Amid a bloody start to the week in crypto markets, which saw liquidations near monthly highs as various major tokens dropped by double-digit percentages, the native token of Solana-based DEX aggregator Jupiter is defying the trend over a new buyback plan.

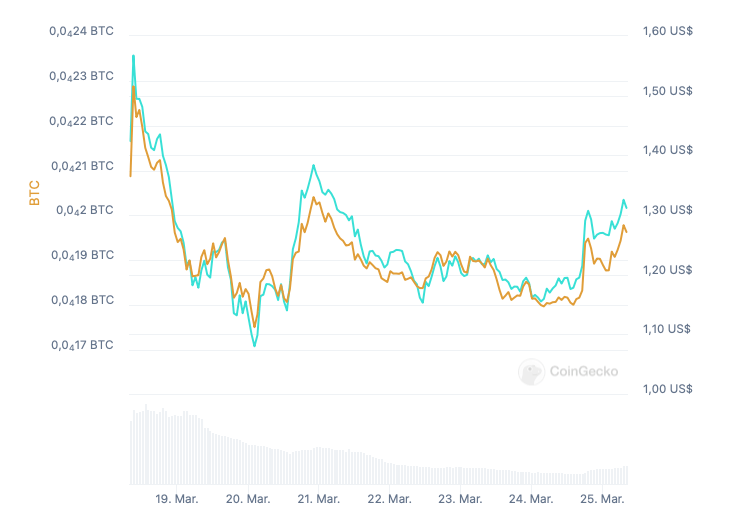

Data from TradingView shows that JUP is up more than 34% against bitcoin over the past week despite seeing an 11% decline over the last 24 hours, compared to BTC’s near 4% drop.

JUP’s outperformance is a result of a series of announcements made during its first-ever event, Catstanbul 2025, which addressed utility concerns. The protocol’s pseudonymous founder, known as ‘Meow’, revealed that 50% of all protocol fees are set to be used to buy tokens from the open market, with the tokens being moved to a “long-term litterbox,” a long-term reserve.

The move led to a price increase, which demonstrated a “high level of investor confidence in the project and its strategy,” according to Bitget Research’s Chief Analyst, Ryan Lee. He said increasing attention on the platform could attract new users and liquidity to the Solana ecosystem in the long run.

In a statement to CoinDesk, Lee noted the buyback program could “act as a catalyst for long-term growth as the team estimates it could add hundreds of millions of dollars to the buyback volume per year.”

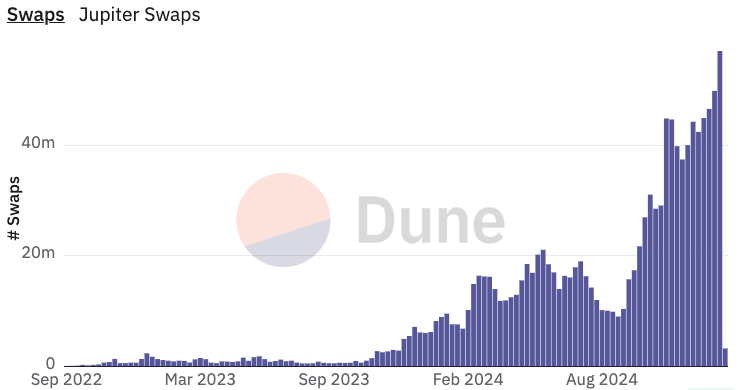

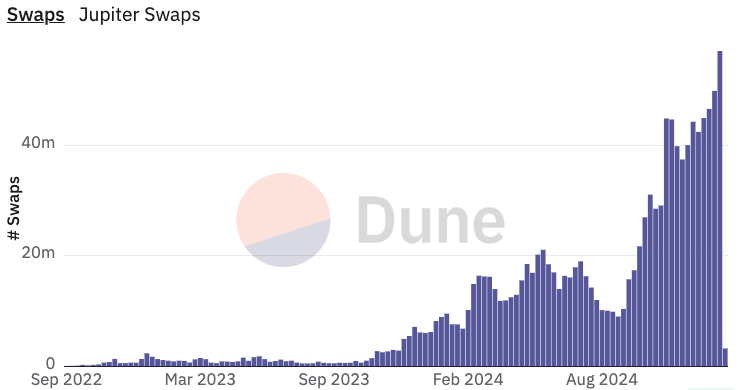

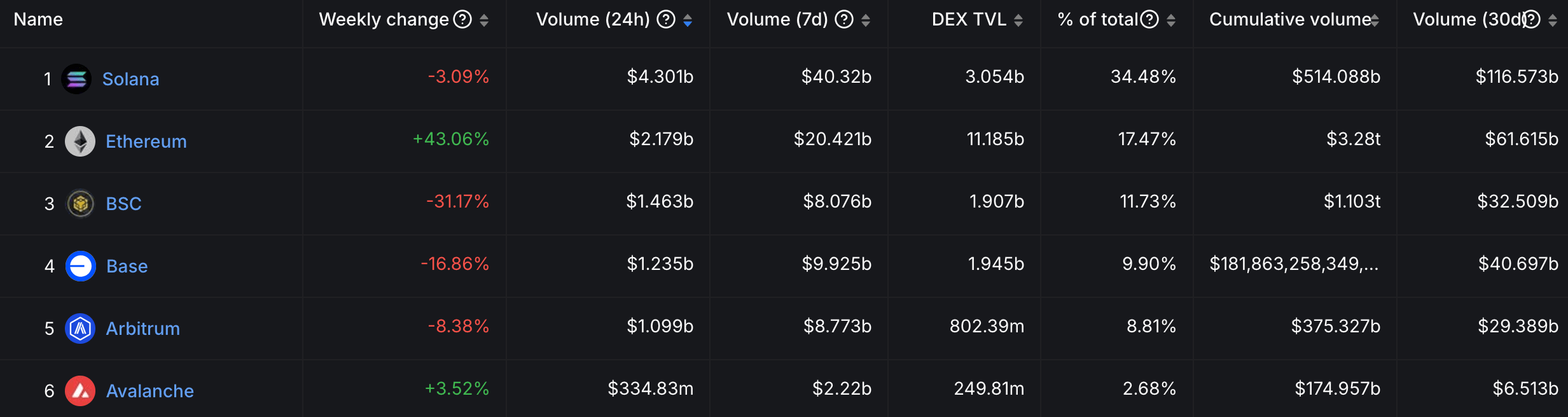

Jupiter is Solana’s leading DEX aggregator, having facilitated nearly $2.2 trillion in total volume over 1.25 billion token swaps, according to data from Dune Analytics. In the last 24 hours, its trading volume was $6.5 billion over 6.9 million swaps.

‘Monopolistic behavior’

The announcement may have helped JUP’s price surge, but it drew some concerns from the community.

Chris Chung, the founder of Solana swap platform Titan, wrote in an emailed statement to CoinDesk that the “news over the weekend that Jupiter – Solana’s most used DEX – is implementing a 5bps fee for basic swap trades in its default ‘Ultra’ mode is disappointing news for traders.”

Jupiter’s Ultra mode is set to include features such as real-time slippage estimation, dynamic priority fees, and optimized transaction landing, all bolstered by a new “Jupiter Shield” security tool. The protocol’s success, Bitget Research’s Lee told CoinDesk, “may come with the risk of centralization.”

“If Jupiter continues to increase its influence and become the dominant player in the Solana ecosystem, it could lead to over-reliance on a single project,” Lee said, adding that the “situation is contrary to the principles of blockchain which are aimed at decentralization and distribution of influence.”

Chung added that Solana’s “entire value proposition is lower cost and higher throughout, and a 5-10bps increase in trading costs is significant in this context. But it’s particularly disappointing when a paid model is being implemented when there is no perceivable performance gain over the previous free version, especially when the features in question are essential in landing transactions.”

Jupiter also announced it acquired a majority stake in Moonshot, the memecoin trading platform that was featured on the website of U.S. President Donald Trump’s memecoin and reportedly “brought 200k+ new people onchain” as a result.

The protocol has also acquired on-chain portfolio tracker SonarWatch, which coupled with the Moonshot acquisition means, to Chung, that Jupiter is “clearly looking to dominate the entire Solana ecosystem,” in a move that’s both “unhealthy and detrimental for innovation and for the user experience.”

To Titan’s founder, Jupiter’s moves amount to “monopolistic behavior” that allows incumbents to “raise prices further and further in absence of competition,” the type of behavior that decentralized finance was meant to eradicate.

Furthering these concerns, Jupiter also announced the launch of Jupnet, described as an omnichain network designed “to aggregate all of crypto in one single decentralized ledger for maximum ease of use for users and developers.” Its public beta version is coming in the next few months.

Although the DEX aggregator’s dominance may have led to concerns over the potential concentration of power in the hands of a single player, it could have a silver lining. Jupiter’s focus on the Solana ecosystem could lead to a new wave of developers engaging with it and creating new, unique products, Bitget’s Lee added.

Mike Cahill, Co-Founder and CEO of Pyth Network’s core contributor Douro Labs, pointed to Jupiter’s moves as a “clear commitment to expanding DeFi infrastructure and improving liquidity dynamics.” The innovation approach, he added, could “push a new influx of builders into the Solana ecosystem, which means we’re going to see a lot of new memecoins and a lot of new dApps as a result.”

Jupiter didn’t respond to CoinDesk’s request for comment at the press time.

(@weremeow)

(@weremeow)  (@JupiterExchange)

(@JupiterExchange)