Here you have a Greek tragedy of a downward spiral in art, culminating in a work being sold by a horse-era institution, propped up by 100 years of destructive philosophy, confirmed shadow games since the 1940s, recent inflationary money printing, and blatant one-sided activism. It’s worth stepping back to see the big picture.

A shiny new web3 house on the hill then asks new-era artists to conform to the old setting by becoming vehicles to sell even worse garbage, while leaving out the OGs of the scene—ensuring the products can’t outshine the primary idiocracy… or so it might seem at first.

Maybe there is more to it all. Something even those directly involved are not even considering to be a thing. This “full circle” above refers to how seemingly progressive ideas are actually about selling the future in a desperate attempt to save the past, and control the present. Much like printing money at the expense of future generations, the fiat era of money is still in full swing in art. The Great Contemporary Art Bubble was a revelation when I first saw it at the start of my career in art in 2008.

This article offers an alternative perspective to the popular banana show recently dominating the web3 art internet. It’s a big “what if”?

If you can be truthful, brave, and funny—say, in the spirit of Joe Rogan—you might get some things wrong, but this article have plenty most have never considered to be a part of the art world. My intent is to be as fair as possible, and to continue saving art from the last hundred years of agendas that no longer serve it, especially in today’s world where decentralisation tools can invite everyone excluded into the party-this being nearly the whole population of the earth right now.

Setting the stage:

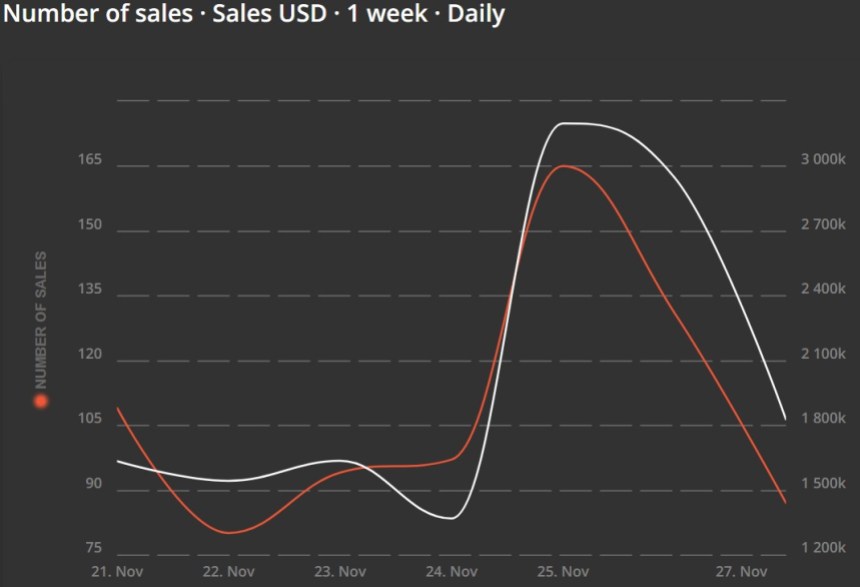

First off, SuperRare has done a great service to the digital art community in impressive numbers of art sold, and development in the scene through their DAO, up keeping the creator resale ryoalties, and fighting for the scene to become a thing among the first in the game. Watch this interview by the founders to get a deep dive into their perspective on the Dinis Guarda show. Thousands of artists will likely speak positively about the whole thing. So what gives? In short, the corporate mindset leading art, once again. This is not about SuperRare alone, but the whole company scene that emerged, but something that is personal to me about it all as well.

As per the selected fifteen bananas, the dilemma of SuperRare is obvious. You can’t outshine the lame duck pre-internet paradigm banana, and the bureaucratic class, so their curator team is stuck choosing the upper end of what can be politically business wise tolerated. That ends up being not much, while they sell the future down the polluted river.

As per the selected fifteen bananas, the dilemma of SuperRare is obvious. You can’t outshine the lame duck pre-internet paradigm banana, and the bureaucratic class, so their curator team is stuck choosing the upper end of what can be politically business wise tolerated. That ends up being not much, while they sell the future down the polluted river.

“A tragedy is a literary, theatrical, or dramatic work that typically depicts the downfall of a central character, often due to a combination of their own flaws (such as hubris, greed, or ambition) and external forces (such as fate, societal pressures, or the actions of others). Tragedy is characterized by serious themes and often evokes feelings of pity and fear in the audience, culminating in catharsis—a purging or emotional release.”

Or actually just..

(Art) Threat To Our Bureaucracy

The SuperRare competition held in sync with Sotheby’s upcoming auction of a famous banana marked a new low in substance for the NFT scene, and there’s plenty to reflect on from before. Not because the art was the worst—that standard is impossible to set in NFTs anymore—but because of the combination of pleasing an old player while simultaneously sidelining the OGs – for the sake of engagement farming and money.

The essence of crypto art—the rugged band of true avant-garde artists who took on the central banking system—has now been mostly washed away from sight. Events like this banana show, where they could have shone brightly to the world, instead pushed them further into the shadows. The watering down the Vodka of this scene is now an equivalent of a frozen bottle in the freezer.

The more partnerships formed with pre-internet and web2 companies in hopes of “reputational gain,” the more a promising beginning started to vanish before our eyes. Very soon, the scene began to resemble the old one the pioneers had been trying to escape. The clearer the communication challenging the status quo in the art world at large, the more certain you became of hearing, “You weren’t selected this time,”, if you heard anything at all in the web3 scene as well. The curatorial team is hidden, so the community can only fight a symbol like SR, while those responsible for the heat generated remain protected.

“I’m afraid I can’t explain myself, sir. Because I am not myself, you see?”

― Lewis Carroll, Alice in Wonderland

Is art free?

If art is truly free, where are the visual artist equivalents of Jordan Peterson, Thomas Sowell, Eric & Bret Weinstein, Gad Saad, Camille Paglia, Joe Rogan, Jonathan Haidt, Graham Hancock, Patrick Bet-David, Coleman Hughes, Yeonmi Park, Casey & Calley Means, Christina Hoff Sommers, Michael Malice, Mike Baker, Matt Taibbi, Matt Walsh, Matt Taibbi, Tucker Carlson, Annie Jacobsen, Ben Shapiro, Candace Owens, Andrew Huberman, Ayaan Hirsi Ali, and an abundance of others?

This list includes credentialed academics, surgeons, scientists, religious and non-religious figures, journalists, people from the left and the right, as well as outside the system. Regardless of what you think of them, together they reach billions of people across various platforms and tackle a vast ocean of topics that are absent from the art world. Many even more provocative voices are deliberately excluded from the list, highlighting just how low the tolerance for dissenting to the postmodern monolith viewpoints is.

This list includes credentialed academics, surgeons, scientists, religious and non-religious figures, journalists, people from the left and the right, as well as outside the system. Regardless of what you think of them, together they reach billions of people across various platforms and tackle a vast ocean of topics that are absent from the art world. Many even more provocative voices are deliberately excluded from the list, highlighting just how low the tolerance for dissenting to the postmodern monolith viewpoints is.

So, are we living in the most restricted era of art history, or are we just now realizing how controlled it has always been? It’s becoming increasingly clear that the culture of convenience in art has overtaken its true purpose, much like what has happened in food, medicine, media, and other fields, as illustrated by the podcast guest list above. It didn’t take long that web3 went down the same stream.

This article, links and all, might just be able to change your whole perception on what art is today. You will, however, need some courage and sincerity to get it.

As I’ve recently discussed, including in this Anna Fischer interview, the art world’s cancellation and selection processes are deeply intertwined with lesser-known histories and fishy agendas also. These include the interference of intelligence agencies like the CIA since the 1940s, working alongside a specific kind of ideological possession—arguably making art less free than even the corporate scene is now substance wise. We’ve just had it for so long that people don’t understand being completely captured by a singular philosophy of postmodernism. You can read my previous “Free web3” article to get clued up on that side if unfamiliar.

The past to shine light to our current state:

Through declassified documents, investigative journalism and biographies related to the Congress for Cultural Freedom (CCF), a CIA-funded organization, revealed that the agency had funded Jackson Pollock, Rotko, and De Kooning. The Museum of Modern Art (MoMA) played a pivotal role in the CIA’s cultural strategy. Key figures like Nelson Rockefeller (a MoMA trustee) were complicit in promoting Abstract Expressionism as a symbol of American freedom. MoMA organized exhibitions that were covertly funded by CIA-backed organizations, ensuring Abstract Expressionism gained prominence internationally to combat soviet art propaganda.

Jackson Pollock in his studio in 1951

Wait a minute, VESA—are you insinuating that SuperRare or Sotheby’s are somehow influenced or captured by an intelligence agency? In short, no not directly, nor do I have any evidence otherwise. Direct involvement is not how these agencies work anymore. Most people would never know if they were behind something. However, it’s impossible to claim they haven’t been influenced indirectly, given what we know about the past

For better or worse, we’ve all been influenced by these forces. The question is, did CIA leave the space after the 50’s, which is unlikely, and how many other agencies have entered, and from which countries since? Undoubtedly this is part of how we’ve arrived at where we are today, and I’ll unpack that as best I can below.

A scene from 1740’s London

A scene from 1740’s London

Sotheby’s was founded in 1744 and has long been one of the rubber stamps of perceived quality. Much like the media, they underwent a strange transformation during COVID, embracing their metaverse and digital assets phase. It was as if, suddenly, serving Big Mac-level artworks in a three Michelin-star restaurant was considered cool. To me, it felt like they were burning down their own house and hosing it with petrol to speed up the process. A similar trend emerged with SuperRare, which increasingly alienated itself from its origins, throwing out OGs like Robness and Max Osiris. These were contrarians, for sure, but contrarians have always been a crucial part of the game. They fought for freedom of expression—annoying to the founders, perhaps—but they were powerful in their expression and represented the core of what this scene was supposed to be about. In essence, they weren’t doing anything Duchamp, Pollock, or even Basquiat wouldn’t have done. I say this, having endured a few unprovoked tirades from Max myself, but keep being on his side.

If you are against free speech, you are anti-art

The talented rarely align with corporate agendas over art. While I was courteous to the early scene people involved, I was merciless in my expression of what this scene was truly about. You can find that in pieces like “Selling banks their fat asses back” or “The Br8ve“. The corportes had clenched assholes just by knowing I existed, especially after taking a freedom of speech stance during Covid. Many platforms didn’t accept my applications in web3, so kudos for SuperRare for keeping me. I said I was going to be fair. The free speech alone was enough to get me sidelined to the tune of tens of millions so far.

Freedom of speech of course is another way of saying freedom of expression aka art. The artists with the greatest potential and the most original expressions found themselves relegated to the outskirts of the pump. Meanwhile, what thrived were imitations of previously made masterworks, done to death concepts from decades back, meaningless glitch art, and whatever iteration of abstract impressionism was f l y i n g. I had some cool ones too along those veins, but crickets. Seemed everyone and their uncles were on Sotheby’s and Christie’s – but not me.

To share some of the load, this was going on for me ever since the beginning. Artnome was among the first three people I contacted in 2017, and he took an active role in making sure I was nowhere to be found in his curation or circle. I contacted him directly, so there is little doubt. Everyone in the early scene was aware of everyone else. Can only imagine what kind of things he has said behind closed DMs. To me, Artnome represents crypto art much like Flint Dibble represents archeology. Many from the early scene felt the same. Not mentioning names as I am not in the habit of throwing people under a bus, nor were they shy to say so either.

To share some of the load, this was going on for me ever since the beginning. Artnome was among the first three people I contacted in 2017, and he took an active role in making sure I was nowhere to be found in his curation or circle. I contacted him directly, so there is little doubt. Everyone in the early scene was aware of everyone else. Can only imagine what kind of things he has said behind closed DMs. To me, Artnome represents crypto art much like Flint Dibble represents archeology. Many from the early scene felt the same. Not mentioning names as I am not in the habit of throwing people under a bus, nor were they shy to say so either.

The personal responsibility part

Back in the day in 2017, when there were very few of us crypto artists indeed, it was the SuperRare guys who reached out to me to join their platform. It was my relative mistake back then to join Four Park and Orion Vault instead, as my ten-year efforts could be priced at $50K there, while SR was averaging $50 per piece in 2017 and 2018. My works were heavy effort and just making one was 5x more expensive than what I could have gotten out of them in SR. Also the quality of the works was some cool stuff but mostly kids throwing shit on a wall and seeing what sticks with a glitch effect. By glitch effect I am not talking about cool stuff like Xcopy or A.L Grego later, but truly amateurish “wtf is this?” stuff. I thought I’ve actually exhibited in reputable galleries and received major press coverage reaching hundreds of millions. Joining this could look bad for me on many levels.

VESA and CTO of SuperRare Jonathan Perkins at the Museum of the Future in Dubai in 2022.

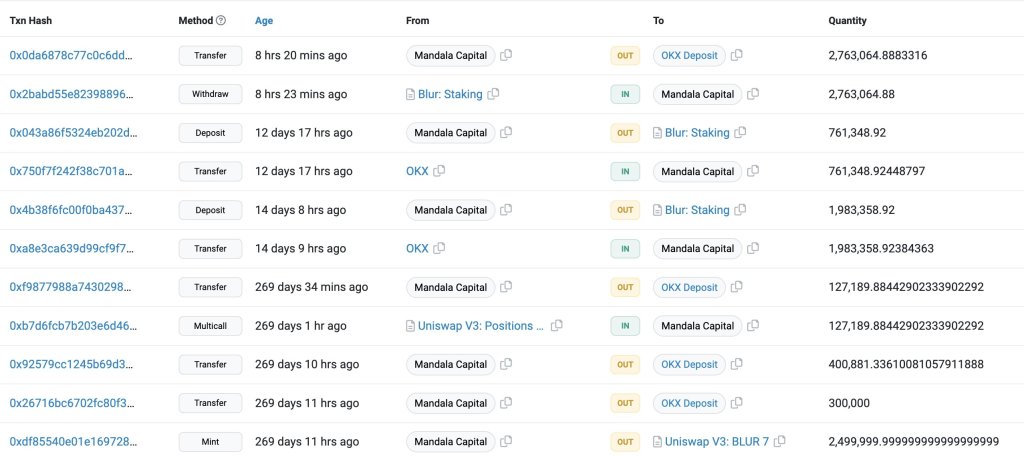

My bad, of course, since I sold nothing through the former two and was priced out of reach for the SR crowd at the start. The bear market and non-existent high level collector base wiped out both Four Park and Orion Vault. It wasn’t long, that things looked different on SR, and I did hop on board already in 2019, which I thought was early enough, but then nearly nothing happened no matter what price or kind of work I uploaded. I thought it very strange, as there was things flying off the digital shelves for more money and less, objectively deserving it much less on the basis of story, aesthetics, CV, reach, process & critical acclaim. Primarily, art matters, and that didn’t suck. So,again, wtf?

The works were being sold for crazy money consistently by others. You could basically literally put out a line of colour and be an artist that started that year, and sell. It was the boom of 2021. Somehow, this was not the case for me in NFTs, despite being here and very visible almost before anyone else.

“The Beginning of a new era” artwork by VESA, a digital original from 2013 made with a Bollywood star, reaching about 300m people when published.

The Shiny New Web3 Art House On The Hill

SuperRare quickly became a standard for collectors, most of whom, for the most part, had little understanding of art. The founders had backgrounds in architecture and new media but lacked direct experience in fine art. It was a degen scene—focused on crypto symbols and positive decentralization propaganda—which soon escalated into pure speculative hype over anything and everything available. There was some sophistication, too. Expertise was then soon imported from the legacy scene, which ended up being the problem.

For the most part, collectors sought the curatorial stamp rather than the substance, career, or depth of the art itself. However, there were exceptions—artists who truly embodied those qualities. Meanwhile, platforms like Rarible, OpenSea, and others turned into a digital Wild West on fire.

I’m using Joseph Desire-Court’s 1826 “Delusion scene” artwork as a meme to help people understand my relationship with SuperRare since the early days to now. It is deeply personal, as well as funny, as my real son was stillborn during the time I realised I was going to be left behind from the movement in 2021. Losing my son, as well as simultaneous access to the first NFT run, was a tough pill to swallow back then. I’m not suggesting this whole situation with NFTs is SR’s fault, but they seemed to have played a part in my deboosting—despite them being well aware of me. In the coming banana show part, I got confirmation of this, as all the founders were tagged in my post & the accompanying text leaves little for imagination for the curators.

It’s proof of censorship.

Painting by Joseph Desiree-Court meme alteration – 1826 to 2024

“In the biblical book of Genesis God flooded the earth, sparing only Noah and his family who had been instructed to build an ark. All others perished in the great deluge. Instead of illustrating the life of Noah, Court gives us a scene from the other side of the story. Here a man has to choose between saving his own son or his father. He chooses his father who, despite the man’s efforts, has just slipped out of his grasp. The painting can be read as an allegory about clinging to the past. If you always look to traditions and the past, you will miss out on all the possibilities that the future can bring.”

End Stage Postmodernism

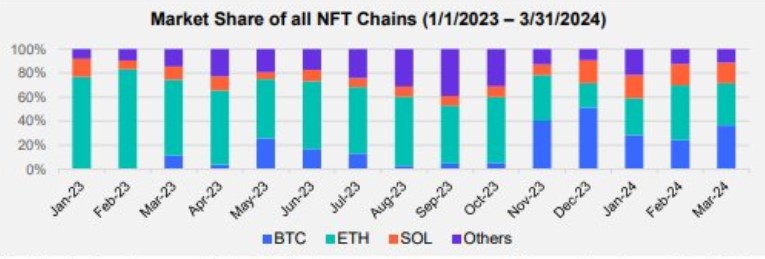

During the NFT boom, the Pride LGBTQ+ movement also reached a stratospheric rise, and overnight, Fewocious became its brightest star. While I think he is a talented artist, his work was clearly youthful; a 16-year-old simply hasn’t had the time to develop much depth yet. His pieces sometimes depicted crying, misunderstood figures with a similar text explanation—if you know what I mean. The cartoonish style of this young artist was soon hailed as Basquiat-esque, with the added elements of gender confusion and being on the spectrum. Altogether, it fit every “tick-a-box” criterion for the emerging ETH scene, that was enhanced by media, marches and organisations. There was a heavy government, media and colliding corporate push for this that came out of seemingly nowhere all of a sudden. During the NFT run, the Bitcoin culture and the rest of the chains truly separated.

It was all WAGMI and “Gm” for the scene—except, of course, for many of the artists who had fled the increasingly absurd woke art world and formed the first wave of crypto art by critiquing central banking, money printing, and promoting hard money principles. We were interested in healing society from a very different set of lenses, and not all that convinced more woke was what we needed to go into the right direction. On top of that, if you dared say a word about the “fresh wave” of end stage postmodernism, you weren’t necessarily cancelled silently, but certainly considered “out”.

It was all WAGMI and “Gm” for the scene—except, of course, for many of the artists who had fled the increasingly absurd woke art world and formed the first wave of crypto art by critiquing central banking, money printing, and promoting hard money principles. We were interested in healing society from a very different set of lenses, and not all that convinced more woke was what we needed to go into the right direction. On top of that, if you dared say a word about the “fresh wave” of end stage postmodernism, you weren’t necessarily cancelled silently, but certainly considered “out”.

I’m Potency

No one likes critique it feels ick, but without it the whole world becomes no rizz.

I haven’t really participated in an ‘art submission competition,’ perhaps ever, as I’m a bit old-school and view it much like Prince might have viewed the rise of TV singing contests. He felt the process and commerce of it killed authenticity in the artist, and wasn’t wrong. In comparison to the music roster we had until about 2000, we live in a post music world now. However, the endless corruption symbolised by the duct-taped banana artwork, colliding with a SR competition, prompted me to enter.

“In I’m-Potency, artist VESA presents a sharp satire on Western society’s spiritual flaccidity. By replacing Adam’s reaching finger with a limp, taped banana—a nod to Maurizio Cattelan’s Comedian—this piece reflects the decay of a culture that once held itself as a beacon of enlightenment but has now veered into absurdity. Michelangelo’s Adam famously reaches toward God with a finger that isn’t fully extended, symbolizing humanity’s hesitation and the delicate gift of free will. In this reimagining, Adam’s once-restrained reach becomes even more compromised, transformed into a limp banana pointing downward. It’s as if Western culture, once brimming with creative potential, is now resigned to existential apathy, unable or unwilling to reach for anything beyond itself.”

That is just the start of the text ending in this:

The post tagged the new head of digital assets in Sotheby’s, the auction house, as well as SR.

The post tagged the new head of digital assets in Sotheby’s, the auction house, as well as SR.

Read the full context of the submission substance here

See the selected, eventually 15 artworks considered more worthy by the SR curation team

Of course, it was not selectedThe most amazing thing about my submission piece “I’m Potency” not selected to the SR banana competition finals was that I am an actually censored artist, making a case on how art has been censored by the postmodernists for over a hundred years, writing the whole thing out crystal clear, but I got censored again out of the show by those who were meant to build the free infrastructure. What we have here, is an illusion of choice. A combination of a totalitarian philosophy, coupled with an illusion of options.

This is made obvious by the objectively much less substance or vision pieces selected over mine with a topic of censorship. More on this a bit later, but you will see it at the very least, vindicates my point that shadow games beyond merit and substance are going on inside of the web3 art world, much like in the legacy art as well.

Pissing on traditional values for a hundred years

In the art world, the war on conservatism began over a century ago with Duchamp’s satire and shock artwork, The Fountain (1917). Duchamp claimed his six-dollar urinal entry piece singled how “art has lost all of its credibility.” Ironically, it sank art even lower from a certain perspective. Fast-forward a hundred years to The Comedian and it seems no amount of bubble gum in the form of “substance” can satiate the post-MTV generations.

If something had already been done with far more punch a century ago, eroding standards in a meaningful way at the time, then today’s attempts are pure LARPing. Sotheby’s, in this context, is not worthy of the reverence it once commanded—especially when their head of digital assets, Michael Bouhanna, calls The Comedian “the most significant work of the 21st century.” Very little of course about this is about art, as most of it is money, power and potentially continued societal agency subversion.

Jonathan Haidt’s research on disgust sensitivity is fascinating. He discovered that conservatives have a much more heightened sense of disgust when boundaries are broken, as well as a greater need for physical cleanliness. In contrast, this is not a high priority for liberals or libertarians. Naturally, those with no boundaries are easier to subvert for whatever cause. Fobia means An intense, irrational fear or aversion to a specific object, situation, or activity that is often disproportionate to the actual danger posed. This is not the same as disgust, which is an emotional response of strong aversion or revulsion to something perceived as unpleasant, offensive, or morally unacceptable. This part is less discussed in this context.

“KISS”

My second inspired banana, which I did not submit to the contest.

So returning to the Pollock paradigm and how he was a darling of the alphabet agencies, with the CIA entering the art world as far back as the 1940s to combat the rise of communism. Leftist artists were propped up to showcase American exceptionalism. Selling the idea of a cocaine-laced drink and “do what you feel like” freedom to American youth and elites wasn’t a hard pitch compared to glorifying Soviet despots who demanded hard work as well as to be elevated to Godlike status.

Read the full context of the “Kiss” artwork

Most know of course the famous Kiss by Gustav Klimt, and how combining the CIA logo and the idiot banana in this context is at least a chuckle, if not a profound question mark on the last 80 years of our understanding of art.

This isn’t conspiracy theory—it’s conspiracy fact. It’s also worth noting that the term “conspiracy theorist” was invented by the CIA as a derogatory label to discredit those questioning their activities, a tactic that gained traction after the JFK assassination. This will be relevant later when discussing how RFK has now been elected as part of the new U.S. cabinet. Conspiracy theories have been around pre-internet, took the internet by storm, and are completely invisible to the art world. This is because there is no right wing thought in the space what so ever. Sure there is cooky thing from flat earth to what ever, but there are legitimate conspiracies proven true that are fascinating. There are no gallery artworks making any waves? Not a single openly conservative artist anyone knows? Seems natural.

Some of you might also be familiar with the famous interviews of Yuri Bezmenov, the defected KGB spy, who outlined how demoralization was part of their plan to take down the U.S. government. If you ask me, the demoralization he described has only ramped up since the 1980s, fueled by postmodern values and the fiat-funded war on conservative ideals and God—or whatever God represents as a symbol of natural order to be discovered rather than manipulated into existence. His “useful idiot” term helps us see many players in art in a different light.

Eric Weinstein gives some indication with his Kayfabe concept to where we might be today. Here are parts 2 & 3

The art world, which has been playing with our collective subconscious for a 100 years, is in deep need of an audit by a character like Elon Musk with his DOGE crew of Vivek, RFK and Trump. Wouldn’t that be something?

You also need me on Rogan going a three hour round to talk about this all. This is why I made the Department of Artistic Freedom. It’s an open invitation to the first 100 builders resonating with this idea, and available on Ador for 369k sats- a nod to Tesla. Buy it if you want to support the cause like that, but I care mostly that the mentality spreads. You don’t have to join to start making the new direction happen. Just choose to do your own exploration without censoring yourself constantly.

It will be a think tank for liberty minded artists, and the function will first be to come to the aid of artists who are being ignored despite obvious merit and substance, as well as facing some form of cancellation for BS reasons.

Given the massive push by governments, media, and activists for the LGBT+ community not long ago, how can we be certain that the art aspect wasn’t a similar operation to the one carried out with Jackson Pollock back in the day? Be so free that no boundary of physical reality can hold you back. Simultaneously, everyone raising their voice will be canceled, and most will be incentivized to stay quiet.

I’m not saying it was—I’m saying that, knowing all we now know, we can’t be sure. And those involved publicly might not have any idea this was the case. Least of all Fewocious, so crytal clear, I am not accusing Fewo, SupeRare, nor Sotheby’s of anything. This is about something much bigger and the sum of the parts.

Beeple’s “Cross Road” sold for 6.6M at Sothebys earlier

Beeple’s “Cross Road” sold for 6.6M at Sothebys earlier

$17 Million Realized in Sotheby’s First NFT Sale with Digital Creator Pak

Postmodern pump:

The same question certainly applies to Pak, Beeple, and many others who used late-stage postmodernism expressions as their vehicle of communication. Much was fitting to the agenda of end stage postmodernism in NFTs.

From the Twitter files, we know for a fact that deboosting and amplifying messages were actively managed, and merit was certainly not at the top of the food chain in the selection process. The real question seemed to be: What can we push and get away with? This approach fit the degen agenda perfectly. It is difficult to sell high level art to an audience that can’t read it. This has been the argument of culture critic Camille Paglia.

Again, I am not accusing any artist, gallery or auction house. This is mere opinion and speculation on big philosophy waves as well as the continued erosion of substance in art. In podcasting, this kind of speculation has been normal for a long time, but not in art, for some reason.

Also, this has nothing to do with hating any group within postmodernism. It has everything to do with the manipulative individuals working behind the scenes to activate and suppress ideas according to power plays and political agendas. People like James Lindsay have committed significant parts of their lives to try to figure this all out.

Some will accuse me of being jealous of other people’s success. While I certainly feel that more financial success would help, if finances were my first priority, this would not have consistently been my focus—to save art from postmodernism—for seven years publicly now. Otherwise, we have continued regress as progress, and a world in general, in inverse mode.

When any artist does well, I’m genuinely happy for them. Artists aren’t usually known for achieving major success, as megastardom has often required aligning with various agendas rather than relying solely on the strength of the art itself to reach stratospheric heights. We can’t fix any of this unless it’s at least discussed.

How differently does this all make us view what was going on before, as well as what might be going on now?

The dignified bananas.

Here are also some other entries that I figured were worthy of attention. Some not submitted to the competition, as understandably people with dignity don’t submit work to be evaluated by clowns, and they have been increasingly disappointed by the quality of curation since the early days. My post started with how I don’t do this, and unleashed as much fire as I can toward the whole system, stress testing it to see if I was correct – and it absolutely turned out to be the case.

Banana Zone by Norman Harman

Norman Harman is one of the most interesting voices in web3. To me, the consumerist era has been gone for 20 years already, but his critique of the bureaucratic class with his new series, as well as an avalanche of dirty little bitch slaps to the auction champagne crew, has been a breath of fresh air in the scene. The new AI motion work is dope too. Both capture perfectly the orgiastic degeneracy scene of this auction vibe. Norman, like many other OGs, wouldn’t “submit” work to a contest like this anymore, having been disillusioned from the scene already many times over.

“RARE In The Machine” by Spaced Painter

“RARE In The Machine” by Spaced Painter

Spaced Painter did her literal submission with this piece, in which the banana fucks her into oblivion, and she metaphorically gives up due to being sidelined and ignored. That makes her Rare. It was visionary, as her being left out of the ten selected, gave her exactly that. The piece illustrates well on how the demoralising effect of 100 years of postmodernism is having on the spiritually minded, and just anyone with common sense anymore, and it is so obvious that we can make super predictive art about it.

The “I Am Banana” by Robness is a parody take of Kevin Abosch’s I Am a Coin project already from 2019 minted on Superrare. How can you go lower than the banana? Well just put tape on tape and watch the yellow paint dry. At least that’s my interpretation.

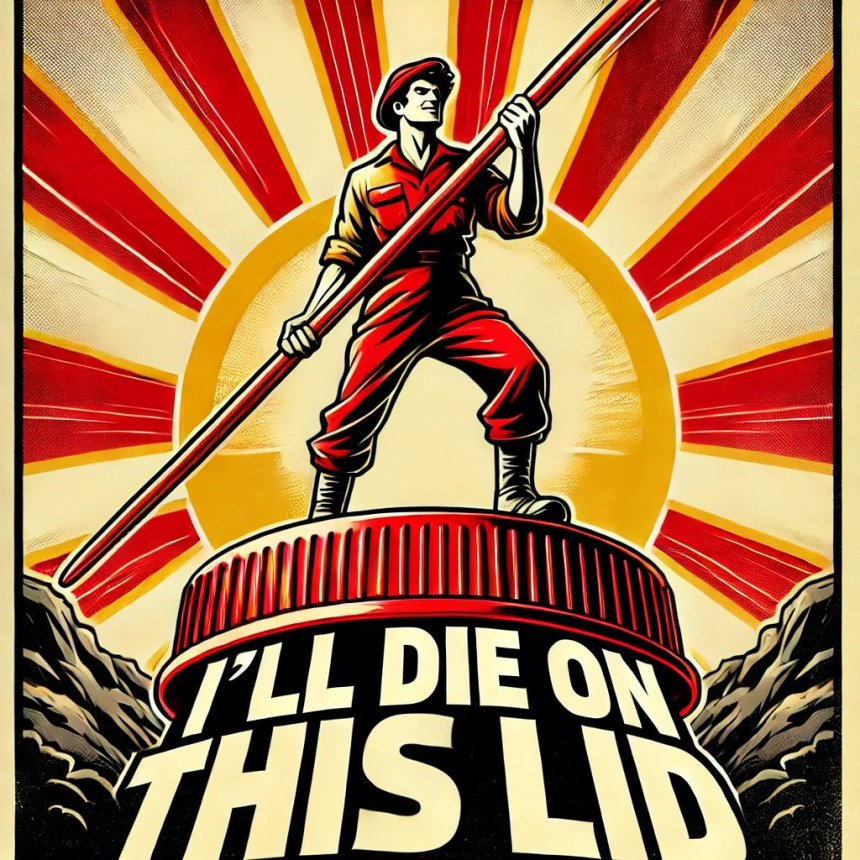

The competition set up by another crypto art enfant terrible, Maxis Osiris, has put together a parody auction competition to parody the parody auction competition parodying the parody auction. Alotta Money would be proud. Like Alan Watts said earlier that academia and religion has become but a foot note on a foot note, the direct experience is “access denied”, so the Farisejan and the money changers can keep doing their thing.

The competition set up by another crypto art enfant terrible, Maxis Osiris, has put together a parody auction competition to parody the parody auction competition parodying the parody auction. Alotta Money would be proud. Like Alan Watts said earlier that academia and religion has become but a foot note on a foot note, the direct experience is “access denied”, so the Farisejan and the money changers can keep doing their thing.

“I’ll die on this lid” by Max Osiris

“I’ll die on this lid” by Max Osiris

We had a nice convo with my friend Nicolaas on all the of above and more on Bitcoin LIVE, but I wasn’t yet unfortunately aware of the selected bananas then. What ever last remaining hopium I had for the early stage platforms died the next day, hence I got motivated to write this article.

Artist extraordinaire ANDRÉS DEL VECCHIO curated a much better selection of bananas from the litter on his X, so leaving that here for you to evaluate in case you don’t have time to go thought the 1100 entries yourself.

It took a child to point to the nude emperor that he had been conned. In art, it has lasted a hundred years.

The measure of intelligence is the ability to change. – Albert Einstein

They are laughing at us. Our creative generative power. We need to understand this.

While an Einstein quote is a tough one to do without seeming pretentious, in the above context it works. If you work with truth, even the setbacks help you rise. We need to stop focusing on the fall. Artists are creators, and we are currently being completely under served by trying to be under the thumb of the destroyers. This is all the postmodernists can do, and by doing garbage bananas, you are submitting to being reduced further and further. Start building the future. Make your own gallery. Band together. Don’t submit to the bureaucrats that run the establishment. We are artists. We are powerful. it’s cool. Old things and people die. Let them.

As you can tell, there has been a lot of wtf going on here. Remember, I was building this, this and this, as well as speaking on big stages when everything flies off the shelves and for me nothing moved.

Despite it all, find gratitude. It’s a lifeline. There is plenty to be grateful for, but step out of harms way. Remember why you got into this in the first place.

If you want to support my efforts, do consider collecting these pieces from my SR page. It’s unlikely that they will age badly. I’m happy to give the platform fee back to SR, as those guys, despite my poor sales, still airdropped me comfort tokens when SUPR was launched for being there early. There was some respect there at least still then.

Unfortunately, I can’t help but wonder, in recent light, how much my art not reaching people there despite significant effort, was artificially suppressed. Maybe not at all by them, but who knows. I still have a bunch of art there that cost me a bomb to mint, so hoping all my efforts with SR and for this scene will be acknowledged at some point. Writing and researching this article took a week, and I was not paid to do it. I’m either brave and pricipled, or a complete idiot. Hard to tell which one sometimes. Bit of both, I guess.

Collect

The NFT includes a physical canvas print, painted on top with acrylics, and it launches an AR animation.

Available for 3 ETH

The NFT includes a physical canvas print, painted on top with acrylics, and it launches an AR animation.

Available for 3 ETH

Stay cool,

VESA

Crypto Artist, Speaker, Consultant, Writer

All links to physical, NFTs, and more below

ROBNESS – I AM BANANA

ROBNESS – I AM BANANA