The founder of decentralized finance protocol Aave said the platform generated $6 million worth of revenue during Monday’s crypto market sell-off.

Kujira Foundation’s Tokens Stung by Its Own Leveraged Positions as Bets Backfire

The developers said the team’s positions were “targeted” and they plan to create an operational DAO to take ownership of the Kujira Treasury and core protocols.

Bitcoin ‘late longs’ washed out as BTC price falls to $65K

Bitcoin leveraged positions increased over the past week, and a portion of these late longs have been wiped out as BTC price dropped closer to $65,000.

Ethereum traders turn bearish as ETH price dips under $3K

ETH price dropped to a multi-month low but ETH derivatives data suggests that traders believe the correction is over.

Bitcoin falls to $55K as crypto liquidations breach $580M

Around $193 million in long Bitcoin positions were liquidated in the past 24 hours, with the price of BTC hitting its lowest point since February.

Bitcoin Crash To $61,000 Drives 24-Hour Crypto Liquidations Toward $300 Million

Early on Monday morning, the Bitcoin price crashed another 5% to drop to the $61,000 level. This drop, which was very sudden, has taken investors by surprise, triggering a massive wave of liquidations. As the volume continues to rise, the crypto liquidation figures have barreled toward $300 million in just 24 hours alone.

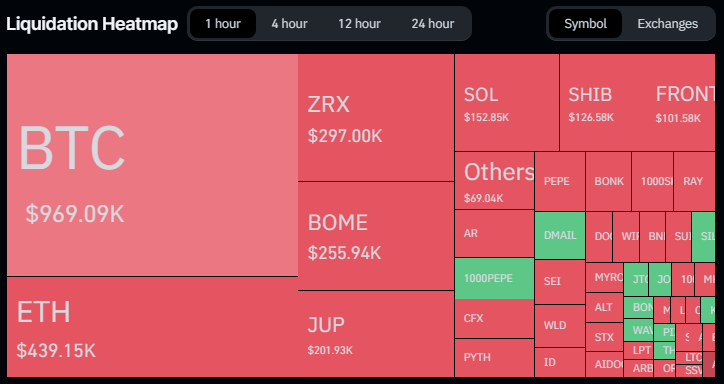

91,000 Crypto Traders Lose $282 Million Amid Bitcoin Crash

Data from Coinglass has shown that tens of thousands of crypto traders have lost their leverage positions in the last day, leading to hundreds of millions of dollars in liquidations. This comes with the decline in the crypto market, spurred on by the Bitcoin crash.

So far, the number of traders who have lost their positions has crossed 91,000, and a little over $282 million has been lost since then. With the Bitcoin and crypto market crash, the majority of these liquidations have come from long traders, with an overwhelming 91.59%.

As expected, Bitcoin has seen the largest liquidation volumes with $103 million. Ethereum follows in second place with $64 million, while Solana comes in third place with $13 million. Liquidations from others have also crossed $38 million during this time.

Binance accounts for around 35% of total liquidations with $102.9 million, while the OKX exchange has recorded $82 million in liquidations. Huobi, Bybit, and Bitmex are in 3rd, 4th, and 5th positions with $47.72 million, $21.33 million, and $15.15 million, respectively. While the largest single liquidation order took place on the Bitmex exchange, where a trader lost $10 million on the XBTUSDT pair.

At the time of writing, the majority of the liquidation had taken place in the last 12 hours alone, making up $230 million out of the recorded $282 million. Meanwhile, in the last hour, the liquidation volumes have crossed $102.5 million.

Despite the notable liquidation volumes, the last 24 hours are still not the worst day for the month of June. Since June has been riddled with crashes, there have been notable liquidation trends for the month. For example, on June 7, liquidation volumes reached $360 million when the Bitcoin price crashed from $71,000 to $68,000.

Then again, on June 18, 24-hour liquidation volumes crossed $300 million when the Bitcoin price fell from $67,000 to $64,000. If the Bitcoin price continues to fall, then these liquidation volumes could continue to climb quickly and reaching $300 million could only be a matter of when and not if.

The Bitcoin price is currently struggling to hold $61,000, with an approximately 5% decline in the last 24 hours. If bulls fail to hold this support level, the possibility of the price falling to the $50,000 territory becomes much higher.

Dogecoin Bulls See $60M Liquidations in Biggest Hit Since 2021

Over $400 million in crypto longs were liquidated in the past 24 hours as major tokens slid as much as 10%.

‘No clear catalyst’ for bloodbath as top altcoins fall double digits

Crypto market analysts suggest the altcoin stumble may be tied to a recent spate of spot Bitcoin ETF outflow.

Bitcoin Plunges to $65K, Altcoins Bleed 10%-20% as Week Turns Ugly

BTC plummeted more than 2% in an hour to $65,200 during the U.S. trading session from around the $67,000 area. The leading crypto was down 7.5% over the past seven days

Bitcoin Pullback to $66K Triggers $250M in Crypto Liquidations as Traders Brace for ‘Wild Wednesday’ of FOMC, CPI Report

Tomorrow’s Fed “dot plot” of interest rate projection and forward guidance by Chairman Powell will be key for what’s next for the digital asset market, K33 Research said.

Wild Bitcoin, Ether Price Swings Amid Spot ETH ETF Decision Triggers $350M Liquidations

U.S. regulators approved listing spot ETH ETFs but have not yet cleared to trade.

Crypto Market Liquidations Top $330 Million In 24 Hours With Ethereum In The Lead

As the Bitcoin and Ethereum prices hav barreled toward a new all-time high, short-term traders have been suffering the brunt of the liquidations. In the last day alone, over $330 million was liquidated from the crypto market and the majority of this has been from short traders who expect prices to fall once again.

Over 78,000 Traders Liquidated For $330 Million

Coinglass data shows that the last 24 hours have been brutal for crypto traders. In this short time, more than 78,000 crypto traders have seen their positions liquidated, leading to hundreds of millions of dollars in losses.

In total, there have been $330 million in liquidations. Out of this figure, 81.42% were positions belonging to short traders, meaning they made up $268.76 million of the total figure. Long traders only made up $61.31 million in the liquidations.

Contrary to the established trend, Bitcoin did not lead liquidations this time around, instead falling behind Ethereum. This is understandable as the Ethereum price had risen over 20% in the 24-hour period, whereas the Bitcoin price maintained gains of around 6%.

Ethereum liquidations accounted for around 32% of the total figure, coming out to $105.13 million at the time of writing. The largest single liquidation event also happened on an ETH-USDT pair on the Huobi exchange, costing the trader $3.11 million.

In constrast, Bitcoin liquidations came out to $96.53 million, but just like Ethereum, the figure was made up by a majority of short traders. Following behind Bitcoin is Solana with liquidations of $21.53 million. Other coins which saw substantial liquidations include Dogecoin with $7.42 million and PEPE with $4.3 million.

Bitcoin And Ethereum Lead Market Rally

The market rally that has shaken the market in the last day has mostly been led by Ethereum, with Bitcoin throwing in support. The United States Securities and Exchange Commission (SEC) asked exchanges to update their 19b-4 filings, which are important to any Spot ETFs being approved.

Given this, the market sentiment had picked up as the expectation for the approval of Spot Ethereum ETFs spread. During this time, Bloomberg analysts James Seyffart and Eric Balchunas also reviewed their approval odds for the funds, taking it from a low 25% to a high 75%.

During this time, the price of Ethereum went from trending around $3,100 to rising above $3,700. At the same time, the Bitcoin price jumped above $71,000, triggering one of the best days for the crypto market so far in 2024.

Bitcoin Buckles Below $69K as Crypto Bulls Endure $175M Liquidations

Bitcoin is showing resilience despite the slip, but the corrective period might continue for a while before a return to growth, one observer noted.

Bitcoin Pumps Above $69K as Crypto Rally Resumes

The rally was broad-based, with SOL and AVAX advancing nearly 10% over the past 24 hours.

Bitcoin Crashes: Dip To $65,000 Triggers Over $400 Million Liquidation Avalanche

In a tumultuous turn of events, the cryptocurrency market has been rattled by a sharp decline in Bitcoin prices. After a sustained period of remarkable gains and record highs, Bitcoin has plunged to a weekly low of $65,000, marking a significant setback for investors.

At the time of writing, Bitcoin numbers were all painted in red, and trading at $65,710, losing value in the 24-hour and weekly timeframes by 5.6% and 4.5%, respectively, according to data from Coingecko.

A few days after its previous low of $68,000, Bitcoin plummeted to its present level, a figure not seen in a week, as bears persisted in their downward pressure.

Altcoins Also Take A Beating

While Bitcoin bears the brunt of the downturn, altcoins are not spared from the fallout. Ethereum (ETH) and Binance Coin (BNB) have also witnessed substantial losses, shedding 10% of their value or more.

Dogecoin and Shiba Inu, two popular meme coins, have experienced even steeper declines, plunging by 20% and nearly 30%, respectively. The broader altcoin market mirrors Bitcoin’s downward trajectory, amplifying the sense of unease among investors.

Bitcoin: Impact On Market Dynamics

The recent price correction in Bitcoin has reverberated across the cryptocurrency landscape, reshaping market dynamics and investor sentiment. The surge in liquidations, with over 151,000 traders facing margin calls in the past 24 hours, underscores the magnitude of the market upheaval. Bitcoin’s dominance in the market is evident as it accounts for the lion’s share of the total liquidations, highlighting its pivotal role in shaping overall market trends.

As a result of the decline in value, the total market liquidations have reached $426 million, with Bitcoin taking the worst hit.

Liquidation Spree

The amount that the price of Bitcoin has liquidated over the last 24 hours has exceeded $104 million, with long traders losing the most money—they lost $86 million compared to $18 million for short sellers. Ethereum saw a $48 million overall liquidation, with $33 million going to long traders and $15 million going to short traders, as a result of the losing run.

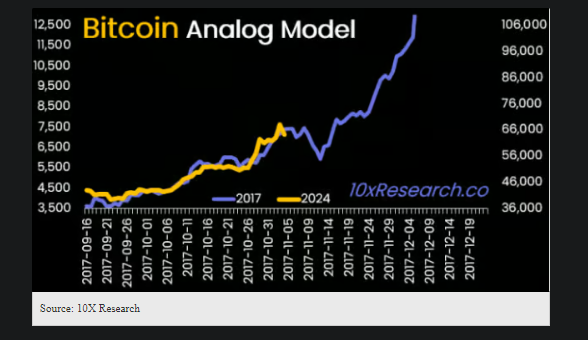

Analyst Sounds Alarm Siren

Meanwhile, market analysts such as Markus Thielen, CEO of 10x Research, have sounded the alarm bells, warning of further downside risks for Bitcoin. Thielen’s prediction of a potential drop to $63,000 sends a sobering message to investors, urging caution and prudence in navigating the current market environment.

His insights shed light on underlying concerns about Bitcoin’s market structure, including low trading volumes and liquidity, which exacerbate the risk of sharp price corrections.

Amidst the market turbulence, investors are grappling with the implications of Thielen’s analysis and adjusting their strategies accordingly. The era of meme coin mania appears to be waning, prompting investors to reassess their positions and secure profits while they still can.

Featured image from Kinesis Money, chart from TradingView

Bitcoin’s Wild Four Hours: New Record of $73K, Tumble to $69K, Rebound to $71K, $360M in Liquidations

Momentum behind bitcoin’s rally has waned so expect a period of consolidation, Matrixport analysts noted.

Solana’s SOL Dips Below $100, Slips Back Behind BNB in Crypto Ranking

Traders were moving capital from SOL to stablecoins suggesting profit taking, one analyst said in an interview.

Three Arrows Co-Founder Su Zhu Faces Questioning in Singapore Court in Hunt for Assets: Bloomberg

Zhu is expected to be released from jail this month for good behavior, Bloomberg reported.

Three Arrows Co-Founder Su Zhu Faces Questioning in Singapore Court in Hunt for Assets: Bloomberg

Zhu is expected to be released from jail this month for good behavior, Bloomberg reported.

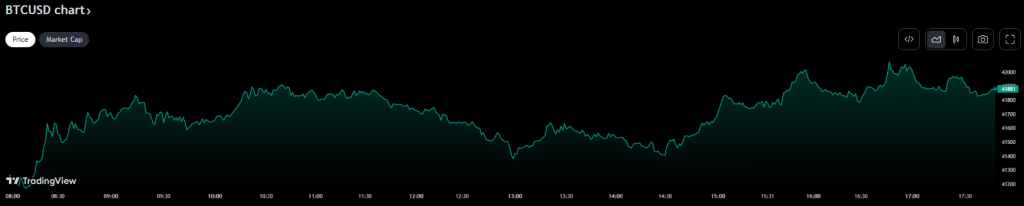

Bitcoin Speed Bump: A Week’s Surge Crumbles In Just 20 Minutes

After hitting $43,000 last week, Bitcoin traded just below it over the weekend. But the price of the cryptocurrency dropped significantly on Tuesday, reaching $41,800. Following Bitcoin’s December surge, investors chose to take profits, which led to this fall. There was a significant decline the night before, with Bitcoin momentarily falling as low as $40,300.

Due to the decline, the top cryptocurrency in the world had almost a week’s worth of gains erased in only 20 minutes on Sunday night. According to statistics from TradingView, Bitcoin saw a dramatic 7% decline at approximately 9:00 p.m. Eastern Time, falling from above $43,200 to as low as $40,290.

Bitcoin Liquidations And Stock Fluctuations

Following months of stagnation in a limited trading range, Bitcoin has been steadily rising in recent weeks. The cryptocurrency has seen a notable change in mood and performance after previously experiencing market disinterest.

Coinglass data indicates a flurry of positions liquidated in the 12 hours starting on Sunday evening, with upwards of $335 million in liquidations across cryptocurrencies, and roughly $300 million of that in long positions. The reason for the abrupt swing down was not immediately evident. In just Bitcoin alone, liquidations totaled over $89 million.

Stocks have fluctuated this week as investors prepare for a busy event schedule. Expectedly high volatility this week—the Federal Reserve’s most recent monetary policy decision is due on Wednesday, and important November inflation data is coming on Tuesday—is the cause of this anxiety.

Related Reading: Hold Your Horses: Bitcoin Could Fall Back To Under $38,000, These Analysts Say

When assessing the present rise in bitcoin, chart analysts all agree that a more significant dip in the cryptocurrency would be necessary before they would reevaluate how strong the rally is.

Rob Ginsberg from Wolfe Research agrees, pointing out that there is a lot of momentum in the continuing rising trend. According to the consensus of industry professionals, there is a general belief in the durability and longevity of Bitcoin’s upward trajectory.

Still A Bright Road Ahead

A number of favorable catalysts for the cryptocurrency is seen in the upcoming year, with the first being the possibility of a bitcoin exchange-traded fund (ETF). Investors anticipate a price spike in the months that follow the anticipated halving of Bitcoin in the spring of 2024.

Although some investors are excited by the prospect of an ETF, the market as a whole is feeling positive and anticipating significant changes to the cryptocurrency environment.

The price of Bitcoin has risen by about 150% since the start of the year, despite the hiccup. The main driver of the surge has been expectations that large financial institutions will soon be able to purchase significant exposure to Bitcoin through exchange-traded funds (ETFs).

The market’s common expectation that the US Federal Reserve would start cutting interest rates in the middle of 2024 has added to the support for Bitcoin’s price climb.

Featured image from Adobe Stock