Injective (INJ) is leading the crypto market with a 26% recovery from the recent lows, suggesting a “strong” rally could be around the corner. Some analysts forecast further upside for the token if it reclaims a key price area.

Injective Sees Strong Daily Move

On Tuesday, Injective saw a massive recovery from its recent drop to the $9 mark, and it’s attempting to reclaim a crucial resistance level. The cryptocurrency has been in a downtrend this month, driven by the increasing global geopolitical tensions.

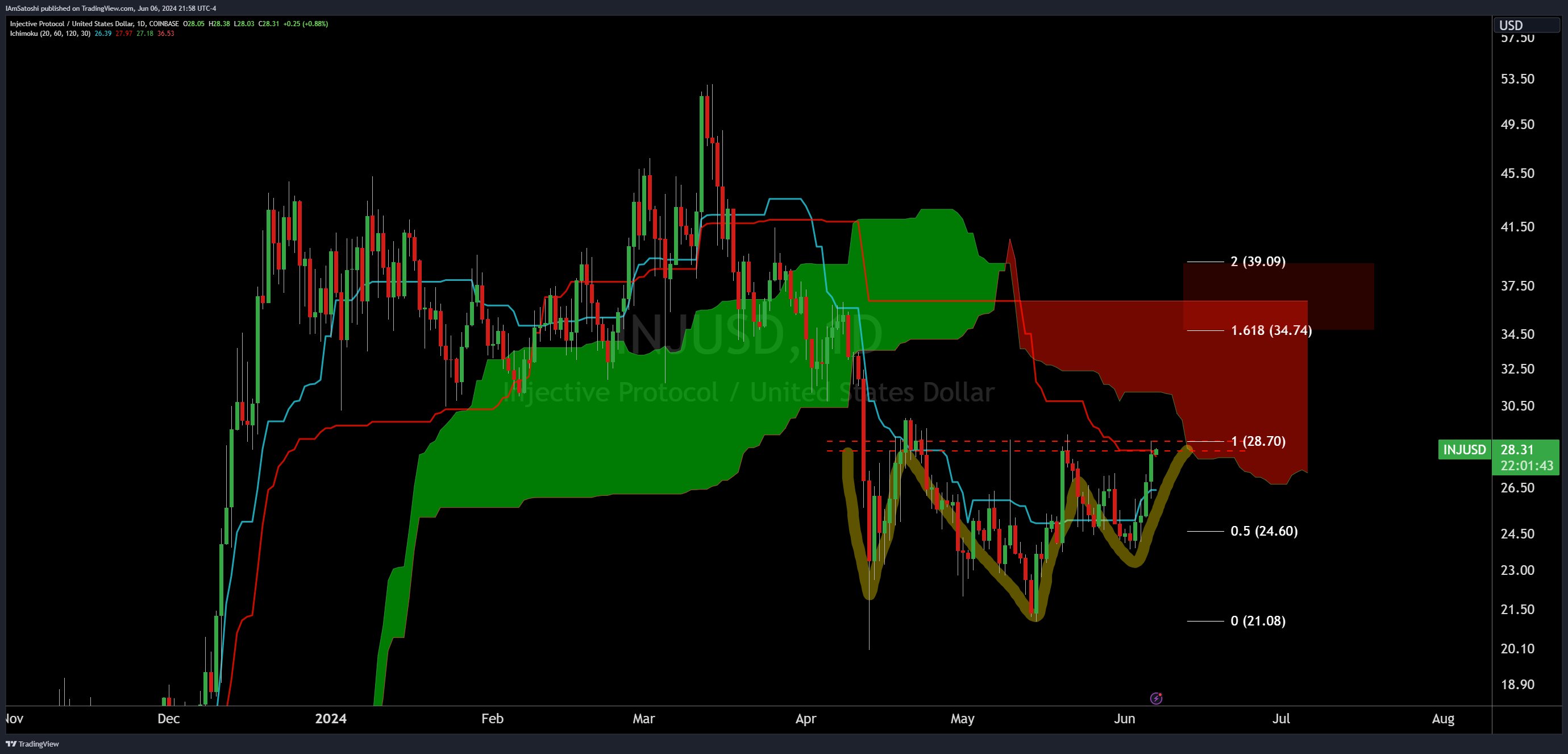

Since hitting its December high of $35.26, INJ has retraced over 65%, dropping below the $10 support multiple times during the 2025 retraces. However, the April-May rally saw the cryptocurrency break out of its multi-month downtrend and climb to its $10-$15 local price range.

Following Monday night’s news of a potential ceasefire between Israel and Iran, Injective, alongside the rest of the market, reclaimed some of its recently lost levels, surging to the $11 area on Tuesday morning and nearing a crucial resistance.

Notably, INJ recorded a 26% rally intraday to hit the $12.02 mark, becoming one of the leading tokens during the crypto market’s rebound. Analyst Crypto Rand noted that the cryptocurrency is now pushing over the June downtrend resistance following its price recovery, suggesting an explosive surge.

According to the post, a breakout above the $12 resistance range would “trigger the bull reversal,” which could propel Injective’s price toward the local range high resistance around the $15 mark.

Meanwhile, Crypto Busy highlighted that the cryptocurrency “just delivered one of the strongest moves in today’s altcoin rally” in “just a few candles” after bouncing from the $9 support zone.

The analyst added that INJ continues to be “one of the most responsive altcoins when Bitcoin bounces,” forecasting potentially more bullish price action driven by the Injective Summit 2025, scheduled for June 26.

INJ Ready For Massive Rally?

Market watcher Clinton highlighted that INJ just completed its retest of its multi-month descending broadening wedge. According to the post, Injective bounced from the pattern’s resistance level, confirming the May breakout in the daily timeframe.

This could set the cryptocurrency’s price for a 100%-150% “massive bullish rally” toward the $23-$30 levels if price holds the $11.5-$11.6 support zone, which served as a key area over the past two months.

Additionally, analyst Sjuul from AltCryptoGems affirmed that Injective is forming a “very clear” Power of Three (Po3) setup since the May Breakout. In this pattern, a cryptocurrency’s price cycle is divided into three phases: accumulation, manipulation, and distribution.

The first phase sees a token’s price consolidate near the recent high after a strong performance. This is followed by the price falling below the accumulation phase support level, trading within a range below the recently lost zone.

Lastly, a strong price breakout occurs in the third phase, with momentum building as participants enter the market.

Based on this, Injective has entered the distribution phase, which is expected to lead to a “nice expansion” toward the $16 local resistance, “as long as we don’t find acceptance back below support.”

As of this writing, Injective is trading at $11.64, a 3% increase in the daily timeframe.

(@injective)

(@injective)