Derivatives trader James Wynn emerged out of the woodworks a few weeks ago, flaunting 9-figure bitcoin positions on HyperLiquid as he went on a seemingly undefeatable run that culminated in around $100 million worth of profit.

But that run, as is often the case with highly-leveraged crypto derivative trading, came to a shocking end — Wynn liquidated his entire account despite BTC only moving by a couple of percent.

“I've decided to give perp trading a break,” Wynn wrote on X after the final blow up. “Its been a fun ride. Approximately $4 million into $100 million and then back down to a total account loss of $17.5 million.”

Wynn's story is nothing new. In 2021, for instance, the industry saw the public rise of Alex Wice — a poker player turned derivatives trader — that also lost $100 million after making huge bets with leverage. And even in 2017, in the BitMEX trollbox days, pseudonymous figures like SteveS and TheBoot used to boast about their 10s of millions in profit and loss before forever fading into obscurity.

The problem with crypto derivatives

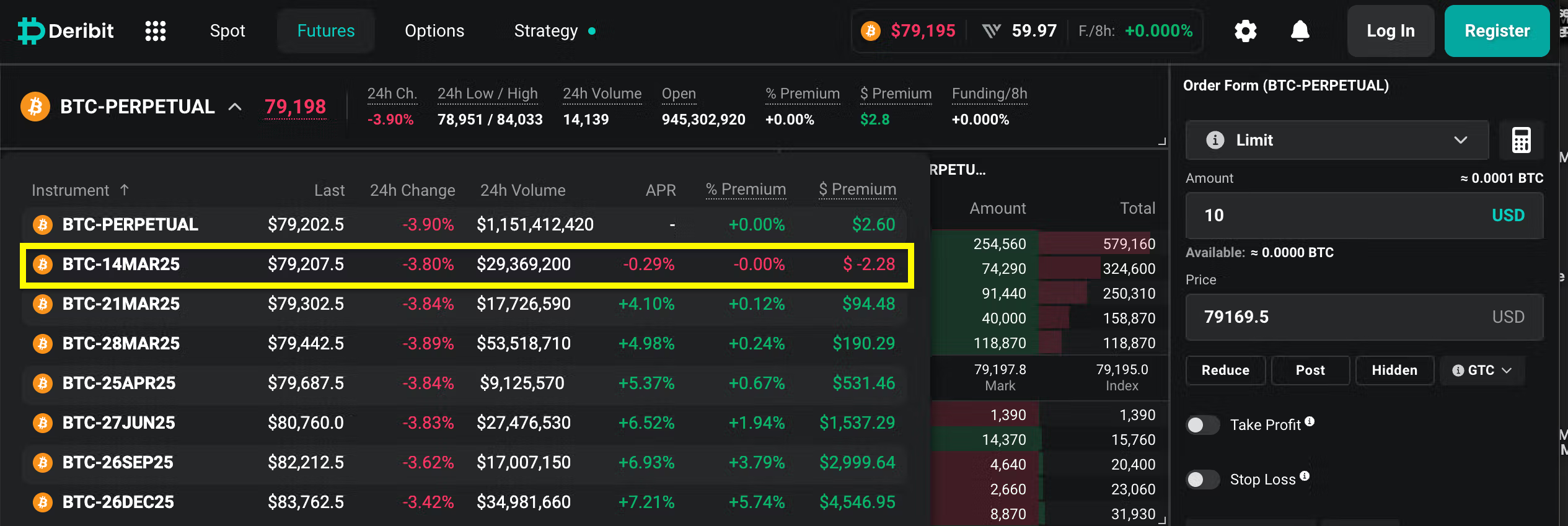

Cryptocurrency derivatives can be an incredibly useful tool; if a trader holds 500 BTC ($52 million) and believes the market will go down, they can hedge their position by going short — reducing exposure without having to sell their spot assets, which in itself could cause slippage or front running.

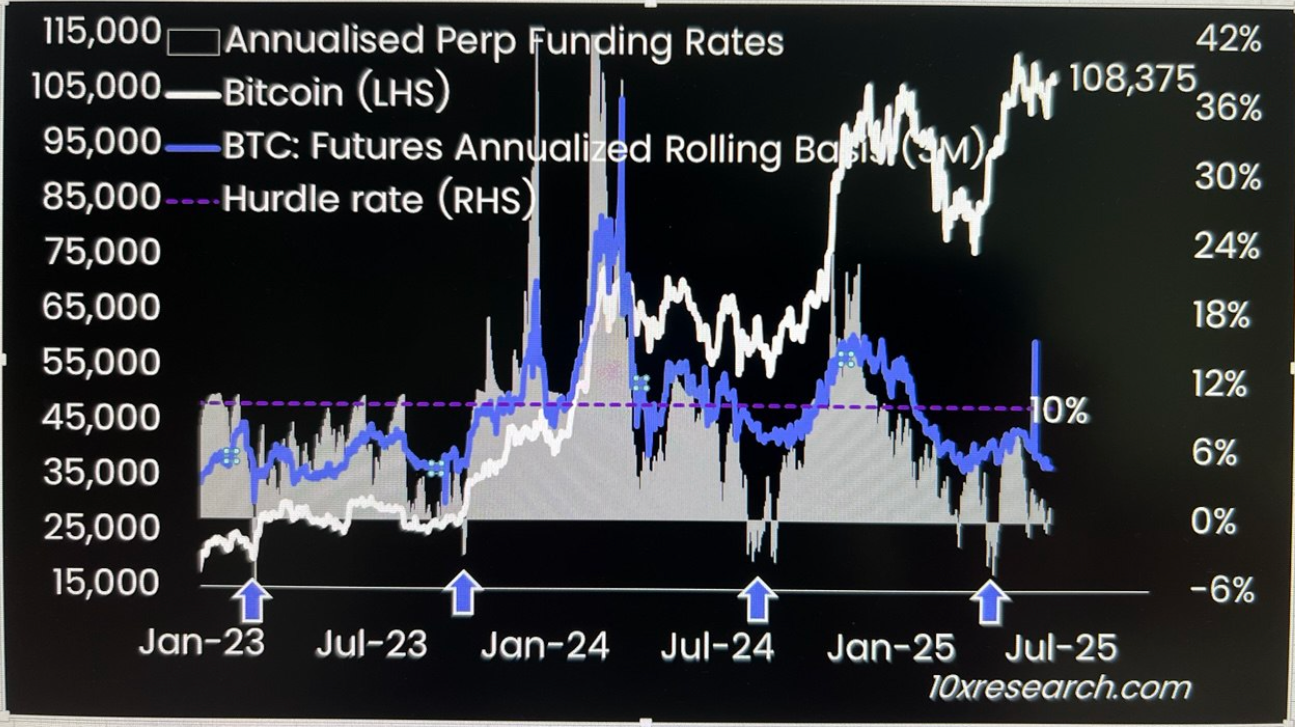

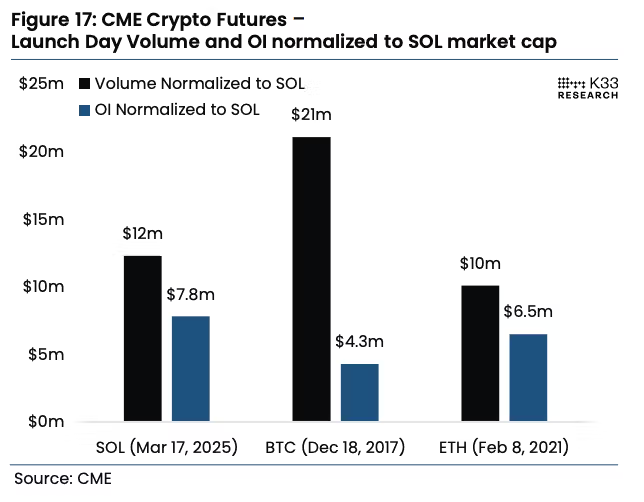

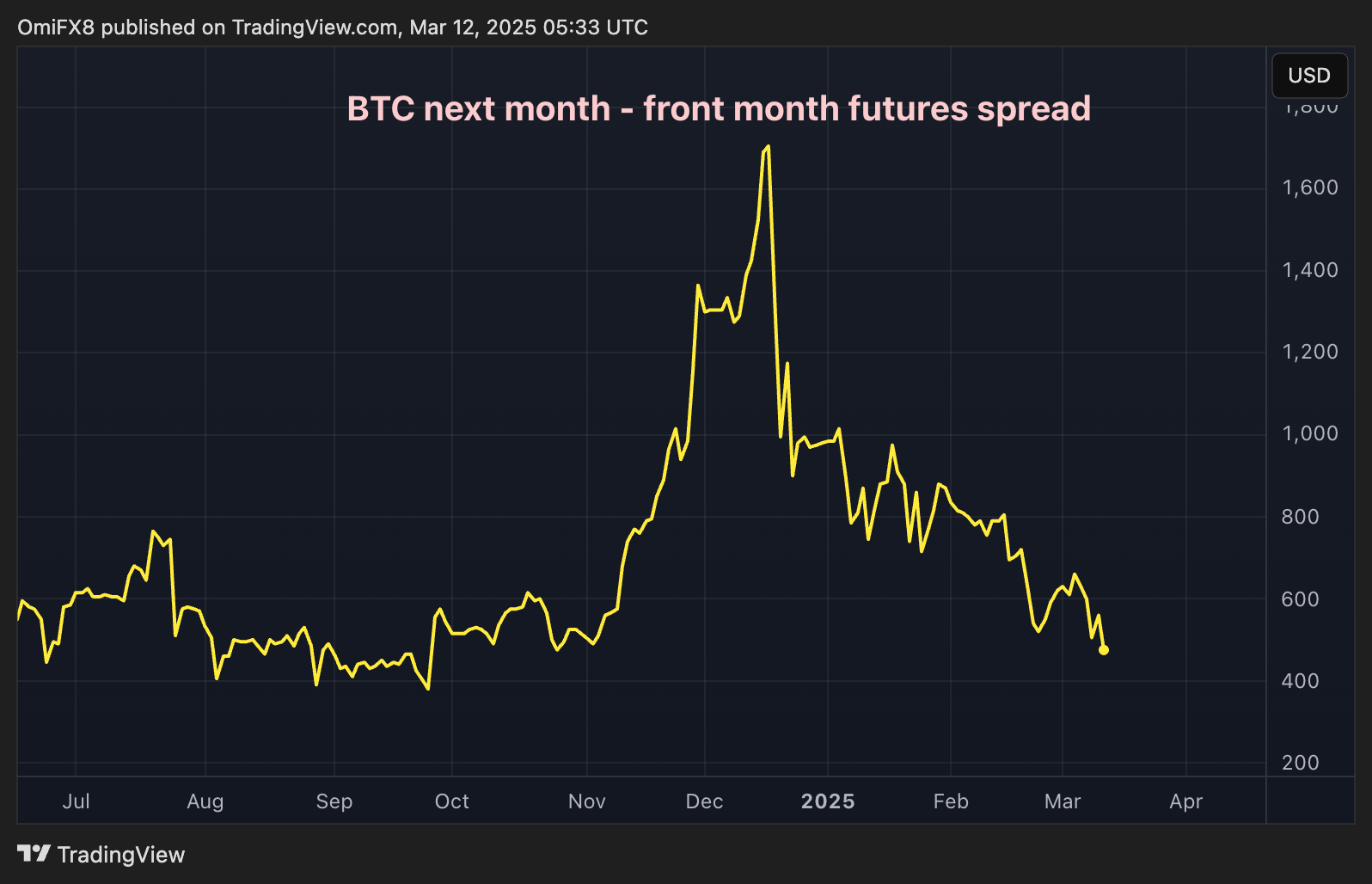

An array of delta neutral strategies can also be employed like the classic basis trade that became popular amongst institutional traders on the bitcoin CME futures market, which involve simultaneously going long and short to harvest the funding rate as a yield.

But issues begin to form when crypto traders, the majority of whom are inexperienced retail traders, use platforms that offer up to 100x leverage.

Imagine a newcomer had $5,000 in trading capital, sure, they could make a few intraday trades and make $50 or $100 per trade, but if they used 100x they could make $50,000 per 10% move. This is the slippery slope of gambling-induced emotional trading that many fall into.

Data from NewTrading shows that just 3% of day traders make a profit and 1% do so consistently. And the game becomes even tougher when, in this case, traders are opening positions worth hundreds of millions of dollars.

James Wynn exists the casino

James Wynn's downfall came in part due to his inability to deal with the emotional swings of trading, but also the sheer size of his positions.

Wynn would often post about getting partially liquidated and re-opening the position at a worse break-even point. This is indicative of a trader out of his depth through over-leverage. As Wynn used in some cases 40x leverage, his liquidation point left no margin for error, this meant that astute traders or trading firms could hunt his liquidation point and force him into an impulsive trade.

HyperLiquid is a relatively liquid derivatives venue, it has millions in market depth within 1% of an asset's price but it does not have hundreds of million, which was required to absorb Wynn's leveraged positions.

In reality, Wynn's trade thesis was based around the Bitcoin Las Vegas event and any potential announcements that could lift bitcoin above a new record high. If this came into fruition, Wynn would have had hundreds of millions in unrealized profit, but unfortunately in his case, bitcoin began to slump during the conference as speeches from Michael Saylor and Ross Ulbricht failed to spark any upside momentum.

The lack of volatility and Wynn's insatiable appetite to keep betting led to him getting chopped out of the market. His losses became so notable that one trader decided to counter trade every position by going short at the same time as Wynn went long, this trader made $17 million, according to Lookonchain.

As the sun finally set on Wynn's derivatives journey he announced he was “going back to the trenches” to trade meme coins, of course.