On Thursday, as the broader cryptocurrency market showed signs of recovery, Solana (SOL), one of the leading altcoins, surged past the $200 mark, reflecting an 8% increase over the past 24 hours.

This upward momentum brings the sixth-largest cryptocurrency by market capitalization closer to its all-time high achieved in November 2024. However, market experts caution that Solana may face significant pressure in the coming days.

A Double-Edged Sword For Solana Investors

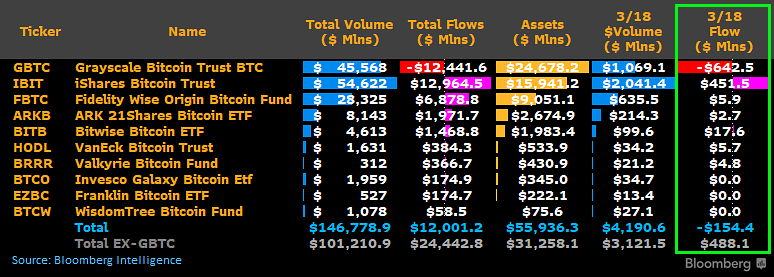

Ben Lilly, a market analyst at Jarvis Labs, recently highlighted potential risks tied to the “Grayscale Effect.” In a social media post, he warned that the upcoming Grayscale SOL tokens unlock could create substantial selling pressure on the altcoin.

Grayscale, a prominent digital asset management company, enforces a policy to protect assets for 12 months following acquisition. As the two major unlocking periods near—January 24 to February 2 and July 24 to August 7—Lilly warns that investors should stay alert.

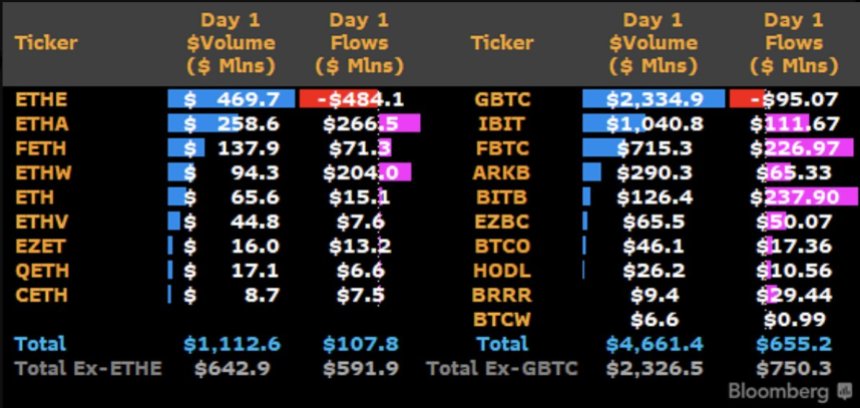

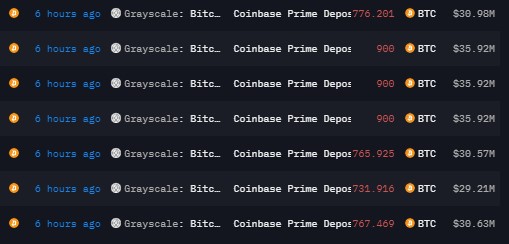

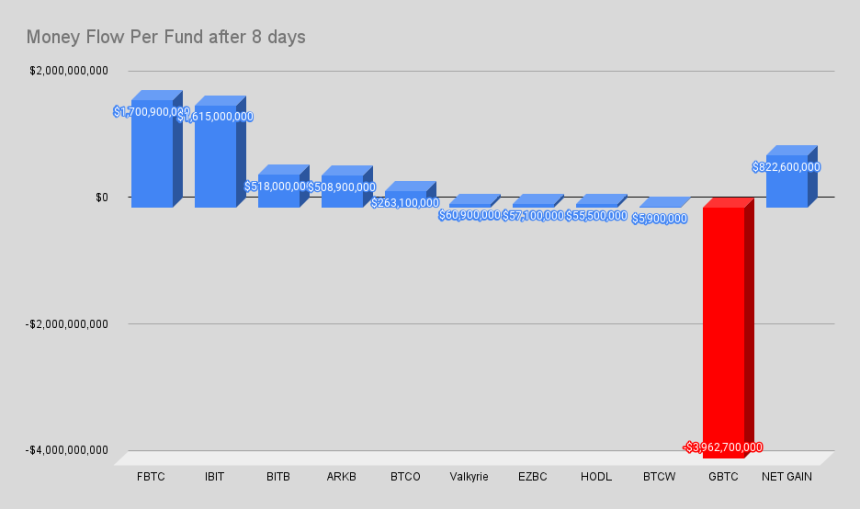

The mechanics of the Grayscale Trust are similar to those seen in the past with the Grayscale Bitcoin Trust (GBTC). In that case, investors would purchase Bitcoin (BTC) through Grayscale, which would hold the assets for a period before issuing shares.

This created a premium, where the shares traded at a higher price than the actual Bitcoin price, leading to significant market rallies.

However, when that premium disappeared, it marked the peak of the market in 2021, resulting in a cascade of failures for firms like Three Arrows Capital, BlockFi, Celsius, and Voyager.

Potential Price Drop Ahead For SOL’s Price

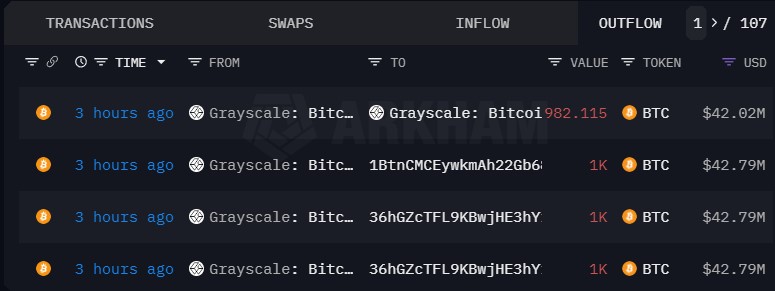

Lilly points out that Grayscale is now executing a comparable strategy with Solana, and the upcoming unlocks could mirror the past volatility seen in the crypto market.

The analyst notes that previous large purchases of SOL tokens saw private placements unlocked from late July 2024, during which the price dropped by 40% in just ten days.

The concern is that the same trend may emerge with the January 2025 unlocks, potentially leading to a significant sell-off. The analysis suggests that when investors who benefited from the premium in the past go to sell their holdings, they may flood the market, creating downward pressure on the SOL price.

Lilly recommends that Solana holders consider selling in advance of the January 24 unlock date, as this could mark a critical turning point for the asset.

While the Grayscale Trust for Solana is relatively small compared to the overall market cap of SOL, the potential impact on price cannot be overlooked.

According to Lilly’s analysis, historical trends indicate that even small unlocks can significantly influence market behavior. He reassures that while the upcoming sell pressure may not lead to catastrophic losses, it could result in local tops and a decrease in premiums.

As of this writing, SOL is priced at $205, decreasing slightly more than 20% from its peak of $263 attained on November 24 last year.

Featured image from DALL-E, chart from TradingView.com