Three major crypto exchanges teased the launch of new Solana-based products. The trading platforms shared mysterious hints on their official X accounts, suggesting their entry to Solana’s Liquid Staking ecosystem. The news received a positive reaction from the crypto community, seemingly fueling a bullish sentiment among SOL investors.

Exchanges Hint At New Solana-Based Products

On Thursday, crypto exchanges Binance, Bybit, and Bidget created a buzz among crypto investors after hinting at the launch of new Solana-based products. Binance, the largest crypto exchange by trading volume, was the first to announce the mysterious partnership with two X posts stating “BNSOL,” and “Coming soon.”

The crypto community quickly speculated about the meaning of the post, wondering about the collaboration. Soon after, Bybit and Bitget posted similar messages. Bybit stated it was “welcoming a new baby to the family” named bbSOL, while Bitget teased that “something BG is coming #BGSOL.”

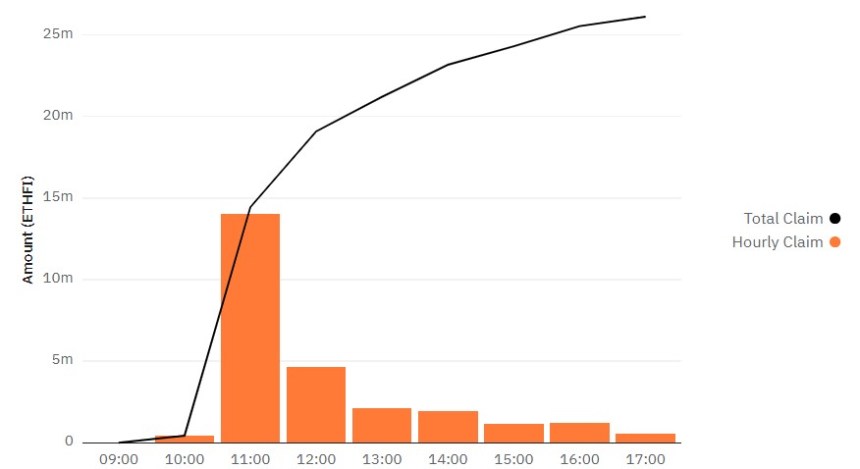

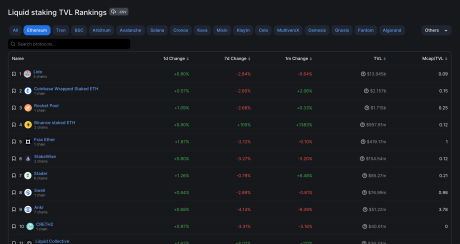

Despite not having further details, the community concluded the exchanges will launch Liquid Staking Tokens (LSTs), based on Sanctum’s comments. The Solana-based Liquid Staking Protocol replied to the news, hinting at its involvement in the project.

In a reply to Bybit’s post, the Liquid Staking protocol said it was “ready to help this bbSOL grow big and strong.” This suggests that the exchanges are entering the Solana Liquid Staking ecosystem.

The BNSOL, BGSOL, and bbSOL LSTs would allow users to stake their tokens and receive rewards while continuing to participate in other DeFi projects. The tokens would offer investors flexibility, as they would have access to liquidity without unstaking their tokens.

Major Boost For SOL Price Coming?

Following the announcements, the crypto community expressed a positive sentiment towards SOL. Many shared their excitement about the products, calling them “bullish” for the Solana ecosystem. Meanwhile, others suggested that positive competition was brewing in Solana’s Liquid Staking sector.

The bullish sentiment seemingly translated to CLOUD, Sanctum’s governance token. The Liquid Staking protocol’s token soared 56% following the announcement. CLOUD saw a massive surge from the $0.16 price range to the $0.25 mark before stabilizing above the $0.24 level.

Similarly, some community members noted that the crypto exchanges appear to see significant potential in SOL’s performance. SOL quickly surged to the $147 range, a 4.2% increase from Wednesday’s lows. Despite the positive sentiment, the price retraced to the $145 support zone before unsuccessfully retesting the daily high a second time.

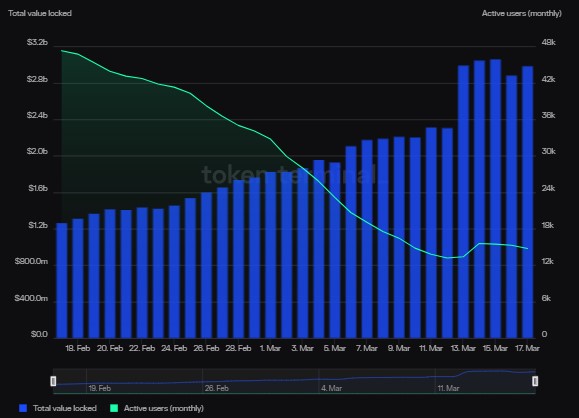

Nonetheless, investors believe that the recently announced tokens could bring a significant inflow of liquidity as the crypto exchanges have a massive user base. Moreover, the TSLs could accelerate Solana’s Liquid staking sector’s expansion and boost its adoption by retail users.

The fifth-largest cryptocurrency by market capitalization had its price recovery halted by the most recent market shakeout. SOL’s price lost the $160 support zone and revisited the $140 level as Bitcoin slipped to $58,000 two days ago.

As a result, some market watchers remain cautious about the token’s short-term performance but suggest that SOL might aim for new heights in the coming months. As of this writing, the cryptocurrency trades at $145, a 2% increase in the last 24 hours.