Welcome to The Protocol, CoinDesk's weekly wrap-up of the most important stories in cryptocurrency tech development. I'm <a href="https://www.coindesk.com/author/marc-hochstein/" target="_blank">Marc Hochstein</a>, CoinDesk's deputy editor-in-chief for features, opinion and standards.

IN THIS ISSUE:

Ethereum's blob mob

Staking on Starknet

Avalanche's big upgrade

L2 teams beam over Beam Chain

Sui suffers a brief outage

Bitcoin bridged, trustlessly

This article is featured in the latest issue of <a href="https://www.coindesk.com/newsletters/the-protocol/" target="_blank">The Protocol</a>, our weekly newsletter exploring the tech behind crypto, one block at a time. <a href="https://www.coindesk.com/newsletters/the-protocol/" target="_blank">Sign up here</a> to get it in your inbox every Wednesday. Also please check out our weekly <a href="https://www.coindesk.com/podcasts/the-protocol/" target="_blank">The Protocol</a> podcast.

Network news

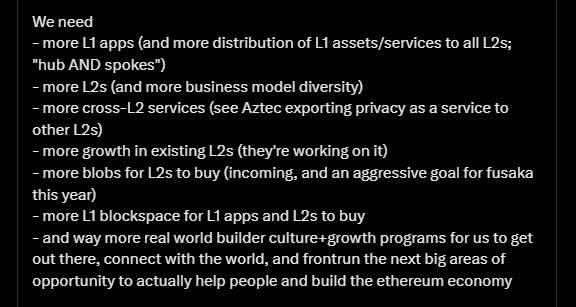

BEAMING OVER THE BEAM CHAIN: What's good for the L1 is good for the L2s. That's the assessment the teams behind zkSync and Polygon, two of the leading layer-2 networks running on top of Ethereum, gave of Justin Drake's proposal to overhaul the $400 billion blockchain, dismissing suggestions it would make their auxiliary networks redundant. “That's really a misconception,” said Alex Gluchowski, the CEO of Matter Labs, the developer firm behind zkSync. “The changes that Justin announced are focused on the consensus layer, not on the execution layer. It's not going to affect the execution layer.” In addition to incorporating ZK, Drake's proposal seeks to shorten block times, which could cut transaction costs for L2s settling on Ethereum. Drake also said he wants to introduce single-slot finality, meaning blocks with transaction data could be finalized immediately, and that information would become permanent right away. “All of those things are great because we depend on Ethereum as the global settlement layer,” Gluchowski said. Brendan Farmer, a co-founder at Polygon, also told CoinDesk he doesn’t think the Beam Chain would obsolesce layer-2s. Instead, he said, the upgrade would “make rollups work better.” However, others in the crypto community were underwhelmed by the whole plan, lamenting in particular that Drake’s five-year timeline wasn’t ambitious enough, leaving ample room for centrally-developed chains like Solana to eat Ethereum’s lunch.” <a href="https://www.coindesk.com/tech/2024/11/21/ethereum-layer-2-teams-welcome-proposal-to-overhaul-blockchain" target="_blank">Read more</a>

SUI OUTAGE: Sui Network (SUI), a relatively new blockchain, experienced an unexpected two-hour outage on Thursday. The downtime was caused by a bug in its transaction scheduling logic, which led to its validator network crashing. The issue was resolved, the network said. Blockchain outages can take place for a plethora of reasons, ranging from a 51% attack to technical errors. A common error is that of nodes – or individual entities that process transactions – being unable to sync with each other, causing the blockchain to go offline. Software bugs may be another error vector, where outdated code can render the network's processes inoperable. <a href="https://www.coindesk.com/tech/2024/11/21/sui-network-back-up-after-scheduling-bug-leads-to-two-hour-downtime-sui-recovers" target="_blank">Read more</a>

STAKING ON STARKNET: Starknet has become the first major rollup blockchain running on top of Ethereum to let users earn money by staking their tokens and validating transactions. (Metis was the first layer-2 to do so but is far smaller and is an "optimium," a different kind of L2.) Now, anyone who has at least 20,000 STRK tokens (roughly $12,000 at recent prices) can pledge the asset as collateral and earn rewards for validating transactions. Users with less than 20,000 STRK can delegate their tokens to validators to stake on their behalf. (Validators that behave maliciously or neglect their duties stand to forfeit staked tokens.) Validators and delegators that want to withdraw staked tokens must wait 21 days to receive them as well as any rewards earned from staking. Implementing staking on Starknet is part of a multiphase plan. During this first phase, StarkWare, the company developing Starknet will study staking habits on the network, and from there will assess whether and how its validators can be given the additional responsibilities of creating and "attesting," or confirming, blocks in the protocol. <a href="https://www.coindesk.com/tech/2024/11/26/crypto-staking-goes-live-on-starknet-in-first-for-ethereum-l2-blockchains" target="_blank">Read more</a>

AVALANCHE'S BIG UPGRADE: Avalanche, the eighth-largest blockchain by total value locked (TVL), is moving ahead with a major technical makeover. The Avalanche9000 upgrade went live in a test network environment Monday, bringing the changes one step closer to the main network. Avalanche9000 will be the largest upgrade that Avalanche has seen. It is designed to cut the costs of sending transactions, operating validators and building apps on the network, whose native token (AVAX) is the 11th-largest cryptocurrency, with a $16 billion market cap. The foundation is trying to attract developers to Avalanche and encourage users to create customized blockchains using its technology, known as subnets. Somewhat confusingly, subnets are now officially referred to in the Avalanche community as "L1s," even though they are roughly analogous to the layer-2, or L2, networks that augment Ethereum and other blockchains. (Avalanche's "primary network," the equivalent of a layer-1 in other ecosystems, is considered a subnet.) The team is hoping to bring Avalanche9000 to mainnet by yearend. Among other changes, 9000 would allow for a new type of validator with which anyone can launch their own subnets. <a href="https://www.coindesk.com/tech/2024/11/25/avalanche-blockchains-largest-ever-upgrade-goes-live-on-testnet?_gl=1*1ycxzn7*_up*MQ..*_ga*MTExNTkwOTY0Ny4xNzMyNjM1NDE3*_ga_VM3STRYVN8*MTczMjYzNTQxNi4xLjEuMTczMjYzNTQyNS4wLjAuNzc0MTY1MjQy" target="_blank">Read more</a>

ONE-WAY TICKET: BitcoinOS, a smart contract project led by crypto O.G. <a href="https://www.coindesk.com/policy/2024/10/26/from-smuggling-gold-out-of-africa-to-bridging-bitcoin-and-cardano" target="_blank">Edan Yago</a>, has executed what it bills as the first trustless bridge transaction for any blockchain. Using zero-knowledge cryptography, a nominal amount of bitcoin (0.0002 BTC, about $19 and change) was locked up on the main blockchain's testnet, and a proof was generated minting tokens on the testnet for Merlin Chain, a layer-2 network. No oracle or custodian was involved, according to BitcoinOS. For now, however, Merlin Chain is like the <a href="https://genius.com/37517" target="_blank">Hotel California</a> or a <a href="https://www.youtube.com/watch?v=ZXUQ_4gMoG0" target="_blank">roach motel</a> for the bridged BTC. "This is one half of the bridge showing the ability to bridge assets from Bitcoin to an EVM," BitcoinOS said in a press release. "Once the other half of the bridge is completed, Merlin Chain users can settle their Bitcoin-pegged assets back to the mainchain by proving that the tokens were burned."

Ethereum's Blob Mob

Usage of binary large objects, or blobs, has surged on the Ethereum network, signaling that more users are embracing layer-2 scaling tech for faster and more affordable transactions.

This year, Ethereum's Dencun upgrade introduced blobs, which allow large chunks of data to be temporarily attached to transactions, and later deleted after the data is verified. (You can think of a blob as a <a href="https://www.cyfrin.io/blog/what-is-eip-4844-proto-danksharding-and-blob-transactions#what-is-a-blob-transaction" target="_blank">sidecar that rides along with a motorcycle</a> for a time but eventually gets detached and discarded.) Layer-2 protocols such as BASE, Arbitrum, and Optimism use blobs to bundle transactions together, process them off-chain and then post them to the Ethereum main chain for verification without permanently gumming up the works.

The number of blobs posted to the network consistently averaged more than 21,000 this month, matching the record activity seen in March, according to pseudonymous data analyst Hildobby's <a href="https://dune.com/hildobby/blobs" target="_blank">Dune Analytics dashboard</a>.

Posting blobs costs a fee, which fluctuates depending on network conditions. The fees are paid in Ethereum's native token ether, and are burned just like regular transaction fees, taking supply of ETH off the market, a positive for the coin's price.

In this way, blobs mitigate the much-discussed cannibalization of the main chain by L2.

The blob base submission fee spiked as high as $80 on Monday, the highest since March, and the average number of blobs posted in each Ethereum block rose to 4.3. More importantly, blob fees have burned over 214 ETH worth $723,000 over the last seven days, the sixth largest source of fee burns on the network over that period, according to data from ultrasound.money.

<a href="https://www.coindesk.com/markets/2024/11/26/ethereum-blob-usage-explodes-as-traders-rush-to-layer-2-solutions" target="_blank">CLICK HERE FOR THE FULL ANALYSIS BY COINDESK'S OMKAR GODBOLE</a>

Money Center

Vibe shift

<a href="https://www.coindesk.com/business/2024/11/22/coinbase-app-gets-left-behind-as-memecoin-craze-drives-traders-on-chain?_gl=1*12vt1du*_up*MQ..*_ga*MTExNTkwOTY0Ny4xNzMyNjM1NDE3*_ga_VM3STRYVN8*MTczMjYzNTQxNi4xLjEuMTczMjYzNTQyNS4wLjAuNzc0MTY1MjQy" target="_blank">Coinbase App Gets Left Behind as Memecoin Craze Drives Traders On-Chain</a>

Not just fun and games?

<a href="https://www.coindesk.com/opinion/2024/11/25/why-memecoins-matter" target="_blank">Why Memecoins Matter</a>

Bringing in the big Sun

<a href="https://www.coindesk.com/business/2024/11/25/trumps-sluggish-de-fi-project-gets-a-big-boost-from-justin-suns-30-m-token-purchase?_gl=1*lnsg8n*_up*MQ..*_ga*MTExNTkwOTY0Ny4xNzMyNjM1NDE3*_ga_VM3STRYVN8*MTczMjYzNTQxNi4xLjEuMTczMjYzNTQyNS4wLjAuNzc0MTY1MjQy" target="_blank">Trump's Sluggish DeFi Project Gets a Big Boost From Justin Sun's $30M Token Purchase</a>

<a href="https://www.coindesk.com/business/2024/11/26/justin-sun-joins-donald-trumps-world-liberty-financial-as-adviser?_gl=1*lnsg8n*_up*MQ..*_ga*MTExNTkwOTY0Ny4xNzMyNjM1NDE3*_ga_VM3STRYVN8*MTczMjYzNTQxNi4xLjEuMTczMjYzNTQyNS4wLjAuNzc0MTY1MjQy" target="_blank">Justin Sun Joins Donald Trump's World Liberty Financial as Adviser</a>

"Reports are greatly exaggerated"

<a href="https://www.coindesk.com/markets/2024/11/27/think-ethereum-s-eth-is-dead-surging-metrics-show-otherwise" target="_blank">Think Ethereum’s ETH is Dead? Surging Metrics Show Otherwise</a>

Calendar

Dec. 4-5: <a href="https://indiablockchainweek.com/" target="_blank">India Blockchain Week</a>, Bangalore

Dec. 5-6: <a href="https://www.theblock.co/post/283406/the-block-launches-emergence-a-premier-conference-for-the-digital-assets-industry" target="_blank">Emergence</a>, Prague

Dec. 9-12: <a href="https://adfw.com/" target="_blank">Abu Dhabi Finance Week</a>

Dec. 11-12: <a href="https://newyork.theaisummit.com/" target="_blank">AI Summit NYC</a>

Dec. 11-14: <a href="https://www.taipeiblockchainweek.com/" target="_blank">Taipei Blockchain Week</a>

Jan 9-12, 2025: <a href="https://www.ces.tech/" target="_blank">CES</a>, Las Vegas

Jan. 15-19: <a href="https://www.weforum.org/events/world-economic-forum-annual-meeting-2024" target="_blank">World Economic Forum</a>, Davos, Switzerland

January 21-25: <a href="https://329b0589.isolation.zscaler.com/profile/2332cf23-bc6a-418b-a941-f595d0e3ea25/zia-session/?controls_id=22337358-9ef1-4c14-8042-bae40f505928®ion=pdx&tenant=cac35314c425&user=065ae33aa0b7fd8bb4e9ae9286b2fcf7c62d677db428d6cd9b6e4d01e6ffa098&original_url=https%3A%2F%2Fwagmi.miami%2F&key=sh-1&hmac=5349b2cbc41b5242c21267747a0dc197c5cb3cc3c860fe73f8de2f049e1adea8" target="_blank">WAGMI conference</a>, Miami.

Jan. 24-25: <a href="https://adoptingbitcoin.org/capetown-2024/" target="_blank">Adopting Bitcoin</a>, Cape Town, South Africa.

Jan. 30-31: <a href="https://planb.sv/" target="_blank">PLAN B Forum</a>, San Salvador, El Salvador.

Feb. 1-6: <a href="https://satoshiroundtable.org/" target="_blank">Satoshi Roundtable</a>, Dubai

Feb. 19-20, 2025: <a href="https://consensus-hongkong2025.coindesk.com/" target="_blank">ConsensusHK</a>, Hong Kong.

Feb. 23-24: <a href="https://www.nftparis.xyz/" target="_blank">NFT Paris</a>

Feb 23-March 2: <a href="https://www.ethdenver.com/" target="_blank">ETHDenver</a>

May 14-16: <a href="https://consensus2025.coindesk.com/" target="_blank">Consensus</a>, Toronto.

May 27-29: <a href="https://x.com/LasVegasLocally/status/1817280637457551831" target="_blank">Bitcoin 2025</a>, Las Vegas.