In a refreshing ruling on August 29, the United States District of Columbia Court of Appeals said the stringent Securities and Exchange Commission (SEC) was, after all, wrong in denying Grayscale to convert their over-the-counter (OTC) Bitcoin Trust (GBTC) into a Bitcoin spot exchange-traded fund (ETF).

The regulator had previously barred the conversion of the GBTC to an ETF, citing an alleged absence of measures to prevent price manipulation, forcing Grayscale to sue. Before this ruling, the presiding judge said SEC needed to elaborate on why they denied Grayscale’s application.

Litecoin Rebounds

Following today’s court statement, Bitcoin prices soared, and the aftermath of this pump has positively impacted Litecoin. As it is, BTC is up roughly 10%, sharply rebounding from around $25,800 support recorded last week. Meanwhile, LTC, the bitcoin “silver,” is up 7% when writing, aiming to reverse losses of August 17.

Litecoin is changing hands at around $70, with a noticeable increment in trading volumes. Typically, in crypto trading, a spike in volumes, regardless of trend direction, can point to engagement and provide a “hint” of traders’ sentiment.

With rising volumes and expanding prices, it could suggest that bulls are positioning themselves for even more gains in the sessions ahead. Meanwhile, sharp losses with increasing volumes may mean bears are unloading, and prices may drop.

Post-Halving Rally On?

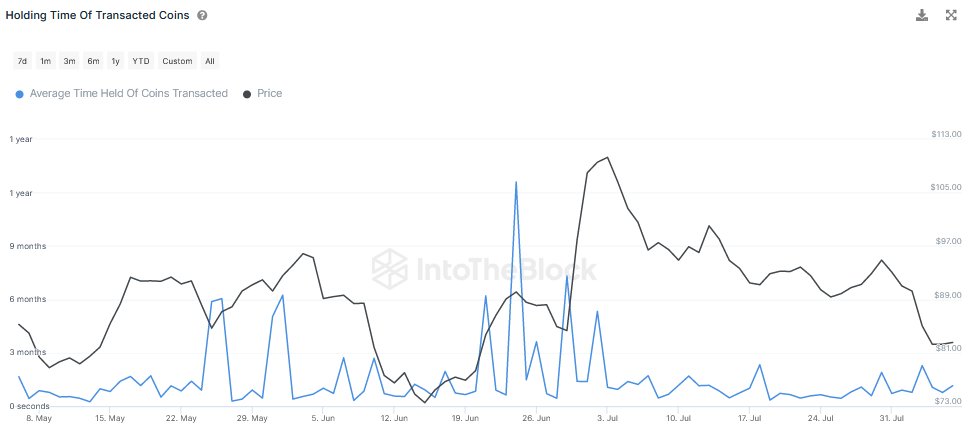

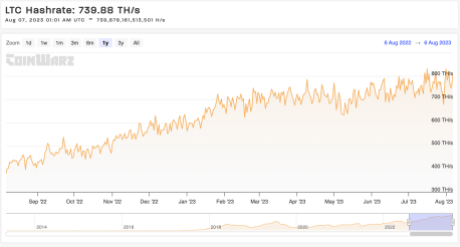

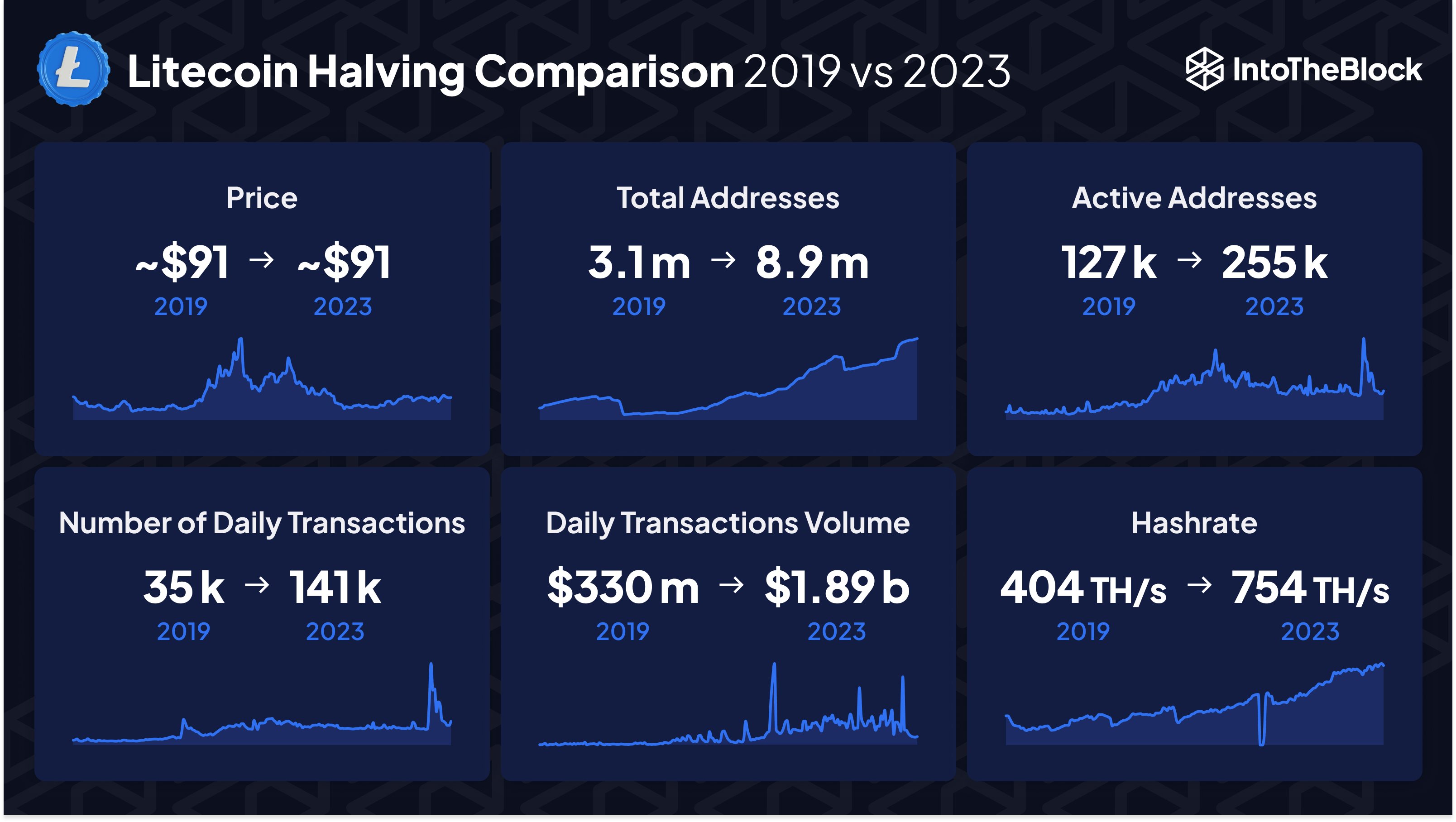

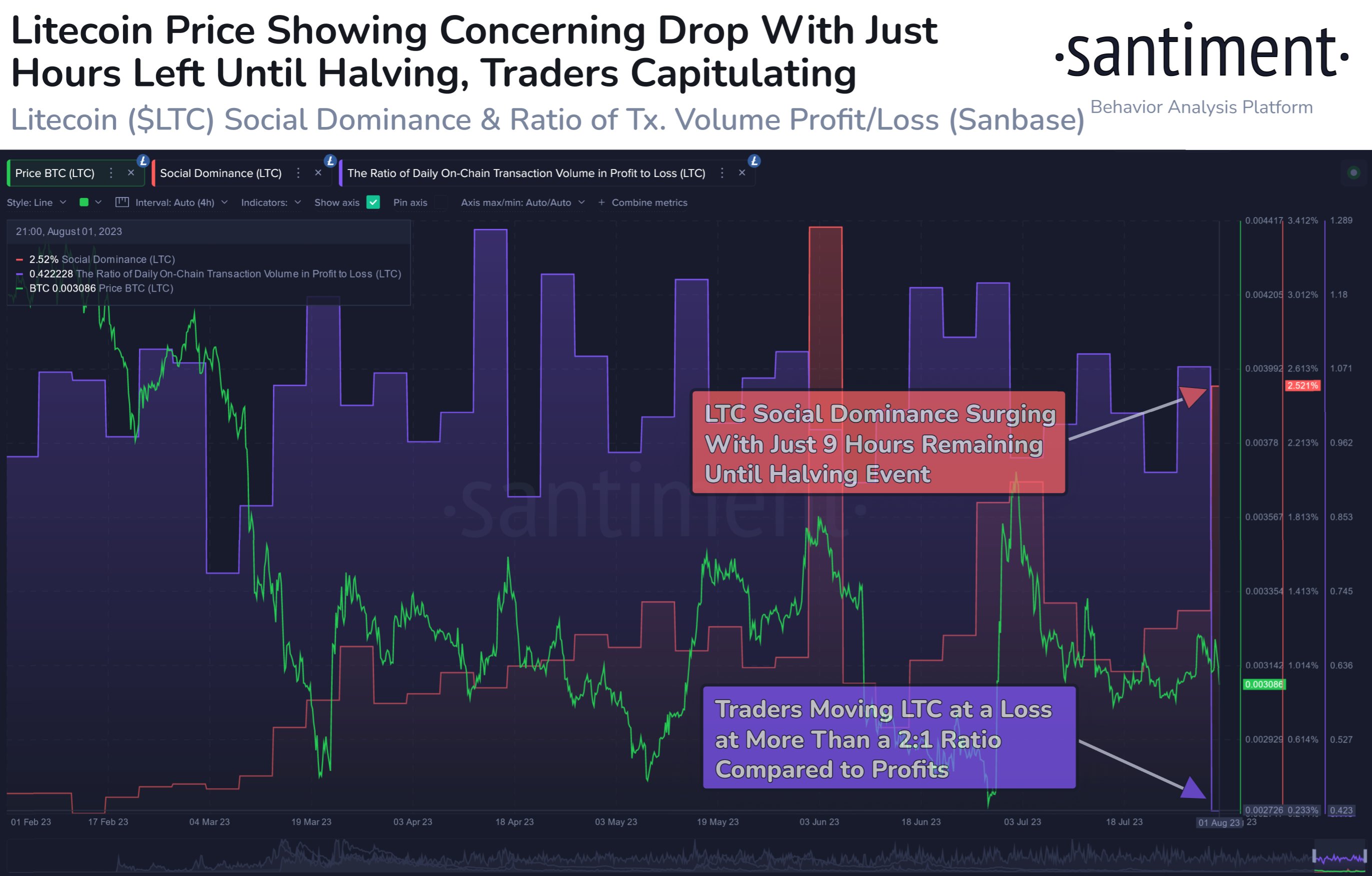

The expansion in LTC trading volumes, as visible in the daily chart, could translate to a possible bottom for the digital asset that has been under pressure in the past few sessions. To illustrate, LTC is down 26% in August 2023 alone. This dump is despite news of the Litecoin network halving its miner rewards to 6.25 LTC in early August.

In crypto, halving events has historically been associated with fresh cycles of increasing demand for the underlying coin. For Bitcoin, past performances indicate that the coin tends to rally months after the halving event. Meanwhile, in Litecoin, it has been mixed, but spot prices are generally higher than in 2019 when it halved.

With Grayscale igniting demand in Bitcoin and other proof-of-work altcoins like Litecoin, it is yet to be seen whether bulls will build on this and push prices, especially of LTC, higher. LTC prices are currently trending inside the August 17 bear candlestick.

Technically, this is bearish from volume analysis. A sharp reversal and rally, ideally above $75, peeling back August 17 losses, might catalyze more demand, potentially setting the base for a relieving post-halving rally.

If this is the case, August 17’s losses could be the climactic end of the leg down as LTC establishes a triple bottom at around the $60 and $65 support zone. Previously, LTC found support in this region in March 2023 and December 2022.