In a recent post on X (formerly Twitter), noted XRP advocate and lawyer John Deaton shared his top 10 cryptocurrency picks for the next 12 months. His selection includes a mix of well-established and emerging digital currencies.

He stated, “If you had to pick only 10 tokens to own for the next 12 months (as a trade) what are they? Here’s mine: BTC, XRP, ETH, QNT, RNDR, SOL, KAS, AVAX, HBAR, CSPR. What am I missing?”

Analysis Of The Pro-XRP Lawyer’s Picks

Bitcoin (BTC): Deaton likely selected Bitcoin due to the potential imminent approval of a spot Bitcoin ETF in the United States. Bloomberg Intelligence analysts anticipate that the US Securities and Exchange Commission (SEC) might approve multiple spot Bitcoin ETF by January 10, 2024, a move that could significantly impact Bitcoin’s value

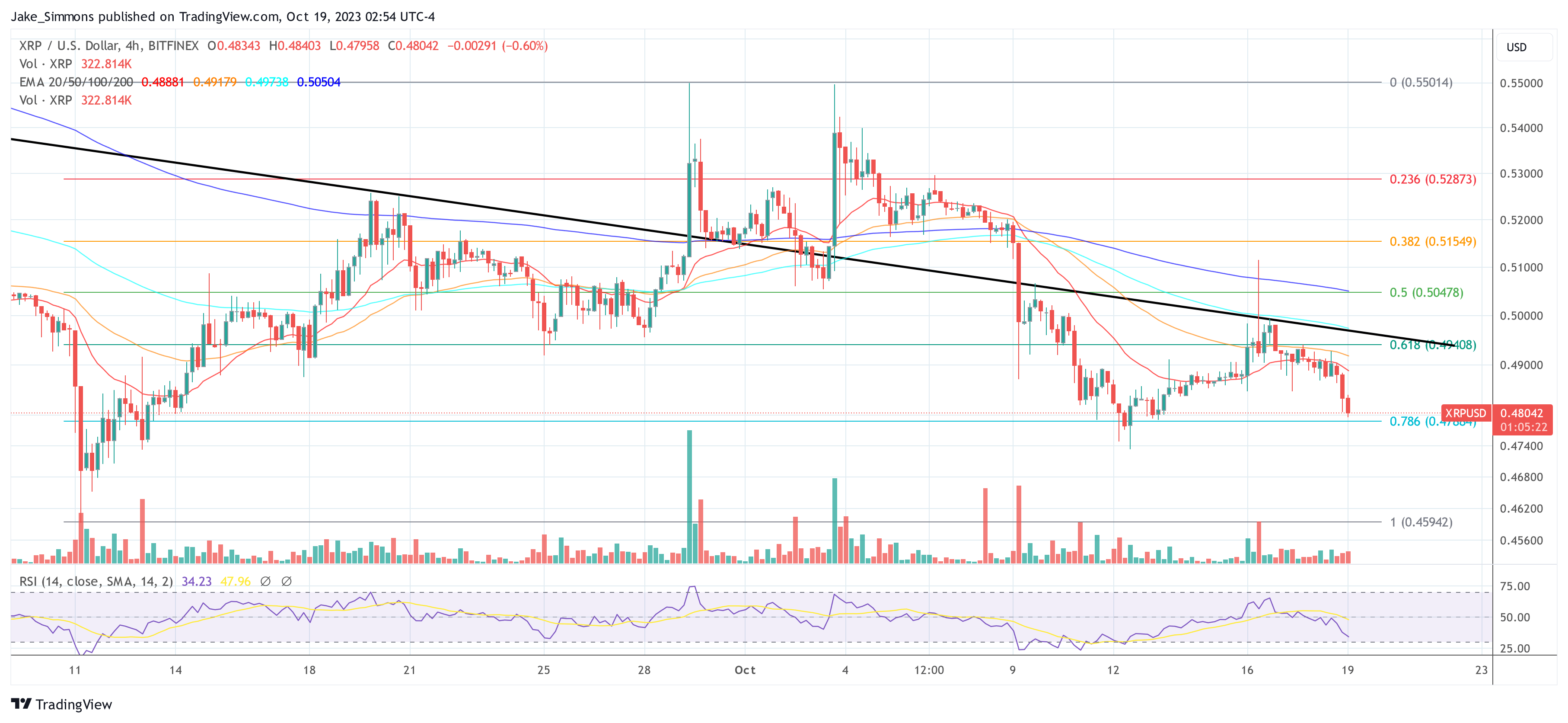

XRP: Deaton’s choice of XRP is consistent with his role as a strong supporter and legal advocate for the XRP community. XRP’s status as a regulatory-defined token in the United States with high utility adds to its appeal. Currently, XRP is consolidating after being rejected at the 0.618 Fibonacci retracement level at $0.7492.

Ethereum (ETH): Despite the harsh criticism of Ethereum’s founder, Deaton has included ETH in his list. This might be due to its position as the second-largest cryptocurrency by market cap. Also, BlackRock and several other financial giants have recently applied for a Spot Ethereum ETF, adding to the potential bullish trajectory of ETH in the next 12 months.

Quant (QNT): The QNT token of Quant Network has found itself in a downtrend channel since late January this year, down approximately 35% from its year-to-date high. With the current price of $98.74, QNT is 78% below its all-time high of $428.38 on November 21, 2023. Nevertheless, Quant can boast partnerships with major financial institutions, including the Bank for International Settlements (BIS), Bank of England, Bank of Canada, MasterCard, Amazon, and Barclays, to develop and test use cases for central bank digital currencies (CBDCs).

Render Network (RNDR): The RDNR token is currently up 725% since the beginning of the year. Render Network provides a decentralized GPU rendering platform, allowing artists to scale GPU rendering work on-demand to high-performance GPU nodes. Notably, the RDNR price has also profited from the AI narrative.

Solana: SOL has been one of the other big winners this year, up nearly 600% at the current price since it went below $8 at the end of last year. Solana is currently seen as the potential biggest challenger to Ethereum as a layer-1 blockchain, which is why Deaton may have ranked SOL on his list.

Kaspa (KAS): Kaspa has gained attention due to its positioning as a highly scalable Layer-1 blockchain, with a focus on fast confirmations and high throughput. Its underlying technology, GhostDAG/PHANTOM protocol, aims to balance security, scalability, and decentralization. The KAS token’s impressive performance, with an over 2,600 % increase year-to-date, makes it a notable inclusion.

Avalanche (AVAX): Avalanche’s AVAX token might be included due to its recent gains of almost 130% since mid-October. Deaton may have chosen AVAX because of Avalanche’s involvement in the Monetary Authority of Singapore’s tokenization initiative, Project Guardian, as well as its partnership with Amazon Web Services and Deloitte, all of which are potential catalysts for price appreciation.

Hedera (HBAR): Hedera Hashgraph has gained prominence by becoming part of FedNow, the US Federal Reserve’s instant payments platform. This development led to a significant surge in the price of Hedera’s HBAR token.

Casper (CSPR): Casper’s inclusion may be due to its position as one of the fastest-growing blockchain projects, with a focus on solving the blockchain trilemma of scalability, security, and decentralization.

Remarkably, Deaton’s selections reflect a balance between established market leaders like Bitcoin and Ethereum, and emerging, high-potential projects like Kaspa and Casper. This blend indicates a strategic approach to cryptocurrency investment, recognizing both stability and innovation within the digital asset space.