose to the weekly resistance zone at 1.1116, where it stabilized above that level. Moreover, several indicators suggest that FTM may be slowing down and losing momentum. Its candle sizes have been gradually shrinking, indicating reduced bullish activity. Additionally, price corrections have intensified, signaling increased selling pressures and potential profit-taking.

Fantom’s trading volume has also declined, suggesting that traders’ interests might shift. Another technical indicator that is currently bearish is the Relative Strength Index (RSI), which is showing signs of divergence, signaling a potential reversal of the price of FTM drops below 55.74 on the RSI.

Looking ahead, the TradingView analyst has revealed that a notable sign of sharp bullish trends and pre-pump movements is when a cryptocurrency exhibits weakness and a potential for a price reversal. If the current bearish trend for Fantom continues, the analyst has set the first minor resistance level at 1.6218.

Additionally, if FTM can maintain a stable price above this zone, its next and strongest resistance could be at 3.2506. This resistance zone is near FTM’s all-time high of $3.46, representing a significant supply region.

On the other hand, if FTM experiences a price correction, it would likely drop to the first support at the curved trendline. If the trendline is broken, the next price levels to watch are 1.1116 and 0.7707. A sustained price decline below 0.7707 would invalidate the previous bullish scenario for Fantom, potentially pushing the price further down to between 0.5349 and 0.2928.

4-Hour Timeframe: Ascending Channel And Potential Breakouts

In the 4-hour timeframe, the TradingView analyst revealed that Fantom is currently moving within an Ascending Channel. The cryptocurrency’s price is interacting with the midline of the channel, providing temporary support.

The analyst has revealed that no significant moves will be expected if Fantom remains within this Ascending channel. However, if the cryptocurrency can break out, it could lead to two potential scenarios: the start of a new parabolic trend or a trend exhaustion due to a loss in bullish momentum.

The TradingView analyst has identified the price level at 1.636 as Fantom’s next static resistance. However, if FTM’s price has not yet reached this zone, the analyst suggests a safer strategy of taking long positions based on Dow Theory and channel breakouts.

Reclaiming the support at 0.568 would be crucial for FTM to maintain its bullish momentum,” the analyst said. “Should FTM fail to bounce even after reaching the Bullish OB area, it would signal a bullish invalidation, indicating a continuation of the bearish trend.”

Reclaiming the support at 0.568 would be crucial for FTM to maintain its bullish momentum,” the analyst said. “Should FTM fail to bounce even after reaching the Bullish OB area, it would signal a bullish invalidation, indicating a continuation of the bearish trend.” (@CoinbaseIntExch)

(@CoinbaseIntExch)