Ethereum (ETH) has recently experienced a significant resurgence, reaching a three-week high of $2,600 after a notable spike on Wednesday. This uptick comes at a time when a key company is considering ETH as a potential treasury reserve asset, underscoring renewed interest in the cryptocurrency.

Forecasting $7,000 Potential

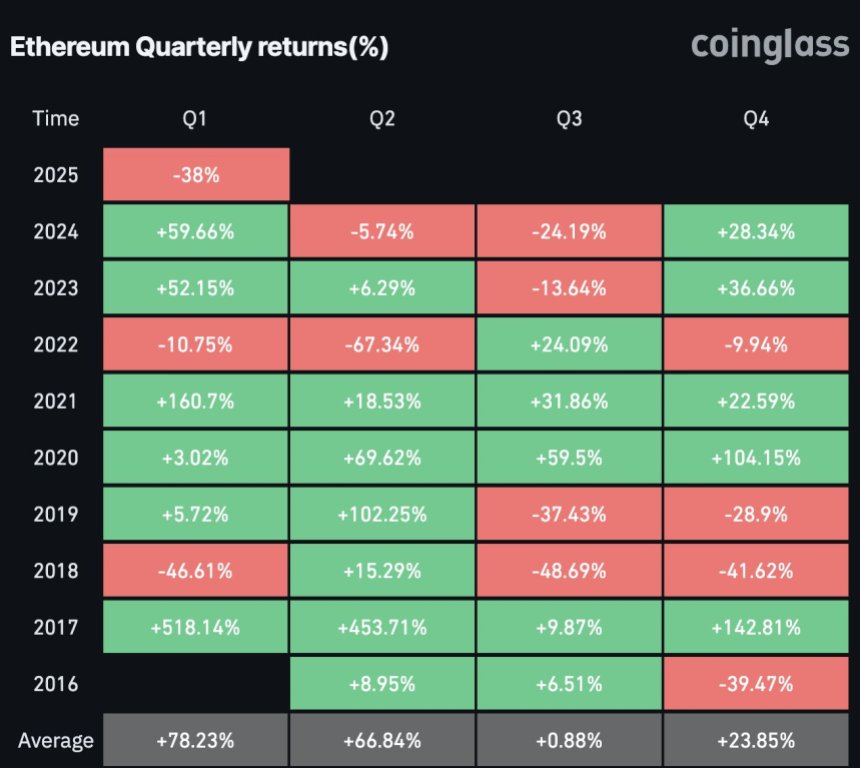

Despite being one of the poorer performers among the top ten cryptocurrencies, with a year-to-date decline of 24%, Ethereum’s recent 6% surge has allowed it to outpace competitors, including Bitcoin (BTC), which is close to its all-time high.

Crypto analyst Alek Carter has also expressed a bullish outlook on Ethereum (ETH), drawing parallels between the current price patterns and those observed in 2020.

He describes the recent movements in ETH’s chart as reminiscent of the “dead cat bounce” phenomenon—a term used to describe a temporary recovery in price after a significant decline—followed by a final retest before a substantial upward trend.

Carter points out that Ethereum underwent a similar trajectory in 2020, where it initially experienced a dip before rebounding sharply to reach a peak of over $3,500.

He believes that the recent completion of what he terms the “final retest” suggests that Ethereum is poised for another significant rally. If the current setup mirrors the previous cycle, Carter anticipates that ETH could potentially reach a new high of $7,000.

Bullish Sentiment For Ethereum

The bullish sentiment surrounding ETH is further reflected in the performance of stocks associated with the cryptocurrency. BitMine, a Bitcoin mining company that recently announced plans to make ETH its primary treasury reserve, saw its stock soar by about 20%, with an increase of over 1,000% since the announcement.

Similarly, SharpLink Gaming, which has adopted an ETH treasury strategy, experienced an 11% rise, while Bit Digital, which shifted its focus from Bitcoin mining to Ethereum treasury and staking, gained more than 6%.

Moreover, the recent interest in ETH is evident in the performance of Ethereum ETFs, which saw inflows of $40 million on Tuesday, led by BlackRock’s iShares Ethereum Trust. A

Experts also highlight that ETH’s smart contract capabilities have established it as a leading platform for the tokenization of traditional assets, including US dollar-pegged stablecoins.

The ‘Backbone’ Of Stablecoins?

Fundstrat’s Tom Lee characterized Ethereum as “the backbone and architecture” of stablecoins, given that issuers like Tether (USDT) and Circle’s USD Coin (USDC) operate on its network. Additionally, BlackRock’s tokenized money market fund, known as BUIDL, launched on Ethereum last year.

Tokenization itself represents a transformative process, allowing digital representations of publicly traded securities and real-world assets to be issued on blockchain networks.

While holders of tokenized assets do not possess outright ownership, the mechanism opens up new avenues for investment and asset management.

The latest wave of interest in Ethereum and related assets follows Robinhood’s announcement to enable trading of tokenized US stocks and ETFs across Europe.

This development comes on the heels of a growing interest in stablecoins, spurred by Circle’s IPO and the Senate’s passage of the GENIUS Act, a proposed stablecoin bill that aims to provide a new framework for these assets to integrate in the broader financial landscape.

Featured image from DALL-E, chart from TradingView.com