Crypto asset manager Grayscale has published an in-depth report outlining sectors poised for bullish growth in the final quarter of the year amid a notable recovery in the cryptocurrency market, particularly for major players such as Bitcoin (BTC) and various altcoins, which have reached price levels not seen in over two months.

Grayscale Highlights Key Trends In Crypto

In its Thursday report, Grayscale updated its Crypto Sectors Indexes, showcasing emerging themes within the digital asset industry. Key trends include the rise of decentralized artificial intelligence (AI) platforms, efforts to tokenize traditional assets, and the growing popularity of memecoins.

Notably, Bitcoin and the cryptocurrency sector have outperformed other market segments in 2024, likely due to the successful launch of spot Bitcoin exchange-traded products (ETPs) in the US earlier this year and favorable macroeconomic conditions following the Federal Reserve’s (Fed) interest rate cut on 18 September.

While gaining 13% this year, Ethereum has underperformed Bitcoin but still surpassed many other cryptocurrencies. Grayscale’s Crypto Sectors Market Index (CSMI) has seen a slight decline of about 1% year-to-date, with the Smart Contract Platforms Crypto Sector Index down approximately 11%, making Ethereum’s performance relatively stronger than its peers.

Despite its challenges, the asset manager finds that Ethereum remains the Smart Contract Platforms sector leader, boasting the highest number of applications, developers, and fee revenue.

Top 20 Cryptocurrencies For Upcoming Quarter

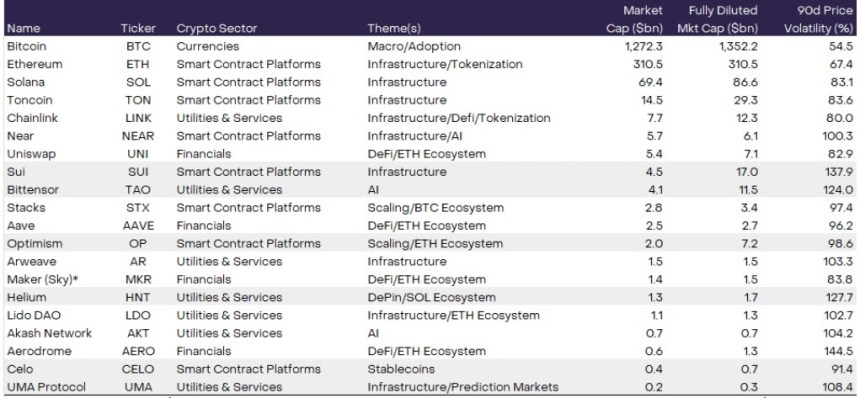

In producing its quarterly Top 20 list of cryptocurrencies, Grayscale thoroughly analyzes hundreds of digital assets. This list represents a diversified selection of assets with high potential for the upcoming quarter.

Among those highlighted by the firm are standout performers such as Sui (SUI), Bittensor (TAO), Optimism (OP), Helium (HNT), Celo (CELO) and the UMA Protocol (UMA). However, below is the full list with other assets beyond these to which Grayscale pays particular attention.

Sui, a third-generation blockchain created by former Meta engineers, has made waves following a recent network upgrade that enhanced its transaction speed by 80%, surpassing Solana’s capabilities.

Optimism, an Ethereum Layer 2 solution, plays a critical role in scaling the Ethereum network. It has developed a framework called the “Superchain,” which is utilized by platforms like Coinbase’s Layer 2 BASE.

Celo and UMA are capitalizing on unique trends, with Celo focusing on stablecoin use and payment solutions in developing regions, particularly in Africa. The platform recently surpassed Tron in stablecoin usage, while UMA serves as an oracle network for decentralized applications like Polymarket.

Helium’s inclusion in the Top 20 reflects Grayscale’s preference for category leaders with sustainable revenue models. The project has established itself as a leader in decentralized physical infrastructure networks (DePIN), growing its network to over one million hotspots and generating significant fee revenues.

Bittensor, which focuses on the intersection of AI and crypto, has recently gained recognition within Grayscale’s framework due to improvements in market structure, offering a decentralized platform for AI innovation.

In this quarter’s adjustments, Grayscale has rotated out several assets, including Render, Mantle, ThorChain, Pendle, Illuvium, and Raydium. While Grayscale sees value in these projects, the revised Top 20 list aims to offer more compelling risk-adjusted returns for investors in the coming months.

At the time of writing, the biggest winner across all time frames in Grayscale’s top 20 list is Bittensor’s TAO token, which has seen gains of 86% over the fourteen-day time frame and a substantial 841% year-to-date, resulting in a current trading price of $536.

Featured image from DALL-E, chart from TradingView.com